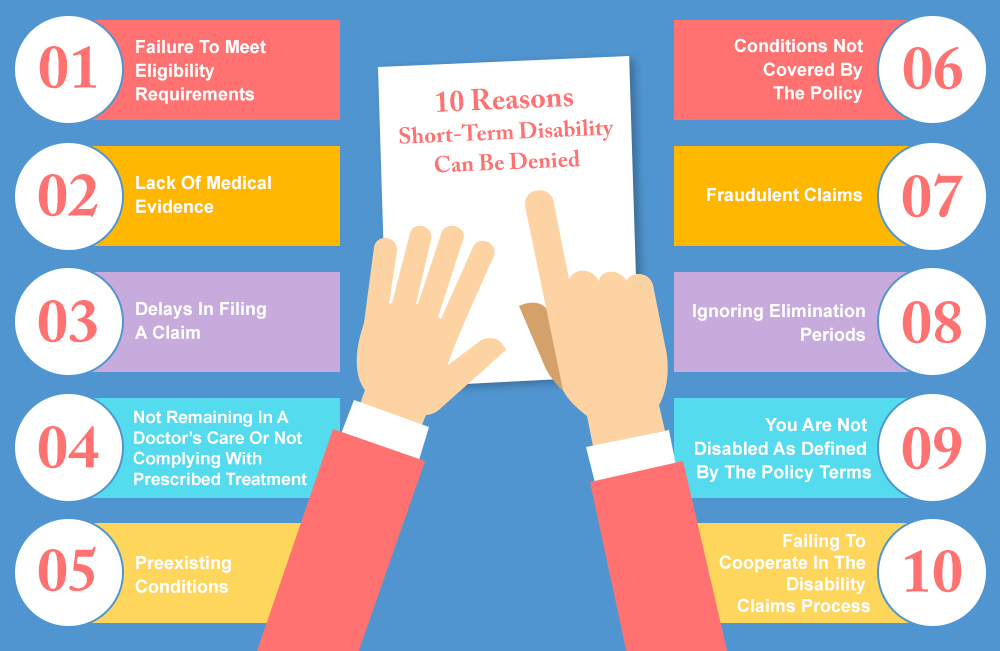

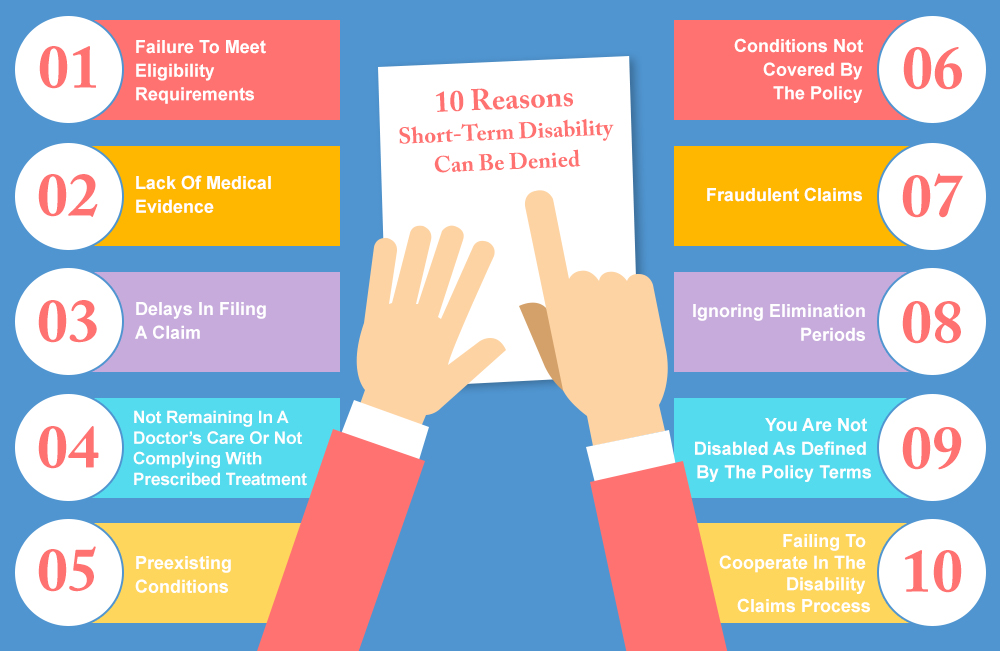

When employees fall ill or get injured, they often rely on short-term disability benefits to support themselves financially while they recover. However, many claimants face disappointment when their claims are denied. Understanding the common pitfalls can help individuals navigate the complex process and avoid potential rejections. Several key factors contribute to the denial of short-term disability claims, ranging from incomplete applications to insufficient medical evidence. Identifying these factors is crucial for successfully securing the benefits that individuals need during challenging times. Proper preparation and knowledge can significantly improve the likelihood of a successful claim.

