Reporting an owner’s draw on your taxes doesn’t have to be complicated, but understanding the process is crucial for small business owners and sole proprietors. Unlike a salary, an owner’s draw isn’t subject to payroll taxes, but it must still be recorded properly to avoid IRS scrutiny. This guide walks you through the steps to report your draws accurately, ensuring compliance while minimizing stress. Whether you’re a first-time business owner or looking to refine your tax strategy, learning the right approach can save you time and prevent costly mistakes. Let’s simplify the process so you can focus on growing your business with confidence.

How to Report Owner’s Draw on Taxes Without Hassle

1. Understanding Owner’s Draw vs. Salary

An owner’s draw is when a business owner takes money from their business profits for personal use. Unlike a salary, which is taxed as earned income, owner’s draws are not considered taxable income because they come from after-tax profits. However, they must still be reported correctly on tax forms.

| Owner’s Draw | Salary |

|---|---|

| Taxed as business profits first | Taxed as personal income |

| Reported via Schedule C (sole proprietors) | Reported via W-2 form |

2. How to Track Owner’s Draws for Tax Reporting

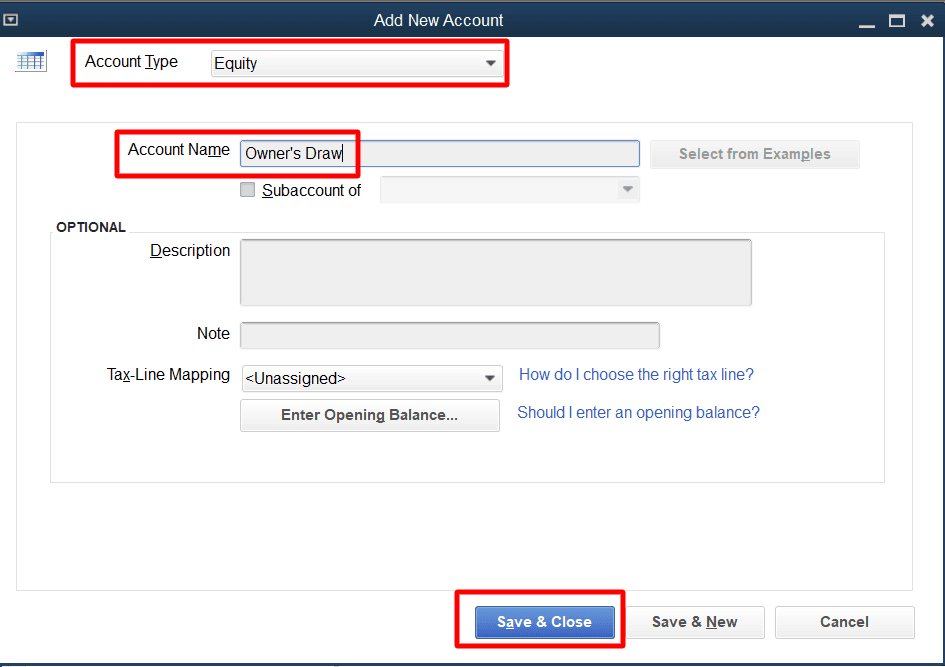

Properly documenting your owner’s draws ensures accuracy during tax season. Use business accounting software like QuickBooks or a spreadsheet to track withdrawals. Always label them as owner’s draws in your books.

| Step | Action |

|---|---|

| 1 | Log each draw in a separate account |

| 2 | Note the date and amount |

| 3 | Update your balance sheet regularly |

3. Reporting Owner’s Draws on Taxes for Sole Proprietors

Sole proprietors report business profits, including owner’s draws, on Schedule C (Form 1040). The IRS does not tax draws separately, but business profits are taxed as self-employment income.

| Form | Purpose |

|---|---|

| Schedule C | Reports business income & expenses |

| Form 1040 | Taxable income filed with IRS |

4. Reporting Owner’s Draws for LLCs and Partnerships

For LLCs and partnerships, owner’s draws are reported differently. Profits pass through to owners’ personal tax returns via Schedule K-1. Owners must report their share of profits, even if they didn’t withdraw all funds.

| Entity Type | Reporting Method |

|---|---|

| Single-Member LLC | Schedule C (like sole proprietors) |

| Multi-Member LLC/Partnership | Schedule K-1 (Form 1065) |

5. Avoiding Common Mistakes When Reporting Owner’s Draws

Mixing personal and business expenses can lead to IRS audits. Always keep separate accounts and never label owner’s draws as business expenses. Misreporting can trigger penalties.

| Mistake | Solution |

|---|---|

| Not tracking draws | Use accounting software for accuracy |

| Labeling draws as expenses | Classify them as equity reductions |

How to show owners draw on taxes?

