Navigating health insurance options as a small business owner in Wyoming can be challenging, but understanding the available choices for 2025 is essential for securing affordable and comprehensive coverage. With evolving regulations, competitive private market plans, and potential state-specific programs, Wyoming’s small businesses have several pathways to explore. Whether through the Small Business Health Options Program (SHOP), private insurers, or association health plans, employers must weigh costs, benefits, and employee needs. This guide breaks down the latest updates, eligibility requirements, and cost-saving strategies to help Wyoming entrepreneurs make informed decisions for their teams and businesses in the coming year.

Wyoming Small Business Health Insurance Options for 2025

Choosing the right health insurance for your small business in Wyoming in 2025 is crucial for employee retention and financial stability. With changing regulations and new options available, business owners must stay informed to make the best decisions. Below, we explore key aspects of small business health insurance in Wyoming, including plans, costs, and eligibility.

1. Available Health Insurance Plans for Wyoming Small Businesses

Wyoming offers a variety of health insurance plans tailored for small businesses, including: – Group Health Insurance (fully insured & self-funded) – Health Maintenance Organization (HMO) Plans – Preferred Provider Organization (PPO) Plans – High-Deductible Health Plans (HDHP) with HSAs Each plan has different coverage levels, premium costs, and network restrictions, so employers should compare options carefully.

| Plan Type | Key Features |

|---|---|

| Group Health Insurance | Covers employees under a single policy with shared costs. |

| HMO | Lower premiums but requires using in-network providers. |

| PPO | More flexibility but higher premiums. |

| HDHP with HSA | Lower premiums, high deductibles, plus tax-advantaged savings. |

2. Costs of Small Business Health Insurance in Wyoming

The cost of health insurance for small businesses varies based on: – Number of employees – Type of plan selected – Employee contributions – Insurance provider On average, employers in Wyoming may pay between $400–$800 per employee per month for group coverage, with employees covering a portion.

| Factor | Impact on Cost |

|---|---|

| Number of Employees | Larger groups often get lower per-person rates. |

| Plan Type | PPOs are more expensive than HMOs. |

| Employee Contributions | Businesses can share costs with employees. |

| Provider Competition | Rural areas may have fewer options, affecting prices. |

3. Employer Requirements and Eligibility in Wyoming

To qualify for small business health insurance in Wyoming: – Businesses must have 1–50 full-time employees. – At least 70% of employees must enroll if the employer offers coverage. – There are no state mandates, but federal laws like the Affordable Care Act (ACA) apply.

| Requirement | Details |

|---|---|

| Employee Count | 1–50 full-time employees qualify for small-group plans. |

| Participation Rule | 70% of employees must enroll if coverage is offered. |

| ACA Compliance | Plans must meet minimum essential coverage standards. |

4. Top Health Insurance Providers for Wyoming Small Businesses

Several insurance providers offer competitive small business health plans in Wyoming: – Blue Cross Blue Shield of Wyoming – UnitedHealthcare – Cigna – Aetna Each company offers different benefits, networks, and pricing tiers—so comparing quotes is essential.

| Provider | Key Offerings |

|---|---|

| Blue Cross Blue Shield | Largest network in Wyoming with customizable plans. |

| UnitedHealthcare | Nationwide coverage with wellness programs. |

| Cigna | Affordable PPO and HDHP options. |

| Aetna | Strong telehealth and prescription benefits. |

5. How to Enroll in Small Business Health Insurance in Wyoming

Enrollment steps for small business health insurance include: 1. Assess needs – Determine budget and coverage requirements. 2. Compare plans – Review options from multiple providers. 3. Get quotes – Request customized pricing. 4. Submit application – Complete paperwork with employee details. 5. Implement coverage – Set a start date and educate employees.

| Step | Action Required |

|---|---|

| Assess Needs | Decide on budget and employee coverage expectations. |

| Compare Plans | Evaluate HMO, PPO, and HDHP options. |

| Get Quotes | Request price estimates from insurers. |

| Submit Application | Complete and send application to the selected insurance provider. |

Can I still enroll in health insurance in 2025?

