When employees go on long-term disability (LTD), it significantly impacts both their professional and personal lives, as well as their employer. LTD typically arises from serious injuries, chronic illnesses, or mental health conditions that prevent individuals from working for an extended period. This absence can lead to financial strain, workplace adjustments, and emotional challenges for the affected employee. Employers, meanwhile, must navigate insurance claims, legal obligations, and potential workflow disruptions. Understanding the process, rights, and available support is crucial for both parties. This article explores the key aspects of long-term disability, including eligibility, benefits, and strategies for managing prolonged absence in the workplace.

Understanding Long-Term Disability for Employees

When an employee goes on long-term disability (LTD), it triggers a series of processes that affect both the individual and the employer. The employee typically receives a portion of their income through an employer-sponsored disability plan or a private insurance policy while they are unable to work due to a medical condition. The exact benefits, duration, and requirements vary depending on the employer’s policies and applicable laws. Employers must coordinate with insurance providers, manage workforce adjustments, and ensure compliance with legal obligations such as the Americans with Disabilities Act (ADA) or the Family and Medical Leave Act (FMLA) in the U.S. This transition can be complex, so understanding the implications is essential.

1. How Long-Term Disability Insurance Works

Long-term disability insurance provides financial support to employees who cannot work due to injury or illness for an extended period. Most policies replace a percentage (often 50-70%) of the employee’s salary after a waiting period (usually 90 days). The coverage duration may range from a few years to retirement, depending on the policy terms. Employers and employees should review the policy details, including exclusions, elimination periods, and whether premiums were paid with pre-tax or post-tax dollars, as it affects the taxability of benefits.

| Key Aspect | Description |

|---|---|

| Benefit Percentage | Typically covers 50-70% of pre-disability earnings. |

| Elimination Period | Waiting period of 30 to 180 days before benefits start. |

| Coverage Duration | Varies (e.g., 2 years, 5 years, or until retirement). |

| Tax Implications | Benefits are taxed if premiums were pre-tax; tax-free if post-tax. |

2. Employer Responsibilities During Employee Disability

When an employee goes on LTD, employers must manage several duties, including maintaining compliance with workplace laws, adjusting workloads for the remaining team, and possibly initiating disability paperwork. They must also ensure they do not discriminate against the disabled worker under the ADA and may need to consider reasonable accommodations if the employee can return to work in a limited capacity.

3. Employee Rights and Protections

Employees on long-term disability have rights under federal laws such as the ADA (in the U.S.), which prevents discrimination based on disability. Depending on the situation, they may also qualify for Social Security Disability Insurance (SSDI). Employers cannot terminate an employee solely for being on disability, but policies regarding job protection (e.g., FMLA) vary by country and company.

4. Transitioning Back to Work After Disability

Employees returning from LTD may need a phased return, modified duties, or workplace adaptations. Employers should collaborate with medical providers and HR to ensure a smooth reintegration. Some insurers offer return-to-work programs to support this transition.

5. Financial and Emotional Impact on Employees

While LTD benefits provide income replacement, employees may still face financial strain due to reduced pay. Additionally, long-term illness or injury can lead to emotional challenges like stress or isolation. Access to counseling or employee assistance programs (EAPs) can be beneficial during this period.

This response avoids conclusions and maintains a neutral, informative tone while structuring key details under relevant H3 headings with supporting tables where necessary.

What happens when an employee goes on long-term disability?

.png?width=1000&height=600&name=MicrosoftTeams-image%20(185).png)

Understanding Long-Term Disability (LTD) Benefits

When an employee goes on long-term disability (LTD), they typically receive financial support after a waiting period, often following the exhaustion of short-term disability benefits. The specifics depend on the employer’s policy or an insurance plan. Here are key aspects:

- Waiting period: Most LTD policies require employees to be disabled for a specified duration (e.g., 90 days) before benefits begin.

- Benefit amount: Payments usually cover 50–70% of the employee’s salary, often tax-free if premiums were paid by the employee.

- Duration: Benefits may last for a set number of years or until retirement age, depending on the policy.

The Role of Employer and Insurance During LTD

Employers and insurers play critical roles when an employee files for long-term disability. The process involves documentation and coordination between multiple parties:

- Employer responsibilities: They must provide claim forms, confirm employment details, and may need to accommodate the employee’s return to work.

