New Jersey’s severance pay laws establish critical requirements for employers navigating workforce reductions, layoffs, or business closures. Understanding these regulations is essential for businesses to remain compliant and avoid legal repercussions. Under state and federal guidelines, severance pay is not always mandatory—unless stipulated in an employment contract, company policy, or collective bargaining agreement. However, New Jersey’s severance provisions may come into play under the WARN Act, which mandates compensation for employees in mass layoffs. Employers must carefully assess their obligations, negotiation strategies, and documentation processes to mitigate risks. Staying informed about these laws ensures fair treatment of departing employees while protecting the company from potential disputes.

Understanding New Jersey Severance Pay Law: Key Requirements for Employers

The New Jersey Severance Pay Law does not mandate employers to provide severance pay unless stipulated in an employment contract, company policy, or under specific circumstances like mass layoffs. However, employers must comply with both federal and state regulations to avoid legal repercussions. This article clarifies critical aspects of the law and what employers need to know.

Is Severance Pay Required Under New Jersey Law?

New Jersey does not have a state law requiring all employers to provide severance pay. However, if an employer has a written agreement, contract, or company policy promising severance, they must honor it. Additionally, under the federal Worker Adjustment and Retraining Notification (WARN) Act, employers conducting mass layoffs or plant closures may be required to provide severance pay or advance notice.

| Scenario | Severance Pay Requirement |

|---|---|

| No employment contract or policy | Not required |

| Contract/policy exists | Required as per terms |

| Mass layoffs (WARN Act) | Severance or 60-day notice required |

How Does the Federal WARN Act Affect New Jersey Employers?