Understanding the Common Reasons Behind Short Term Disability Claim Denials

When individuals file for short term disability benefits, they often expect a straightforward process. However, many claims get denied due to various reasons. Understanding these reasons can help applicants prepare and potentially avoid denial.

Insufficient Medical Evidence

One of the primary reasons short term disability claims get denied is the lack of sufficient medical evidence. Insurance companies require comprehensive documentation to support the claim, including detailed medical records, diagnosis, and treatment plans. If the provided evidence is incomplete or doesn’t clearly demonstrate the severity of the condition, the claim may be denied.

| Required Medical Evidence | Description |

|---|---|

| Detailed Medical Records | Comprehensive documentation of the condition, including symptoms, diagnosis, and treatment. |

| Physician’s Statement | A statement from the treating physician explaining the condition’s impact on the individual’s ability to work. |

| Test Results and Imaging | Results of relevant tests and imaging studies that support the diagnosis and condition severity. |

Misunderstanding the Policy Terms

Many claim denials result from a misunderstanding of the policy terms and conditions. Policyholders may not fully comprehend what is covered, the definition of disability, or the requirements for filing a claim. It’s crucial to carefully review the policy and understand its terms before submitting a claim.

| Policy Terms to Understand | Description |

|---|---|

| Definition of Disability | The policy’s specific definition of what constitutes a disability. |

| Coverage Period | The duration for which benefits are payable. |

| Filing Requirements | Specific requirements for filing a claim, including deadlines and necessary documentation. |

Pre-existing Conditions

Pre-existing conditions can be a significant factor in claim denials. Insurance companies often have clauses that exclude coverage for conditions that existed before the policy’s effective date. Understanding how pre-existing conditions are handled is vital.

| Pre-existing Condition Considerations | Description |

|---|---|

| Pre-existing Condition Clause | The specific clause in the policy that addresses pre-existing conditions. |

| Waiting Periods | Any waiting periods before coverage for pre-existing conditions begins. |

| Disclosure Requirements | The importance of disclosing pre-existing conditions when applying for the policy. |

Incomplete Claim Forms

Submitting incomplete claim forms is another reason for denial. It’s essential to fill out the forms accurately and completely, ensuring all required information is provided.

| Claim Form Requirements | Description |

|---|---|

| Accurate Information | Ensuring all information provided is accurate and truthful. |

| Complete Documentation | Attaching all required documentation to support the claim. |

