As a small business owner in Utah, offering competitive employee benefits is crucial for attracting and retaining top talent. With the state’s thriving economy and growing workforce, it’s essential to understand the top employee benefits options available. From health insurance to retirement plans, and other perks, small business owners must navigate the complex landscape of benefits to remain competitive. This article explores the top small business employee benefits options in Utah, providing insights to help business owners make informed decisions and create a comprehensive benefits package that meets the needs of their employees.

Understanding Small Business Employee Benefits in Utah

Small businesses in Utah are increasingly recognizing the importance of offering competitive employee benefits to attract and retain top talent. In a competitive job market, benefits can be a deciding factor for potential employees. Understanding the various options available is crucial for small business owners to make informed decisions.

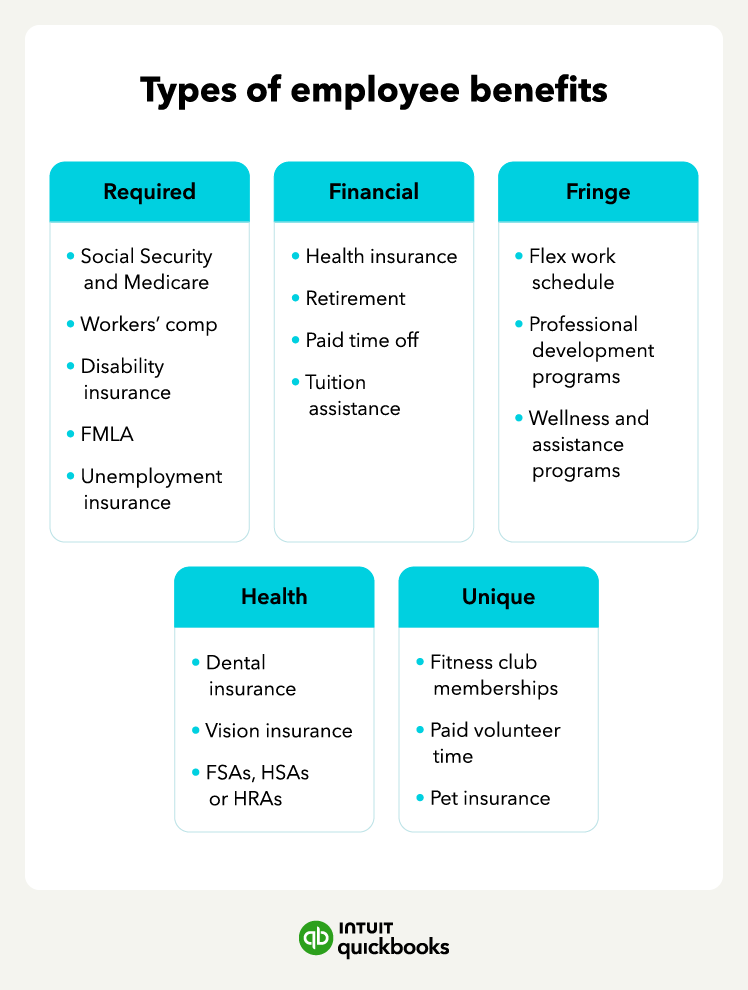

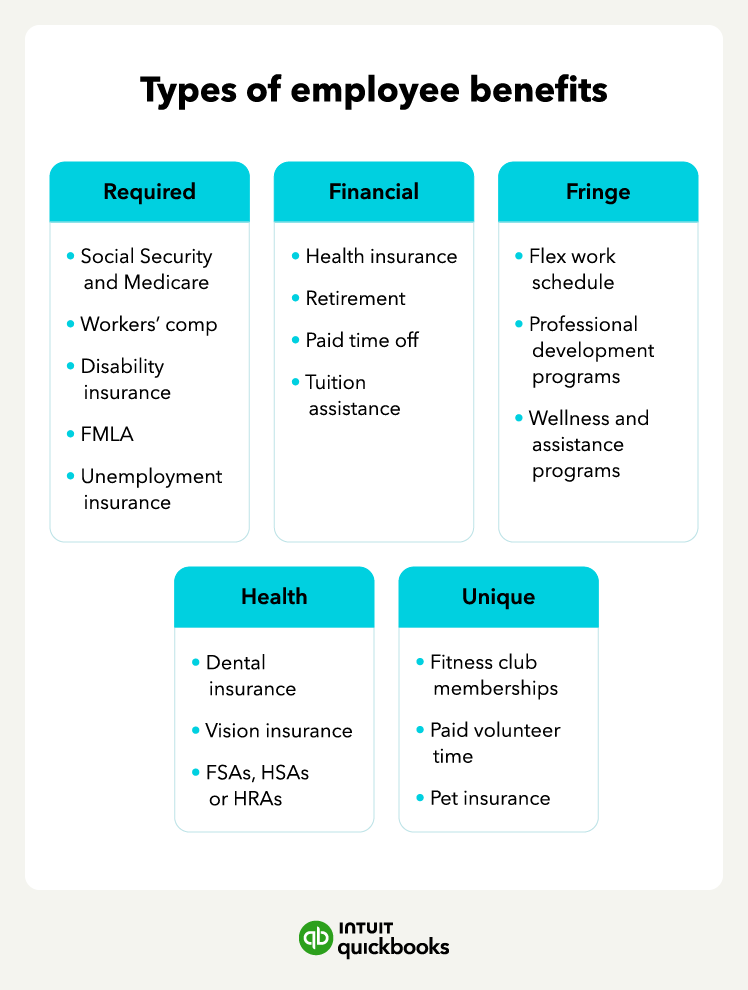

Types of Employee Benefits

Employee benefits can be broadly categorized into several types, including health insurance, retirement plans, paid time off, and other benefits such as life insurance and disability insurance. Each of these categories offers various options that can be tailored to meet the needs of both the employer and the employees. For instance, health insurance can range from basic coverage to comprehensive plans that include dental and vision care.

Health Insurance Options for Small Businesses

For small businesses in Utah, health insurance is a critical benefit. The Small Business Health Options Program (SHOP) is a marketplace where small businesses can compare and purchase health insurance plans. This program allows businesses to offer affordable health insurance to their employees. The plans available through SHOP can vary in terms of coverage, deductible, and out-of-pocket costs.

