When analyzing a company’s financial health, two documents often come to the forefront: the Profit and Loss statement (P&L) and the Income Statement. Many assume these terms are interchangeable, used synonymously to describe a financial document that outlines a company’s revenues and expenses over a specific period. However, the nuance lies not in their general purpose, but in the specifics of their content and the context in which they are used. This article aims to dissect the similarities and differences between the two, determining whether they are indeed the same or if distinctions exist.

Understanding the Difference Between P&L and Income Statement

When it comes to financial reporting, two terms that are often used interchangeably are P&L (Profit and Loss) and Income Statement. However, are they really the same thing? The answer lies in understanding the nuances of each term and how they are used in different contexts.

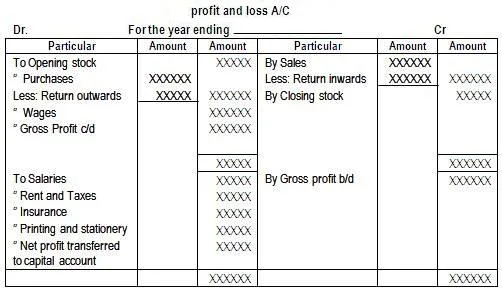

What is a P&L Statement?

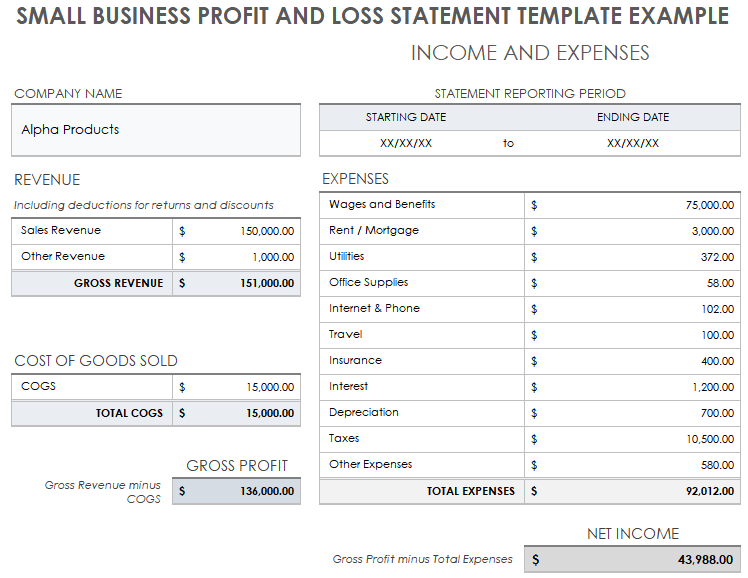

A P&L Statement, also known as a Profit and Loss Statement, is a financial statement that summarizes a company’s revenues and expenses over a specific period of time. It provides a snapshot of a company’s financial performance, highlighting its ability to generate profits. The P&L Statement typically includes items such as revenue, cost of goods sold, gross profit, operating expenses, and net income.

What is an Income Statement?

An Income Statement, on the other hand, is a financial statement that provides a detailed breakdown of a company’s revenues and expenses over a specific period of time. It is often referred to as a Statement of Earnings or Statement of Operations. The Income Statement is designed to provide stakeholders with a clear understanding of a company’s financial performance, including its ability to generate earnings.

| Financial Statement | Description |

|---|---|

| P&L Statement | Summarizes a company’s revenues and expenses over a specific period |

| Income Statement | Provides a detailed breakdown of a company’s revenues and expenses |

Key Differences Between P&L and Income Statement

While both P&L and Income Statement are used to report a company’s financial performance, there are some key differences between the two. The main difference lies in the level of detail provided. A P&L Statement typically provides a summary of a company’s financial performance, while an Income Statement provides a more detailed breakdown.