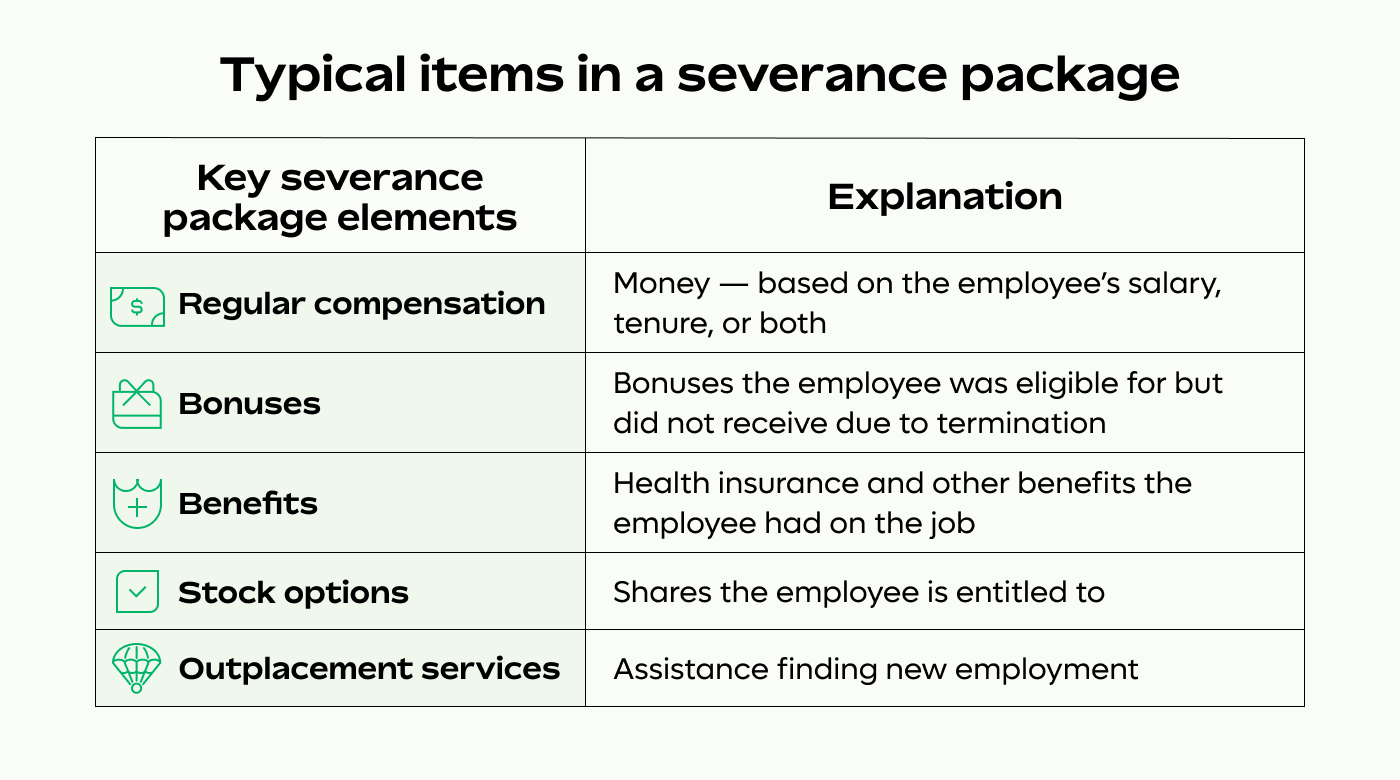

The federal WARN Act requires employers with 100+ employees to provide a 60-day notice before a mass layoff or plant closing. Failure to comply may require payment of severance for the notice period. New Jersey’s mini-WARN Act imposes stricter rules, including coverage for employers with 50+ employees and extending notice requirements to smaller-scale layoffs.

| Act | Coverage | Notice Period |

|---|---|---|

| Federal WARN | 100+ employees | 60 days |

| NJ Mini-WARN | 50+ employees | 90 days (as of 2023) |

Can Employers Waive Severance Pay Obligations?

Employers may condition severance pay on employees signing a release of claims (waiver). However, such waivers must comply with the Older Workers Benefit Protection Act (OWBPA) if involving employees over 40. The waiver must be knowingly and voluntarily signed, with adequate time for review (typically 21 days for individuals, 45 days for group layoffs).

| Key Requirement | Details |

|---|---|

| Written Waiver | Must clearly outline rights being waived |

| Consideration | Severance must be more than what the employee is already owed |

| Revocation Period | 7 days to rescind after signing |

Tax Implications of Severance Pay in New Jersey

Severance pay is considered taxable income under both federal and New Jersey state law. Employers must withhold Social Security, Medicare, federal income tax, and state income tax. Additionally, severance may impact unemployment benefits eligibility.

