When unexpected illnesses or injuries strike, short-term disability insurance can provide a vital financial safety net. Reliance Standard is a well-established provider of disability insurance, and their short-term disability coverage is designed to help individuals stay afloat during challenging times. This article will delve into the details of Reliance Standard’s short-term disability coverage, exploring the benefits, eligibility requirements, and other essential aspects of their policies. By examining the specifics of their coverage, individuals can make informed decisions about their insurance needs and gain a deeper understanding of what Reliance Standard has to offer in this regard.

Reliance Standard Short Term Disability Insurance: Understanding the Benefits

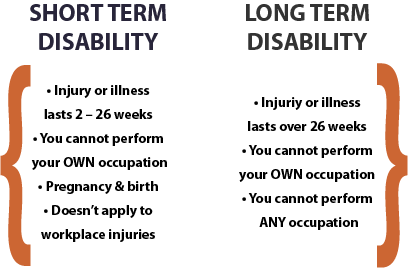

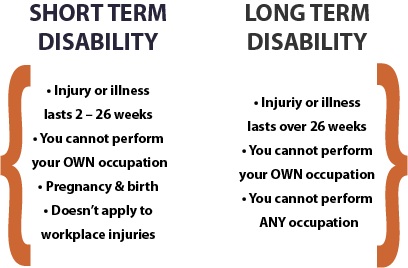

Reliance Standard Short Term Disability insurance is designed to provide financial support to individuals who are unable to work due to a non-occupational illness or injury. This type of insurance typically replaces a portion of the insured’s income, helping them to meet their financial obligations while they recover. The specifics of the coverage can vary depending on the policy, but generally, it includes benefits for a limited period, usually up to 90 or 180 days.

Eligibility Criteria for Reliance Standard Short Term Disability

To be eligible for Reliance Standard Short Term Disability benefits, individuals typically must be employed and actively working at the time of becoming disabled. The definition of actively working and the specifics of eligibility can vary by policy, but generally, it means the individual is working their regular schedule and is not on a leave of absence. Disability must result from a non-occupational illness or injury and must be severe enough to prevent the individual from performing their job duties.

| Eligibility Criteria | Description |

|---|---|

| Employment Status | Must be actively employed and working |

| Nature of Disability | Non-occupational illness or injury |

| Impact on Work Ability | Unable to perform regular job duties |

Benefits and Coverage Period

The benefits provided by Reliance Standard Short Term Disability insurance are designed to replace a portion of the insured’s income during their period of disability. The coverage period can vary, but typically, benefits are paid for up to 90 or 180 days. The exact duration of benefits depends on the policy terms and the specific circumstances of the disability.

| Coverage Aspect | Details |

|---|---|

| Benefit Duration | Up to 90 or 180 days |

| Benefit Amount | Percentage of pre-disability income |

| Elimination Period | Waiting period before benefits start |

Understanding the Elimination Period

The elimination period, also known as the waiting period, is the time between when the disability occurs and when the benefits start being paid. This period can vary depending on the policy but is typically a few days to a couple of weeks. During this time, the insured is expected to use their sick leave or other available resources to cover their expenses.

| Elimination Period | Impact |

|---|---|

| Duration | Varies by policy (e.g., 0 to 14 days) |

| Purpose | To ensure benefits are used for significant disabilities |

| Financial Impact | Insured must cover expenses during this period |

Filing a Claim for Reliance Standard Short Term Disability

To file a claim, the insured or their representative must notify Reliance Standard of the disability and provide required documentation, including medical evidence supporting the disability. The claim process involves submitting a claim form and supporting documents, which are then reviewed by Reliance Standard to determine eligibility for benefits.