Yes, you can still enroll in health insurance in 2025, but the availability and process depend on your specific circumstances and the type of health insurance you are seeking. Below are key details and subtopics to consider:

Open Enrollment Period for 2025

During the Open Enrollment Period (OEP), you can sign up for health insurance plans through the Health Insurance Marketplace (Healthcare.gov or state-based exchanges). Here are the critical details:

- Dates: The OEP typically runs from November 1, 2024, to January 15, 2025, with coverage starting as early as January 1, 2025.

- Eligibility: Most individuals qualify, including those without employer-sponsored insurance, freelancers, or part-time workers.

- Late Enrollment: Missing the OEP may require a Special Enrollment Period (SEP), triggered by qualifying life events.

Special Enrollment Period (SEP) Options

If you miss the Open Enrollment Period, you may still enroll if you qualify for a Special Enrollment Period (SEP). Key points include:

- Qualifying Life Events: Marriage, birth/adoption of a child, loss of previous coverage, or moving to a new area.

- Timeframe: You typically have 60 days from the qualifying event to enroll.

- Documentation: Proof of the life event (e.g., marriage certificate, termination letter) may be required.

Medicaid and CHIP Enrollment

Medicaid and the Children’s Health Insurance Program (CHIP) have different rules compared to Marketplace plans:

- Year-Round Enrollment: Unlike Marketplace plans, Medicaid and CHIP allow enrollment at any time if you meet eligibility criteria.

- Income-Based Eligibility: These programs serve low-income individuals and families, with eligibility varying by state.

- No OEP Restrictions: You can apply even outside the OEP, but approval depends on income verification.

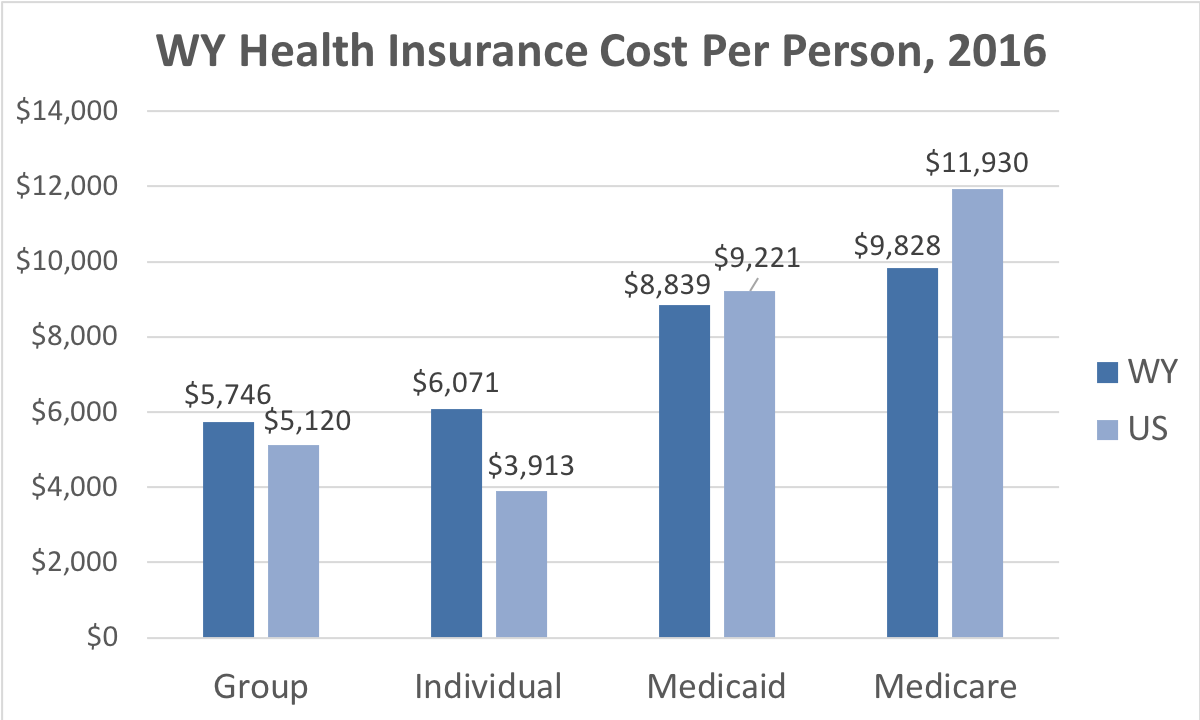

What is the average cost of health insurance in Wyoming?