How to Report Owner’s Draw on Business Taxes

An owner’s draw is not treated as taxable income but still must be reported correctly to avoid IRS issues. Here’s how to document it:

- Separate personal and business accounts to clearly track withdrawals.

- Report draws on your Schedule C (Form 1040) or Part II of Schedule SE if applicable.

- Ensure the draw aligns with your business’s profit and loss statement to avoid misclassification.

Tax Implications of Owner’s Draws

Unlike salaries, owner’s draws aren’t subject to payroll taxes, but they impact your tax liability.

- Draws reduce the owner’s equity in the business but do not incur income tax withholding.

- If classified improperly, the IRS may reclassify draws as taxable wages, incurring penalties.

- Keep records to prove draws are from retained earnings, not disguised salary payments.

Documenting Owner’s Draws for Tax Purposes

Proper documentation ensures compliance with IRS rules and simplifies tax filing.

- Use business ledgers or accounting software to log each draw with date and amount.

- Attach a profit distribution memo for significant withdrawals to justify them as draws.

- Consult a tax professional if draws exceed business profits to avoid triggering tax issues.

How do you document an owner’s draw?

What Is an Owner’s Draw?

An owner’s draw is a withdrawal of funds from a business by its owner for personal use. It is common in sole proprietorships, partnerships, and LLCs where the business and owner are not separate legal entities. Proper documentation ensures accurate financial records and tax compliance.

- Definition: An owner’s draw represents personal use of business profits, not a salary or wages.

- Applicability: Typically used in pass-through entities where profits flow to the owner’s personal tax return.

- Impact: Reduces the owner’s equity in the business but does not count as a business expense.

How to Record an Owner’s Draw in Accounting

Recording an owner’s draw correctly is crucial for maintaining accurate financial statements and tax records. The process involves adjusting the owner’s equity account and ensuring all transactions are traceable.

- Debit the Owner’s Draw Account: Record the withdrawal as a debit to the owner’s draw account, reducing equity.

- Credit the Cash Account: Offset the entry by crediting the cash or bank account from which funds were taken.

- Year-End Adjustment: Close the draw account by transferring the balance to the owner’s equity account at fiscal year-end.

Tax Implications of an Owner’s Draw

Unlike salaries, owner’s draws are not subject to payroll taxes but still affect the owner’s taxable income. Proper documentation is essential to avoid discrepancies during tax filing.

- No Payroll Taxes: Draws are not wages, so no Social Security, Medicare, or withholding taxes apply.

- Income Reporting: Draws must be reported as personal income on the owner’s individual tax return (e.g., Schedule C for sole proprietors).

- Estimated Tax Payments: Owners must plan for quarterly estimated tax payments to avoid penalties.

How do I report taxes if I get paid cash?

How to Track Cash Income for Tax Reporting

Reporting cash income accurately requires diligent record-keeping. Since cash payments lack digital traces, maintaining detailed records is essential.

- Keep receipts or invoices for all cash transactions to verify income.

- Use a logbook or spreadsheet to track dates, amounts, and payer details.

- Deposit cash into a bank account periodically to create a paper trail.

Filing Taxes When Paid in Cash

Cash earnings must be reported as self-employment income or under miscellaneous income if untaxed. The IRS requires disclosure regardless of payment method.

- Report cash income on Form 1040, Schedule C (for self-employed) or Line 8z (other income).

- Estimate and pay quarterly taxes if earning significant cash to avoid penalties.

- Consider deducting business expenses related to cash work (e.g., tools, travel).

IRS Documentation and Audits for Cash Payments

The IRS may scrutinize cash income, so proper documentation is critical to avoid penalties or audits.

- Retain records for at least 3 years (longer if underreporting is suspected).

- Use Form 1099-MISC if a client pays you $600+ annually (even in cash).

- Consult a tax professional if unsure about reporting cash transactions.

Do owner distributions count as income?

Are Owner Distributions Taxable Income?

Owner distributions, also known as draws, are typically not considered taxable income for the business owner because they are usually taken from after-tax profits. However, the tax treatment depends on the business structure:

- Sole proprietorships/LLCs: Distributions are not taxed separately since profits are reported on the owner’s personal tax return.

- S Corporations: Distributions to shareholders are tax-free if they do not exceed the shareholder’s stock basis.

- C Corporations: Dividends (a form of distribution) are taxable as personal income to shareholders.

