Employers in California must provide a range of legally required benefits to their employees to remain compliant with state and federal laws. These mandated benefits include minimum wage, overtime pay, paid sick leave, workers’ compensation, and disability insurance, among others. Non-compliance can result in costly penalties, litigation, and damage to a company’s reputation. Understanding these obligations is critical for businesses of all sizes, as California’s employment laws are among the strictest in the U.S. This article outlines the essential employee benefits required by law, ensuring employers stay informed and avoid legal pitfalls while fostering a fair and compliant workplace.

Essential Legally Required Employee Benefits in California

California employers must comply with various state and federal laws when providing employee benefits. Ensuring compliance minimizes legal risks and promotes a fair workplace. Below are key legally mandated employee benefits in California.

1. Minimum Wage and Overtime Pay

California has stricter wage laws than federal standards. Employers must pay at least the state minimum wage and provide overtime pay for eligible employees. Non-exempt workers must receive 1.5 times their regular rate for hours worked beyond 8 in a day or 40 in a week, and double pay for exceeding 12 hours in a day.

| Requirement | Details |

|---|---|

| Minimum Wage (2023) | $15.50 per hour (for all employers) |

| Overtime After | 8 hours/day or 40 hours/week |

| Double Time After | 12 hours/day |

2. Paid Sick Leave

California employers must provide paid sick leave to employees working at least 30 days in a year. Employees accrue at least 1 hour of sick leave per 30 hours worked, up to a minimum of 24 hours (3 days) per year.

| Requirement | Details |

|---|---|

| Accrual Rate | 1 hour per 30 worked |

| Annual Cap | 24 hours (3 days) |

| Covered Employees | Part-time, full-time, and temporary workers |

3. Workers’ Compensation Insurance

All California employers must provide workers’ compensation insurance—even for a single employee. This benefit covers medical expenses and lost wages due to work-related injuries or illnesses.

| Requirement | Details |

|---|---|

| Coverage Mandate | Required for all employees |

| Benefits Include | Medical treatment, disability pay, rehabilitation |

| Penalties for Non-Compliance | Fines up to $10,000+ and stop-work orders |

4. Unemployment Insurance (UI)

California employers must contribute to the Unemployment Insurance (UI) program, which provides temporary financial assistance to eligible workers who lose their jobs through no fault of their own.

| Requirement | Details |

|---|---|

| Contribution Rate | Varies based on payroll and industry |

| Eligibility | Employees must meet earning and job-loss criteria |

| Maximum Weekly Benefit (2023) | $450 (for up to 26 weeks) |

5. Disability Insurance (SDI)

California’s State Disability Insurance (SDI) program provides short-term wage replacement for employees unable to work due to non-work-related illnesses, injuries, or pregnancies. Employers must withhold payroll deductions (unless they offer a private paid leave plan).

| Requirement | Details |

|---|---|

| Employee Contribution | 1.1% of wages (up to $153,164 in earnings) |

| Maximum Weekly Benefit (2023) | $1,620 for up to 52 weeks |

| Coverage | Non-work-related disabilities, pregnancy leave |

What is the Labor Code 2806 in California?

What is Labor Code 2806 in California?

Labor Code 2806 is a specific section within California’s labor laws that pertains to the examination and certification of electricians. This code ensures that electricians meet the required standards of knowledge and competence to perform electrical work safely and effectively. Key aspects include:

- Certification Requirements: Electricians must pass a state-approved examination to obtain certification.

- Scope of Work: The code defines the types of electrical work that require certification.

- Enforcement: Authorities may penalize uncertified individuals performing regulated electrical work.

Who Does Labor Code 2806 Apply To?

This code applies to electricians and contractors engaging in electrical work within California. Specific categories include:

- Journeyman Electricians: Workers with substantial experience but not yet master-level certification.

- Master Electricians: Highly skilled professionals certified to oversee complex projects.

- Electrical Contractors: Businesses employing electricians must ensure compliance with the code.

What Are the Penalties for Violating Labor Code 2806?

Violations of Labor Code 2806 can result in serious consequences, including:

- Fines: Monetary penalties for uncertified individuals or non-compliant contractors.