The average cost of health insurance in Wyoming ranges between $600 to $900 per month for an individual, depending on factors like age, plan type, and coverage level. Family plans typically cost around $1,800 to $2,500 per month. Wyoming’s insurance market is influenced by its rural nature, leading to higher premiums compared to more urban states.

Factors Affecting Health Insurance Costs in Wyoming

Several factors influence health insurance premiums in Wyoming:

- Age: Older individuals generally pay higher premiums due to increased medical needs.

- Plan Type: High-deductible plans are cheaper monthly but cost more out-of-pocket, while comprehensive plans have higher premiums.

- Location: Rural areas may have fewer providers, leading to higher costs.

Types of Health Insurance Plans Available in Wyoming

Wyoming residents can choose from several types of plans:

- Health Maintenance Organization (HMO): Lower cost but requires using in-network providers.

- Preferred Provider Organization (PPO): More flexibility in choosing providers at a higher price.

- Catastrophic Plans: Low premiums with high deductibles, ideal for healthy, younger individuals.

Ways to Reduce Health Insurance Costs in Wyoming

To lower health insurance expenses in Wyoming, consider these options:

- Subsidies: Qualify for federal subsidies through the Affordable Care Act (ACA) marketplace.

- Short-Term Plans: Temporary, low-cost coverage for those between jobs or waiting for other insurance.

- Health Savings Account (HSA): Pair with a high-deductible plan for tax-advantaged savings.

How can small businesses reduce health insurance costs?

1. Shop Around for Competitive Health Insurance Plans

Small businesses can reduce health insurance costs by exploring multiple providers and comparing plans. Market competition often leads to better pricing and benefits. Consider working with an insurance broker who can help navigate options tailored to your business size and needs.

- Request quotes from at least three different insurers to compare premiums and coverage.

- Evaluate network options (HMO, PPO, etc.) to balance cost and employee access to healthcare.

- Negotiate terms—some insurers may offer discounts for long-term contracts or healthy employee demographics.

2. Implement Wellness Programs to Lower Claims

Wellness initiatives can reduce long-term insurance costs by promoting healthier lifestyles, decreasing claims, and potentially qualifying for premium discounts. Preventive care benefits both employees and employers financially.

- Offer gym memberships or onsite fitness classes to encourage physical activity.

- Provide health screenings to catch issues early, reducing costly treatments later.

- Incentivize participation with rewards like lower premiums or gift cards for meeting health goals.

3. Opt for High-Deductible Health Plans (HDHPs) with HSAs

High-deductible plans paired with Health Savings Accounts (HSAs) can significantly lower monthly premiums. Employees benefit from tax-advantaged savings, while employers save on upfront costs.

- Educate employees on how HSAs work to maximize their benefits and offset higher deductibles.

- Contribute to HSAs as an employer to enhance the plan’s appeal and support staff financially.

- Combine HDHPs with wellness programs to mitigate high out-of-pocket costs through preventive care.

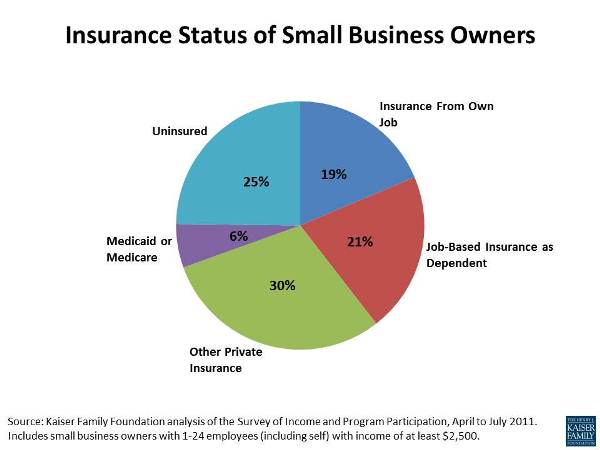

Where do small business owners get health insurance?

