Choosing the right Professional Employer Organization (

Essential Questions to Ask a PEO Before Making a Decision

Choosing a Professional Employer Organization (PEO) is a major decision that can impact your business operations, compliance, and employee satisfaction. To ensure you select the right partner, it’s crucial to ask the right questions before signing an agreement. Below are key areas to explore when evaluating a PEO provider.

What Services Are Included in the PEO Agreement?

A PEO partnership should cover essential HR functions, payroll processing, benefits administration, and compliance support. However, the scope of services can vary significantly between providers. Be sure to clarify:

- Whether payroll processing includes tax filings and wage garnishments.

- If employee benefits (health insurance, retirement plans) are offered and how they compare to market rates.

- How workers’ compensation and risk management services are handled.

| Service | Included? | Notes |

|---|---|---|

| Payroll Processing | Yes/No | Tax filings included? |

| Employee Benefits | Yes/No | Types of plans available |

| Compliance Support | Yes/No | Federal & state regulations |

How Does the PEO Handle Compliance and Legal Risks?

One of the main advantages of using a PEO is ensuring legal compliance, especially regarding labor laws and tax regulations. Ask the provider:

- How they stay updated on changing employment laws.

- If they provide guidance on I-9 verification and EEO compliance.

- Whether they assume liability for payroll tax errors.

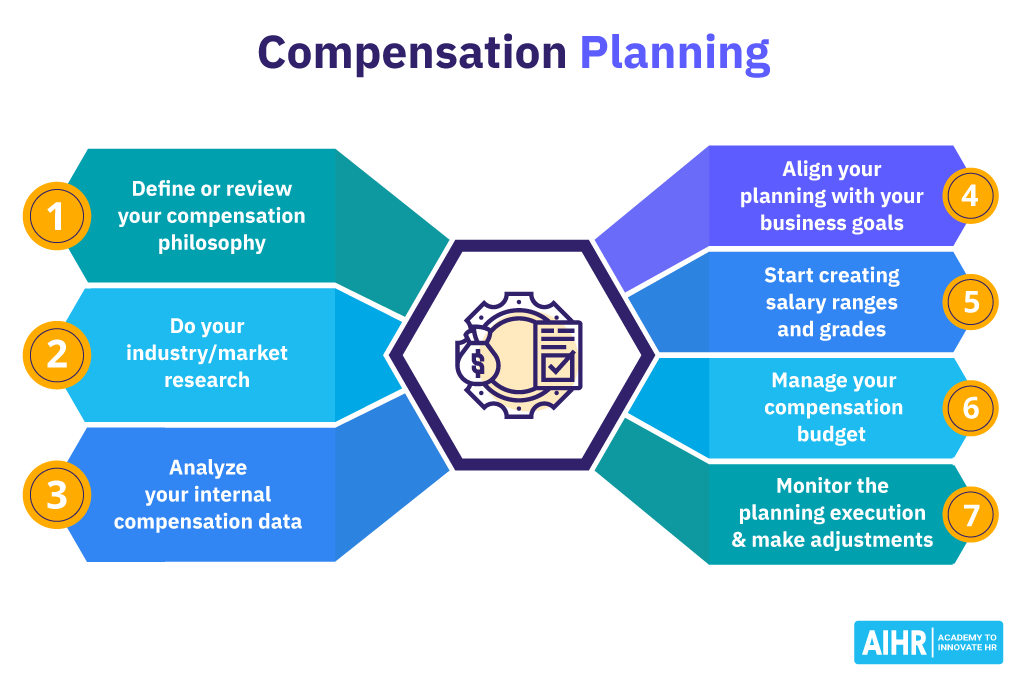

What Are the Fees and Pricing Structure?

PEOs typically charge a percentage of payroll or a flat fee per employee. Transparency in pricing is essential to avoid hidden costs. Key questions include:

- Are there setup fees or additional charges for onboarding?

- What happens if the workforce size changes—does pricing adjust accordingly?

- Are benefits administration fees separate from service costs?

What Is the PEO’s Experience in Your Industry?

Not all PEOs specialize in every sector. Industry-specific knowledge ensures better compliance and benefits management. Ask:

- How many clients do they serve in your industry?

- Do they understand unique challenges, such as seasonal hiring spikes or overtime regulations?

How Seamless Is the Transition Process?

Switching to a PEO involves migrating data, setting up payroll, and possibly changing benefits. Understand:

- The estimated timeline for full integration.

- What support is offered to employees during the transition period.

- If the PEO provides training for your HR team.

What is an example of a PEO question?