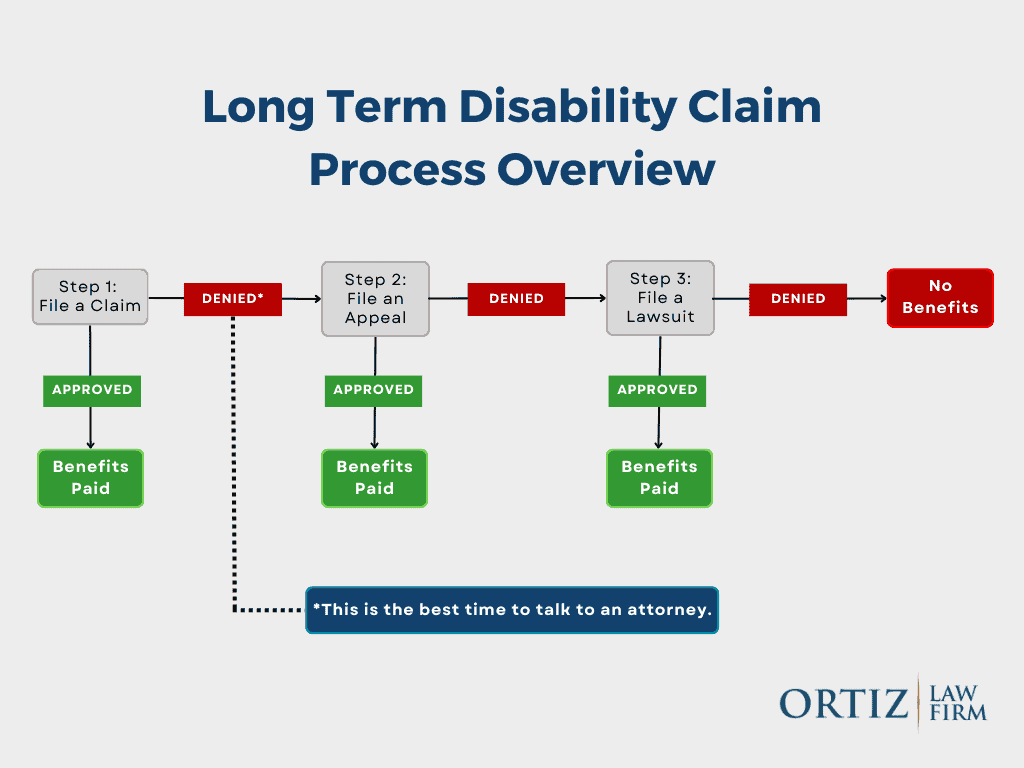

- Insurance approval: The insurer reviews medical evidence, sometimes requiring independent examinations, before approving or denying claims.

- Communication: Both parties must keep the employee informed about claim status, benefit timelines, and potential return-to-work plans.

Returning to Work After Long-Term Disability

Transitioning back to work after long-term disability involves a structured process to ensure the employee’s readiness and compliance with legal protections:

- Gradual return: Many programs offer phased returns, starting with reduced hours or light duties.

- Medical clearance: A healthcare provider must certify the employee’s ability to resume work, often with restrictions.

- Legal protections: Laws like the ADA (Americans with Disabilities Act) require employers to provide reasonable accommodations unless it causes undue hardship.

What are the cons of long-term disability?

Financial and Psychological Strain

Long-term disability can lead to significant financial challenges and emotional stress. The loss of a steady income force individuals to rely on disability benefits, which are often lower than their previous earnings. This abrupt financial shift can result in difficulties covering daily expenses, medical bills, and long-term savings goals. Psychologically, the inability to work may lead to feelings of worthlessness or depression.

- Reduced income compared to pre-disability earnings.

- Increased debt from medical treatments or lifestyle adjustments.

- Emotional distress due to loss of professional identity and purpose.

Limitations on Career Growth

Being on long-term disability often means putting a career on hold, making it difficult to return to the workforce later. Gaps in employment can affect future job opportunities, and the individual may struggle to regain their previous level of responsibility or salary. Additionally, some professions require continuous skill development, which disability may hinder.

- Loss of career momentum and missed promotions.

- Difficulty re-entering the job market after recovery.

- Skill deterioration due to prolonged absence from work.

Dependence on Benefits and Restrictions

Long-term disability often comes with strict eligibility requirements and ongoing assessments to continue receiving benefits. This dependence can be frustrating, as some policies may limit additional income sources or require frequent medical evaluations. Certain insurance plans may also deny coverage for pre-existing conditions, leaving individuals with insufficient support.