Retirement Plans for Small Business Employees

Retirement plans are another essential benefit that small businesses can offer. Options such as 401(k) plans, SIMPLE IRAs, and SEP-IRAs are popular among small businesses due to their flexibility and the benefits they offer to employees. These plans not only help employees save for retirement but also provide tax benefits to the employer.

Other Benefits to Consider

In addition to health insurance and retirement plans, small businesses can consider offering other benefits to enhance their overall compensation package. These can include paid time off, life insurance, disability insurance, and wellness programs. Offering a range of benefits can help small businesses stand out in the job market and improve employee satisfaction.

Implementing Employee Benefits

Implementing employee benefits requires careful planning and consideration of the business’s financial situation and the needs of its employees. It’s essential to communicate effectively with employees about the benefits available and how they can enroll. Businesses should also regularly review their benefits packages to ensure they remain competitive and aligned with the needs of their workforce.

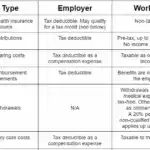

| Benefit Type | Description | Key Features |

|---|---|---|

| Health Insurance | Medical coverage for employees | SHOP marketplace, various coverage levels |

| Retirement Plans | Plans to help employees save for retirement | 401(k), SIMPLE IRA, SEP-IRA |

| Paid Time Off | Time off for vacation, sick leave, etc. | Flexible accrual rates, carryover options |

| Life and Disability Insurance | Financial protection for employees and their families | Group life insurance, short-term and long-term disability |

| Wellness Programs | Programs to promote employee health and well-being | Fitness programs, health screenings, nutrition counseling |

What benefits do most small businesses offer?