| Tax Type | Withholding Requirement |

|---|---|

| Federal Income Tax | Yes |

| NJ State Tax | Yes |

| Social Security/Medicare | Yes |

Best Practices for Employers Managing Severance Agreements

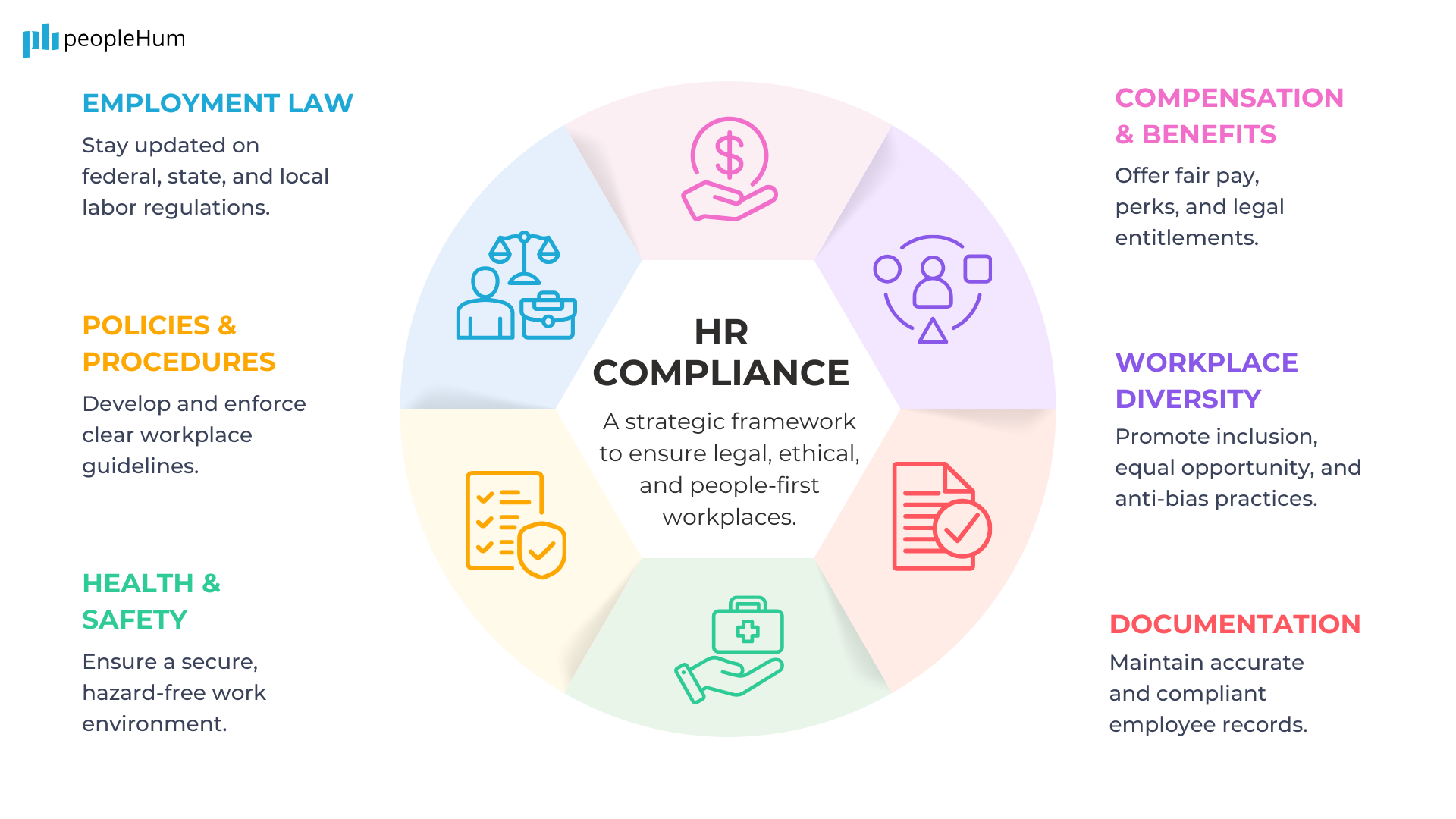

To mitigate legal risks, employers should:

- Document policies clearly in employee handbooks

- Ensure compliance with federal and state laws (WARN, OWBPA)

- Offer neutral third-party review for severance agreements

- Consult legal counsel for complex layoff scenarios

| Practice | Reason |

|---|---|

| Clear documentation | Avoids disputes over promised benefits |

| Timely WARN notices | Prevents penalties and lawsuits |

| Legal review | Ensures enforceable agreements |

What are the rules for severance in NJ?

Is Severance Pay Required by Law in New Jersey?

In New Jersey, severance pay is not mandated by state or federal law unless it is stipulated in an employment contract, company policy, or a collective bargaining agreement. However, employers may offer severance voluntarily, often in exchange for a severance agreement that includes a waiver of legal claims. The terms are typically negotiated between the employer and employee.

- New Jersey follows at-will employment, meaning employers can terminate employees without cause, but severance is not automatic.

- If an employer has a written policy promising severance, they must honor it.

- Mass layoffs or plant closings under the WARN Act may trigger severance or continuation of benefits.

How Is Severance Pay Calculated in New Jersey?

Severance pay calculations in New Jersey are not standardized but often follow company guidelines or negotiated terms. Common methods include weeks of pay per year worked or a lump-sum payment. Employers may also consider factors like seniority, position, and reason for termination.

- Formula-based: One or two weeks’ pay per year of service is typical.

- Negotiated amounts: Higher-level employees may receive larger packages.

- Benefits continuation: Some agreements include extended health insurance.

What Are the Tax Implications of Severance Pay in New Jersey?

Severance pay is considered taxable income by both federal and New Jersey state authorities. It is subject to income tax withholding, Social Security, and Medicare taxes. Employers must report it on Form W-2, and recipients should plan for potential tax liabilities.

- Federal taxes: Severance is taxed as ordinary income under IRS rules.

- New Jersey state tax: Severance is also subject to NJ income tax.

- Unemployment eligibility: Severance may delay unemployment benefits.

What are the industry standards for severance packages?

What Factors Influence Severance Package Standards?

