The terms Income Statement and Profit and Loss Statement are often used interchangeably in the business world, but subtle differences exist between them. Understanding these differences is crucial for businesses, investors, and financial analysts to make informed decisions. Both statements provide insights into a company’s financial performance over a specific period, but their presentation, content, and purpose can vary. This article aims to uncover the key differences between these two financial statements, exploring their unique characteristics, similarities, and the implications of their differences on financial analysis and decision-making processes.

Understanding the Distinction: Income Statement and Profit and Loss Statement

The terms Income Statement and Profit and Loss Statement are often used interchangeably, but they represent the same financial document that summarizes a company’s revenues and expenses over a specific period. The primary purpose of both statements is to provide insights into a company’s financial performance, helping stakeholders understand its profitability and make informed decisions.

Definition and Purpose

An Income Statement, also known as a Profit and Loss Statement, is a financial statement that outlines the revenues and expenses of a business over a specific accounting period. Its primary purpose is to calculate the net income or net loss of the company, providing a snapshot of its financial health.

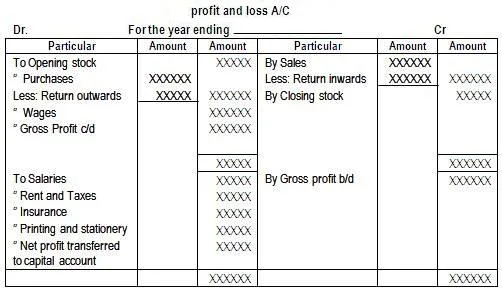

Components of an Income Statement

The key components of an Income Statement include revenues, cost of goods sold, operating expenses, non-operating income, and non-operating expenses. These components are crucial in determining a company’s gross profit, operating income, and ultimately, its net income.

| Component | Description |

|---|---|

| Revenues | Total income earned from sales and other business activities |

| Cost of Goods Sold | Direct costs associated with producing and selling the company’s products or services |

| Operating Expenses | Expenses incurred during the normal course of business, such as salaries and rent |

| Non-Operating Income | Income earned from non-core business activities, such as investments |

| Non-Operating Expenses | Expenses not related to the company’s core business operations |

Income Statement vs Profit and Loss Statement: Are They Different?

In essence, there is no difference between an Income Statement and a Profit and Loss Statement. Both terms refer to the same financial statement that outlines a company’s revenues and expenses. The difference lies in the terminology used, with Income Statement being more commonly used in the United States, while Profit and Loss Statement is used in other parts of the world.

Importance of Income Statement Analysis

Analyzing an Income Statement is crucial for stakeholders to understand a company’s financial performance and make informed decisions. By examining the statement, investors can assess a company’s profitability, efficiency, and growth potential. It also helps identify areas of improvement and provides insights into a company’s competitive position.

Preparation and Presentation of Income Statement

The preparation and presentation of an Income Statement involve several steps, including the selection of the reporting period, classification of revenues and expenses, and calculation of net income. The statement should be presented in a clear and concise manner, with adequate disclosures to facilitate understanding.

| Best Practices | Description |

|---|---|

| Clear Classification | Classify revenues and expenses into relevant categories |

| Adequate Disclosures | Provide sufficient information to facilitate understanding |

| Consistency | Maintain consistency in presentation and classification |

How is an income statement different from a profit and loss statement?

An income statement and a profit and loss statement are often used interchangeably, but there is a subtle difference between the two. The primary distinction lies in the terminology and the regional usage. The income statement is a more general term that is widely used in the United States, while the profit and loss statement is more commonly used in other parts of the world, such as the United Kingdom and Australia.

Key Differences in Terminology

The difference in terminology is largely a matter of regional preference. The income statement and the profit and loss statement both provide a summary of a company’s revenues and expenses over a specific period. However, the income statement tends to focus more on the net income, while the profit and loss statement emphasizes the profit or loss.

- The income statement typically includes non-operating income and non-operating expenses, such as interest income and interest expense.

- The profit and loss statement, on the other hand, tends to focus on the operating profit or loss, which is the profit earned from the company’s core operations.

- Both statements provide a snapshot of a company’s financial performance over a specific period.

Regional Usage and Presentation

The presentation and content of the income statement and the profit and loss statement can vary depending on the region and the regulatory requirements. In general, the income statement is more commonly used in the United States, where it is required by the Securities and Exchange Commission (SEC).

- In the United States, the income statement is typically presented in a multi-step format, which includes gross profit, operating income, and net income.

- In other parts of the world, such as the United Kingdom and Australia, the profit and loss statement is more commonly used, and it is often presented in a single-step format.

- The International Financial Reporting Standards (IFRS) also require the presentation of a profit and loss statement, which is similar to the income statement.

Implications for Financial Analysis

The difference between an income statement and a profit and loss statement has implications for financial analysis. Analysts need to understand the accounting standards and regulatory requirements that govern the preparation of these statements.