Most small businesses offer a variety of benefits to their employees, although the specific benefits can vary widely depending on the size, industry, and financial health of the business. Typically, small businesses provide benefits that are essential for attracting and retaining talent in a competitive job market. These benefits often include health insurance, paid time off, and retirement plans. The specific mix and generosity of these benefits can be crucial in determining the overall compensation package and job satisfaction for employees.

Common Benefits Offered by Small Businesses

Small businesses often strive to offer a competitive benefits package despite limited resources. The most common benefits include health, dental, and vision insurance, which are crucial for employee well-being. Other benefits may encompass paid vacation days, sick leave, and holidays, allowing employees to maintain a healthy work-life balance. Additionally, some small businesses offer more comprehensive benefits like life insurance and disability insurance to provide further security for their employees.

- Health Insurance: A key benefit that many small businesses offer to support their employees’ physical and mental health.

- Retirement Plans: Such as 401(k) plans, which help employees save for their future.

- Paid Time Off: Including vacation days, sick leave, and holidays, which contribute to a better work-life balance.

Financial Benefits and Incentives

Financial benefits and incentives are another way small businesses attract and retain employees. These can include bonuses, profit-sharing plans, and stock options. Such benefits not only provide a financial boost but also give employees a sense of ownership and motivation. By directly tying employee rewards to the company’s performance, small businesses can foster a more engaged and productive workforce.

- Bonuses: Performance-based bonuses can significantly enhance an employee’s total compensation.

- Profit-Sharing Plans: These plans distribute a portion of the company’s profits to employees, aligning their interests with the company’s success.

- Stock Options: Offering employees the opportunity to purchase company stock at a predetermined price, potentially leading to significant financial gains.

Wellness and Development Benefits

Beyond financial benefits, many small businesses are now focusing on wellness and development benefits to enhance job satisfaction and employee retention. These can include gym memberships, professional development courses, and flexible working arrangements. By investing in their employees’ well-being and career growth, small businesses can create a more positive and supportive work environment.

- Gym Memberships: Supporting physical health and reducing stress through access to fitness facilities.

- Professional Development Courses: Enhancing employees’ skills and knowledge, contributing to their career advancement.

- Flexible Working Arrangements: Allowing employees to balance work and personal responsibilities more effectively.

How to offer benefits to employees in a small business?

To offer benefits to employees in a small business, it is essential to understand the importance of providing a comprehensive benefits package that meets the diverse needs of your workforce. A well-structured benefits program can help attract and retain top talent, improve employee satisfaction, and increase productivity.

Understanding Employee Needs

Understanding the needs and preferences of your employees is crucial in designing a benefits package that is relevant and effective. To achieve this, you can conduct surveys or focus groups to gather information about what benefits are most valued by your employees.

- Identify the demographics of your workforce, including age, gender, and family status.

- Determine the types of benefits that are most important to your employees, such as health insurance, retirement plans, or paid time off.

- Consider offering flexible benefits that allow employees to choose the benefits that best suit their needs.

Designing a Benefits Package

Designing a benefits package that is both comprehensive and cost-effective requires careful consideration of various factors, including the size and budget of your business, as well as the needs and preferences of your employees.

- Consider offering a group health insurance plan that provides coverage for employees and their families.

- Develop a retirement plan, such as a 401(k) or SIMPLE IRA, that helps employees save for their future.

- Provide paid time off, including vacation days, sick leave, and holidays, to help employees achieve a better work-life balance.

Communicating Benefits to Employees

Effective communication is critical in ensuring that employees understand and appreciate the benefits that are available to them. To achieve this, you can use various channels, such as employee handbooks, company intranets, or benefits fairs, to educate employees about their benefits.

- Provide clear and concise information about the benefits that are available, including eligibility criteria and enrollment procedures.

- Use multiple communication channels to reach employees, including email, company meetings, and benefits websites.

- Offer ongoing support to employees, including benefits counseling and enrollment assistance, to help them make informed decisions about their benefits.