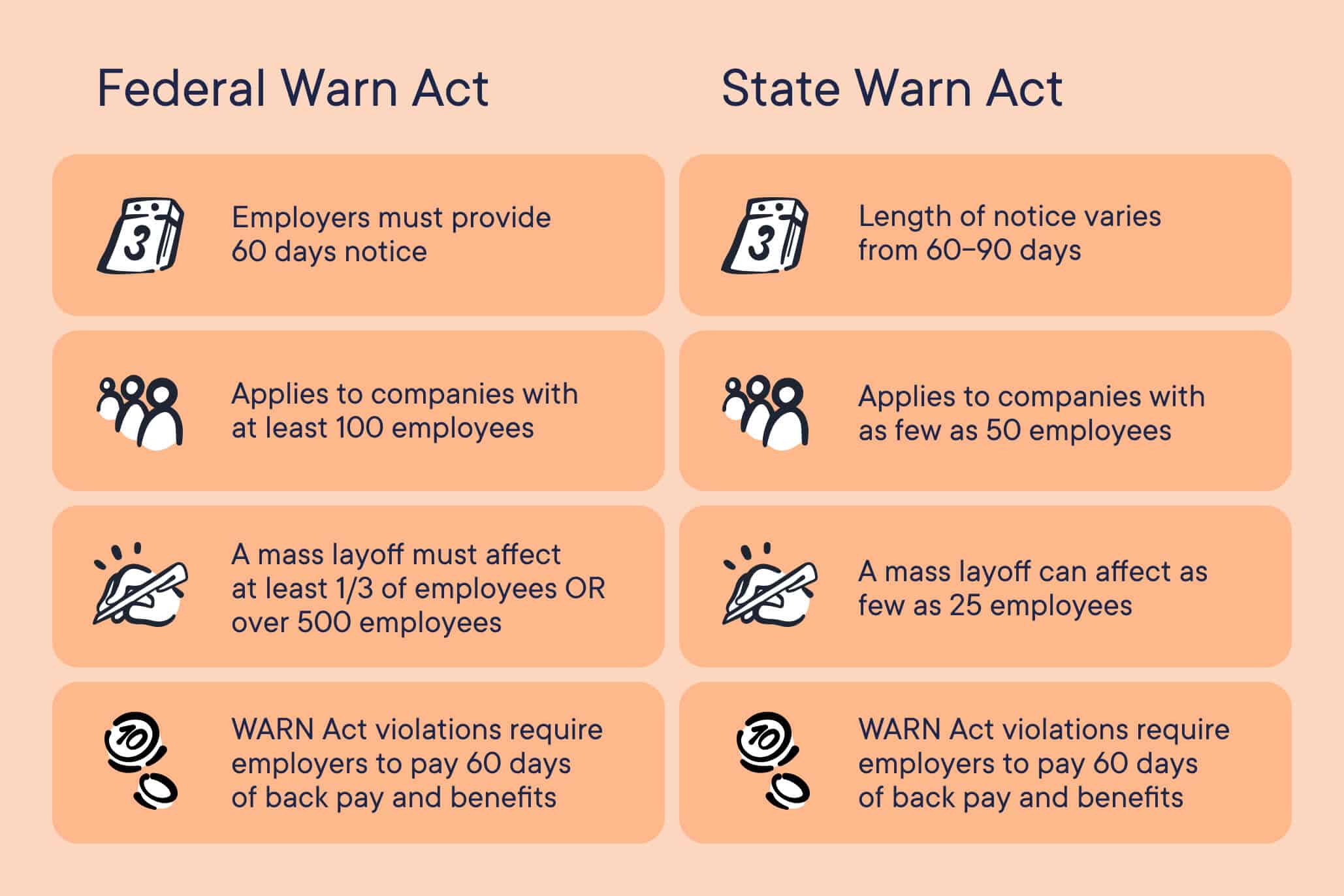

Severance package standards vary depending on several factors, including industry norms, company size, and employee tenure. Generally, more established companies and industries with higher unionization rates tend to offer more structured severance agreements. Key influencing factors include:

- Length of service: Employees with longer tenure often receive more generous packages.

- Job level: Executives and senior managers typically secure better terms than entry-level staff.

- Geographic location: Legal requirements and cultural expectations differ by country.

What Are Common Components of a Severance Package?

A typical severance package includes financial and non-financial benefits designed to support the employee during the transition. The most common components are:

- Base pay: Often 1-2 weeks of salary per year of service.

- Extended benefits: Continued health insurance for a limited period.

- Career support: Outplacement services or resume coaching.

How Do Legal Requirements Affect Severance Packages?

Legal frameworks play a significant role in determining severance terms, especially in regions with strict labor laws. Employers must consider:

- Statutory obligations: Some jurisdictions mandate minimum severance pay.

- Contractual agreements: Employment contracts may outline specific severance clauses.

- Workforce reductions: Mass layoffs often trigger additional legal requirements.

What is the WARN Act in New Jersey?

The WARN Act in New Jersey, formally known as the New Jersey Millville Dallas Airmotive Plant Job Loss Notification Act, is a state law that requires employers to provide advance notice to employees and government officials before conducting mass layoffs, plant closings, or relocations. It is stricter than the federal Worker Adjustment and Retraining Notification (WARN) Act, with broader coverage and more stringent notification requirements. Key provisions include:

– Notification Period: Employers must give at least 90 days’ notice (compared to 60 under federal law).

