Navigating short-term disability coverage for a pre-existing pregnancy can be complex, as policies often vary widely between providers. Many employees rely on these benefits for financial support during pregnancy-related leave, yet exclusions for pre-existing conditions may apply. Understanding the nuances—such as waiting periods, medical documentation requirements, and employer-specific policies—is crucial for expectant parents planning their leave. This article explores key insights into short-term disability coverage for pre-existing pregnancies, helping individuals assess eligibility and avoid potential gaps in support. Whether you’re reviewing an existing policy or considering new coverage, knowing these details can ensure a smoother transition during this important time.

Understanding Short-Term Disability Coverage for Pre-Existing Pregnancy

When exploring short-term disability (STD) insurance, pre-existing pregnancy can significantly impact coverage eligibility and benefits. Many insurance providers have specific waiting periods or exclusions for pregnancies that existed before policy enrollment. This guide provides insights into how pre-existing pregnancy affects STD coverage, what options are available, and key details to consider before filing a claim.

1. What Qualifies as a Pre-Existing Pregnancy in STD Policies?

A pre-existing pregnancy is typically defined as a pregnancy that was confirmed (e.g., through a doctor’s diagnosis) before the short-term disability policy was active. Most insurers impose a look-back period (e.g., 3–12 months) to determine if the pregnancy existed before coverage began. Waiting periods may apply before benefits are paid.

| Key Factor | Coverage Impact |

|---|---|

| Look-back period | Determines if pregnancy was pre-existing |

| Waiting period | Delays benefit eligibility (e.g., 10 months) |

2. Do All STD Policies Exclude Pre-Existing Pregnancies?

Not all STD policies exclude pre-existing pregnancies, but many employer-sponsored or private plans do. Some insurers offer limited coverage after a waiting period, while others deny claims outright. Carefully review your policy wording or consult an insurance representative to confirm specifics.

| Policy Type | Pre-Existing Pregnancy Coverage |

|---|---|

| Employer-sponsored STD | Often excludes pre-existing conditions |

| Private STD plans | Varies; may have waiting requirements |

3. How Long Do You Need to Wait to Claim STD Benefits?

If your STD policy includes a waiting period for pre-existing pregnancies, this duration can range from 30 days to 12 months, depending on the insurer. Some policies may waive the waiting period if you switch jobs but maintain continuous coverage.

| Waiting Period Type | Typical Duration |

|---|---|

| Standard exclusion | 3-12 months from policy start |

| Continuous coverage exemption | May reduce or eliminate wait |

4. Are There Alternatives If STD Denies Pregnancy Coverage?

If your short-term disability claim is denied due to a pre-existing pregnancy, alternatives include: – State disability programs (e.g., California’s SDI) – Paid Family Leave (PFL) – Employer-provided maternity leave

| Alternative | Eligibility |

|---|---|

| State Disability Insurance (SDI) | Available in some states |

| Paid Family Leave (PFL) | Covers bonding time post-birth |

5. How to Verify Coverage Before Enrolling in an STD Plan

To avoid surprises, always: – Review policy exclusions – Check look-back and waiting periods – Ask insurers directly

| Step | Action Required |

|---|---|

| Policy review | Identify pre-existing condition clauses |

| Consult insurer | Request written confirmation |

Does pregnancy count as a pre-existing condition for short-term disability?

Does Pregnancy Qualify as a Pre-Existing Condition for Short-Term Disability?

Whether pregnancy counts as a pre-existing condition for short-term disability depends on the insurance policy and the timing of coverage. Many policies exclude pre-existing conditions if the pregnancy began before the policy’s effective date. However, some plans may offer partial or full coverage if the policy was active before conception.

- Standard policies often define a pre-existing condition as any illness or condition diagnosed or treated within a certain window (e.g., 3–12 months) before coverage starts.

- Waiting periods may apply; some insurers require enrollment before pregnancy to qualify for benefits.

- Employer-sponsored plans or state-specific programs (e.g., California’s Paid Family Leave) might have different rules.

How Do Insurance Providers Determine Pregnancy as a Pre-Existing Condition?

Insurers assess whether pregnancy is a pre-existing condition by reviewing medical records and the policy’s effective date. Key factors include when prenatal care began, conception dates, and policy exclusions.