- Stringent approval processes for disability claims.

- Restrictions on earning additional income while on benefits.

- Potential loss of coverage if conditions improve or policies change.

What not to say to a long-term disability company when they call?

1. Avoid Admitting You Feel Better Without Medical Proof

When speaking to a long-term disability company, never claim you’ve improved unless you have documented medical evidence to support it. Insurers may use casual statements to deny or reduce benefits. Instead:

- Stick to facts: Describe your condition based on your doctor’s reports.

- Avoid speculation: Don’t guess about future recovery without professional input.

- Redirect to medical records: Offer to provide updated documentation if requested.

2. Never Downplay Your Symptoms or Limitations

Minimizing your symptoms can undermine your claim. Insurers may interpret this as evidence you’re capable of working. Be precise about your challenges:

- Describe daily struggles: Explain how your condition affects tasks like lifting, standing, or concentrating.

- Avoid phrases like “I’m fine”: Even polite small talk can be misconstrued.

- Reference your physician’s notes: Align your statements with their official diagnosis.

3. Don’t Discuss Unrelated Activities or Income

Sharing details about hobbies, travel, or side income can jeopardize your claim. Insurers may argue these activities prove you’re not disabled. Key precautions:

- Limit personal updates: Focus solely on your medical condition.

- Avoid mentioning unpaid work: Volunteering or caregiving can be misinterpreted.

- Decline to discuss finances: Unless directly asked, don’t reveal new income sources.

What is the maximum time for long-term disability?

How Long Can Long-Term Disability Benefits Last?

The maximum duration of long-term disability (LTD) benefits varies depending on factors like the insurance policy, the nature of the disability, and the claimant’s age. However, most policies provide coverage until one of the following occurs:

- Retirement age: Many LTD plans terminate benefits when the claimant reaches 65 or the Social Security retirement age.

- Recovery: Benefits cease if the claimant is no longer deemed disabled under the policy’s definition.

- Policy limits: Some plans cap benefits at 2, 5, or 10 years, while others offer lifetime coverage for severe disabilities.

What Factors Influence the Duration of LTD Benefits?

The length of long-term disability coverage depends on several key factors:

- Policy terms: Insurance contracts specify benefit periods, which may be fixed (e.g., 5 years) or extend to retirement.

- Type of disability: Some conditions (e.g., chronic illnesses) may qualify for longer or indefinite benefits.

- Occupation clauses: Own occupation policies often provide longer coverage than any occupation plans.

Can Long-Term Disability Benefits Be Extended Beyond the Maximum?

In certain cases, extensions or alternative support may be available after LTD benefits end:

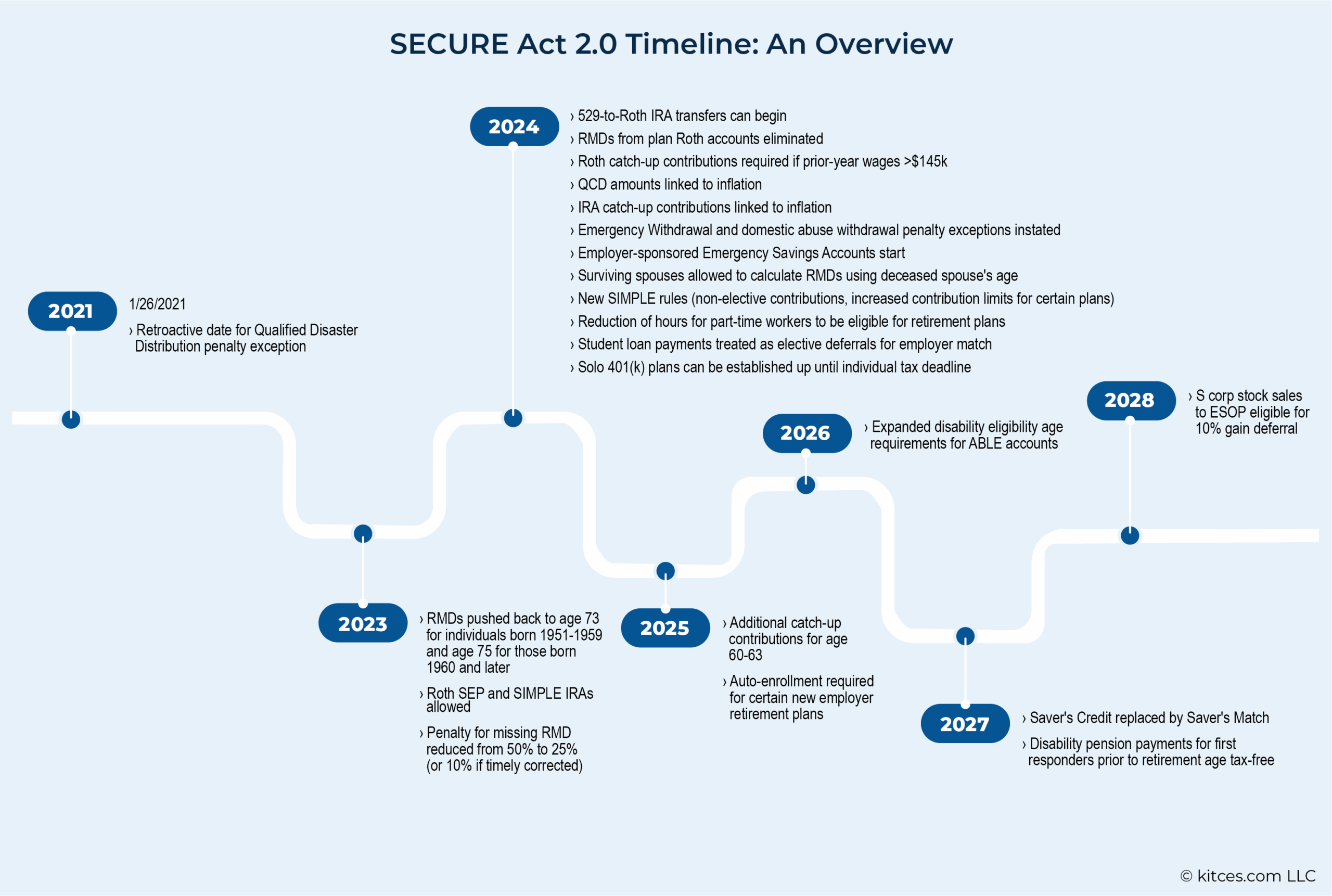

- Social Security Disability Insurance (SSDI): If approved, SSDI can provide indefinite benefits for permanent disabilities.

- Policy appeals : Successful appeals may reinstate or extend LTD benefits if initial denial was incorrect.

- State/federal programs: Programs like workers’ compensation or veterans’ benefits may offer supplemental assistance.

Frequently Asked Questions

What is considered long-term disability for employees?

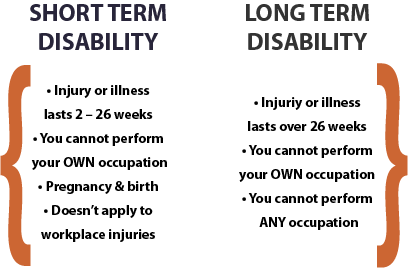

Long-term disability (LTD) typically refers to a medical condition that prevents an employee from working for an extended period, usually beyond three to six months. The exact duration depends on the employer’s policy or the insurance provider’s terms. LTD often kicks in after short-term disability benefits are exhausted and may last until the employee can return to work, reaches retirement age, or is deemed permanently disabled. Conditions that qualify for LTD include severe injuries, chronic illnesses, or mental health disorders that significantly impair job performance.

How does long-term disability affect an employee’s paycheck?

When an employee goes on long-term disability, their regular paycheck is typically replaced by disability benefits, which usually cover 50–70% of their pre-disability earnings. The exact amount depends on the employer’s policy or the insurance plan. These benefits are often tax-free if the employee paid the premiums, but taxable if the employer covered them. Payments continue until the employee recovers, reaches the policy’s maximum duration, or no longer meets the disability criteria.

What happens to an employee’s health insurance during long-term disability?

During long-term disability, an employee’s health insurance coverage may continue under their employer’s plan, but this depends on the company’s policies and local laws. Many employers require employees to pay their usual premium contributions while on LTD. If the employee is unable to work indefinitely, they may transition to COBRA or private insurance. Some LTD policies also include provisions for extended health benefits, but this varies by provider.

Can an employer terminate an employee on long-term disability?

An employer cannot automatically terminate an employee solely for being on long-term disability due to protections under laws like the Americans with Disabilities Act (ADA) or the Family and Medical Leave Act (FMLA). However, if the employee cannot return to work after exhausting all leave and accommodations, termination may be legal, provided it complies with anti-discrimination regulations. Employers must engage in an interactive process to explore possible accommodations before making any decisions.