– Covered Employers: Applies to businesses with 100 or more full-time employees (federal WARN applies to 100+ employees with specific hourly thresholds).

– Triggers: Applies to layoffs of 50 or more employees at a single site, regardless of percentage (federal WARN includes percentage-based triggers).

Who Must Comply with the New Jersey WARN Act?

The New Jersey WARN Act applies to private employers with 100 or more full- or part-time employees who have worked at least 20 hours per week and 6 months in the preceding year. This includes:

- Manufacturing plants with 50+ employees, even if the total workforce is below 100.

- Businesses relocating operations 50+ miles away, affecting 50+ employees.

- Temporary or contract workers employed through staffing agencies if they meet hourly thresholds.

What Are the Notification Requirements Under the NJ WARN Act?

Employers must provide written notice at least 90 days before a qualifying event to:

- Affected employees (or their unions, if applicable).

- The New Jersey Department of Labor and Workforce Development.

- The chief elected official of the municipality where the site is located.

Failure to comply may result in severance pay obligations (up to one week per year of service) and civil penalties.

What Are the Penalties for Violating the NJ WARN Act?

Non-compliance triggers significant financial consequences:

- Severance pay equal to one week’s wages per year of service for each affected employee.

- Civil fines up to $10,000 per day for failing to notify the state.

- Employee lawsuits for back pay, benefits, and legal fees.

Exceptions exist for unforeseeable circumstances, such as natural disasters, but employers must still provide as much notice as possible.

Does an employer have to offer a severance package?

Is a Severance Package Legally Required?

In most cases, employers are not legally required to offer a severance package unless specified in an employment contract, company policy, or collective bargaining agreement. However, there are exceptions, such as:

- Contractual obligations: If the employment agreement guarantees severance, employers must comply.

- Mass layoffs: Under the WARN Act (U.S.), companies with 100+ employees may need to provide 60 days’ notice or pay in lieu.

- State/local laws: Some jurisdictions have unique requirements for severance or termination pay.

Why Do Employers Offer Severance Packages?

Employers often provide severance packages voluntarily to maintain goodwill and mitigate legal risks. Common reasons include:

- Employee morale: Softening the blow of termination helps preserve the company’s reputation.

- Legal protection: Packages may include a release of claims, preventing lawsuits.

- Transition support: Offering pay or benefits assists employees while they seek new employment.

What Should Employees Know About Severance Negotiation?

While not mandatory, employees can often negotiate severance terms. Key considerations include:

- Review the offer: Check for fair compensation, extended benefits, or outplacement services.

- Legal advice: Consult an attorney to understand waived rights (e.g., discrimination claims).

- Timing: Employers may revise offers if the employee highlights valuable contributions or potential legal issues.

How long does an employer have to pay you after termination in NJ?

In New Jersey, the law requires an employer to pay a terminated employee their final wages by the next regular payday, whether the termination was voluntary or involuntary. This includes all earned wages, commissions, bonuses, and any accrued vacation pay (if the company policy allows it). If the employer fails to do so, they may be subject to penalties, including liquidated damages equal to 200% of the unpaid wages.

When Must Final Wages Be Paid After Termination in NJ?

Under New Jersey labor laws, an employer must issue the final paycheck by the next scheduled payday following termination. This applies to both:

- Involuntary termination (layoff, firing) — Payment is due by the next regular payday.

- Voluntary termination (quitting) — Same rule applies; no additional waiting period is permitted.

- Direct deposit or paper check — The method must comply with the usual payroll process.

What If the Employer Fails to Pay on Time?

Delayed final wages in NJ can result in legal consequences for the employer, including:

- Liquidated damages — Up to 200% of the unpaid wages may be awarded to the employee.

- Legal action — Employees can file a claim with the NJ Division of Wage and Hour Compliance.

- Attorney fees and costs — Employers may also be liable for court-related expenses.

Are There Exceptions to the Payment Deadline?

While NJ law is strict, certain limited exceptions or disputes could delay payment:

- Bona fide disputes — If the employer contests the amount owed, they must still pay undisputed wages.

- Commission structures — Final commissions may follow a different timeline if defined by contract.

- Union agreements — CBA terms may override standard state laws in some cases.

What are the requirements for termination in New Jersey?