- Medical history review: Insurers check if prenatal visits or diagnoses occurred before coverage started.

- Policy clauses: Some explicitly exclude pregnancy if conception happened before enrollment.

- State laws: Certain jurisdictions prohibit denying coverage for pregnancy as a pre-existing condition.

Can You Get Short-Term Disability for Pregnancy Despite Pre-Existing Condition Rules?

Yes, in some cases. Even with pre-existing condition exclusions, alternatives like employer benefits or state programs may provide coverage. Planning ahead is crucial.

- Enroll early: Secure coverage before conception to avoid exclusions.

- Supplemental plans: Explore add-ons like voluntary short-term disability insurance.

- Legal protections: The Pregnancy Discrimination Act or state laws may override insurer exclusions.

Should I get short-term disability before pregnancy?

What Is Short-Term Disability Insurance for Pregnancy?

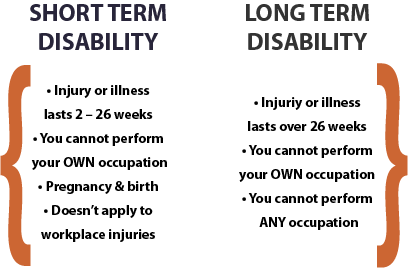

Short-term disability insurance provides income replacement if you are unable to work due to a medical condition, including pregnancy. It typically covers a portion of your salary for a limited period, such as 6–12 weeks, while you recover. Since pregnancy and childbirth are considered qualifying conditions under many policies, securing this coverage before conception ensures financial protection if complications arise.

- Coverage timing: Most policies have a waiting period (e.g., 10–30 days) before benefits begin.

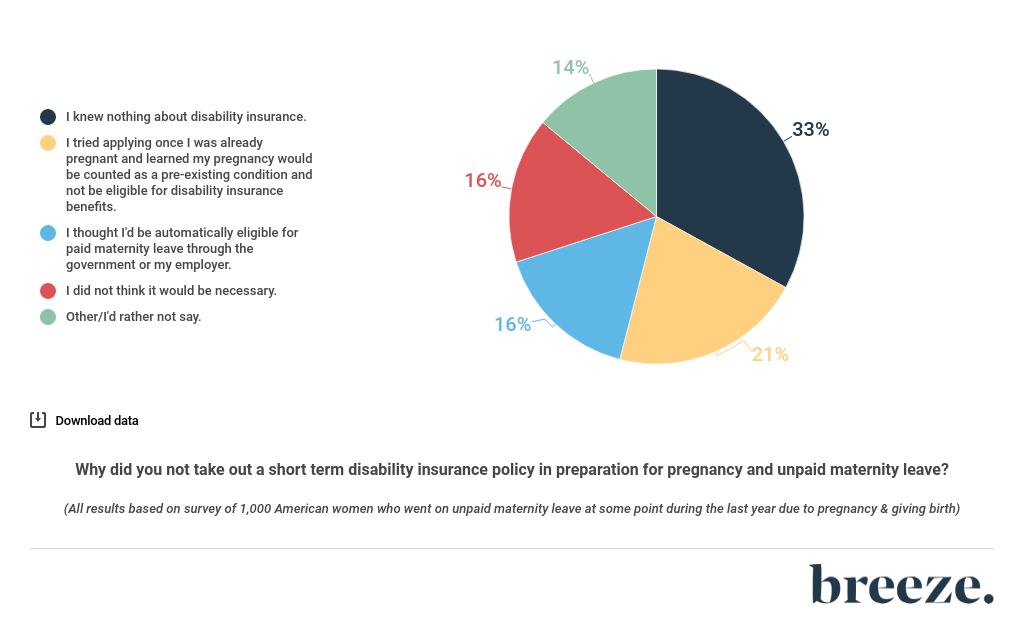

- Pre-existing conditions: Pregnancy is often excluded if you’re already pregnant when applying.

- Employer vs. private plans: Employer-sponsored plans may offer better terms than individual policies.

Why Should You Consider Short-Term Disability Before Pregnancy?