- Legal Action: Potential lawsuits or cease-and-desist orders from regulatory bodies.

- License Suspension: Certified professionals risk losing their credentials for repeated violations.

What are the three basic employee benefits required by law?

Social Security Contributions

The first legally required employee benefit in many countries is Social Security contributions. Employers must deduct these payments from employees’ wages and contribute a matching amount. The funds support retirement, disability, and survivor benefits.

- Federal Insurance Contributions Act (FICA) in the U.S. mandates contributions to Social Security and Medicare.

- Employers are responsible for withholding and submitting the correct amounts.

- Failure to comply may result in penalties or legal action.

Workers’ Compensation Insurance

Another mandatory benefit is Workers’ Compensation, which provides financial and medical support to employees injured on the job.

- Coverage varies by state but generally includes medical expenses and lost wages.

- Employers must purchase insurance or qualify as self-insured.

- The system is no-fault, meaning employees don’t need to prove employer negligence.

Unemployment Insurance

The third compulsory benefit is Unemployment Insurance, designed to offer temporary financial aid to workers who lose their jobs involuntarily.

- Funded by employer taxes, this benefit varies by state regulations.

- Employees must meet eligibility criteria, such as job separation reasons and work history.

- It provides a partial wage replacement for a limited period.

Which of the following is a legally required benefit?

In the United States, the following are legally required benefits that employers must provide to employees:

– Social Security and Medicare contributions (under the Federal Insurance Contributions Act, or FICA).

– Workers’ compensation insurance (varies by state).

– Unemployment insurance (under the Federal Unemployment Tax Act, or FUTA).

– Family and Medical Leave Act (FMLA) (unpaid leave for eligible employees).

– Health insurance (for employers with 50+ full-time employees under the Affordable Care Act).

