Employment Practices Liability Insurance (EPLI) is a type of coverage designed to protect businesses from financial losses resulting from employment-related lawsuits. As the number of workplace discrimination, harassment, and wrongful termination claims continues to rise, EPLI insurance has become an essential consideration for companies of all sizes. But is EPLI insurance worth the investment for your business? This article will weigh the pros and cons of EPLI coverage, examining its benefits and drawbacks to help you make an informed decision about whether this type of insurance is right for your organization. Evaluating the costs and potential risks is crucial.

Understanding EPLI Insurance: A Comprehensive Overview

Employment Practices Liability Insurance (EPLI) is a type of insurance that protects businesses against claims of wrongful employment practices, such as discrimination, harassment, and wrongful termination. As the modern workplace continues to evolve, the risk of employment-related lawsuits has increased significantly, making EPLI insurance a vital consideration for businesses of all sizes.

What Does EPLI Insurance Cover?

EPLI insurance provides coverage for a wide range of employment-related claims, including wrongful termination, discrimination, harassment, and retaliation. It also covers the costs associated with defending against these claims, including attorney fees and settlements. By having EPLI insurance, businesses can mitigate the financial risks associated with employment-related lawsuits.

| Coverage | Description |

|---|---|

| Wrongful Termination | Claims alleging that an employee was terminated unfairly or without just cause |

| Discrimination | Claims alleging that an employee was discriminated against based on age, sex, race, or other protected characteristics |

| Harassment | Claims alleging that an employee was subjected to a hostile work environment or sexual harassment |

| Retaliation | Claims alleging that an employee was retaliated against for reporting wrongdoing or participating in an investigation |

Pros of EPLI Insurance

One of the primary benefits of EPLI insurance is that it provides businesses with financial protection against costly employment-related lawsuits. By having EPLI insurance, businesses can avoid the financial devastation that can result from a single lawsuit. Additionally, EPLI insurance can help businesses to mitigate risk by providing access to HR support and legal guidance.

Cons of EPLI Insurance

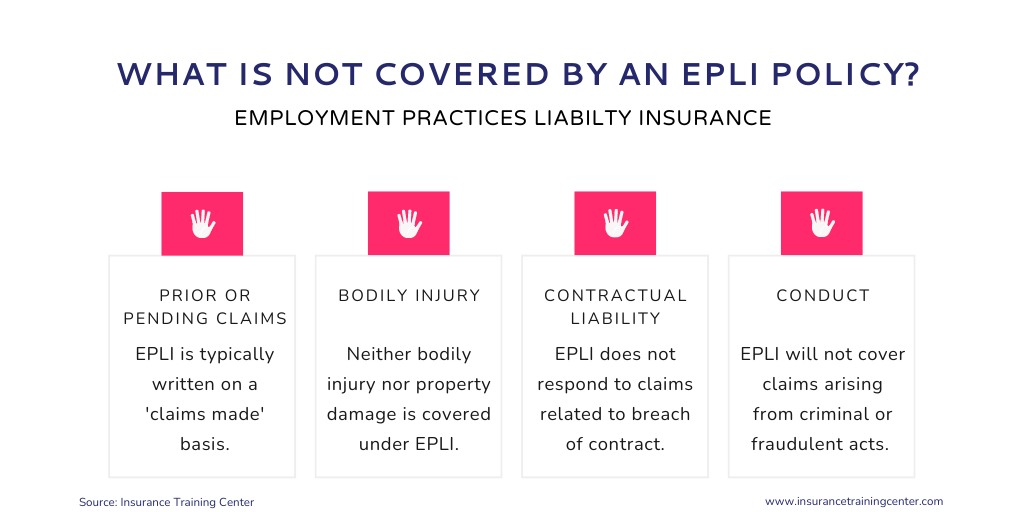

While EPLI insurance provides numerous benefits, there are also some potential drawbacks to consider. One of the main cons is the cost of EPLI insurance, which can be significant for businesses with a large number of employees. Additionally, EPLI insurance may not cover all types of employment-related claims, such as workers’ compensation claims.

| Pros | Cons |

|---|---|

| Financial protection against costly lawsuits | Cost of EPLI insurance can be significant |

| Mitigates risk through HR support and legal guidance | May not cover all types of employment-related claims |

| Provides peace of mind for business owners | May have deductibles and limits on coverage |

Who Needs EPLI Insurance?

EPLI insurance is not just for large businesses; small businesses and startups can also benefit from this type of insurance. Any business with employees is at risk of employment-related lawsuits, and EPLI insurance can provide financial protection and peace of mind.