Purchasing short-term disability insurance before pregnancy ensures you meet eligibility requirements and avoid coverage gaps. Many insurers classify pregnancy as a pre-existing condition if you apply after conception, leaving you without financial support during leave. Planning ahead also allows you to compare policies and maximize benefits.

- Guaranteed approval: Applying pre-pregnancy eliminates denial risks.

- Cost savings: Premiums are typically lower when you’re not pregnant.

- Extended leave: Some policies may supplement unpaid maternity leave.

How to Choose the Right Short-Term Disability Policy

Selecting the best short-term disability insurance requires evaluating coverage limits, waiting periods, and policy exclusions. Look for plans that specifically include pregnancy-related disabilities and offer sufficient benefit durations. Employer-sponsored options often provide the most cost-effective coverage, but private policies may be necessary for self-employed individuals.

- Benefit amount: Aim for coverage that replaces 50–70% of your income.

- Elimination period: Shorter waiting periods (e.g., 7–14 days) ensure faster payouts.

- Policy terms: Verify if vaginal and cesarean deliveries are covered equally.

Can you get aflac short-term disability if you are already pregnant?

Eligibility for Aflac Short-Term Disability During Pregnancy

If you are already pregnant when applying for Aflac short-term disability, your eligibility depends on several factors. Aflac typically requires you to have an existing policy before becoming pregnant to qualify for pregnancy-related disability claims. Here’s what you need to know:

- Pre-existing condition clause: Most policies exclude coverage for pregnancies if you enroll after conception.

- Waiting periods: You may need to wait a certain period (e.g., 10 months) before filing a pregnancy-related claim.

- State regulations: Some states have specific rules about pregnancy and disability coverage that may override policy terms.

How Aflac’s Short-Term Disability Covers Pregnancy

If you qualify, Aflac short-term disability can provide financial support during pregnancy-related leave. However, coverage specifics vary based on your policy. Consider the following:

- Coverage duration: Typically, benefits last 6–8 weeks for vaginal delivery or 8 weeks for C-section.

- Benefit amount: Policies usually pay a percentage (e.g., 60%) of your weekly income, up to a maximum limit.

- Documentation required: You must submit medical certification proving inability to work due to pregnancy or childbirth.

Alternatives If You’re Already Pregnant and Ineligible

If you’re unable to secure Aflac short-term disability due to an existing pregnancy, explore these alternatives:

- Employer-sponsored benefits: Check if your company offers paid maternity leave or state-mandated disability programs.

- State disability insurance (SDI): Some states (e.g., California, New York) provide pregnancy disability benefits regardless of pre-existing conditions.

- Personal savings or FMLA: Use savings or unpaid leave under the Family and Medical Leave Act (FMLA) for job protection during absence.

Is pregnancy a qualifying life event for short-term disability?

Is Pregnancy Considered a Qualifying Life Event for Short-Term Disability?

Yes, pregnancy is often considered a qualifying life event for short-term disability (STD) coverage, but this depends on the specific policy and provider. Most employer-sponsored STD plans include pregnancy-related conditions as eligible for benefits, especially if complications or medical restrictions arise. Key factors include:

- Policy terms: Check if your STD plan explicitly covers pregnancy, childbirth, or related medical conditions.

- Waiting period: Some plans require a 7–14 day elimination period before benefits begin.

- Medical certification: A doctor must confirm the pregnancy disability, such as bed rest or complications like gestational diabetes.

How Does Short-Term Disability Coverage Work for Pregnancy?

STD coverage for pregnancy typically replaces a portion of your income (e.g., 50–70%) for a limited period, usually 6–8 weeks for vaginal delivery or 8–10 weeks for C-sections. Important considerations include:

- Benefit duration: Coverage length varies by policy; some extend for high-risk pregnancies.

- Pre-existing conditions: If you enroll after becoming pregnant, some plans may impose exclusions.

- Employer requirements: Employers may mandate STD enrollment before pregnancy occurs.

What Steps Should You Take to Claim Short-Term Disability for Pregnancy?

To secure STD benefits for pregnancy, follow these steps:

- Review your policy: Confirm pregnancy coverage and note deadlines for claims.

- Submit medical documentation: Provide forms signed by your healthcare provider detailing restrictions.

- File promptly: Notify your insurer or HR department as soon as possible to avoid delays.