Components of a P&L Statement

A typical P&L Statement includes the following components: Revenue: The total amount of income generated by a company’s sales or services Cost of Goods Sold: The direct costs associated with producing a company’s products or services Gross Profit: The difference between revenue and cost of goods sold Operating Expenses: The indirect costs associated with running a company’s operations Net Income: The company’s total earnings after deducting all expenses

| P&L Component | Description |

|---|---|

| Revenue | Total income generated by sales or services |

| Cost of Goods Sold | Direct costs associated with producing products or services |

| Gross Profit | Difference between revenue and cost of goods sold |

Importance of P&L and Income Statement

Both P&L and Income Statement are essential tools for stakeholders to evaluate a company’s financial performance. They provide insights into a company’s ability to generate profits, manage costs, and make informed decisions about future investments.

Real-World Applications

In practice, P&L and Income Statement are used by various stakeholders, including investors, creditors, and management, to make informed decisions. For instance, investors use these statements to evaluate a company’s financial health and potential for growth, while creditors use them to assess a company’s creditworthiness.

Why does my profit and loss not match my bank statement?

The discrepancy between your profit and loss statement and your bank statement can be attributed to several factors. Accounting methods and bank statement processing can lead to differences in the two statements. Your profit and loss statement is typically prepared using the accrual method of accounting, which recognizes revenues and expenses when earned or incurred, regardless of when cash is received or paid. In contrast, your bank statement reflects the actual cash inflows and outflows during a specific period.

Reasons for Discrepancies

There are several reasons why your profit and loss statement may not match your bank statement. The main reasons include differences in accounting treatments, timing differences, and unrecorded transactions.

- The accounting treatment for certain transactions, such as depreciation or amortization, may not be reflected in your bank statement.

- Timing differences can occur when transactions are recorded in your profit and loss statement in one period, but the corresponding cash flow is reflected in your bank statement in a different period.

- Unrecorded transactions, such as bank fees or interest income, may be present in your bank statement but not in your profit and loss statement.

Reconciling the Differences

To reconcile the differences between your profit and loss statement and your bank statement, you need to identify and understand the reconciling items. This involves analyzing both statements and identifying the transactions that are present in one statement but not the other.

- Identify unrecorded transactions in your bank statement, such as bank charges or interest income, and record them in your accounting records.

- Verify the accounting treatment for certain transactions, such as loan repayments or investments, to ensure that they are correctly recorded in your profit and loss statement.

- Check for timing differences and ensure that transactions are recorded in the correct period in both your profit and loss statement and your bank statement.

Best Practices for Reconciliation

To minimize discrepancies between your profit and loss statement and your bank statement, it’s essential to follow best practices for reconciliation. This includes regularly reviewing and reconciling your bank statements, maintaining accurate and up-to-date accounting records, and ensuring that all transactions are correctly recorded.

- Regularly review and reconcile your bank statements to identify and address any discrepancies in a timely manner.

- Maintain accurate and up-to-date accounting records to ensure that your profit and loss statement is reliable and reflects the true financial position of your business.

- Ensure that all transactions are correctly recorded in your accounting records, including bank fees, interest income, and other transactions that may be present in your bank statement.

Is a profit and loss statement proof of income?

A profit and loss statement, also known as an income statement, is a financial document that summarizes a company’s revenues and expenses over a specific period. While it provides valuable information about a company’s financial performance, its role as proof of income is nuanced. A profit and loss statement is not necessarily a direct proof of income, as it includes various accounting entries and may not reflect the actual cash flows. However, it is often used as a starting point for assessing a company’s income.

Understanding the Components of a Profit and Loss Statement

A profit and loss statement comprises various elements, including revenues, cost of goods sold, operating expenses, and non-operating items. To understand its implications as proof of income, it’s essential to analyze these components. The key aspects to consider are:

- The revenue recognition principle, which dictates when revenue is recorded, affecting the income reported.

- Accounting policies for depreciation, amortization, and inventory valuation, which can significantly impact the net income.

- The inclusion of non-cash items, such as provisions and accruals, which may not directly relate to cash inflows or outflows.