| Claim Requirement | Description |

|---|---|

| Notification | Insured or representative must notify Reliance Standard |

| Documentation | Medical evidence and claim form required |

| Review Process | Reliance Standard reviews claim for eligibility |

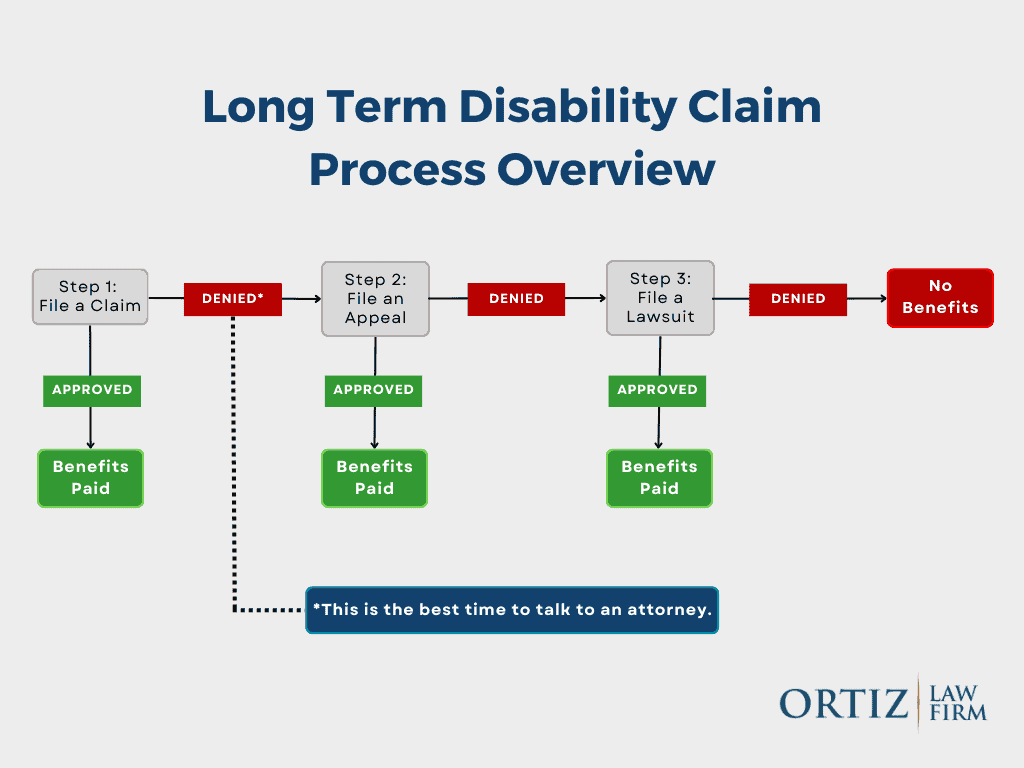

Appealing a Denied Claim

If a claim is denied, the insured has the right to appeal the decision. The appeals process involves submitting additional information or clarifying existing information to support the claim. This process is designed to ensure that decisions are fair and based on a thorough review of the available evidence.

| Appeals Process | Steps Involved |

|---|---|

| Initial Review | Review of the initial denial and supporting documentation |

| Submission of Additional Evidence | Insured can provide more information to support their claim |

| Appeals Decision | Reliance Standard makes a final decision on the claim |

What is Reliance Standard short term disability insurance?

Reliance Standard short term disability insurance is a type of insurance coverage that provides financial support to individuals who are unable to work due to a non-occupational illness or injury. This insurance typically replaces a portion of the individual’s income, usually between 50% to 67%, for a specified period, usually up to 90 or 180 days. The primary purpose of short-term disability insurance is to help individuals maintain their financial stability while they recover from a temporary disability.

Key Features of Reliance Standard Short Term Disability Insurance

Reliance Standard short term disability insurance has several key features that make it an attractive option for individuals seeking financial protection. The insurance provides income replacement benefits to individuals who are unable to work due to a covered disability. Some of the key features include:

- Flexible Benefit Periods: The insurance offers flexible benefit periods, allowing individuals to choose a benefit period that suits their needs, typically ranging from 13 weeks to 26 weeks.

- Partial Disability Benefits: Some policies offer partial disability benefits, which provide a proportionate benefit amount if an individual is able to work part-time or in a limited capacity.

- Return to Work Incentives: Many Reliance Standard short term disability insurance policies include return to work incentives, such as rehabilitation benefits or vocational training, to help individuals return to work as soon as possible.

Eligibility and Coverage

To be eligible for Reliance Standard short term disability insurance, individuals typically need to be employed and working a minimum number of hours per week. The insurance coverage is usually offered through an employer-sponsored group plan or can be purchased individually. Some key aspects of eligibility and coverage include:

- Occupation Class: The insurance provider considers the individual’s occupation class, which determines the level of risk associated with their job and affects the premium rates.

- Pre-Existing Conditions: Some policies may have pre-existing condition exclusions or limitations, which can impact the individual’s eligibility for benefits.

- Waiting Period: The insurance typically has a waiting period, also known as an elimination period, before benefits become payable, usually ranging from 0 to 14 days.

Benefits and Claims Process

When an individual becomes disabled and is unable to work, they can file a claim with Reliance Standard to receive short-term disability benefits. The benefits and claims process typically involve:

- Claim Filing: The individual or their employer must file a claim with Reliance Standard, providing required documentation, including medical evidence to support the disability claim.

- Benefit Payment: Once the claim is approved, Reliance Standard will pay the individual a weekly or monthly benefit, usually based on a percentage of their pre-disability income.

- Ongoing Benefits: The individual will continue to receive benefits as long as they remain disabled and meet the policy’s requirements, up to the maximum benefit period.

What is typically covered under short-term disability?

Short-term disability insurance is designed to provide partial income replacement for a limited period, usually up to 90 or 180 days, when an individual is unable to work due to a non-work-related illness, injury, or condition. The specific coverage and duration vary depending on the insurance policy and provider. Generally, short-term disability insurance covers conditions that prevent an individual from performing their job duties, such as pregnancy, surgery, injuries, or serious illnesses.

