Running a bed and breakfast (B&B) offers a rewarding opportunity to host guests in a cozy, personalized setting. However, unexpected events—from property damage to guest injuries—can threaten your business and finances. Standard insurance policies often fall short in addressing the unique risks of a B&B, leaving gaps that could result in significant losses. Tailored bed and breakfast insurance provides specialized coverage designed to protect your property, liability, and income. By understanding your specific needs and customizing your policy, you can safeguard your investment and ensure peace of mind. This article explores key insurance options to help you secure your B&B against unforeseen challenges.

How Tailored Insurance Safeguards Your Bed and Breakfast Business

Understanding the Risks Faced by Bed and Breakfast Owners

Running a Bed and Breakfast (B&B) involves unique risks that standard insurance may not cover. From property damage caused by guests to liability claims due to accidents, B&B owners need specialized coverage. Tailored insurance addresses industry-specific risks, ensuring you’re protected against unforeseen events that could otherwise lead to financial losses.

| Risk Type | Insurance Coverage |

|---|---|

| Property Damage | Building and Contents Insurance | Guest Injuries | Public Liability Insurance |

| Business Interruption | Loss of Income Protection |

Key Insurance Policies Every B&B Owner Should Consider

Not all insurance policies are created equal. As a B&B owner, you should evaluate core coverages like property insurance, liability insurance, and business interruption insurance. Additionally, consider specialized policies such as food liability coverage if you serve meals or employers’ liability if you have staff.

| Insurance Policy | What It Covers |

|---|---|

| Property Insurance | Damage to buildings and furnishings |

| Public Liability Insurance | Injury or damage claims from guests |

| Business Interruption Insurance | Loss of income due to unexpected closures |

How to Customize Insurance for Your B&B’s Specific Needs

Every B&B is different, so a one-size-fits-all policy won’t suffice. Work with an insurer who understands hospitality risks to customize coverage. Factors like location, size, amenities (such as pools or hot tubs), and additional services (like event hosting) influence your insurance needs.

| Customization Factor | Insurance Adjustment |

|---|---|

| Location (e.g., flood-prone areas) | Additional natural disaster coverage |

| On-site amenities (e.g., pool) | Higher liability limits |

| Additional services (e.g., weddings) | Event liability insurance |

Benefits of Working with an Insurance Specialist for Your B&B

A specialized insurance broker can help navigate the complexities of B&B coverage. They assess your business’s unique risks and recommend policies that provide comprehensive protection. Their expertise ensures you don’t overpay for unnecessary coverage while avoiding critical gaps.

| Advantage | How It Helps |

|---|---|

| Industry Knowledge | Identifies hospitality-specific risks |

| Policy Customization | Tailors coverage to your needs |

| Claims Assistance | Supports fast, fair settlements |

Common Claims Made by B&B Owners and How Insurance Protects You

B&Bs frequently encounter claims related to slip-and-fall accidents, property damage, or cancellation losses. Proper insurance ensures these incidents don’t cripple your business financially. For example, public liability insurance covers legal fees if a guest sues, while cancellation insurance reimburses lost bookings.

| Common Claim | Insurance Solution |

|---|---|

| Guest Injuries | Public Liability Insurance |

| Fire or Storm Damage | Property Insurance |

| Booking Cancellations | Business Interruption Insurance |

How much does it cost to insure a bed and breakfast?

Factors Influencing the Cost of Insuring a Bed and Breakfast

The cost of insuring a bed and breakfast (B&B) varies widely based on several factors. These include the property’s location, size, and value, as well as the level of coverage required. Additionally, the number of guests accommodated, amenities offered, and local risks (e.g., natural disasters) can significantly impact premiums. Below are key factors:

- Location: High-risk areas (e.g., flood zones) typically have higher premiums.

- Property size and age: Larger or historic buildings may cost more to insure due to higher repair or replacement costs.

- Coverage type: Comprehensive policies (e.g., liability, property damage, and business interruption) increase costs compared to basic plans.