An example of a PEO (Population, Exposure, Outcome) question is: In elderly patients (Population), does regular physical exercise (Exposure) reduce the risk of falls (Outcome)? This structured format helps clarify research objectives by defining the target group, the intervention or exposure, and the expected result.

How to Formulate a PEO Question?

To craft an effective PEO question, follow these steps:

- Define the Population: Identify the specific group being studied (e.g., pregnant women, diabetic patients).

- Specify the Exposure: Determine the intervention or factor (e.g., diet, medication, lifestyle change).

- Measure the Outcome: Establish the measurable result (e.g., reduced symptoms, improved recovery rates).

Why Use the PEO Framework?

The PEO framework is valuable because it:

- Improves Clarity: Breaks down complex research questions into manageable components.

- Guides Literature Reviews: Helps identify relevant studies by aligning keywords with the PEO structure.

- Supports Evidence-Based Practice: Ensures questions are focused and answerable through research.

Common PEO Question Examples

Here are additional examples of PEO questions:

- Population: Children with asthma. Exposure: Air purifiers. Outcome: Frequency of asthma attacks.

- Population: Office workers. Exposure: Standing desks. Outcome: Lower back pain incidence.

- Population: Elderly adults. Exposure: Social interactions. Outcome: Cognitive decline rates.

How to evaluate a PEO?

Evaluating the Experience and Reputation of a PEO

When assessing a Professional Employer Organization (PEO), consider their industry experience and market reputation. Look for established providers with positive client testimonials and robust case studies. Key indicators include longevity in the industry, recognition by professional bodies, and client retention rates.

- Industry tenure – Longer history often signifies stability and expertise.

- Client feedback – Reviews and testimonials highlight real-world performance.

- Accreditations – Certifications like IRS or ESAC demonstrate compliance credibility.

Assessing PEO Services and Client Support

A PEO should offer comprehensive services, including payroll processing, benefits administration, HR compliance, and risk management. Evaluate whether their support aligns with your business needs. Responsiveness, accessibility, and dedicated account managers are crucial for smooth operations.

- Service breadth – Ensure they cover payroll, benefits, and HR tasks.

- Support quality – Check availability (24/7 vs. business hours) and response times.

- Technology integration – Assess user-friendly platforms for reporting and management.

Analyzing Cost Structures and Contract Terms

Pricing transparency and contract flexibility are vital. Scrutinize fee structures (flat-rate, per-employee, or percentage-based) and hidden costs. Review termination clauses, scalability options, and potential penalties to ensure alignment with your business growth.

- Pricing models – Compare fixed fees vs. variable costs.

- Hidden fees – Clarify charges for additional services or employee changes.

- Contract flexibility – Look for scalable, short-term, or cancellation-friendly terms.

