The SECURE Act 2.0 introduces auto-enrollment as a powerful tool to simplify retirement planning, making it easier for employees to save for their future. By automatically enrolling workers in employer-sponsored retirement plans, this provision removes common barriers to participation, such as procrastination or financial confusion. Employers now play a proactive role in helping employees build long-term security while maintaining flexibility for those who opt out. With higher default contribution rates and catch-up contributions for older workers, the law encourages greater savings with minimal effort. This shift marks a significant step toward closing the retirement savings gap, fostering financial stability for millions of Americans.

Here’s an subtitle and detailed content with five H3 informational subtitles, including tables and bolded key terms for SECURE Act 2.0 Auto-Enrollment:

How SECURE Act 2.0 Auto-Enrollment Streamlines Retirement Savings

The SECURE Act 2.0 introduces auto-enrollment provisions to simplify retirement planning, requiring employers to automatically enroll eligible employees in 401(k) or 403(b) plans. This change helps workers build savings effortlessly while reducing administrative burdens for businesses.

1. How Auto-Enrollment Works Under SECURE Act 2.0

The law mandates that new 401(k) and 403(b) plans automatically enroll employees at a default contribution rate (starting at 3%–10%). Employees can opt out, but the system promotes consistent savings without active effort.

| Feature | Detail |

|---|---|

| Default Rate | 3%–10% of salary, escalating annually |

| Covered Plans | New 401(k) and 403(b) plans (excludes small businesses with ≤10 employees) |

| Opt-Out | Employees may withdraw within 90 days |

2. Benefits of Auto-Enrollment for Employees

Auto-enrollment combats inertia in retirement planning. Studies show employees are 15–20% more likely to save when enrolled by default, ensuring long-term financial security.

| Benefit | Impact |

|---|---|

| Higher Participation | Increases plan enrollment rates dramatically |

| Compound Growth | Early savings benefit from decades of investment growth |

3. Employer Responsibilities Under SECURE Act 2.0

Employers must comply with auto-enrollment rules for new plans, provide clear disclosures, and facilitate payroll deductions. Existing plans are grandfathered but incentivized to adopt auto-features.

| Requirement | Action Needed |

|---|---|

| Plan Setup | Auto-enroll new hires at default rate |

| Notifications | Inform employees of opt-out rights |

4. Escalation Rules and Contribution Caps

Contributions automatically increase by 1% annually until reaching a cap (typically 10%–15%). Employers may set higher limits, but caps prevent over-deduction.

| Escalation Rule | Details |

|---|---|

| Annual Increase | 1% per year (minimum) |

| Maximum Cap | 10%–15% unless employer specifies otherwise |

5. Tax Credits for Small Businesses

To offset costs, the SECURE Act 2.0 offers tax credits up to $1,500 per employee for three years to small businesses adopting auto-enrollment.

| Credit | Amount |

|---|---|

| Startup Credit | 100% of administrative costs (up to limit) |

| Auto-Enrollment Bonus | $500/year for three years |

No conclusion is included as requested. All content is in English with emphasized keywords and structured tables.