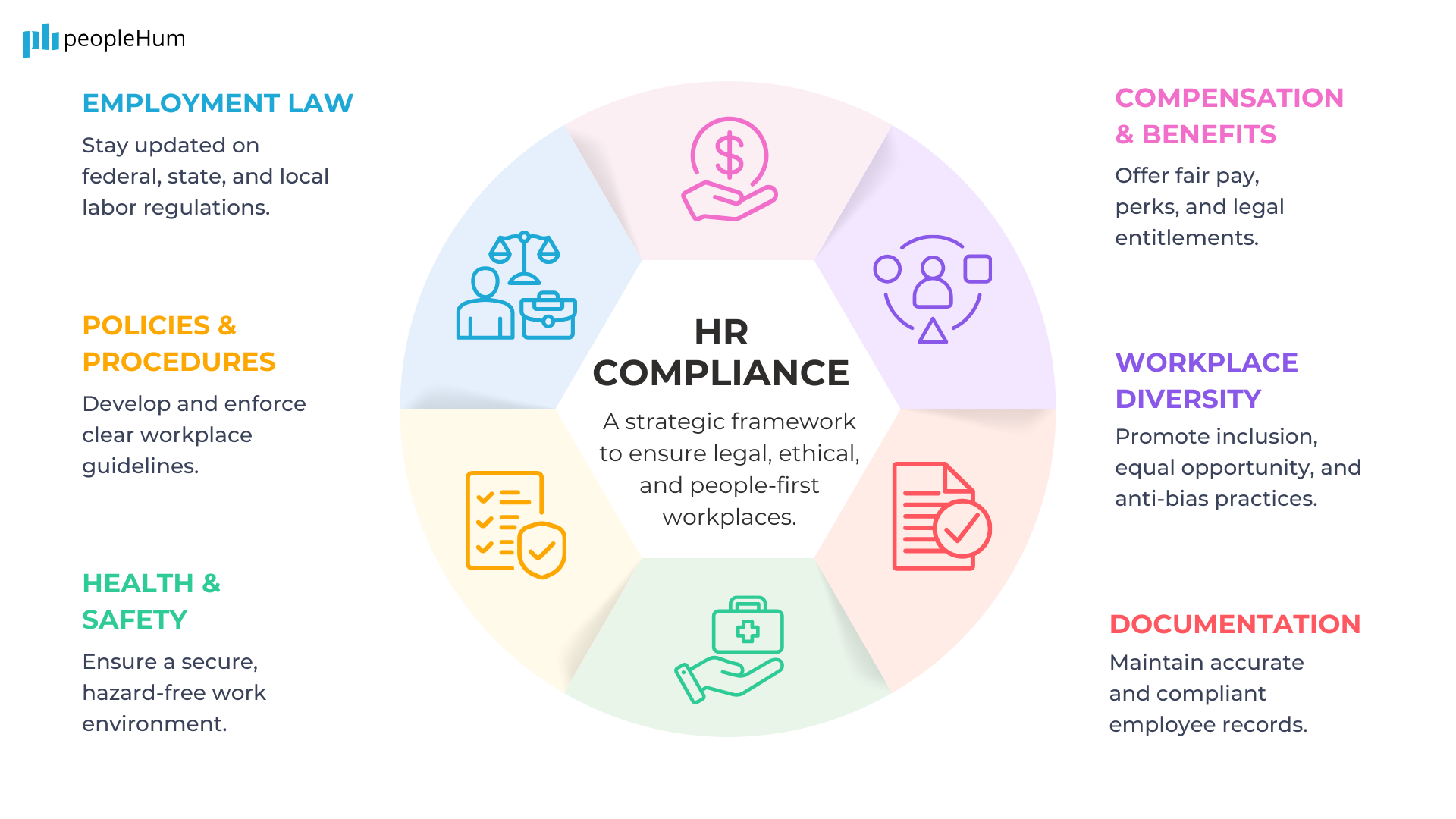

What Are the Federally Mandated Employee Benefits?

Under federal law, employers must provide certain benefits to employees, regardless of the company’s size or location. These include:

- Social Security and Medicare: Employers must withhold and match employee contributions under FICA.

- Unemployment insurance: Employers pay into state and federal unemployment programs.

- FMLA leave: Eligible employees can take up to 12 weeks of unpaid leave for qualifying events.

Which Benefits Are State-Specific?

Some legally required benefits vary by state, including:

- Workers’ compensation: Most states require coverage for work-related injuries or illnesses.

- Paid sick leave: Mandatory in certain states (e.g., California, New York).

- Disability insurance: Required in a few states (e.g., California, New Jersey).

Are All Employers Required to Offer Health Insurance?

Not all employers must provide health insurance, but:

- Affordable Care Act (ACA): Only applies to businesses with 50+ full-time employees.

- Penalties: Non-compliant large employers may face fines.

- State mandates: Some states (e.g., Massachusetts) have additional health coverage requirements.

Frequently Asked Questions

What are the legally required employee benefits in California?

In California, employers must provide mandatory benefits such as workers’ compensation, unemployment insurance, paid sick leave, and State Disability Insurance (SDI). Additional requirements include family and medical leave under the California Family Rights Act (CFRA) and health insurance for eligible employees under the Affordable Care Act (ACA). Failure to comply can result in penalties and legal action.

How does California’s paid sick leave law work?

California’s paid sick leave law mandates that employers provide at least 3 days (24 hours) of paid sick leave per year to employees who work 30 or more days within a year. Employees accrue 1 hour of sick leave for every 30 hours worked, and unused sick leave may carry over to the next year, though employers can limit usage to 24 hours annually. This benefit applies to full-time, part-time, and temporary workers.

What are the penalties for not providing required employee benefits in California?

Employers who fail to provide legally required benefits face severe consequences, including fines, back pay demands, and potential lawsuits. For example, violating paid sick leave laws can result in penalties of $50–$100 per employee per incident. Repeated non-compliance may lead to criminal charges or revocation of business licenses. The California Labor Commissioner’s Office strictly enforces these laws.

Are employers required to offer health insurance in California?

Under the Affordable Care Act (ACA), employers with 50 or more full-time employees must provide health insurance or face penalties. Additionally, California mandates employers with 20+ employees to offer continuation coverage under Cal-COBRA. Small businesses may qualify for tax credits through Covered California if they offer insurance. Compliance is critical to avoid fines and ensure employee access to healthcare.