Paying employees on time is crucial for maintaining their trust and satisfaction. Traditional payroll processing often results in delayed payments, affecting workers’ financial stability. Same Day Payroll Direct Deposit is revolutionizing the way businesses handle employee compensation by providing a faster, more efficient payment solution. This modern approach ensures that employees receive their wages on the same day they are processed, enhancing their financial security and overall job satisfaction. By adopting Same Day Payroll Direct Deposit, employers can significantly improve their payroll processing, benefiting both the company and its workforce.

Streamlining Payroll Processes with Same Day Direct Deposit

Same Day Payroll Direct Deposit is revolutionizing the way businesses manage their payroll processes. By providing employees with fast and secure access to their wages, companies can improve employee satisfaction, reduce administrative burdens, and enhance their overall financial stability.

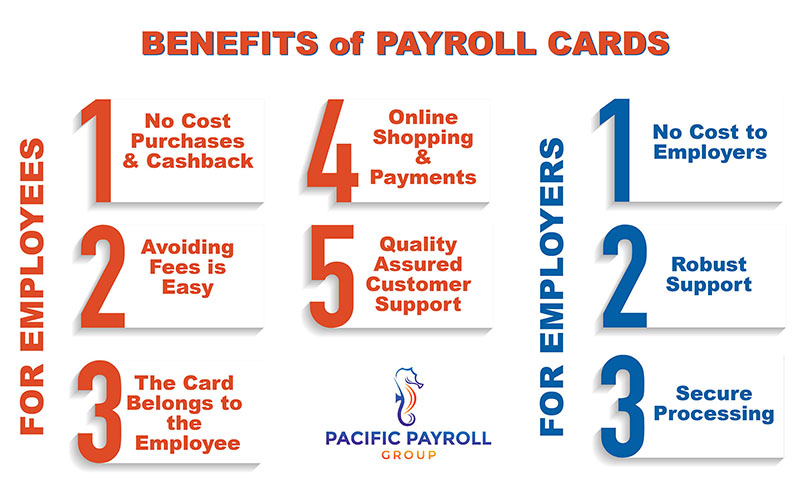

Benefits of Same Day Payroll Direct Deposit for Employees

Same Day Payroll Direct Deposit offers numerous benefits to employees, including immediate access to their wages, reduced reliance on expensive check cashing services, and increased financial flexibility. With same day direct deposit, employees can access their pay as soon as it is processed, allowing them to manage their finances more effectively.

| Benefits | Description |

|---|---|

| Immediate Access to Wages | Employees can access their pay as soon as it is processed |

| Reduced Check Cashing Fees | Employees can avoid expensive check cashing services |

| Increased Financial Flexibility | Employees can manage their finances more effectively |

How Same Day Payroll Direct Deposit Works

Same Day Payroll Direct Deposit uses faster payment processing and advanced banking technology to enable same-day deposits. By leveraging these advancements, businesses can provide their employees with rapid access to their wages, improving overall employee satisfaction.

| Process | Description |

|---|---|

| Faster Payment Processing | Payroll is processed and sent to the bank for same-day deposit |

| Advanced Banking Technology | Banks use advanced technology to facilitate same-day deposits |

| Same-Day Deposit | Employees receive their pay on the same day it is processed |

Security Measures for Same Day Payroll Direct Deposit

To ensure the security of same day payroll direct deposit, businesses must implement robust security measures, including data encryption, secure authentication, and regular monitoring. By taking these steps, companies can protect their employees’ sensitive financial information.

| Security Measure | Description |

|---|---|

| Data Encryption | Sensitive financial information is encrypted to prevent unauthorized access |

| Secure Authentication | Employees’ identities are verified to ensure secure access to their wages |

| Regular Monitoring | Transactions are regularly monitored to detect and prevent suspicious activity |