Average Insurance Costs for a Bed and Breakfast

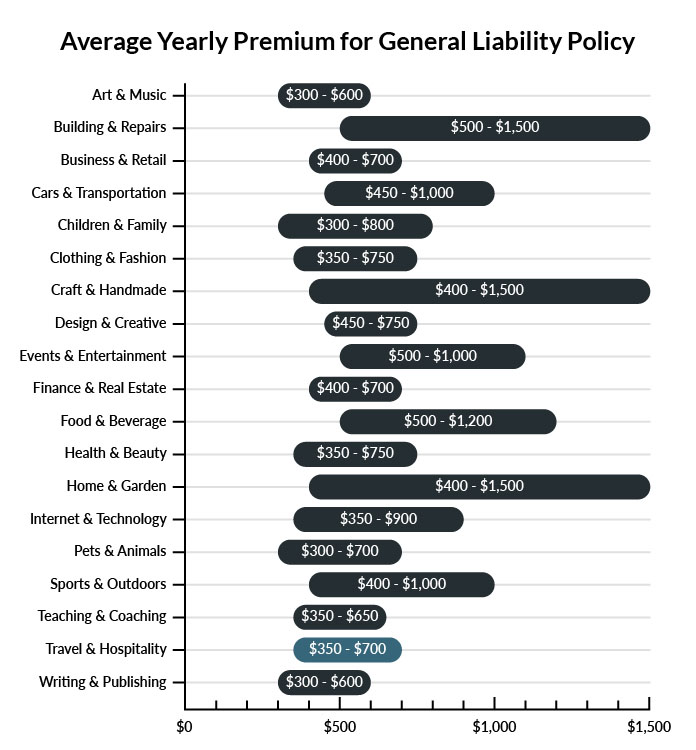

On average, B&B insurance can range from $1,000 to $5,000 annually, though high-end or large establishments may pay significantly more. The final cost depends on the factors mentioned earlier, as well as the insurer’s pricing model. Here’s a breakdown of potential expenses:

- Basic coverage: Starts at around $1,000–$2,000 per year for essential property and liability protection.

- Mid-tier coverage: Ranges from $2,500–$4,000, including additional protections like guest injury or equipment breakdown.

- Premium coverage: Exceeds $5,000 for extensive policies covering luxe amenities, high guest capacity, or rare perils.

Ways to Reduce Bed and Breakfast Insurance Costs

While insuring a bed and breakfast can be expensive, there are strategies to lower premiums without sacrificing coverage. Proactive risk management and comparing quotes are essential. Consider these actionable tips:

- Bundle policies: Combining property, liability, and commercial auto insurance with one provider often yields discounts.

- Implement safety measures: Install security systems, fire alarms, and sprinklers to reduce risk and qualify for lower rates.

- Raise deductibles: Opting for higher out-of-pocket costs can decrease monthly or annual premium payments.

Frequently Asked Questions

What types of coverage does tailored bed and breakfast insurance include?

Tailored bed and breakfast insurance typically offers a range of coverages to protect your business. Key policies include property insurance to safeguard your building and furnishings, liability insurance to cover guest injuries or damages, business interruption insurance for income loss due to unexpected closures, and commercial auto insurance if you provide transportation services. Additional options may include cyber liability for online booking systems or equipment breakdown coverage for essential appliances.

Why is specialized insurance important for a bed and breakfast?

Unlike standard home or business insurance, specialized B&B insurance addresses the unique risks of hosting guests. Standard policies may exclude commercial activities, leaving you vulnerable to claims like guest injuries, food-related illnesses, or property damage caused by visitors. A tailored policy ensures comprehensive protection, covering liabilities specific to hospitality while also accounting for your property’s dual role as a residence and a business.

How much does bed and breakfast insurance cost?

The cost of B&B insurance varies based on factors like location, property size, number of guests, and coverage limits. On average, premiums can range from $1,000 to $3,000 annually, but high-risk locations or extensive amenities may increase costs. To manage expenses, consider bundling policies or adjusting deductibles. An insurance provider can offer a customized quote after evaluating your specific operations and risk exposures.

What steps should I take if a guest files a claim against my B&B?

If a guest files a claim, notify your insurer immediately and provide all relevant details, including incident reports and witness statements. Document everything—photographs, communications, and medical records (if applicable). Avoid admitting fault before consulting your provider. Your liability coverage should handle legal fees or settlements, but cooperation and thorough documentation are critical to a smooth claims process.