As a beauty industry professional, navigating the complex world of taxes can be overwhelming, but understanding available tax write-offs is crucial for maximizing deductions and minimizing liability. Claiming the right deductions can significantly reduce taxable income, resulting in a lower tax bill and increased cash flow for your business. This article will explore the various tax write-offs available to beauty industry professionals, including deductions for equipment, supplies, marketing, and more, helping you make informed decisions to optimize your tax strategy and keep more of your hard-earned profits. Proper planning is key.

Understanding Tax Deductions for Beauty Professionals

As a beauty industry professional, you’re likely no stranger to the concept of tax deductions. However, navigating the complex world of tax write-offs can be daunting, especially when it comes to industry-specific expenses. In this section, we’ll break down the basics of tax deductions and explore how beauty professionals can maximize their deductions.

Common Tax-Deductible Expenses for Beauty Salons

Beauty salons incur a variety of expenses on a daily basis, many of which can be written off on their taxes. Some common examples include: Rent or mortgage payments for the salon space Utilities such as electricity and water Salon equipment and furniture Supplies such as haircare products and styling tools Marketing and advertising expenses

| Expense Category | Examples |

|---|---|

| Occupancy Expenses | Rent, mortgage payments, utilities |

| Equipment and Furniture | Hair dryers, styling chairs, salon equipment |

| Supplies | Haircare products, styling tools, towels |

| Marketing and Advertising | Social media ads, print ads, promotional materials |

Tax Deductions for Beauty Education and Training

Staying up-to-date with the latest beauty trends and techniques is essential for beauty professionals. Fortunately, the cost of continuing education and training can be tax-deductible. This includes: Workshops and conferences Online courses and tutorials Travel expenses related to education and training To qualify for these deductions, the education or training must be directly related to your current business or profession.

Home-Based Beauty Business Tax Deductions

For beauty professionals who work from home, there are a variety of tax deductions available. These include: Home office deductions Utilities and insurance Equipment and supplies To qualify for these deductions, you must use a dedicated space in your home for business purposes.

| Deduction | Description |

|---|---|

| Home Office Deduction | A portion of your rent or mortgage interest, utilities, and insurance |

| Business Use Percentage | The percentage of your home used for business purposes |

Tax Deductions for Beauty Product Inventory

For beauty professionals who sell products as part of their business, the cost of inventory can be tax-deductible. This includes: The cost of purchasing products for resale Shipping and handling costs Storage costs To qualify for these deductions, you must have accurate records of your inventory purchases and sales.

Record-Keeping for Beauty Industry Tax Deductions

To maximize your tax deductions, it’s essential to maintain accurate and detailed records of your business expenses. This includes: Receipts and invoices Bank statements and cancelled checks Records of business use percentage for home-based businesses By keeping accurate records, you can ensure you’re taking advantage of all the tax deductions available to you.

| Record Type | Description |

|---|---|

| Receipts and Invoices | Proof of business expenses |

| Bank Statements | Records of business income and expenses |

| Business Use Percentage | Records of business use percentage for home-based businesses |