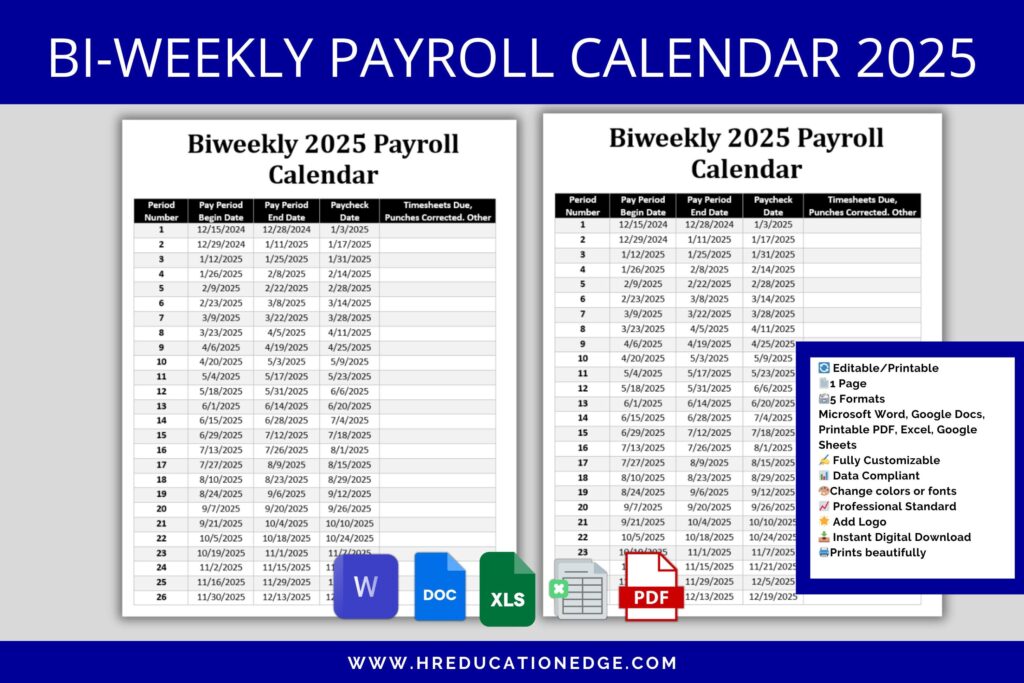

Implementing Same Day Payroll Direct Deposit

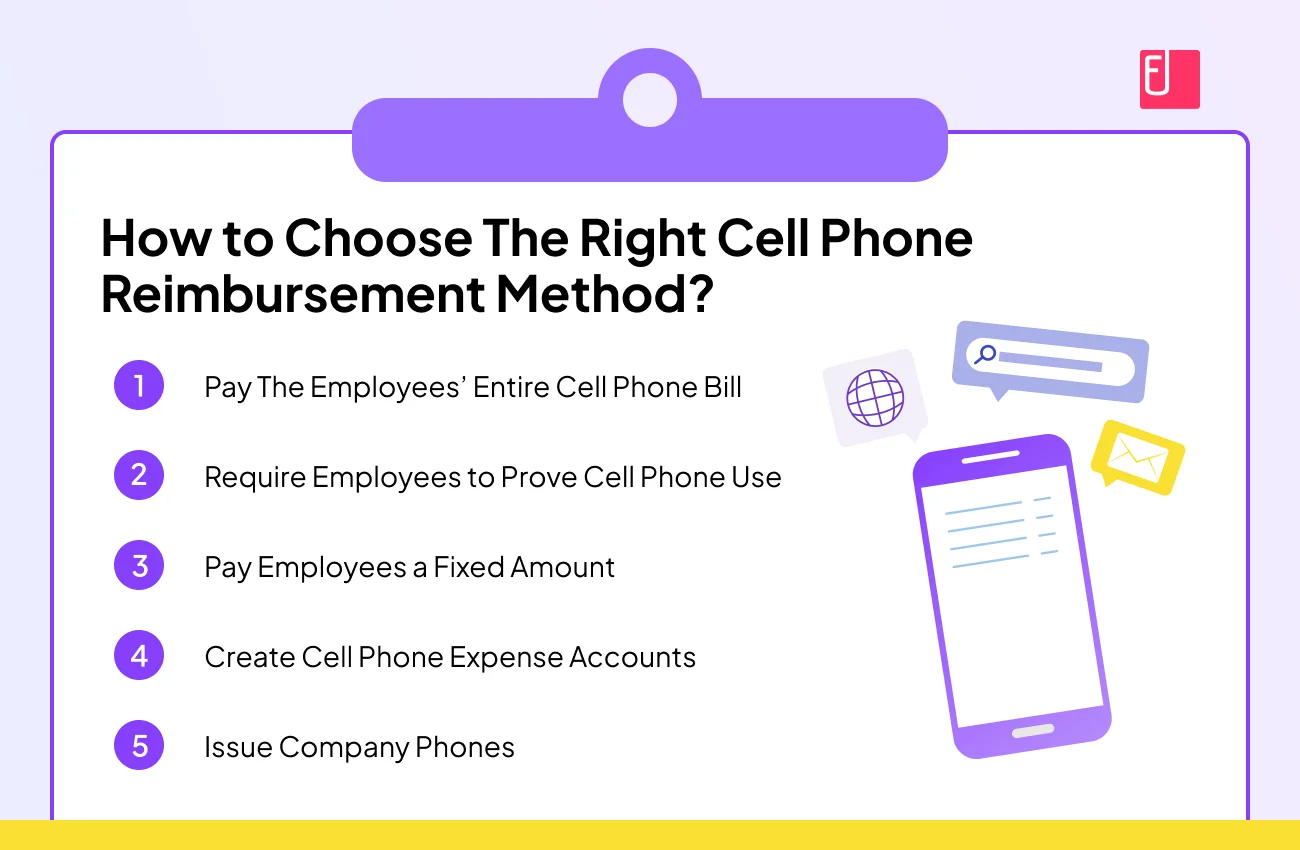

To implement same day payroll direct deposit, businesses should partner with a reputable payroll provider, update their payroll systems, and communicate with their employees. By taking these steps, companies can ensure a smooth transition to same day payroll direct deposit.

| Implementation Step | Description |

|---|---|

| Partner with a Reputable Payroll Provider | Businesses partner with a trusted payroll provider to facilitate same day direct deposit |

| Update Payroll Systems | Companies update their payroll systems to support same day direct deposit |

| Communicate with Employees | Businesses communicate the benefits and details of same day payroll direct deposit to their employees |

Best Practices for Same Day Payroll Direct Deposit

To get the most out of same day payroll direct deposit, businesses should clearly communicate with their employees, monitor their payroll processes, and continuously evaluate their payroll systems. By following these best practices, companies can ensure that their same day payroll direct deposit program is running smoothly and efficiently.

| Best Practice | Description |

|---|---|

| Clear Communication | Businesses clearly communicate the benefits and details of same day payroll direct deposit to their employees |

| Regular Monitoring | Companies regularly monitor their payroll processes to ensure smooth operation |

| Continuous Evaluation | Businesses continuously evaluate their payroll systems to identify areas for improvement |

Can direct deposit hit the same day?

The answer to this question is a bit complex and depends on several factors, including the time of day the deposit is initiated, the type of account it’s being deposited into, and the policies of the financial institution handling the deposit. Generally, direct deposit can hit on the same day if it’s processed early enough in the day.

Factors Affecting Same-Day Direct Deposit

The timing of when a direct deposit is made can significantly affect whether it is available on the same day. Financial institutions have different cut-off times for processing direct deposits. If the deposit is initiated before this cut-off time, it’s more likely to be processed on the same day. Here are some key factors to consider:

- The processing time of the financial institution receiving the deposit.

- The type of account the deposit is being made into, as some accounts may have different processing rules.

- The originator’s timing in initiating the direct deposit.