- Financial analysts need to carefully review the accounting policies and disclosures to understand the company’s financial performance.

- The income statement and the profit and loss statement provide valuable insights into a company’s revenue streams, cost structure, and profitability.

- By analyzing these statements, analysts can identify trends and risks that may impact the company’s future financial performance.

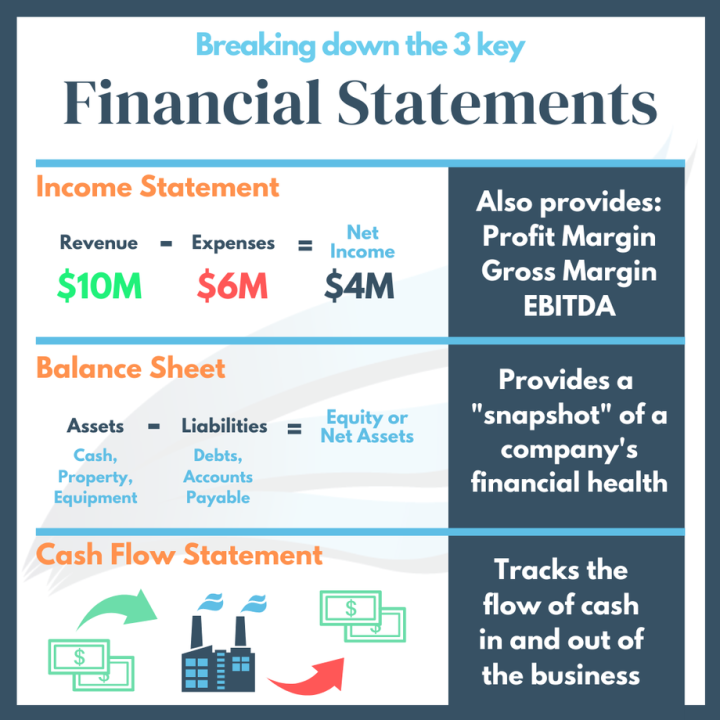

What are the key differences between the three main types of financial statements?

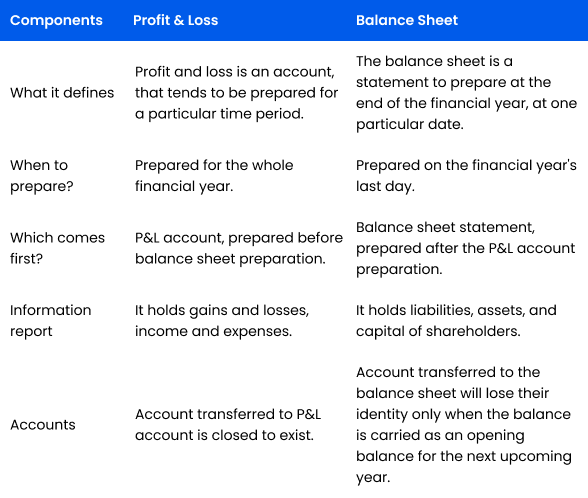

The three main types of financial statements are the Balance Sheet, Income Statement, and Cash Flow Statement. The key differences between them lie in their purpose, content, and the insights they provide to stakeholders.

Balance Sheet: Snapshot of Financial Position

The Balance Sheet provides a snapshot of a company’s financial position at a specific point in time, typically at the end of an accounting period. It presents the company’s assets, liabilities, and equity in a structured format, allowing users to assess its financial health and solvency. The key components of a Balance Sheet include:

- Assets: Resources owned or controlled by the company, such as cash, inventory, and property, plant, and equipment.

- Liabilities: Amounts owed by the company to its creditors, such as accounts payable and long-term debt.

- Equity: The residual interest in the company’s assets after deducting its liabilities, representing the ownership stake in the business.

Income Statement: Measure of Financial Performance

The Income Statement, also known as the Profit and Loss Statement, measures a company’s financial performance over a specific period, typically a quarter or a year. It presents the company’s revenues, expenses, and net income, providing insights into its ability to generate earnings and sustain its operations. The key components of an Income Statement include:

- Revenues: Income earned by the company from its normal business operations, such as sales and service fees.

- Expenses: Costs incurred by the company to generate its revenues, such as cost of goods sold and operating expenses.

- Net Income: The company’s profit or loss after deducting its total expenses from its total revenues.

Cash Flow Statement: Analysis of Cash Flows

The Cash Flow Statement provides an analysis of a company’s inflows and outflows of cash and cash equivalents over a specific period. It categorizes cash flows into operating, investing, and financing activities, enabling users to assess the company’s ability to generate cash and meet its financial obligations. The key components of a Cash Flow Statement include:

- Operating Activities: Cash flows related to the company’s core business operations, such as cash received from customers and cash paid to suppliers.