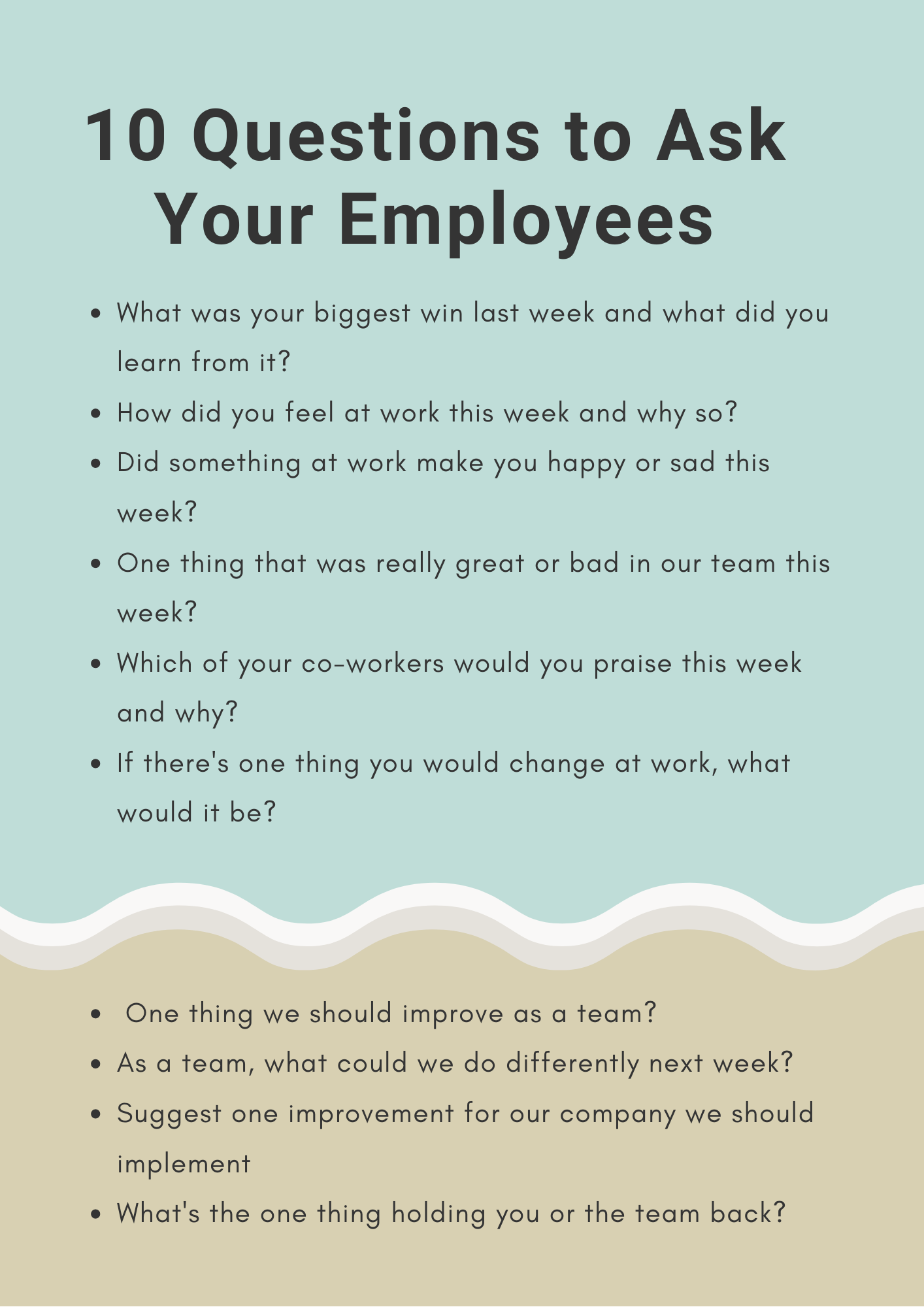

What are some unique questions to ask employees?

Insightful Questions to Understand Employee Growth

Asking employees about their personal and professional development can reveal their aspirations and challenges. Here are some unique questions to uncover their growth mindset:

- If you could master one new skill instantly, what would it be and why? This highlights their priorities and areas they feel could benefit their career.

- What’s a project you’ve worked on that made you feel proud, and what did you learn from it? This emphasizes their achievements and self-awareness.

- How would you redesign your role to make it more fulfilling? This encourages creative thinking about job satisfaction and productivity.

Creative Questions to Gauge Problem-Solving Abilities

Understanding how employees approach challenges helps assess their critical thinking. Consider these thought-provoking questions:

- Describe a time you had to solve a problem with limited resources—what was your approach? This reveals adaptability and resourcefulness.

- If you were in charge for a day, what’s one change you’d implement immediately? This uncovers their observations about inefficiencies or opportunities.

- What’s a failure that taught you more than a success? This emphasizes resilience and learning from setbacks.

Engaging Questions to Measure Team Dynamics

Team cohesion is critical for success. These questions help evaluate collaboration and communication styles:

- Which colleague’s work style do you admire most, and why? This identifies role models and values within the team.

- What’s one thing we could do as a team to improve our meetings? This encourages constructive feedback about workflow.

- How do you prefer to receive feedback, and how can I better support you? This tailors leadership to individual needs.

Frequently Asked Questions

What services does the PEO provide, and are they customizable?

A Professional Employer Organization (PEO) typically offers a wide range of services, including payroll processing, employee benefits administration, HR compliance, and risk management. However, not all PEOs provide the same services, and some may allow customization based on your business needs. It’s essential to verify whether their services align with your requirements—especially if you need specialized support like international payroll or industry-specific compliance. Ask for a detailed breakdown of their offerings and whether you can opt in or out of certain features.

How is pricing structured, and are there hidden fees?

PEOs usually charge either a percentage of payroll or a flat fee per employee. However, additional costs may arise for services like workers’ compensation, benefits administration, or setup fees. To avoid surprises, request a transparent pricing model and ask about potential hidden fees, such as charges for contract amendments, emergency payroll runs, or employee onboarding. A reputable PEO should provide a clear cost breakdown before you commit.

What is the PEO’s approach to compliance and risk management?