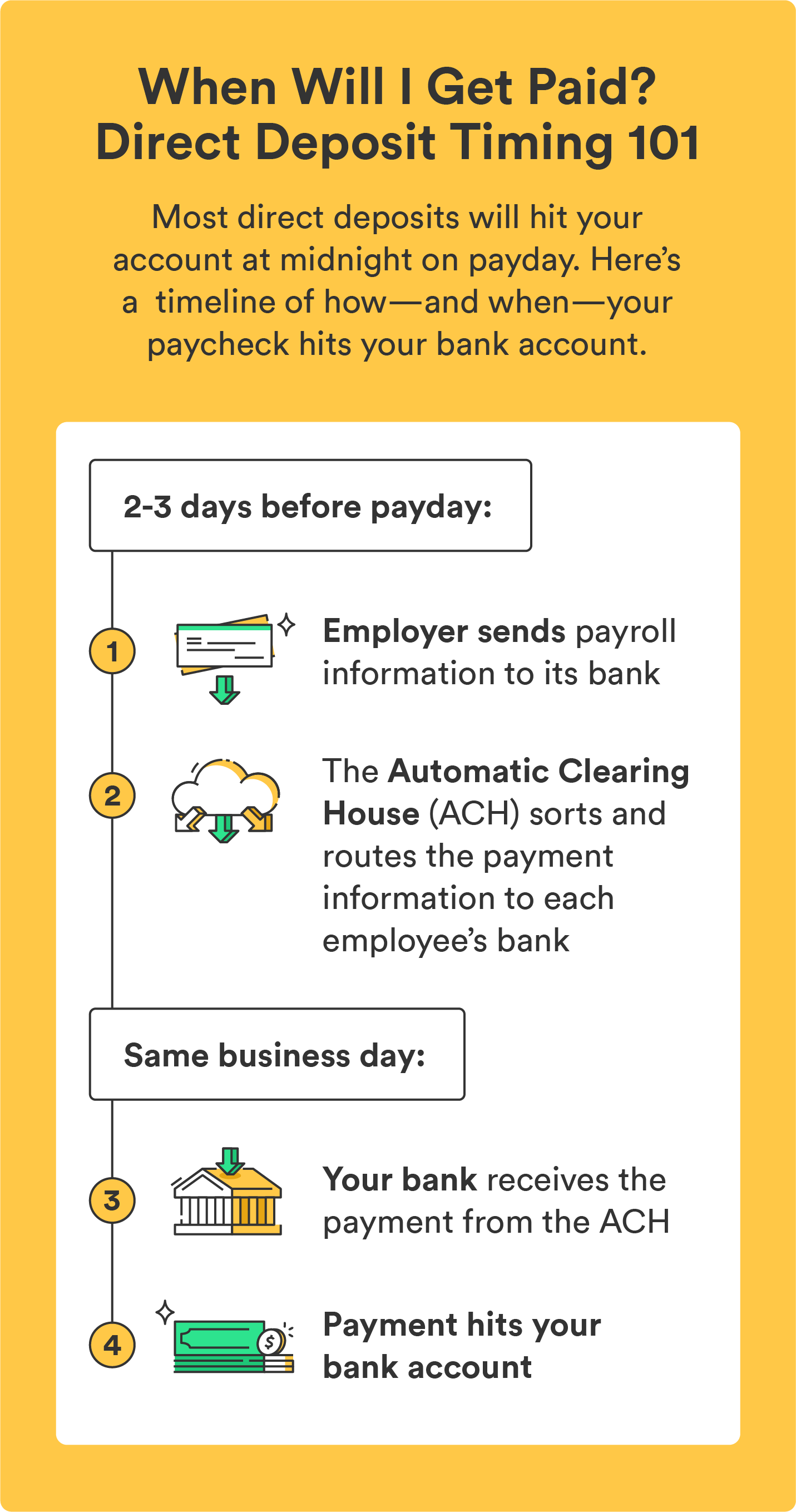

How Direct Deposit Processing Works

Direct deposit processing involves several steps, starting from the originator (employer or payer) to the recipient’s financial institution. The process typically involves the Automated Clearing House (ACH) network, which facilitates the transfer of funds between financial institutions. For a direct deposit to hit on the same day, it must be processed through the ACH network quickly. Here are the key steps in the direct deposit process:

- The originator initiates the deposit, sending the payment information to their bank.

- The originator’s bank processes the transaction and sends it through the ACH network.

- The ACH network facilitates the transfer to the recipient’s financial institution, which then credits the recipient’s account.

Benefits of Same-Day Direct Deposit

Same-day direct deposit can offer several benefits to recipients, including quicker access to their funds. This can be particularly important for individuals who rely on timely payments for their daily expenses. The benefits include:

- Improved cash flow management, as recipients can access their funds sooner.

- Reduced need for overdraft protection or other emergency financial services.

- Enhanced financial flexibility, allowing for more timely payment of bills or other financial obligations.