- Investing Activities: Cash flows related to the company’s investments in assets, such as purchases and sales of property, plant, and equipment.

- Financing Activities: Cash flows related to the company’s financing activities, such as borrowings and repayments of debt, and dividend payments.

How does the term income and expenditure statement differ from the profit and loss account?

The term ‘income and expenditure statement’ and ‘profit and loss account’ are often used interchangeably, but they have distinct differences in their application and the type of entities they serve. Essentially, both documents are financial statements that summarize the revenues and expenses of an entity over a specific period. However, the key difference lies in the nature of the entities that use these statements and the purposes they serve.

Entity Type and Purpose

The primary distinction between an income and expenditure statement and a profit and loss account is the type of entity that prepares them. Non-profit organizations typically prepare an income and expenditure statement, as their primary objective is not to make a profit but to utilize their resources for a specific cause or mission. On the other hand, profit-making entities, such as businesses and companies, prepare a profit and loss account to determine their profitability. The main purpose of an income and expenditure statement is to show how funds have been utilized, while a profit and loss account aims to calculate the net profit or loss.

- The income and expenditure statement is designed to show the surplus or deficit of an entity, highlighting whether it has managed its resources effectively.

- In contrast, a profit and loss account is crucial for businesses to assess their financial performance and make informed decisions.

- The preparation and presentation of these statements also differ in terms of the accounting standards and regulatory requirements they must adhere to.

Accounting Treatment and Presentation

The accounting treatment and presentation of an income and expenditure statement and a profit and loss account also exhibit differences. For instance, the income and expenditure statement focuses on the receipts and payments of an entity, categorizing them into different heads to show how the funds have been utilized. In contrast, a profit and loss account follows the accrual principle of accounting, where revenues and expenses are matched to determine the profit or loss.

- The income and expenditure statement is usually presented in a way that highlights the funds available and how they have been utilized during the period.

- A profit and loss account, on the other hand, is presented in a format that facilitates the calculation of gross profit, operating profit, and net profit.

- The disclosure requirements for these statements also vary, with profit and loss accounts typically requiring more detailed disclosures about revenues and expenses.

Regulatory and Compliance Aspects

The regulatory and compliance aspects surrounding the preparation of an income and expenditure statement and a profit and loss account differ significantly. Non-profit organizations are subject to specific regulations and guidelines that dictate how their financial statements should be prepared and presented. Similarly, profit-making entities are governed by various laws, regulations, and accounting standards that require them to prepare their financial statements, including the profit and loss account, in a specific manner.

- The preparation of an income and expenditure statement must comply with the regulations governing non-profit organizations in the relevant jurisdiction.

- Profit and loss accounts are subject to accounting standards and regulatory requirements, such as those related to revenue recognition and expense matching.

- The audit requirements for these statements also differ, with profit and loss accounts typically being subject to more stringent audit requirements due to the stakeholder interests involved.

Frequently Asked Questions

What is the main difference between an Income Statement and a Profit and Loss Statement?

The primary distinction between an Income Statement and a Profit and Loss Statement lies in their terminology and regional usage, as they essentially convey the same financial information. Both statements are designed to provide a summary of a company’s revenues and expenses over a specific period, ultimately revealing the net profit or loss. The difference is largely a matter of nomenclature, with the terms often being used interchangeably in different parts of the world. Understanding this equivalence is crucial for financial analysis and decision-making.

How do Income Statements and Profit and Loss Statements reflect a company’s financial performance?

Both the Income Statement and the Profit and Loss Statement serve as critical tools for assessing a company’s financial health and operational efficiency. By detailing income, costs, and expenses, these statements offer insights into a company’s ability to generate profits. They help investors, analysts, and management evaluate revenue streams, cost structures, and the overall profitability of the business. This information is vital for making informed strategic decisions and investments.

Are there any specific items that are uniquely reported on an Income Statement versus a Profit and Loss Statement?

While the terms Income Statement and Profit and Loss Statement are used interchangeably, the content and disclosure requirements can vary slightly based on the accounting standards being followed, such as GAAP or IFRS. Generally, both statements will include revenue, cost of goods sold, operating expenses, and non-operating items. However, the classification and presentation of certain items, like extraordinary items or discontinued operations, might differ. It’s essential to review the accounting policies and disclosures to understand any nuances.

Can the terms Income Statement and Profit and Loss Statement be used synonymously in all contexts?

In most financial and accounting contexts, the terms Income Statement and Profit and Loss Statement can be used interchangeably. However, it’s crucial to be aware of the regional preferences and specific requirements of financial reporting frameworks. For instance, Income Statement is more commonly used in US GAAP, while Profit and Loss Statement might be seen in other jurisdictions or under IFRS. Being mindful of these differences ensures clarity and accuracy in financial communication.