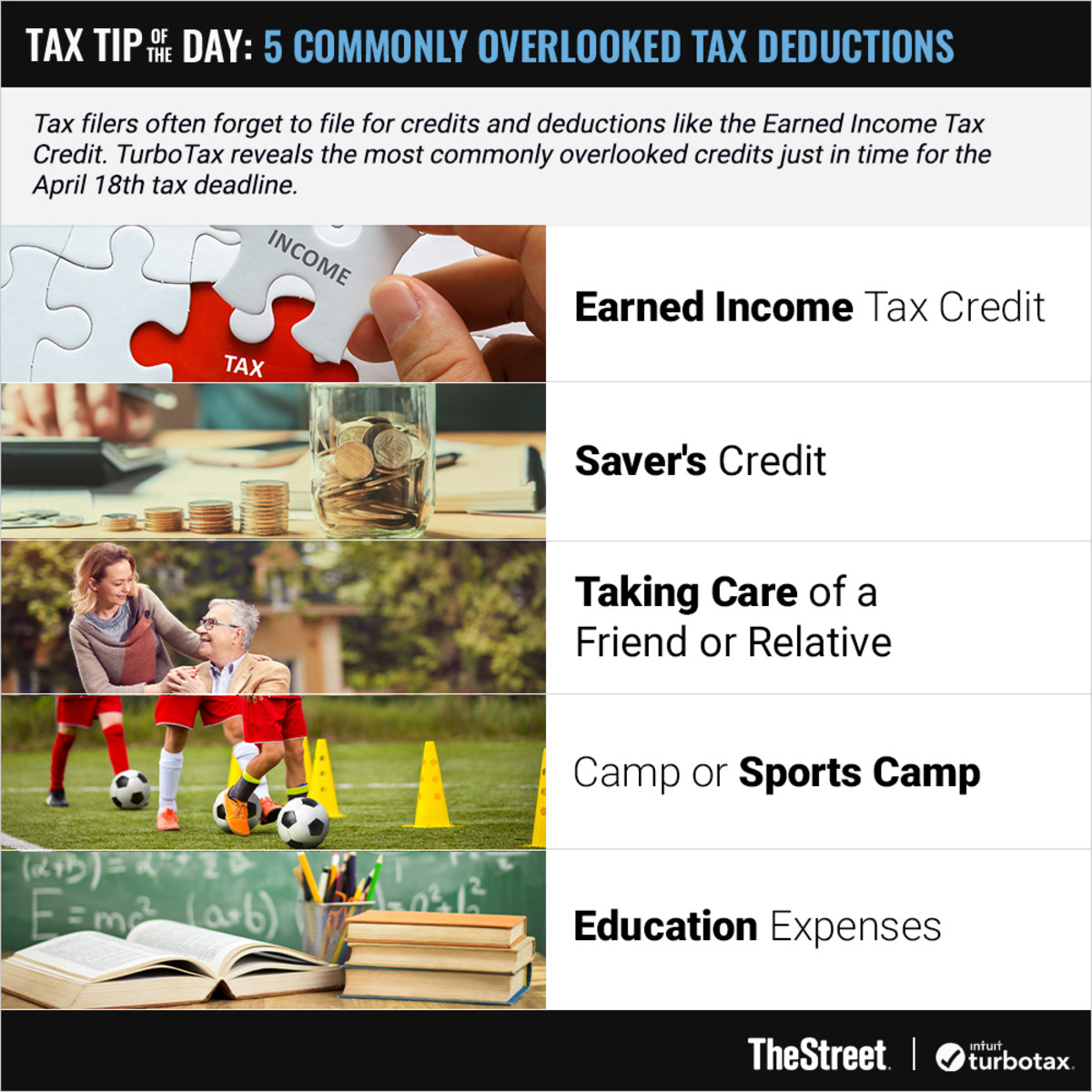

What is the most overlooked tax break?

The most overlooked tax break is often considered to be the Saver’s Credit, also known as the Retirement Savings Contributions Credit. This credit is designed to encourage low- and moderate-income individuals to save for retirement by contributing to a qualified retirement plan, such as a 401(k) or an IRA. The credit is available to taxpayers who meet certain income and filing status requirements and who contribute to a qualified retirement plan.

Eligibility Criteria for Saver’s Credit

To be eligible for the Saver’s Credit, taxpayers must meet certain requirements. The credit is available to individuals who are at least 18 years old, are not full-time students, and are not claimed as dependents on another taxpayer’s return. The income limits for the credit vary based on filing status, with Adjusted Gross Income (AGI) limits ranging from $32,500 to $66,000 for the 2022 tax year.

- Income Limits: The AGI limits for the Saver’s Credit are adjusted annually for inflation.

- Filing Status: The credit is available to taxpayers who file as single, head of household, married filing jointly, or qualifying widow(er).

- Contribution Requirements: Taxpayers must contribute to a qualified retirement plan, such as a 401(k), 403(b), or IRA.

Benefits of the Saver’s Credit

The Saver’s Credit can provide a significant tax benefit to eligible taxpayers. The credit is worth between 10% and 50% of the taxpayer’s qualified retirement contributions, up to a maximum credit of $1,000 ($2,000 for married couples filing jointly). The credit is also refundable, meaning that it can be claimed even if the taxpayer has little or no tax liability.

- Credit Amount: The credit amount is based on the taxpayer’s income, filing status, and qualified retirement contributions.

- Qualified Contributions: Contributions to a qualified retirement plan, including 401(k), 403(b), and IRA contributions, are eligible for the credit.