How Do Owner Distributions Affect Business Taxes?

Owner distributions do not directly impact business taxes because they are not deductible as business expenses. Instead, their tax implications are tied to the owner’s individual tax situation. Key considerations include:

- Basis tracking: Owners must track their investment basis to avoid taxable gains on excess distributions.

- Payroll vs. distributions: S Corp owners must pay themselves a reasonable salary before taking tax-advantaged distributions.

- Retained earnings: Distributions reduce retained earnings but do not alter taxable profits reported by the business.

What’s the Difference Between Owner Draws and Salaries?

Owner draws and salaries have distinct tax treatments and legal implications, depending on the business entity type.

- Tax withholding: Salaries require payroll taxes (e.g., Social Security, Medicare), while draws do not.

- IRS scrutiny: S Corps face penalties if owners replace salaries with distributions to avoid payroll taxes.

- Flexibility: Draws offer irregular payment options, whereas salaries must follow a consistent payroll schedule.

Can you write off an owner’s draw?

Can You Deduct an Owner’s Draw on Taxes?

An owner’s draw is not a deductible business expense because it represents the distribution of profits to the owner rather than an operational cost. The IRS treats owner draws as personal income, which is not eligible for tax deductions. However, owners can still claim deductions for legitimate business expenses, such as salaries, supplies, or rent, which are separate from personal draws.

- Owner’s draws are taxable as personal income, but they do not reduce business income.

- Business expenses like wages or equipment can be deducted, unlike draws.

- Only structured salaries (for S-Corp owners) may be deductible as payroll expenses.

How Does an Owner’s Draw Affect Business Taxes?

An owner’s draw does not directly impact the taxable income of a business since it is not considered an expense. Instead, the draw is reported on the owner’s personal tax return as income. For sole proprietorships and partnerships, draws are tracked in the owner’s equity account, while S-Corporations may require payroll taxes on reasonable salaries before draws.

- Sole proprietors report draws as part of their net income on Schedule C.

- Partnerships allocate profits, and draws are reflected in the partner’s capital account.

- S-Corps must pay owners a salary subject to payroll taxes before allowing draws.

What Are Alternatives to Owner’s Draws for Tax Benefits?

Instead of relying on non-deductible owner’s draws, consider structuring payments as deductible business expenses. For example, paying yourself a salary (if incorporated) allows for payroll tax deductions, while reimbursements for business expenses can also reduce taxable income. Proper classification is critical to maximizing deductions.

- Payroll salaries (for S-Corps or LLCs taxed as corporations) are deductible.

- Reimbursed expenses, such as mileage or office costs, lower taxable income.

- Retirement contributions (e.g., SEP IRA) can reduce personal and business tax liability.

Frequently Asked Questions

What is an owner’s draw and how does it affect my taxes?

An owner’s draw refers to money taken out of a business by its owner for personal use, commonly seen in sole proprietorships, partnerships, and LLCs. Unlike a salary, it’s not taxed as payroll income but still impacts your taxes because it reduces your business’s equity. You must report owner’s draws on your personal tax return, typically through Schedule C (for sole proprietors) or by adjusting your capital account if you’re in a partnership or LLC. The key is to track these withdrawals meticulously to avoid discrepancies with the IRS.

How do I report an owner’s draw on my tax return?

Reporting an owner’s draw depends on your business structure. For sole proprietors, the draw itself isn’t a separate tax line item but lowers your net profit, reported on Schedule C. For LLCs or partnerships, draws reduce your capital account and must be documented on Form 1065 (for partnerships) or the owner’s personal return. Accurate bookkeeping is critical—log each draw as a reduction in owner’s equity, not as a business expense, to avoid misclassification.

Can I deduct owner’s draws as a business expense?

No, owner’s draws are not deductible as business expenses. They represent personal withdrawals, not operational costs like supplies or salaries. Misclassifying draws as expenses can trigger IRS scrutiny and penalties. Instead, focus on reporting them correctly as reductions to equity in your financial records. Ensure your accounting software (or ledger) separates draws from deductible expenses to maintain compliance and simplify tax filing.

What records should I keep to substantiate owner’s draws for tax purposes?

To avoid tax issues, maintain detailed records of every owner’s draw, including dates, amounts, and purpose (if relevant). Use a separate bank account for business transactions to distinguish draws from business expenses. Retain bank statements, receipts, and a ledger tracking withdrawals throughout the year. The IRS may request proof, so consistency is key—whether you use accounting software like QuickBooks or a spreadsheet, ensure the data aligns with your tax filings.