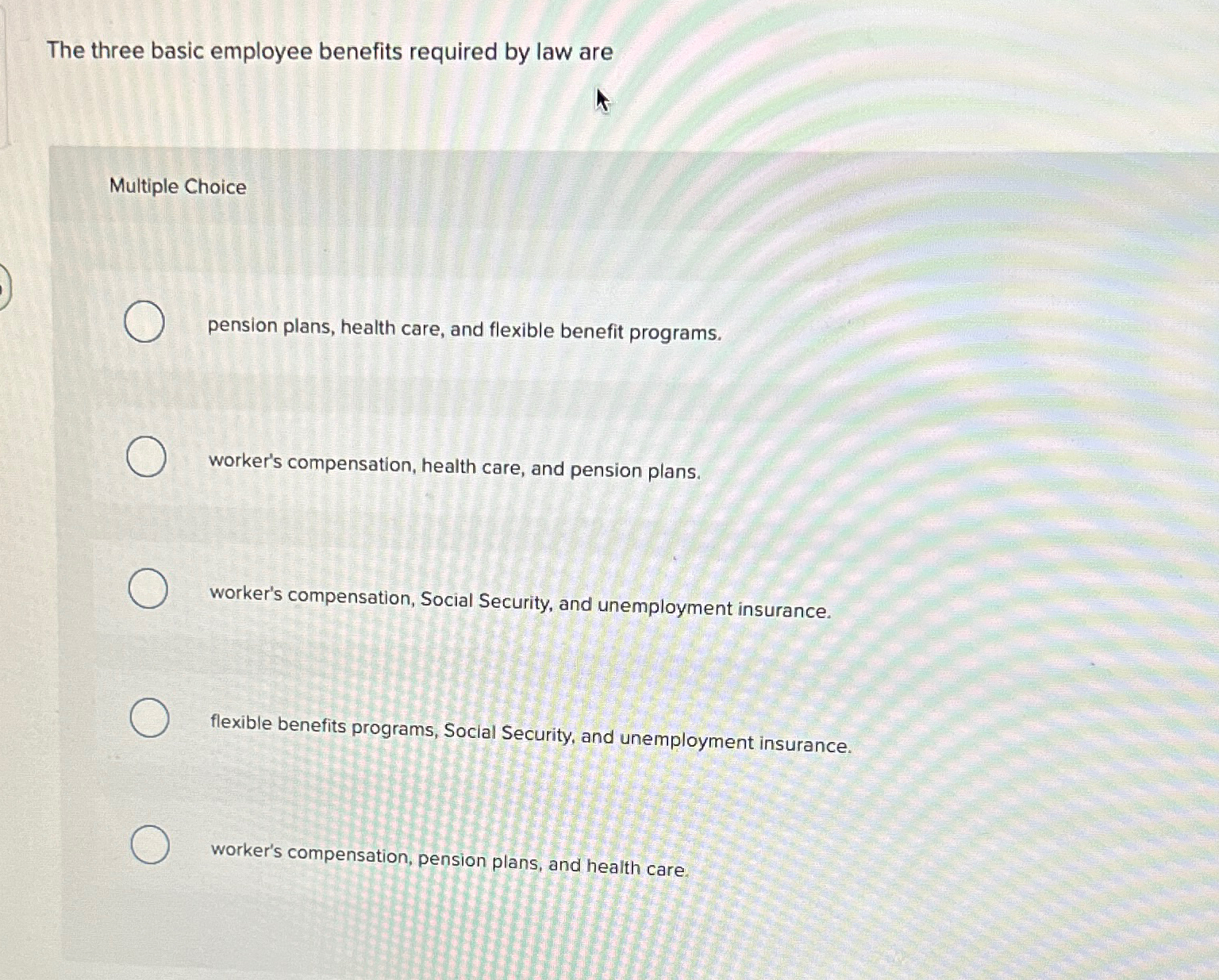

Which of the following are the three basic employee benefits offered to every employee as required by law?