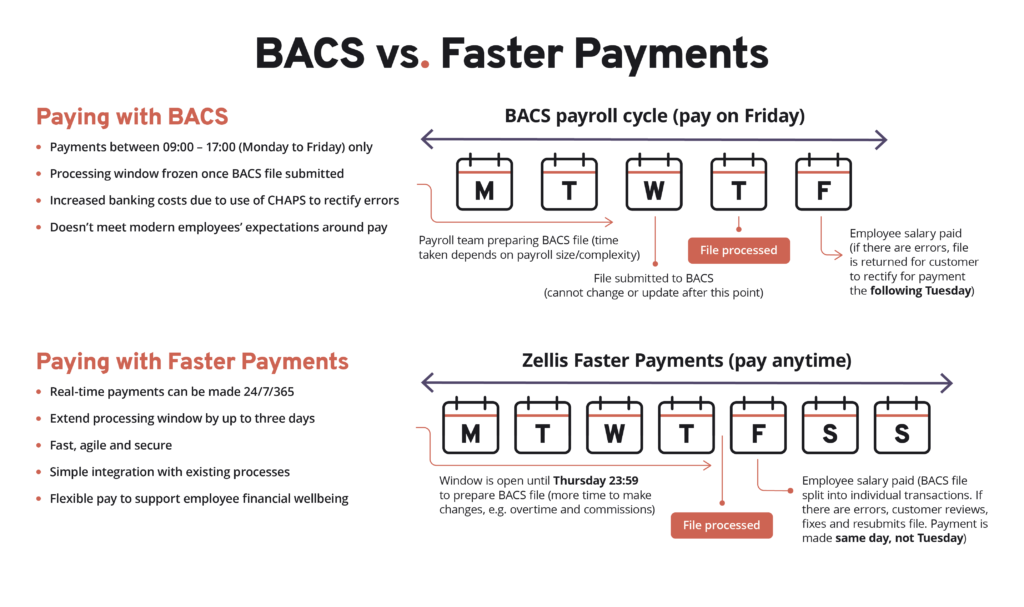

What is faster payments for payroll?

Faster payments for payroll refer to the ability of employers to pay their employees quickly and efficiently, often through electronic payment systems. This can include same-day or next-day payment options, allowing employees to access their wages more rapidly than traditional payment methods.

Faster Payments Benefits

Faster payments for payroll offer numerous benefits to both employers and employees. For employees, faster payments can improve financial stability and reduce the need for costly alternative financial services. For employers, faster payments can enhance employee satisfaction and reduce administrative burdens.

- Improved Employee Satisfaction: Faster payments can lead to increased job satisfaction and reduced turnover rates.

- Reduced Administrative Burden: Automated payment systems can simplify payroll processing and reduce the need for manual intervention.

- Increased Financial Inclusion: Faster payments can help employees access their wages more quickly, reducing the need for costly alternative financial services.

How Faster Payments Work

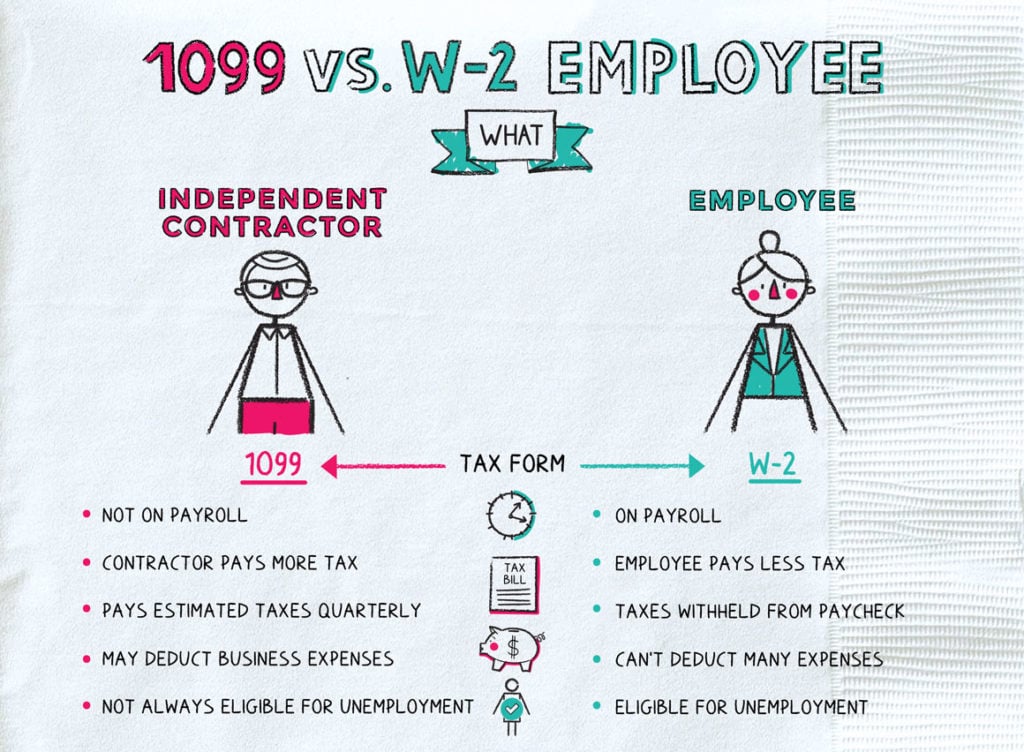

Faster payments for payroll typically involve the use of electronic payment systems, such as Automated Clearing House (ACH) or Real-Time Gross Settlement (RTGS) systems. These systems enable employers to transfer funds directly into employees’ bank accounts, often in real-time or near-real-time.

- Electronic Payment Systems: Employers use electronic payment systems to initiate payroll payments.

- Real-Time Processing: Payments are processed in real-time or near-real-time, allowing employees to access their wages quickly.