Common Conditions Covered

Short-term disability insurance typically covers a range of conditions that prevent an individual from working. These conditions can be related to physical health, such as back pain, or mental health, such as depression. Some common conditions covered under short-term disability include:

- Musculoskeletal disorders, such as back strain or tendonitis

- Pregnancy and childbirth-related conditions, including complications during pregnancy or postpartum recovery

- Mental health conditions, such as anxiety or depression

Exclusions and Limitations

While short-term disability insurance provides coverage for various conditions, there are often exclusions and limitations. For example, pre-existing conditions may be excluded or subject to a waiting period. Additionally, some policies may not cover self-inflicted injuries or conditions resulting from illegal activities. It is essential to review the policy terms to understand what is covered and what is not:

- Pre-existing condition exclusions, which may limit or exclude coverage for conditions that existed before the policy took effect

- Waiting periods, which require individuals to wait for a specified period before becoming eligible for benefits

- Maximum benefit periods, which limit the duration of benefits, such as 90 or 180 days

Filing a Claim

To receive benefits under a short-term disability insurance policy, individuals must file a claim with their insurance provider. The claims process typically involves submitting medical documentation and completing a claim form. It is crucial to understand the claims process and required documentation to ensure a smooth and efficient experience:

- Medical documentation, such as doctor’s notes or medical records, to support the claim

- Claim forms, which must be completed accurately and submitted on time

- Follow-up communication, which may be necessary to provide additional information or clarify details

What is Reliance Standard coverage?

Reliance Standard coverage refers to the insurance policies and benefits provided by Reliance Standard Life Insurance Company, a leading provider of group and individual life insurance, disability insurance, and other employee benefits. The company offers a range of coverage options designed to protect individuals and businesses from financial losses due to unforeseen events such as death, disability, or critical illness.

Reliance Standard Life Insurance Coverage

Reliance Standard Life Insurance coverage provides a death benefit to the beneficiaries of the insured individual in the event of their passing. The coverage can be tailored to meet the specific needs of individuals or groups, with options for term life, whole life, and other types of life insurance policies. Some key features of Reliance Standard Life Insurance coverage include:

- Flexible coverage options to suit different needs and budgets

- Convertible term life insurance that can be converted to a permanent policy

- Accelerated death benefit that allows policyholders to access a portion of the death benefit if diagnosed with a terminal illness

Reliance Standard Disability Insurance Coverage

Reliance Standard Disability Insurance coverage provides income replacement benefits to individuals who become disabled and are unable to work due to illness or injury. The coverage can be designed to meet the specific needs of individuals or groups, with options for short-term and long-term disability insurance policies. Some key features of Reliance Standard Disability Insurance coverage include:

- Partial disability benefits that provide a percentage of the total disability benefit if the individual is able to work part-time

- Rehabilitation benefits that help individuals return to work through vocational rehabilitation programs

- Cost-of-living adjustments that increase the disability benefit to keep pace with inflation

Reliance Standard Supplemental Insurance Coverage

Reliance Standard Supplemental Insurance coverage provides additional benefits to help individuals and families cover expenses related to critical illnesses or other unforeseen events. The coverage can be designed to supplement existing insurance policies, providing additional financial protection and peace of mind. Some key features of Reliance Standard Supplemental Insurance coverage include:

- Critical illness benefits that provide a lump-sum payment upon diagnosis of a covered condition

- Accidental death and dismemberment benefits that provide additional benefits in the event of accidental death or injury

- Hospital indemnity benefits that provide a daily benefit for hospital stays

Frequently Asked Questions

What is Reliance Standard Short Term Disability Insurance?

Reliance Standard Short Term Disability insurance is designed to provide financial protection to individuals who are unable to work due to a non-occupational illness or injury. This type of insurance typically offers a percentage of the insured’s pre-disability income as a monthly benefit, helping to replace lost earnings and support living expenses during the period of disability. The specifics of the coverage, including the benefit amount and duration, can vary depending on the policy details.

How do I qualify for Reliance Standard Short Term Disability benefits?

To qualify for Reliance Standard Short Term Disability benefits, you must meet the policy’s definition of disability, which typically involves being unable to perform the material duties of your own occupation due to a covered illness or injury. You will need to provide medical documentation to support your claim, and the insurance company will review your application to determine whether you satisfy the policy’s requirements for benefit eligibility.

What is the typical benefit period for Reliance Standard Short Term Disability insurance?

The benefit period for Reliance Standard Short Term Disability insurance is generally designed to provide support for a limited time, often up to 90 days or 180 days, although this can vary based on the specific policy. The exact duration of benefits will depend on the terms of your policy and the nature of your disability. Understanding the benefit period is crucial for planning and managing your finances during a period of disability.

Can I purchase Reliance Standard Short Term Disability insurance as an individual or is it typically offered through an employer?

Reliance Standard Short Term Disability insurance can be available through various channels, including as an employer-sponsored plan or as an individual policy. Many employers offer this type of insurance as part of their employee benefits package, providing employees with a valuable layer of financial protection. Individuals may also be able to purchase a policy directly, depending on the insurance company’s offerings and underwriting criteria, which may involve assessing the applicant’s health status and other factors.

![2024 ERC Refund Delays [Updated] | The 1st Capital Courier](https://hrforsmb.com/wp-content/uploads/2025/05/erc-refund-processing-time-2024-how-long-will-you-wait.png)