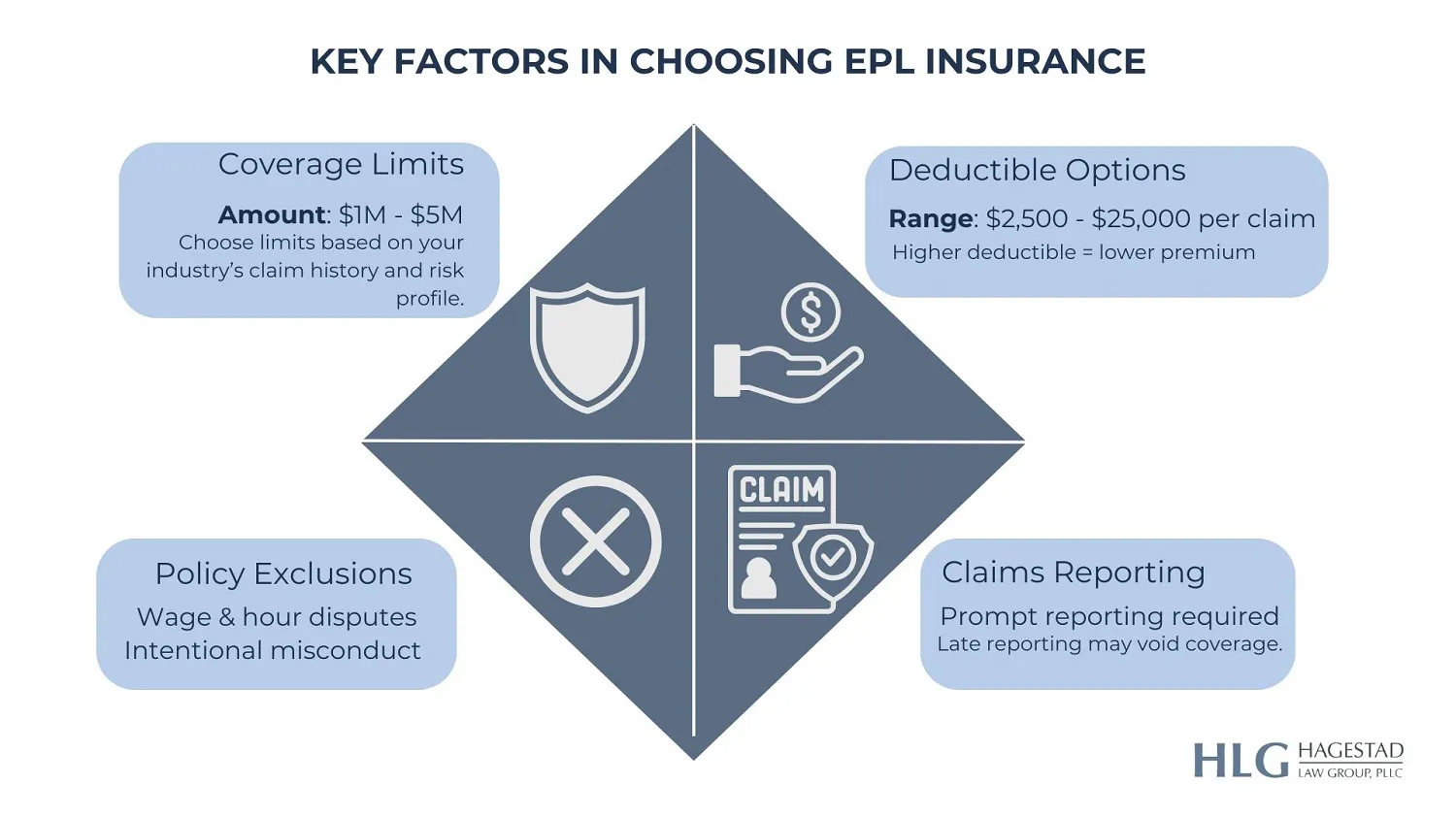

How to Choose the Right EPLI Insurance Policy

When selecting an EPLI insurance policy, businesses should consider several factors, including the level of coverage, deductibles, and limits on coverage. It’s also essential to choose an insurance provider that offers HR support and legal guidance to help mitigate risk.

Best Practices for Managing Employment-Related Risks

To minimize the risk of employment-related lawsuits, businesses should implement best practices, such as having a clear employee handbook, providing training on workplace harassment and discrimination, and maintaining accurate records. By taking proactive steps to manage risk, businesses can reduce the likelihood of employment-related claims.

Is epli worth it?

The answer to this question largely depends on various factors including personal preferences, dietary needs, and health goals. Epli, or eggplant, is a nutrient-rich food that is low in calories and high in fiber, making it a great addition to a weight management diet. It is also rich in antioxidants, vitamins, and minerals, which can provide several health benefits.