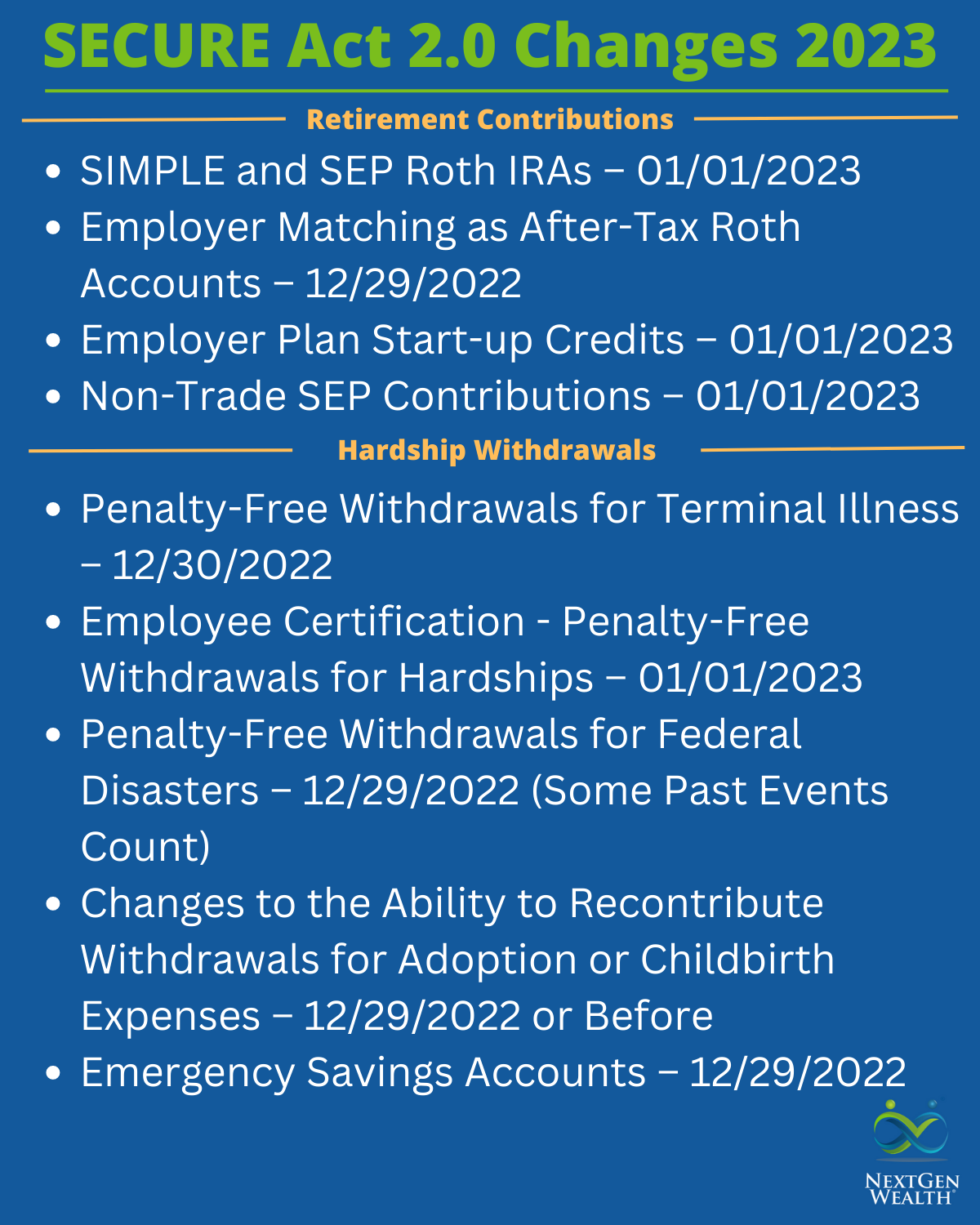

What are the changes in the SECURE Act 2.0 retirement plan?