Limitations of a Profit and Loss Statement as Proof of Income

While a profit and loss statement is a crucial tool for financial analysis, it has limitations as a definitive proof of income. The statement is based on accounting rules and estimates, which can lead to variations in reported income. Key limitations include:

- The impact of accounting standards and changes therein, which can alter the financial reporting and comparability.

- The presence of one-off or exceptional items, which can distort the underlying profitability.

- The absence of cash flow information, making it difficult to ascertain the actual cash generated during the period.

Using Profit and Loss Statements for Income Assessment

Despite its limitations, a profit and loss statement is a vital document for assessing a company’s income. To effectively use it, one must consider it in conjunction with other financial statements and analyses. Important considerations are:

- Analyzing the statement in the context of the company’s industry and market conditions.

- Reviewing comparative statements over several periods to identify trends and anomalies.

- Adjusting the reported income for non-recurring items to arrive at a more accurate picture of the company’s financial health.

Do the balance sheet and an income statement show basically the same thing?

The balance sheet and an income statement are two fundamental financial statements that provide insights into a company’s financial performance and position. While they are related, they do not show basically the same thing. The balance sheet provides a snapshot of a company’s financial position at a specific point in time, typically at the end of an accounting period, by listing its assets, liabilities, and equity. On the other hand, the income statement, also known as the profit and loss statement, shows a company’s financial performance over a specific period of time by detailing its revenues and expenses.

Understanding the Balance Sheet

The balance sheet is a critical financial statement that presents a company’s financial situation at a particular moment. It categorizes items into assets, liabilities, and equity, providing a comprehensive view of what the company owns and owes, as well as the shareholders’ interest.

- The assets section includes items such as cash, inventory, and property, plant, and equipment.

- Liabilities comprise debts and other financial obligations that the company must settle.

- Equity represents the residual interest in the assets after deducting liabilities, essentially the shareholders’ stake in the business.

Purpose of the Income Statement

The income statement serves to illustrate a company’s ability to generate profits over a specified period. It outlines the revenues earned and the expenses incurred, culminating in the net income or loss for the period.

- Revenues are the income generated from the company’s core operations and other activities.

- Expenses include the cost of goods sold, operating expenses, and other expenditures.

- The resulting net income or loss indicates the company’s financial performance and is a key indicator for investors and analysts.

Key Differences Between the Two Statements

The primary distinction between the balance sheet and the income statement lies in their focus and the type of information they convey.

- The balance sheet is concerned with a company’s financial position at a single point in time.

- The income statement, in contrast, reflects the company’s financial performance over a range of time.

- Understanding both statements is crucial for a comprehensive analysis of a company’s financial health and operational efficiency.

Frequently Asked Questions

What is the main difference between a P&L statement and an Income Statement?

The main difference between a P&L statement and an Income Statement lies in the terminology used, as both refer to a financial statement that summarizes a company’s revenues and expenses over a specific period. Revenue and expenses are the key components of both statements, and they are used interchangeably in most contexts. However, some companies may use the term P&L statement more informally, while Income Statement is a more formal term used in financial reporting.

Are P&L statements and Income Statements used for the same purpose?

Both P&L statements and Income Statements are used to provide stakeholders with a snapshot of a company’s financial performance over a specific period. They are used for the same purpose, which is to report a company’s revenue, cost of goods sold, operating expenses, and net income. The information presented in these statements is used by investors, analysts, and other stakeholders to assess a company’s profitability and make informed decisions.

Can a company’s P&L statement be different from its Income Statement?

In most cases, a company’s P&L statement and Income Statement are the same thing, as they are based on the same financial data. However, some companies may present the information in different formats or use different terminology, which can result in slight differences between the two statements. Nevertheless, the underlying financial data and the net income reported in both statements should be the same.

How do I interpret a P&L statement or Income Statement?

To interpret a P&L statement or Income Statement, you need to analyze the various components, including revenue, gross profit, operating expenses, and net income. You should also consider the trend of these components over time to assess a company’s financial performance and identify areas for improvement. By analyzing these statements, you can gain insights into a company’s financial health and make informed decisions about investments or other business opportunities.