Frequently Asked Questions

Does Short Term Disability Cover Pre-Existing Pregnancy Conditions?

Short-term disability (STD) policies often have specific rules regarding pre-existing pregnancy conditions. Many plans exclude coverage if the pregnancy was confirmed or treated before the policy’s effective date. However, some policies may offer partial coverage after a waiting period. Always review the policy terms carefully or consult your insurer to confirm eligibility.

How Long Must You Wait for Coverage If You’re Already Pregnant?

Most short-term disability plans impose an elimination period (waiting period) before covering pregnancy-related disabilities. For pre-existing pregnancies, this period can range from 30 days to 12 months, depending on the insurer. Coverage typically begins after this timeframe, but documentation from a healthcare provider may be required to prove the disability is unrelated to prior complications.

Can You Get STD Benefits for Pregnancy If You Switch Jobs While Pregnant?

Changing jobs while pregnant may complicate STD coverage, as new policies often exclude pre-existing conditions for a set period. If your new employer’s plan has a look-back clause, your pregnancy may be deemed pre-existing, delaying benefits. To avoid gaps, verify your new plan’s waiting periods and consider extending COBRA or other interim coverage if eligible.

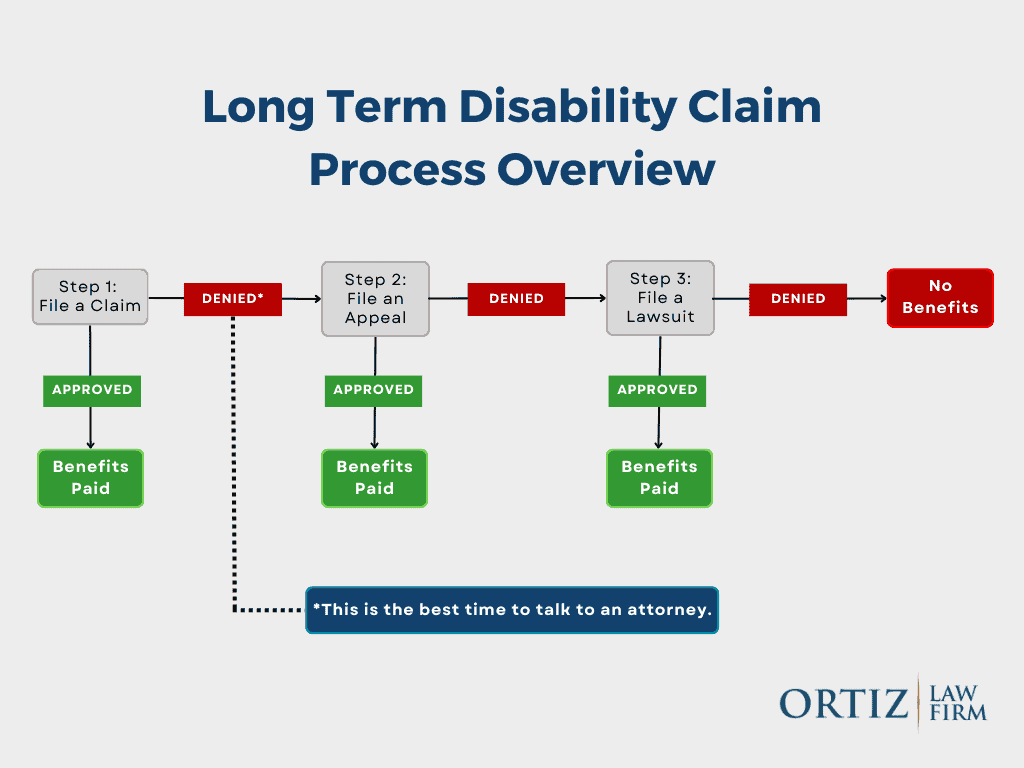

What If Your Short-Term Disability Claim for Pregnancy Is Denied?

If your STD claim is denied due to a pre-existing pregnancy, you have the right to appeal. Gather all medical records, policy documents, and correspondence with the insurer. Highlight any discrepancies in their decision or evidence proving your disability arose after coverage began. Consulting an employment attorney or insurance specialist may strengthen your case for reconsideration.