Grounds for Termination in New Jersey

In New Jersey, an employer may terminate an employee for several valid reasons, as long as they comply with state and federal laws. At-will employment is the standard, meaning either party can end the employment relationship at any time, with or without cause. However, termination cannot be based on discriminatory or retaliatory reasons. Key grounds for termination include:

- Poor performance or failure to meet job expectations after warnings or improvement plans.

- Misconduct, such as theft, harassment, or violation of company policies.

- Business-related reasons, like downsizing, restructuring, or financial difficulties.

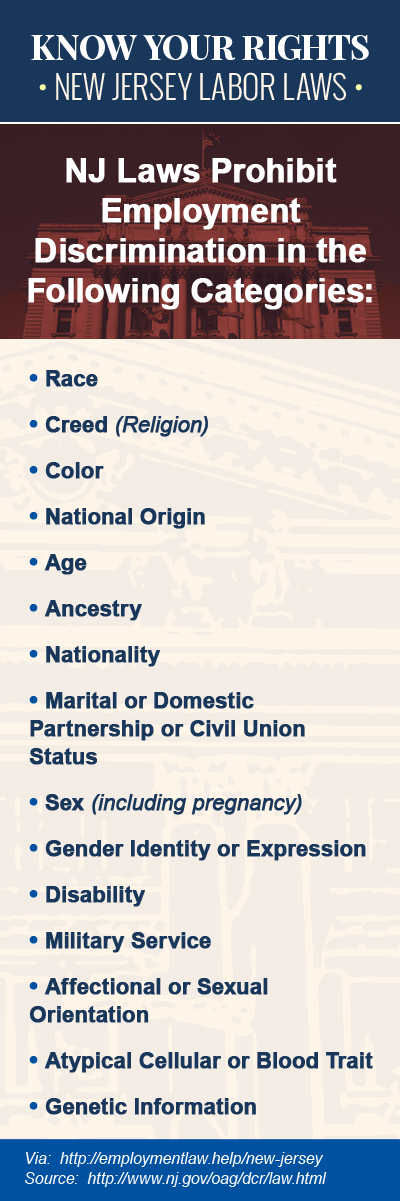

Legal Protections Against Wrongful Termination

New Jersey employees are protected under state and federal laws prohibiting termination for unlawful reasons. Employers must avoid violations of anti-discrimination laws (e.g., based on race, gender, religion) or retaliation for exercising legal rights. Important protections include:

- The New Jersey Law Against Discrimination (NJLAD), covering protected classes.

- The Conscientious Employee Protection Act (CEPA), safeguarding whistleblowers.

- Federal laws like the FMLA, ADA, and Title VII, which prevent termination for medical leave, disabilities, or other protected activities.

Notice and Severance Requirements

While New Jersey does not mandate employers to provide termination notices or severance pay, certain conditions may apply. For example:

- Mass layoffs (50+ employees) require 60 days’ notice under the federal WARN Act.

- Employment contracts or union agreements may stipulate severance or notice periods.

- Company policies may outline voluntary severance packages or outplacement services.

Frequently Asked Questions

What is required under New Jersey severance pay laws?

New Jersey law does not generally mandate employers to provide severance pay unless it is stipulated in an employment contract, company policy, or collective bargaining agreement. However, if an employer chooses to offer severance, they must adhere to the terms outlined in their policies. In cases of mass layoffs or plant closings, the federal WARN Act may require advance notice or severance pay, which also applies to New Jersey employers meeting specific thresholds.

Are there any exceptions where New Jersey employers must pay severance?

Yes, New Jersey employers may be required to pay severance under the federal WARN Act if they conduct a mass layoff or plant closing without providing 60 days’ notice. In such cases, employers must provide back pay and benefits for the notice period, which functions similarly to severance. Additionally, if severance is promised in an employment agreement or an employee handbook, employers must honor those terms.

How does the New Jersey WARN Act differ from the federal WARN Act?

The New Jersey WARN Act imposes stricter requirements than the federal version, including applying to smaller employers (those with 100 or more employees) and requiring 90 days’ notice for mass layoffs or closures (compared to the federal 60-day rule). Additionally, New Jersey’s law mandates severance pay equal to one week of pay per year of service if proper notice isn’t given, while the federal WARN Act requires only back pay for the notice period.

Can employers require employees to sign a release to receive severance pay in New Jersey?

Yes, employers in New Jersey can require employees to sign a release or waiver (often forgoing legal claims) in exchange for voluntary severance pay. However, the release must comply with federal and state laws, including the Older Workers Benefit Protection Act (OWBPA), which sets standards for waivers involving age discrimination claims. Employees must be given adequate time to review the agreement and may have a revocation period (typically seven days).