Paying employees in cash can be a practical option for some businesses, but it must be done carefully to comply with legal requirements. While cash payments are not inherently illegal, failing to follow tax, labor, and reporting regulations can lead to significant penalties. Employers must ensure proper documentation, withhold and remit taxes correctly, and adhere to minimum wage and overtime laws. Transparency is key—both the employer and employee should maintain clear records of payments. This guide explores the legal steps to compensate employees in cash while staying compliant with federal and state laws, helping businesses avoid costly mistakes and maintain ethical payroll practices.

Best Practices for Legally Paying Employees in Cash

1. Understanding the Legal Requirements for Cash Payments

Paying employees in cash is allowed in some cases but must strictly follow labor laws and tax regulations. Employers must ensure proper documentation, including signed receipts or pay stubs, to validate payments. Failure to comply can lead to penalties or legal consequences.

| Requirement | Why It Matters |

|---|---|

| Employee Agreement | Must confirm acceptance of cash payments |

| Payroll Records | Necessary for tax and labor compliance |

2. Maintaining Accurate Payroll Records

Every cash payment must be recorded in a payroll ledger, including details such as date, amount, and employee signature. This ensures transparency and compliance with IRS or local tax authorities.

| Record Type | Purpose |

|---|---|

| Time Sheets | Tracks hours worked for wage calculation |

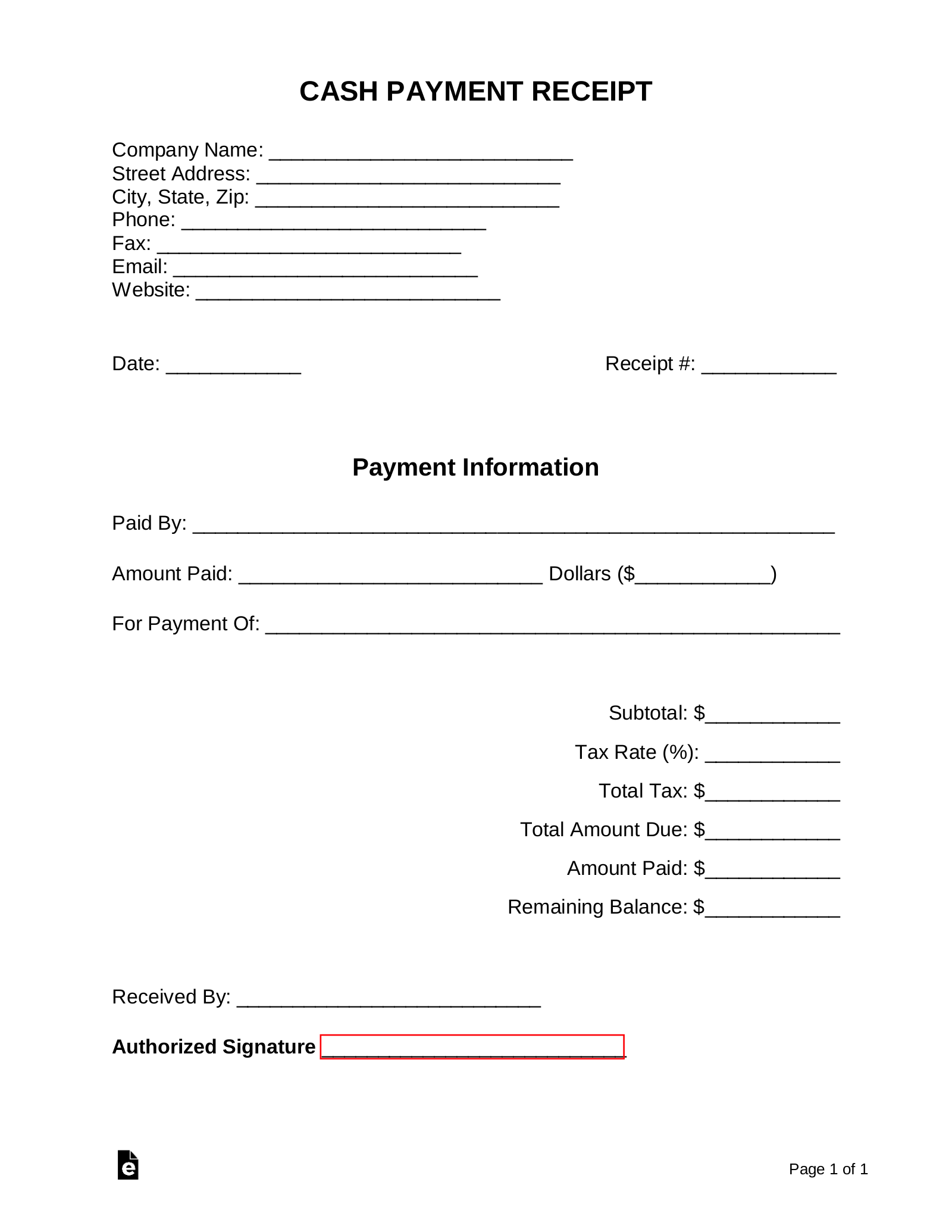

| Payment Receipts | Serves as proof of legal cash disbursement |

3. Properly Reporting Cash Wages for Taxes

Employers must report cash wages to the IRS via Form W-2 (or 1099 for contractors). Deductions for Social Security, Medicare, and income tax still apply. Misclassification can lead to audits or fines.

| Tax Form | Usage |

|---|---|

| W-2 | For regular employees |

| 1099-NEC | For independent contractors |

4. Ensuring Compliance with Minimum Wage Laws

Even when paying in cash, employers must meet or exceed federal or state minimum wage standards. Employees must receive overtime pay (if eligible) at 1.5x their regular rate for hours exceeding 40 per week.

| Requirement | Description |

|---|---|

| Base Wage | Cannot fall below minimum wage laws |

| Overtime Rules | Applies to non-exempt employees |

5. Avoiding Common Pitfalls of Cash Payments

Unreported cash wages can trigger IRS scrutiny, while poor documentation risks labor disputes. Employers should use written agreements, retain payment evidence, and consider digital payroll solutions to minimize errors.

| Risk | Prevention Method |

|---|---|

| Audits | Accurate bookkeeping and tax filings |

| Employee Claims | Secure signed payment confirmations |

How to pay employees cash legally?

Understanding Legal Cash Payments to Employees