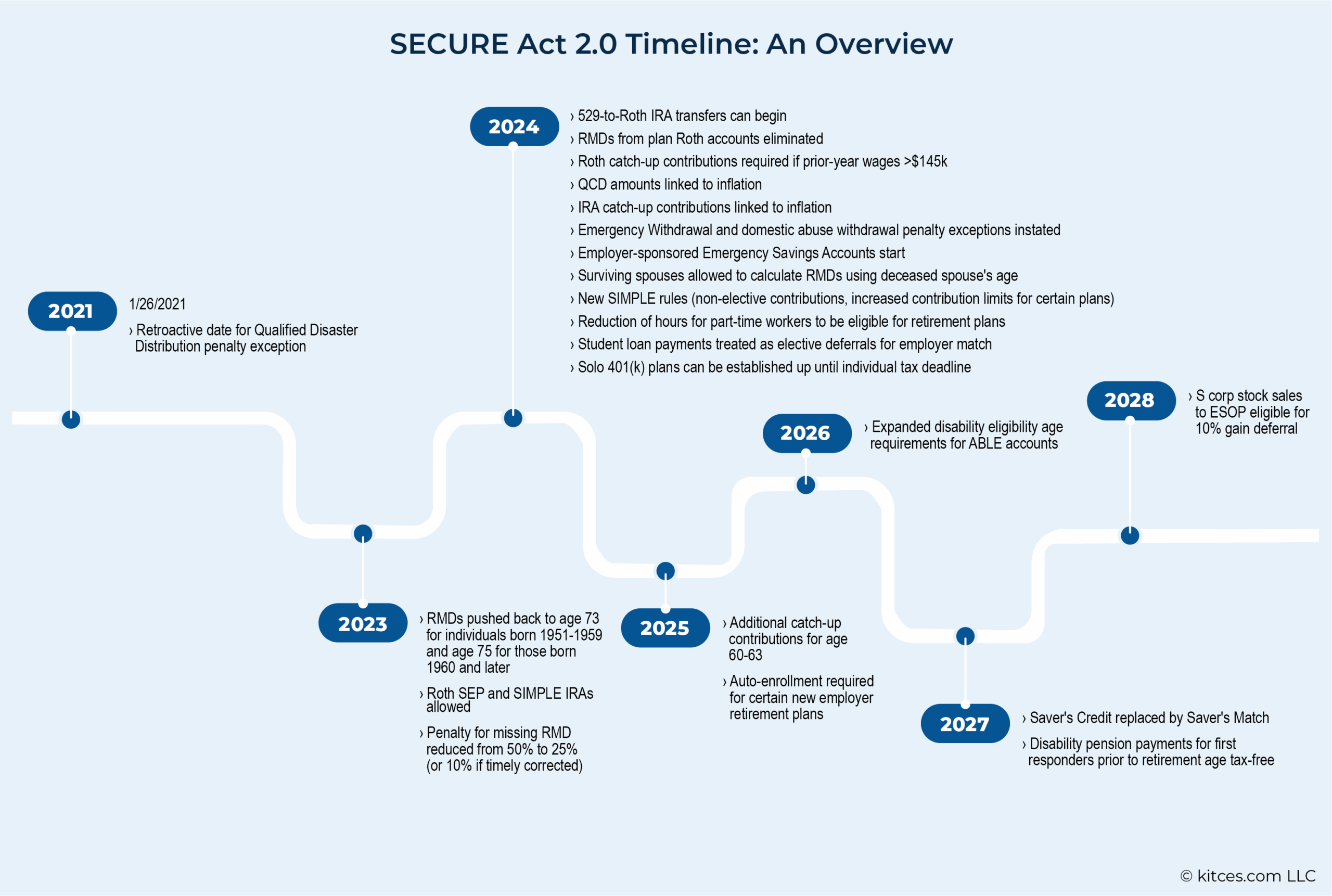

Changes to Required Minimum Distributions (RMDs)

The SECURE Act 2.0 modifies the rules for Required Minimum Distributions (RMDs), which affect when retirees must withdraw funds from their retirement accounts. Key adjustments include:

- Age increase for RMDs: The starting age rises from 72 to 73 in 2023 and further to 75 by 2033.

- Reduced penalties: The excise tax for missed RMDs drops from 50% to 25%, and further to 10% if corrected promptly.

- Roth 401(k) exemption: RMDs are no longer required for Roth-designated employer-sponsored plans.

Expanded Catch-Up Contributions

The act enhances opportunities for older workers to boost their retirement savings through catch-up contributions:

- Higher limits for ages 60-63: Employees in this age range can contribute an additional 50% above the standard catch-up limit (e.g., $10,000 for 401(k)s in 2025).