The three basic employee benefits offered to every employee as required by law are Social Security, Workers’ Compensation, and Unemployment Insurance. These benefits are mandated by law to provide a safety net for employees in various situations.

Understanding the Basics of Mandatory Employee Benefits

The law requires employers to provide certain benefits to their employees to ensure their well-being and financial security. These benefits are designed to protect employees from unforeseen circumstances such as illness, injury, or job loss. The three basic employee benefits are fundamental to the employer-employee relationship and are enforced by law to safeguard employees’ rights.

- Social Security: Provides financial assistance to employees upon retirement or in the event of disability.

- Workers’ Compensation: Offers medical and financial benefits to employees who suffer work-related injuries or illnesses.

- Unemployment Insurance: Supports employees who lose their jobs through no fault of their own, helping them during the transition period.

The Importance of Mandatory Benefits in the Workplace

Mandatory employee benefits play a crucial role in maintaining a stable and secure work environment. By providing these benefits, employers not only comply with the law but also contribute to the overall well-being of their employees. This, in turn, can lead to increased employee satisfaction, productivity, and loyalty.

- Financial Security: Mandatory benefits provide employees with financial protection against unforeseen events.

- Employee Retention: Offering these benefits can help employers retain top talent and reduce turnover rates.

- Compliance with the Law: Employers who fail to provide mandatory benefits risk facing legal penalties and reputational damage.

How Mandatory Benefits Impact Employees and Employers

The impact of mandatory employee benefits is multifaceted, affecting both employees and employers in significant ways. For employees, these benefits offer a sense of security and stability. For employers, they represent a crucial aspect of their overall compensation package and a means of demonstrating their commitment to their workforce.

- Enhanced Job Security: Mandatory benefits can make a job more attractive to potential employees.

- Reduced Financial Risk: By providing a safety net, these benefits reduce the financial risk associated with employment.

- Improved Employer Brand: Employers who prioritize their employees’ well-being through mandatory benefits can enhance their brand reputation.

Frequently Asked Questions

What are the most common small business employee benefits offered in Utah?

In Utah, small businesses often offer a variety of employee benefits to attract and retain top talent. Health insurance is a highly sought-after benefit, with many companies opting for group health plans that provide comprehensive coverage to their employees. Additionally, retirement plans such as 401(k) or SIMPLE IRA are popular choices, as they enable employees to save for their future while also providing tax benefits to the employer. Other common benefits include paid time off, life insurance, and disability insurance, which help to support employees’ overall well-being and provide financial security.

How do small business employee benefits impact employee retention in Utah?

Offering competitive employee benefits is crucial for small businesses in Utah to retain their employees and reduce turnover rates. Comprehensive benefits packages can significantly enhance job satisfaction, as employees feel valued and supported by their employer. When employees receive competitive compensation and benefits, they are more likely to be engaged and committed to their work, leading to improved productivity and reduced absenteeism. Moreover, a positive company culture that prioritizes employee well-being can foster a sense of loyalty among employees, making them more likely to stay with the company long-term.

What are the top options for small business health insurance in Utah?

Utah small businesses have several options for health insurance, including group health plans, association health plans, and individual coverage health reimbursement arrangements. Group health plans are the most traditional option, where employers purchase a single policy that covers all eligible employees. Association health plans allow small businesses to band together to purchase health insurance as a group, often at a lower cost. Individual coverage health reimbursement arrangements enable employers to reimburse employees for individual health insurance premiums, providing a more flexible and cost-effective solution.

Are there any Utah state-specific regulations or incentives for small business employee benefits?

Utah has implemented various regulations and incentives to encourage small businesses to offer employee benefits. For example, Utah’s Small Business Health Insurance Tax Credit provides a tax credit to small businesses that offer health insurance to their employees. Additionally, Utah requires employers to provide workers’ compensation insurance to their employees, which provides financial assistance in the event of a work-related injury or illness. Employers must also comply with ERISA regulations and other federal laws governing employee benefits, ensuring that their benefits plans are administered fairly and in accordance with the law.