- Reduced Processing Time: Faster payments can reduce the time and effort required to process payroll.

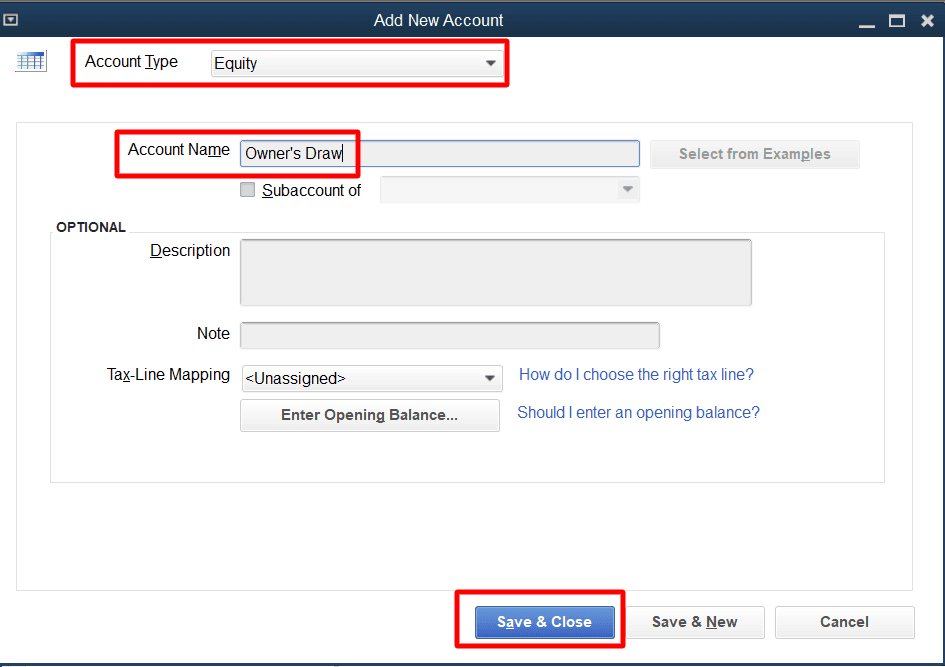

Implementing Faster Payments

To implement faster payments for payroll, employers can work with their payroll providers or financial institutions to set up electronic payment systems. This may involve integrating new technology or updating existing payroll systems.

- Assessing Payroll Systems: Employers should assess their current payroll systems to determine the feasibility of implementing faster payments.

- Selecting a Payment Provider: Employers should select a payment provider that offers fast and reliable payment processing.

- Communicating with Employees: Employers should communicate with employees about the benefits and implementation of faster payments.

Frequently Asked Questions

What is Same Day Payroll Direct Deposit and how does it work?

Same Day Payroll Direct Deposit is a payment solution that enables employers to pay their employees on the same day they are processed, providing fast access to wages. This is achieved through an electronic payment system that facilitates the transfer of funds directly into the employee’s bank account. By utilizing this system, employers can ensure that their employees receive their pay in a timely manner, improving their overall financial stability and job satisfaction.

What are the benefits of using Same Day Payroll Direct Deposit for my business?

The benefits of using Same Day Payroll Direct Deposit include increased employee satisfaction, reduced administrative burden, and improved cash flow management. By providing employees with quick access to their wages, businesses can experience a reduction in payroll-related inquiries and an improvement in overall employee morale. Additionally, Same Day Payroll Direct Deposit can help businesses to streamline their payroll processes, reducing the need for paper checks and manual processing.

Is Same Day Payroll Direct Deposit secure and compliant with relevant regulations?

Same Day Payroll Direct Deposit is a secure payment solution that is designed to be compliant with relevant regulations, including those related to data protection and financial transactions. The system uses advanced encryption technology and secure networks to protect sensitive employee information and ensure that payments are processed accurately and efficiently. By using a reputable Same Day Payroll Direct Deposit provider, businesses can be confident that their payroll processes are secure and compliant.

Can I use Same Day Payroll Direct Deposit with my existing payroll system?

Yes, Same Day Payroll Direct Deposit can be integrated with existing payroll systems, making it easy to implement and use. Many Same Day Payroll Direct Deposit providers offer integration with popular payroll software, allowing businesses to continue using their existing payroll processes while still benefiting from the advantages of same-day direct deposit. By integrating Same Day Payroll Direct Deposit with their existing payroll system, businesses can simplify their payroll processes and improve the overall efficiency of their payroll operations.