| Timely Submission | Submitting the claim within the specified timeframe. |

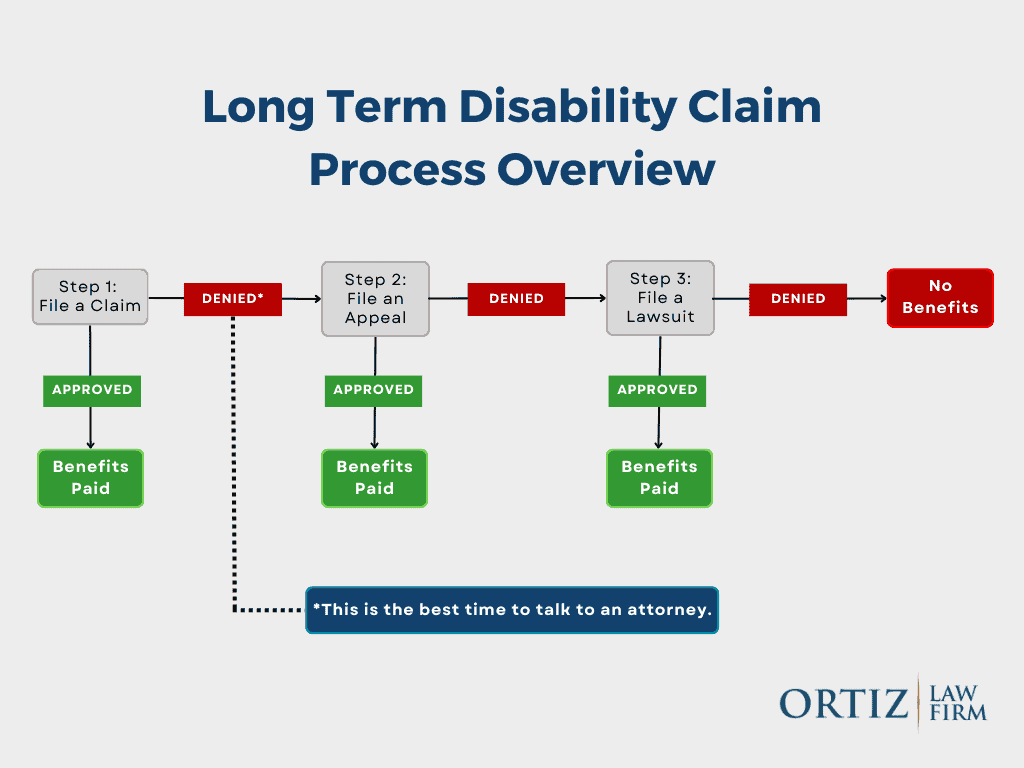

Failure to Appeal a Denial

If a claim is denied, it’s crucial to understand the appeals process. Failing to appeal or not following the appeals process correctly can result in the denial becoming final.

| Appeals Process | Description |

|---|---|

| Understanding the Denial Reason | Clearly understanding why the claim was denied. |

| Gathering Additional Evidence | Collecting any additional evidence that may support the claim upon appeal. |

| Filing the Appeal | Submitting the appeal within the required timeframe and following the specified process. |

Why would a short-term disability claim be denied?

A short-term disability claim can be denied for several reasons. The insurance company may not consider the claimant’s condition severe enough to qualify for benefits, or they may determine that the condition is not covered under the policy. Additionally, if the claimant fails to provide sufficient medical evidence or does not follow the treatment plan recommended by their doctor, their claim may be denied.

Insufficient Medical Evidence

One of the primary reasons for a short-term disability claim denial is insufficient medical evidence. Insurance companies require detailed medical documentation to support a claim, including diagnoses, treatment plans, and progress reports. If the claimant’s medical records are incomplete, inconsistent, or lack sufficient detail, the insurance company may deny the claim.

- The claimant’s doctor may not have provided detailed medical records to support the claim.

- The insurance company may not consider the claimant’s condition severe enough to qualify for benefits.

- The claimant may not have undergone the necessary medical testing to confirm their condition.

Pre-Existing Conditions

Another reason for a short-term disability claim denial is the presence of a pre-existing condition. If the claimant had a medical condition before purchasing the insurance policy, the insurance company may deny their claim if they determine that the condition is related to the pre-existing condition.

- The insurance company may exclude coverage for pre-existing conditions for a certain period.

- The claimant may not have disclosed their pre-existing condition when applying for the insurance policy.

- The insurance company may require additional medical documentation to determine the cause of the claimant’s condition.

Failure to Follow Treatment Plan

A short-term disability claim can also be denied if the claimant fails to follow their doctor’s recommended treatment plan. Insurance companies expect claimants to take reasonable steps to recover from their condition, and failure to do so may result in a denial.

- The claimant may not have been compliant with medication or other treatments.

- The claimant may have refused recommended surgery or other necessary treatments.

- The claimant may not have attended follow-up appointments with their doctor.

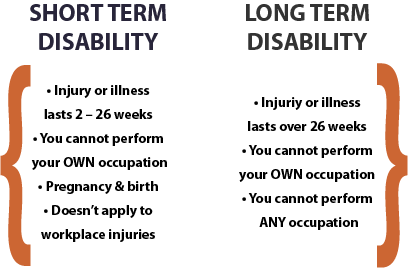

Why is short-term disability so difficult?

Short-term disability is a type of insurance that provides partial income replacement to individuals who are unable to work due to illness, injury, or other medical conditions. The process of obtaining short-term disability benefits can be challenging and complex, leading to frustration and financial strain for those who need it.

Complexity of the Application Process

The application process for short-term disability benefits is often cumbersome and requires a significant amount of documentation, including medical records and proof of income. This can be overwhelming for individuals who are already dealing with a serious health issue. Some of the common requirements include:

- Providing detailed medical information about the condition, including diagnosis, treatment, and prognosis.

- Submitting supporting documentation, such as doctor’s notes, test results, and hospital records.

- Filling out extensive paperwork, including application forms and questionnaires.

Insurance Company Requirements and Denials

Insurance companies often have strict requirements for approving short-term disability claims, which can lead to denials if not met. These requirements may include specific medical criteria, documentation, and timelines. Some common reasons for denials include:

- Insufficient medical evidence to support the claim, such as inadequate documentation or lack of objective medical findings.

- Failure to meet the policy’s definition of disability, which can vary depending on the insurance provider and policy.