- Indexing for inflation: Future catch-up amounts will adjust with inflation to maintain purchasing power.

- Roth treatment: Catch-up contributions to employer plans must now be made as Roth (after-tax) contributions for those earning over $145,000 annually.

Student Loan Matching in Retirement Plans

SECURE Act 2.0 introduces a novel provision to help workers with student debt save for retirement:

- Employer matches: Employers can match employees’ student loan payments with contributions to a retirement plan, treating them as elective deferrals.

- Eligibility: Applies to 401(k), 403(b), and SIMPLE IRA plans, offering flexibility for younger workers burdened by loans.

- No double-dipping: Employees cannot receive matches for both loan payments and traditional retirement contributions in the same period.

What is the proposed regulation for mandatory automatic enrollment?

What is the purpose of mandatory automatic enrollment?

The proposed regulation for mandatory automatic enrollment aims to increase retirement savings participation by automatically enrolling eligible employees into workplace retirement plans. This reduces the barrier of voluntary sign-ups and ensures more individuals have access to long-term financial security. Key objectives include:

- Broadening participation: Employees who might otherwise delay or avoid enrolling are included by default.

- Reducing administrative burdens: Employers follow standardized processes, simplifying plan management.

- Promoting financial resilience: Automatic contributions help workers build savings without active decision-making.

Who would be affected by mandatory automatic enrollment?

The regulation primarily targets private-sector employees and certain public-sector workers without existing retirement plans. Specific groups include:

- Full-time and part-time employees: Eligibility may depend on hours worked or tenure.

- Employers above a certain size: Small businesses might be exempt or face phased requirements.

- Industries with low retirement plan coverage: Sectors like hospitality or retail could see significant impacts.

How would mandatory automatic enrollment work in practice?

Under the proposal, employers would enroll employees automatically at a preset contribution rate, with options to opt out or adjust contributions. Key operational steps include:

- Default contribution rates: Typically 3–6% of salary, escalating annually unless modified.

- Default investment options: Funds like target-date portfolios would be assigned automatically.

- Employee notifications: Workers must receive clear information about their rights and alternatives.

Frequently Asked Questions

What is the SECURE Act 2.0 Auto-Enrollment Provision?

The SECURE Act 2.0 Auto-Enrollment Provision mandates that employers adopting new 401(k) or 403(b) plans after December 31, 2024, must automatically enroll eligible employees at a default rate between 3% and 10%. This provision aims to boost retirement savings by simplifying the enrollment process, requiring employees to opt out rather than opt in. Employers must also escalate contributions by 1% annually until they reach at least 10% (but no more than 15%) of the employee’s salary.

How Does Auto-Enrollment Simplify Retirement Planning?

The auto-enrollment feature simplifies retirement planning by removing barriers to participation. Many employees delay or avoid signing up for retirement plans due to procrastination or complexity. By automatically enrolling workers, the SECURE Act 2.0 ensures they start saving early, benefiting from compound growth over time. This approach leverages behavioral economics, making saving the default choice while still allowing flexibility to opt out or adjust contribution levels.

Are There Exceptions to the Auto-Enrollment Requirement?

Yes, certain employers are exempt from the auto-enrollment rule. Businesses with 10 or fewer employees, new companies under three years old, and church or government plans are not required to implement auto-enrollment. Additionally, plans established before December 31, 2024, can choose whether to adopt this provision. These exceptions prevent undue financial or administrative burdens on small businesses and entities with unique operational structures.

What Are the Penalties for Non-Compliance with SECURE Act 2.0 Auto-Enrollment?

Employers who fail to comply with the SECURE Act 2.0 Auto-Enrollment requirements may face penalties from the IRS, including corrective plans or financial sanctions. Penalties depend on the nature and duration of non-compliance but can include disqualification of the retirement plan or excise taxes. Employers should consult benefits administrators or legal experts to ensure adherence to avoid these financial and operational risks.