Epli Nutritional Benefits

Epli is considered a superfood due to its high nutritional value. It is an excellent source of dietary fiber, vitamins, and minerals. Consuming epli can help in maintaining a healthy digestive system, reducing the risk of chronic diseases like heart disease and diabetes. Some of the key nutritional benefits of epli include:

- High in antioxidants that help protect against cell damage and reduce inflammation

- Rich in fiber, which can help lower cholesterol levels and promote digestive health

- Good source of essential minerals like potassium, manganese, and copper

Culinary Uses of Epli

Epli is a versatile vegetable that can be used in a variety of dishes, from savory meals to sweet desserts. Its meaty texture makes it a great substitute for meat in many recipes, making it a popular choice among vegetarians and vegans. Some of the ways epli can be used in cooking include:

- Grilled or roasted as a side dish, bringing out its natural sweetness and adding a smoky flavor

- Used in stir-fries and curries, adding texture and flavor to the dish

- Made into eggplant parmesan, a popular Italian-American dish that is both delicious and satisfying

Epli and Health Concerns

While epli is generally considered safe to eat, there are some potential health concerns to be aware of. Some people may experience allergic reactions or digestive issues after consuming epli. Additionally, epli contains a compound called solanine, which can be toxic in large quantities. Some of the potential health concerns associated with epli include:

- Allergic reactions, which can range from mild symptoms like hives to severe reactions like anaphylaxis

- Digestive issues, such as bloating, gas, and stomach cramps, which can be caused by its high fiber content

- Solanine toxicity, which can cause symptoms like nausea, vomiting, and diarrhea if consumed in excess

Do I need EPLI coverage?

To determine whether you need Employment Practices Liability Insurance (EPLI) coverage, it’s crucial to understand what this insurance entails and the risks it mitigates. EPLI is designed to protect businesses from financial losses resulting from employment-related lawsuits, including allegations of discrimination, harassment, wrongful termination, and other employment-related issues. The necessity of EPLI coverage depends on various factors, including the size of your business, the industry you’re in, and your company’s history regarding employment practices.

Understanding the Risks Covered by EPLI

EPLI coverage is essential for businesses of all sizes because it protects against a wide range of employment-related claims. These claims can arise from current, former, or even prospective employees. Having EPLI can safeguard your business’s financial stability by covering the costs associated with defending against such claims, as well as any potential settlements or judgments. The key risks covered include:

- Wrongful Termination: Claims alleging that an employee was fired unfairly or based on discriminatory reasons.

- Discrimination: Allegations of discrimination based on age, gender, race, disability, or other protected characteristics.

- Sexual Harassment: Claims of creating a hostile work environment or failing to adequately address harassment allegations.

Factors Influencing the Need for EPLI Coverage

The decision to obtain EPLI coverage should be based on a thorough assessment of your business’s specific situation and risk factors. Businesses with a diverse workforce, those in industries known for higher litigation rates, or companies that have previously faced employment-related claims may particularly benefit from EPLI. It’s also worth considering the financial implications of defending against an employment lawsuit, even if the claim is unfounded. Key factors to consider include:

- Business Size and Structure: Larger businesses or those with more complex organizational structures may face a higher risk of employment-related claims.

- Industry and Workforce Demographics: Certain industries and workplaces with diverse or transient workforces might be more prone to employment disputes.

- Past Employment Practices and Litigation History: Businesses that have previously faced employment-related lawsuits or have questionable employment practices may be at a higher risk.

Benefits of Having EPLI Coverage

Having EPLI coverage can provide your business with significant benefits beyond just financial protection. It can also offer access to resources and expertise that can help mitigate risks and improve employment practices. By investing in EPLI, businesses can demonstrate a proactive approach to managing employment-related risks. The benefits include:

- Financial Protection: EPLI can cover the costs of legal defense, settlements, and judgments, protecting your business’s financial assets.

- Risk Management Resources: Many EPLI policies provide access to resources and guidance on best practices for employment policies and procedures.

- Reputation Protection: By having a structured process for handling employment disputes, businesses can better protect their reputation.

What is the average cost of EPLi?

The average cost of EPLi (Employment Practices Liability Insurance) varies widely depending on several factors such as the size of the organization, industry, number of employees, and the level of coverage required. Generally, the cost can range from a few hundred dollars to several thousand dollars per year.

Factors Affecting EPLi Cost

The cost of EPLi is influenced by various factors, including the type of industry, number of employees, and the organization’s claims history. High-risk industries such as healthcare and finance may have higher premiums due to the increased likelihood of employment-related claims.

- The number of employees, as larger organizations are more likely to face employment-related claims

- The type of industry, with high-risk industries facing higher premiums

- The organization’s claims history, with those having a history of claims facing higher premiums

EPLi Premium Calculation

EPLi premiums are typically calculated based on the organization’s number of employees, revenue, and industry. Insurers may also consider the organization’s HR practices and employment policies when determining premiums.