Paying employees in cash is legal if done correctly, but it requires strict adherence to labor laws and tax regulations. Employers must ensure they document all cash payments accurately to avoid penalties. Below are key steps to follow:

- Comply with minimum wage laws: Cash payments must meet or exceed the federal, state, or local minimum wage.

- Withhold payroll taxes: Employers must deduct income tax, Social Security, and Medicare from cash wages, just like with checks or direct deposits.

- Keep detailed records: Maintain a written log of cash payments, including dates, amounts, and signed receipts from employees.

Documenting Cash Payments for Payroll

Proper documentation is critical when paying employees in cash. Employers must maintain records to prove compliance with labor and tax laws. Below are essential practices:

- Issue pay stubs: Provide employees with written statements showing gross pay, deductions, and net cash amounts.

- Require employee signatures: Obtain signed receipts or timecards to confirm cash payments were received.

- Report wages to tax authorities: Submit accurate payroll reports (e.g., IRS Form 941) to reflect cash wages paid.

Avoiding Risks When Paying Employees Cash

While paying cash is legal, improper handling can lead to audits, fines, or legal disputes. Employers must mitigate risks by following these steps:

- Never pay under the table: Avoid untraceable cash payments, as this violates labor and tax laws.

- Use a payroll service or accountant: Professionals can ensure compliance with tax withholding and reporting requirements.

- Regularly audit payroll records: Verify that cash payments match documented wages and tax filings.

Can an employer get in trouble for paying cash without?

Yes, an employer can get in serious legal trouble for paying employees in cash without proper documentation. This practice, often referred to as under-the-table payments, violates multiple labor and tax laws. Employers are required to maintain accurate payroll records, report wages to tax authorities, and withhold income taxes, Social Security, and Medicare contributions. Failure to do so can result in penalties, fines, or even criminal charges.

Legal Consequences for Employers Paying Cash Under the Table

Employers who pay cash without documentation face severe legal consequences. The Internal Revenue Service (IRS) and state labor agencies actively pursue cases involving unreported wages.

- Tax evasion charges: The IRS may impose hefty fines or pursue criminal prosecution for unpaid payroll taxes.

- Penalties from labor departments: Employers may be fined for failing to comply with wage and hour laws, including minimum wage and overtime rules.

- Loss of business licenses: Some states may revoke or suspend a business’s operating license due to labor law violations.

Employee Risks When Paid in Cash Without Records

Employees paid in cash without proper documentation also face several risks and potential disadvantages.