Compliance is a critical aspect of partnering with a PEO, as they handle sensitive areas like tax filings, labor laws, and employee classification. Ask how they stay updated on federal, state, and local regulations, and whether they offer compliance audits or legal support. Additionally, inquire about their process for managing risks, such as workplace safety programs or liability insurance. A strong PEO will proactively address compliance issues to protect your business.

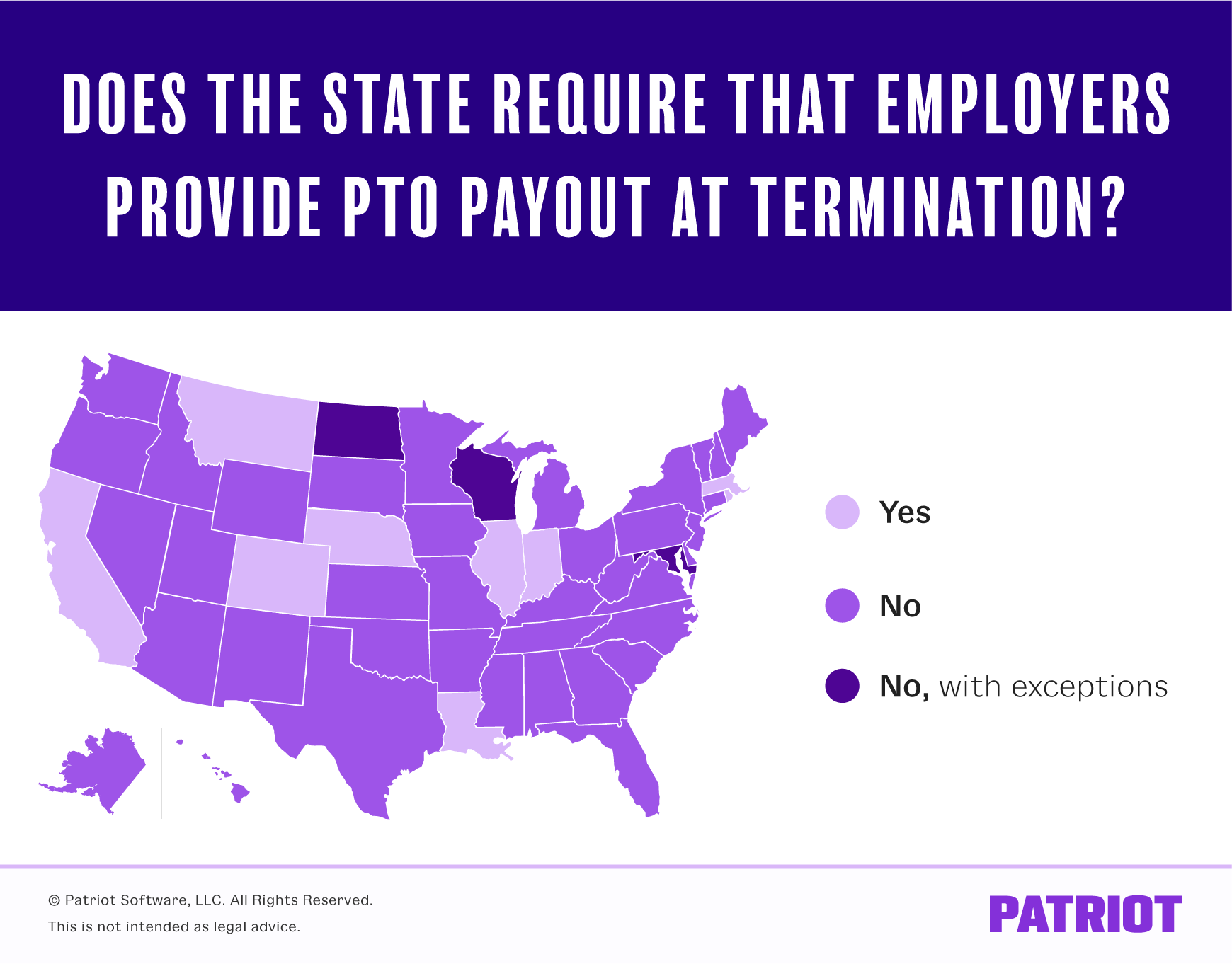

How does the PEO handle employee benefits and insurance?

Many businesses partner with a PEO to access better employee benefits, such as health insurance, retirement plans, and wellness programs. Ask about the quality of benefits offered, whether they are nationwide or region-specific, and how often they are reviewed or renegotiated. Also, clarify how the PEO manages open enrollment, claims processing, and employee inquiries. A reliable PEO should provide competitive benefits that help attract and retain talent while keeping costs manageable.