- The organization’s employee handbook and employment policies are reviewed to assess the level of risk

- The number of employees and annual revenue are used to determine the premium

- The industry and claims history are also taken into account when calculating the premium

Reducing EPLi Costs

Organizations can take steps to reduce their EPLi costs by implementing effective HR practices and maintaining a positive work environment. This can include providing regular training to employees and managers on employment laws and company policies.

- Implementing effective HR practices such as regular training and clear employment policies

- Maintaining a positive work environment through open communication and fair treatment of employees

- Regularly reviewing and updating employment policies to ensure compliance with changing employment laws

Does my business need professional liability insurance?

Professional liability insurance, also known as errors and omissions insurance, is a type of insurance that protects businesses and professionals from financial losses resulting from negligence, errors, or omissions in the services they provide. This insurance is particularly important for businesses that offer professional services or expert advice, as it can help to mitigate the financial risks associated with lawsuits and other claims.

What is Professional Liability Insurance?

Professional liability insurance is designed to protect businesses from financial losses resulting from claims of negligence, breach of contract, or other professional mistakes. This type of insurance can help to cover the costs of defending against a lawsuit, as well as any damages or settlements that may be awarded to the plaintiff. Some key benefits of professional liability insurance include:

- Protection against lawsuits and claims resulting from professional mistakes or negligence

- Coverage for defense costs, including attorney fees and court costs

- Financial protection against damages or settlements awarded to the plaintiff

Who Needs Professional Liability Insurance?

Businesses that offer professional services or expert advice are typically the ones that need professional liability insurance. This can include businesses such as medical professionals, lawyers, accountants, consultants, and financial advisors. These businesses are at risk of being sued for negligence, errors, or omissions in the services they provide, and professional liability insurance can help to mitigate this risk. Some key professions that require professional liability insurance include:

- Medical professionals, such as doctors and nurses, who are at risk of being sued for medical malpractice

- Financial advisors and accountants, who are at risk of being sued for negligence or errors in their advice or services

- Consultants and coaches, who are at risk of being sued for breach of contract or professional mistakes

How to Determine if Your Business Needs Professional Liability Insurance?

To determine if your business needs professional liability insurance, you should consider the type of services you offer and the level of risk associated with those services. If your business provides professional services or expert advice, it’s likely that you need professional liability insurance. You should also consider the potential financial impact of a lawsuit or claim on your business. Some key factors to consider include:

- The level of risk associated with the services you provide

- The potential financial impact of a lawsuit or claim on your business

- The cost of professional liability insurance and whether it’s a worthwhile investment for your business

Frequently Asked Questions

What is EPLI Insurance and How Does it Protect My Business?

EPLI, or Employment Practices Liability Insurance, is designed to protect businesses from financial losses resulting from employment-related claims, such as wrongful termination, discrimination, and sexual harassment. This type of insurance coverage is crucial for businesses of all sizes, as it can help mitigate the costs associated with defending against these claims, including legal fees, settlements, and judgments. By having EPLI insurance, businesses can ensure they are protected against the potentially devastating financial consequences of employment-related lawsuits.

What are the Pros of Having EPLI Insurance for My Business?

One of the primary advantages of EPLI insurance is that it provides businesses with financial protection against costly employment-related claims. Additionally, EPLI insurance can help businesses mitigate risk by providing access to experienced attorneys and HR experts who can help navigate complex employment issues. Furthermore, having EPLI insurance can also help businesses attract and retain top talent by demonstrating a commitment to maintaining a positive and respectful work environment. Overall, EPLI insurance can be a valuable risk management tool for businesses looking to minimize their exposure to employment-related liabilities.

Are There Any Cons or Drawbacks to Having EPLI Insurance?

While EPLI insurance can provide significant benefits to businesses, there are also some potential drawbacks to consider. One of the main disadvantages is that EPLI insurance can be costly, particularly for businesses with a history of employment-related claims. Additionally, EPLI insurance policies often come with specific exclusions and limitations, which can impact the level of coverage provided. Furthermore, businesses may need to meet certain requirements, such as implementing specific HR practices, in order to qualify for EPLI insurance or to maintain coverage.

How Do I Determine if EPLI Insurance is Right for My Business?

To determine if EPLI insurance is right for your business, it’s essential to assess your risk exposure and consider factors such as your business size, industry, and employment practices. You should also review your current insurance coverage to determine if you have any gaps in protection. Additionally, consulting with an experienced insurance professional can help you evaluate your options and determine if EPLI insurance is a valuable addition to your risk management strategy. By carefully considering these factors, you can make an informed decision about whether EPLI insurance is worth it for your business.