- No proof of income: Workers may struggle to secure loans, mortgages, or government benefits due to a lack of official pay records.

- Loss of Social Security benefits: Undocumented wages mean no contributions to Social Security, reducing future retirement benefits.

- No worker protections: Without records, employees may find it harder to claim unpaid wages or file for workers’ compensation if injured.

How Employers Can Legally Pay Employees in Cash

Employers can still pay employees in cash if they follow legal requirements to remain compliant.

- Issue detailed pay stubs: Provide employees with records showing gross pay, deductions, and net pay.

- Report wages to tax authorities: Withhold and submit payroll taxes, including Social Security and Medicare.

- Maintain accurate records: Keep timesheets, payment logs, and tax filings for audits or disputes.

How to show proof of income if paid in cash?

How to Keep Accurate Records When Paid in Cash

If you are paid in cash, maintaining accurate records is crucial to proving your income. Start by documenting every payment you receive, including dates and amounts. Use a dedicated ledger, spreadsheet, or financial app to track transactions.

- Save receipts or invoices from employers or clients as proof of payments.

- Deposit cash into a bank account regularly, as bank statements can serve as income verification.

- Use a self-employment tracking app like QuickBooks or Wave to log earnings automatically.

Using Affidavits or Signed Letters for Proof of Income

When official documents are unavailable, a signed affidavit or letter from an employer can validate your cash income. This should include details such as payment frequency, amounts, and the employer’s contact information.

- Request a signed letter from your employer stating your earnings and payment method.

- Notarize the document to add legal credibility if required.

- Keep copies of all correspondence for future reference.

Bank Statements and Deposits as Income Proof

Regular cash deposits into a bank account create a paper trail that lenders or authorities can accept as income verification. Ensure deposits align with your reported earnings and occur consistently.

- Deposit cash immediately after receiving payments to maintain a clear record.

- Label deposits with a memo indicating the source (e.g., Payment from XYZ Employer).

- Provide bank statements highlighting regular deposits if requested for verification.

What is a legal proof of cash payment?

What Constitutes a Legal Proof of Cash Payment?

A legal proof of cash payment is any documented evidence that confirms a transaction was made in cash and is recognized by authorities or courts. This proof ensures transparency and protects both parties in disputes. Common examples include:

- Receipts: Signed documents detailing the amount, date, and purpose of payment.

- Witnessed agreements: Contracts or invoices acknowledging cash transactions, signed by both payer and payee.

- Bank withdrawal slips: Records showing cash was withdrawn for the payment purpose.

Why Is Legal Proof of Cash Payment Important?

Having legal proof safeguards against disputes, tax audits, or fraudulent claims. It establishes accountability and complies with financial regulations. Key reasons include:

- Tax compliance: Proof verifies income/expenses for accurate reporting.

- Dispute resolution: Provides evidence in case of contractual disagreements.

- Legal protection: Shields against false claims of non-payment.

How to Create Valid Proof for Cash Payments?

To ensure valid documentation, follow these steps:

- Issue a receipt: Include names, amounts, dates, and signatures from both parties.

- Use notarized documents: For large sums, a notary public can certify the transaction.

- Maintain records: Store copies securely for future reference or audits.

Frequently Asked Questions

Is it legal to pay employees in cash?

Yes, paying employees in cash is legal as long as you comply with all federal, state, and local labor laws. Employers must withhold payroll taxes, report wages, and provide employees with payslips that detail deductions. Failing to do so could result in penalties, fines, or legal action for tax evasion or labor violations.

What tax obligations exist when paying employees in cash?

Employers must still withhold income tax, Social Security, and Medicare taxes from cash payments and submit them to the IRS. Additionally, you must report wages on Form W-2 for employees or Form 1099 for contractors. Failure to report cash wages can lead to audits, back taxes, and severe penalties from tax authorities.

How can I properly document cash payments to employees?

To stay compliant, maintain detailed records of all cash payments, including dates, amounts, and tax withholdings. Provide employees with pay stubs for each payment and require signed receipts or acknowledgments. Using payroll software or working with a payroll service can help ensure accurate documentation and tax compliance.

Are there special rules for small businesses paying cash wages?

Small businesses must follow the same legal requirements as larger companies when paying employees in cash. However, some states may require additional reporting for cash transactions. Always check state labor laws and consult a tax professional to ensure compliance with all regulations, regardless of business size.