- Impact on Tax Liability: The Saver’s Credit can reduce a taxpayer’s tax liability, potentially resulting in a larger refund.

Maximizing the Saver’s Credit

To maximize the Saver’s Credit, taxpayers should consider contributing as much as possible to a qualified retirement plan, especially if they are eligible for employer matching contributions. Taxpayers should also be aware of the income limits and filing status requirements for the credit.

- Maximize Contributions: Contribute as much as possible to a qualified retirement plan to maximize the credit.

- Take Advantage of Employer Matching: Contribute enough to a 401(k) or other employer-sponsored plan to maximize employer matching contributions.

- Consult a Tax Professional: Consult with a tax professional to ensure that you are eligible for the Saver’s Credit and to maximize your credit amount.

What tax deductions are 100% deductible?

Understanding 100% Tax Deductions

Some expenses are considered 100% deductible for tax purposes, meaning that the entire amount can be claimed as a deduction against taxable income. These deductions can significantly reduce an individual’s or business’s tax liability. To qualify for 100% deductibility, expenses must be legitimate, properly documented, and directly related to the generation of income or business operations.

- Business Expenses: Expenses that are wholly and exclusively incurred for business purposes can be 100% deductible.

- Charitable Donations: Donations to qualified charitable organizations can be fully deductible.

- Certain Investment Expenses: Some investment expenses, such as fees for investment advice, can be deductible.

The tax code allows for certain expenses to be fully deductible, providing relief to taxpayers who incur these expenses.

Fully Deductible Business Expenses

Businesses can deduct expenses that are ordinary and necessary for their operations. These can include a wide range of expenses such as rent, utilities, and employee salaries. To be 100% deductible, these expenses must be directly related to the business and not personal in nature.

- Operational Costs: Expenses like rent and utilities are typically 100% deductible.

- Employee-Related Expenses: Salaries, benefits, and training costs for employees can be fully deductible.

- Business Travel Expenses: Expenses related to business travel, including transportation and lodging, can be 100% deductible if properly documented.

Other 100% Deductible Expenses

In addition to business expenses, there are other categories of expenses that can be 100% deductible. These include medical expenses under certain conditions and mortgage interest on primary residences and sometimes second homes. The deductibility of these expenses is subject to specific rules and limitations.

- Medical Expenses: Certain medical expenses can be 100% deductible if they exceed a certain threshold of adjusted gross income.

- Mortgage Interest: Homeowners can deduct mortgage interest on their primary residence and sometimes a second home.

- State and Local Taxes (SALT): Some taxpayers can deduct state and local taxes, although this is subject to a $10,000 cap for individuals.

Can you write off beauty expenses?

The answer to this question largely depends on the context and purpose of these expenses. For individuals, beauty expenses are generally considered personal expenses and are not deductible. However, there are certain circumstances under which beauty expenses can be considered tax-deductible, particularly for those in the beauty industry or for specific medical conditions.

Beauty Expenses for Business Purposes

For individuals who work in the beauty industry, such as makeup artists, hairstylists, or models, certain beauty expenses can be considered business expenses and may be tax-deductible. To qualify, these expenses must be directly related to their profession and be necessary for them to perform their job effectively.

- Professional makeup and hairstyling expenses for models or performers.

- Maintenance costs for equipment or tools used in their profession.

- Training and education expenses to improve their skills or stay updated with the latest trends.

Medical Conditions and Beauty Expenses

In some cases, beauty expenses can be related to medical conditions or treatments, making them potentially tax-deductible as medical expenses. For instance, individuals undergoing chemotherapy may experience hair loss, and expenses related to wigs or other hair replacement treatments might be deductible.

- Medical treatments that involve cosmetic procedures as part of the treatment.

- Prescribed skincare or other dermatological treatments for conditions like acne or psoriasis.

- Expenses for prosthetics or devices that are medically necessary.

Tax Laws and Regulations

It’s crucial to understand the current tax laws and regulations regarding the deductibility of beauty expenses. Tax authorities often have specific guidelines on what can be considered a legitimate business or medical expense.

- Record-keeping is essential to substantiate claims for beauty expenses.

- Consulting a tax professional can help in navigating the complexities of tax laws.

- Staying updated with changes in tax regulations that may affect the deductibility of beauty expenses.

What is the 20% self-employment deduction?