- Missed deadlines or failure to comply with the insurance company’s requests for additional information.

Lack of Standardization and Consistency

The short-term disability process can be further complicated by a lack of standardization and consistency across insurance providers and policies. This can lead to confusion and uncertainty for individuals navigating the system. Some of the issues include:

- Variability in policy terms and conditions, including different definitions of disability and benefit periods.

- Differences in claims handling practices, including the level of scrutiny and documentation required.

- Inconsistent communication from insurance companies, including unclear or misleading information about the claims process.

What are the odds of getting a short-term disability?

The odds of getting a short-term disability depend on various factors, including the type of disability, age, occupation, and health conditions. According to the Social Security Administration (SSA), a significant portion of the workforce will become disabled at some point in their careers. In the United States, approximately 1 in 4 of today’s 20-year-olds will become disabled before reaching retirement age.

Factors Influencing Short-Term Disability Odds

The likelihood of getting a short-term disability is influenced by several key factors. Age is a significant factor, as older workers are more likely to experience a disability. Additionally, certain occupations, such as those involving manual labor or high-risk activities, increase the likelihood of disability. Health conditions, including chronic illnesses and mental health disorders, also play a crucial role. Some of the key factors that influence short-term disability odds include:

- Pre-existing medical conditions, such as diabetes or heart disease, which can increase the risk of disability.

- Occupational hazards, such as injuries or illnesses related to the workplace.

- Lifestyle factors, including smoking, lack of exercise, or poor nutrition, which can contribute to health problems.

Common Causes of Short-Term Disability

Short-term disabilities can result from a variety of causes, including injuries, illnesses, and surgeries. Some of the most common causes include musculoskeletal disorders, such as back pain or carpal tunnel syndrome, as well as mental health conditions like depression or anxiety. Other common causes of short-term disability include:

- Accidents and injuries, such as those sustained in a car accident or while engaging in physical activity.

- Chronic health conditions, such as arthritis or multiple sclerosis, which can cause flare-ups or exacerbations.

- Surgical recovery, as individuals may need time to recover from surgical procedures.

Assessing the Risk of Short-Term Disability

To assess the risk of short-term disability, individuals should consider their overall health, occupation, and lifestyle. It is essential to identify potential risk factors and take steps to mitigate them. This can involve maintaining a healthy lifestyle, managing chronic health conditions, and taking steps to prevent injuries or illnesses. Some strategies for assessing and managing the risk of short-term disability include:

- Conducting a risk assessment to identify potential hazards and take steps to mitigate them.

- Maintaining a healthy lifestyle, including regular exercise, a balanced diet, and stress management.

- Reviewing and updating disability insurance coverage to ensure adequate protection in the event of a disability.

Frequently Asked Questions

What are the primary reasons for short-term disability claims being denied?

Short-term disability claims can be denied due to a variety of reasons, with one of the most common being insufficient medical evidence. Insurance companies require substantial proof that the claimant’s condition prevents them from performing their job duties. If the medical documentation is incomplete, inconsistent, or lacks detail about the claimant’s functional limitations, the insurer may deny the claim. It’s crucial for claimants to ensure their healthcare providers submit comprehensive and detailed reports that directly relate to their inability to work.

How does pre-existing condition exclusion affect short-term disability claims?

Many short-term disability insurance policies include pre-existing condition exclusions, which can be a significant reason for claim denials. If a claimant’s disability is related to a condition they had before purchasing the policy, the insurer may deny their claim if it falls within the specified pre-existing condition period. Understanding the specifics of these exclusions and how they apply to individual circumstances is vital for avoiding claim denials.

Can failure to comply with treatment plans lead to a denial of short-term disability benefits?

Yes, failing to comply with a prescribed treatment plan can result in a denial of short-term disability benefits. Insurers expect claimants to follow the recommended treatment by their healthcare providers to mitigate their condition. If a claimant does not adhere to the treatment plan without a valid reason, the insurer may argue that their condition is not as debilitating as claimed, leading to a claim denial. It’s essential for claimants to follow their treatment plans and document their compliance.

How does the definition of ‘disability’ impact the approval of short-term disability claims?

The definition of disability as outlined in the insurance policy is a critical factor in determining whether a short-term disability claim is approved or denied. Policies vary in how they define disability, with some requiring that the claimant be unable to perform their own occupation, while others demand that they be unable to work in any occupation. If a claimant’s condition does not meet the policy’s definition of disability, their claim will likely be denied. Understanding the specific definition used in the policy is crucial for a successful claim.