Where can small business owners purchase health insurance?

Small business owners have several options to purchase health insurance for themselves and their employees. They can explore private marketplaces, government-sponsored programs, or professional organizations. Below are the most common sources:

- Private Health Insurance Marketplaces: Websites like eHealth or Healthcare.gov allow comparisons of plans from multiple providers.

- Insurance Brokers or Agents: Licensed professionals can help find tailored plans that fit business needs and budgets.

- Professional or Trade Associations: Groups like the Chamber of Commerce often offer group health insurance discounts to members.

What government programs assist small business owners with health insurance?

Government programs provide affordable health insurance options for small businesses. These programs aim to reduce costs and simplify enrollment. Key options include:

- SHOP Marketplace (Small Business Health Options Program): A federal and state-run exchange offering tax credits for qualifying businesses.

- Medicaid Expansion: Some states allow small business employees to enroll in Medicaid if they meet income requirements.

- State-Specific Programs: Certain states offer additional subsidies or incentives to encourage small business health coverage.

How do small business owners compare health insurance plans?

Comparing health insurance plans is crucial for finding the best coverage and pricing. Owners should assess premiums, networks, and benefits. Here’s how:

- Evaluate Premiums vs. Deductibles: Lower premiums may mean higher out-of-pocket costs, so balance affordability with coverage needs.

- Check Provider Networks: Ensure preferred doctors and hospitals are included to avoid extra expenses.

- Review Additional Benefits: Some plans offer wellness programs, dental, or vision coverage that add value.

Frequently Asked Questions

What small business health insurance plans will be available in Wyoming for 2025?

Wyoming small businesses will have access to several health insurance options in 2025, including group health plans from providers like Blue Cross Blue Shield of Wyoming and Cigna. Additionally, the SHOP Marketplace (Small Business Health Options Program) will offer federally facilitated plans with tax credits for qualifying employers. Some businesses may also explore self-funded plans or level-funded arrangements to better control costs. It’s important to compare coverage, premiums, and provider networks to find the best fit.

How can Wyoming small businesses qualify for health insurance tax credits in 2025?

To qualify for small business health care tax credits in Wyoming, employers must meet specific criteria, such as having fewer than 25 full-time equivalent employees with average wages below $60,000 annually (adjusted for inflation). Additionally, the business must contribute at least 50% of employee premium costs and purchase coverage through the SHOP Marketplace. These credits can cover up to 50% of employer-paid premiums, making health insurance more affordable for qualifying small businesses in 2025.

What are the key deadlines for enrolling in small business health insurance in Wyoming for 2025?

The open enrollment period for Wyoming small businesses typically runs from November to mid-December for coverage starting January 1, 2025. However, employers can enroll outside this window if they meet certain conditions, such as adding new employees or experiencing a qualifying life event. For SHOP Marketplace plans, applications must be submitted by the 15th of the month for coverage to begin the following month. Missing deadlines could delay coverage, so businesses should plan ahead.

Can Wyoming small businesses offer Health Reimbursement Arrangements (HRAs) instead of traditional insurance in 2025?

Yes, Wyoming small businesses can choose Health Reimbursement Arrangements (HRAs) as an alternative to traditional group health insurance in 2025. Options include the Qualified Small Employer HRA (QSEHRA) for businesses with fewer than 50 employees or the Individual Coverage HRA (ICHRA), which has no size restrictions. These arrangements allow employers to reimburse employees tax-free for medical expenses or individual insurance premiums. However, HRAs must comply with federal guidelines, and businesses should consult a benefits advisor for proper implementation.