The 20% self-employment deduction, also known as the Qualified Business Income (QBI) deduction, is a tax deduction available to self-employed individuals and owners of pass-through businesses. This deduction allows eligible taxpayers to deduct up to 20% of their qualified business income from their taxable income, resulting in a significant reduction in their tax liability.

Eligibility Criteria for the 20% Self-Employment Deduction

To qualify for the 20% self-employment deduction, taxpayers must meet certain eligibility criteria. The deduction is available to self-employed individuals, including sole proprietors, partners in partnerships, and S corporation shareholders. The business must also be a qualified trade or business, which excludes certain service businesses, such as healthcare, law, and financial services, unless the taxpayer’s taxable income is below a certain threshold.

- The business must be a pass-through entity, such as a sole proprietorship, partnership, or S corporation.

- The taxpayer must have qualified business income, which includes income from the business, but excludes certain items, such as capital gains and dividends.

- The taxpayer’s taxable income must be below certain thresholds, which are $163,300 for single filers and $326,600 for joint filers in 2022.

Calculating the 20% Self-Employment Deduction

The 20% self-employment deduction is calculated based on the taxpayer’s qualified business income. The deduction is generally equal to 20% of the taxpayer’s qualified business income, but it is subject to certain limitations and phase-outs. For example, the deduction may be limited by the amount of W-2 wages paid by the business, or by the unadjusted basis of certain property used in the business.

- The taxpayer must calculate their qualified business income, which includes income from the business, but excludes certain items.

- The taxpayer must then calculate the 20% deduction, which is generally equal to 20% of their qualified business income.

- The deduction may be subject to certain limitations and phase-outs, such as the W-2 wage limit or the unadjusted basis limit.

Impact of the 20% Self-Employment Deduction on Tax Liability

The 20% self-employment deduction can have a significant impact on a taxpayer’s tax liability. By reducing taxable income, the deduction can result in a lower tax bill and increased cash flow for the taxpayer. For example, a self-employed individual with $100,000 of qualified business income may be eligible for a $20,000 deduction, resulting in a significant reduction in their tax liability.

- The deduction can result in a lower tax bill, as it reduces taxable income.

- The deduction can increase cash flow for the taxpayer, as they will have more money available to invest or use for other purposes.

- The deduction can also impact other tax benefits, such as the alternative minimum tax (AMT), as it can reduce the taxpayer’s taxable income.

Frequently Asked Questions

What are the most common tax write-offs for beauty industry professionals?

Beauty industry professionals can claim a variety of tax write-offs to reduce their taxable income. Some of the most common deductions include business expenses such as salon rent, equipment, and supplies. Additionally, marketing expenses like advertising and promotional materials can also be deducted. Beauty professionals can also write off education and training expenses related to their profession, such as workshops, conferences, and online courses. Furthermore, travel expenses related to business, like mileage or flights to industry events, can be claimed as a deduction.

How do I qualify for tax write-offs as a beauty industry professional?

To qualify for tax write-offs, beauty industry professionals must be able to prove that their expenses are legitimate business expenses. This means keeping accurate and detailed records of all business-related expenses, including receipts, invoices, and bank statements. It’s also essential to separate personal and business expenses to avoid commingling funds. Beauty professionals should also be aware of the ordinary and necessary rule, which states that expenses must be common and accepted in the industry to be eligible for deduction.

Can I deduct the cost of beauty products and supplies as a tax write-off?

Yes, beauty industry professionals can deduct the cost of beauty products and supplies as a tax write-off, but only if they are used for business purposes. This can include products used for services provided to clients, as well as supplies used for education and training. It’s essential to keep accurate records of the products and supplies used for business, including receipts and inventory records. Beauty professionals should also be aware of the de minimis rule, which allows for the deduction of small expenses, like products and supplies, without having to capitalize them.

How can I maximize my tax deductions as a beauty industry professional?

To maximize tax deductions, beauty industry professionals should keep accurate and detailed records of all business-related expenses. This includes receipts, invoices, bank statements, and mileage logs. Beauty professionals should also consult with a tax professional to ensure they are taking advantage of all eligible deductions. Additionally, staying up-to-date on tax law changes and being aware of industry-specific deductions can help beauty professionals maximize their tax savings. By being proactive and organized, beauty professionals can reduce their taxable income and keep more of their hard-earned money.