Creating accurate check stubs is essential for both employers and employees to document wages, deductions, and taxes. Whether you run a business or need proof of income, knowing how to make check stubs ensures transparency and compliance. This step-by-step guide will walk you through the process, from gathering necessary details to choosing the right format—manual or digital. You’ll learn what information to include, how to calculate deductions correctly, and tools that simplify the task. By the end, you’ll be able to generate professional check stubs effortlessly, helping streamline payroll management and maintain clear financial records. Let’s get started!

How to Make Check Stubs: A Detailed Step-by-Step Guide

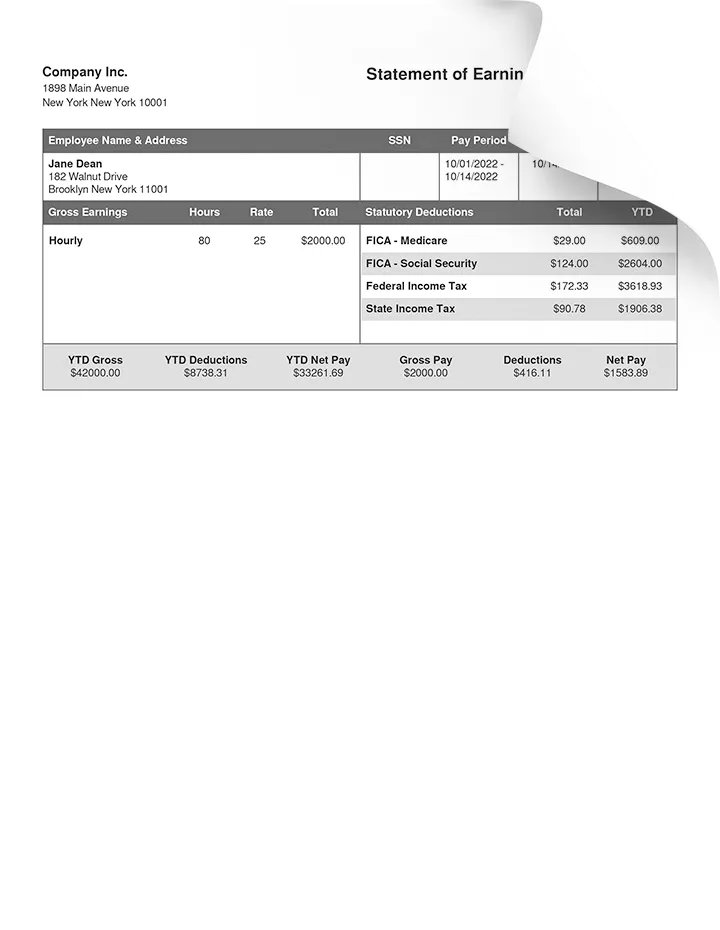

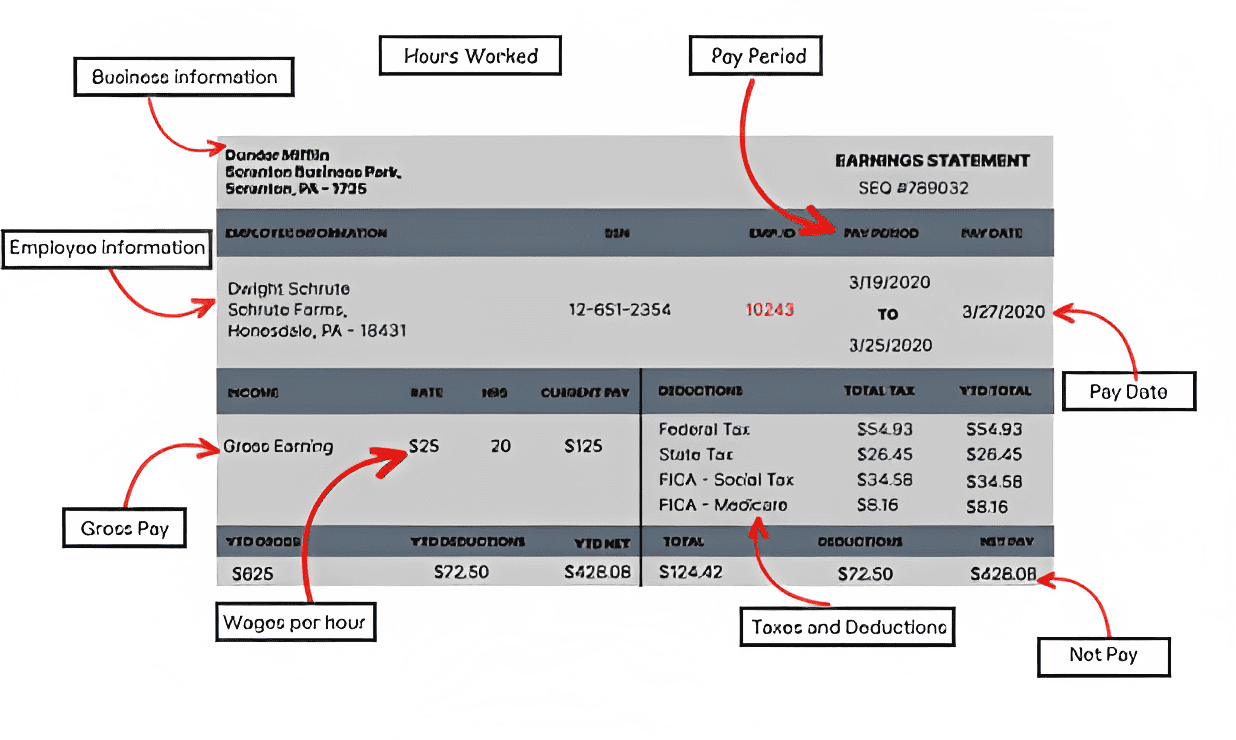

Detailed Explanation: Creating check stubs is essential for both employers and employees to maintain accurate payroll records. A check stub, also known as a pay stub, details an employee’s earnings, deductions, and taxes for a specific pay period. Below is a comprehensive breakdown of the process, along with key subtopics.

1. Gather Necessary Information for Your Check Stubs

Before creating a check stub, you must collect all relevant payroll information. This includes the employee’s name, pay rate, hours worked, tax withholdings, and any deductions (e.g., health insurance, retirement contributions). Example Table of Required Information:

| Information Needed | Example |

|---|---|

| Employee Name | John Smith |

| Pay Rate | $20/hour |

| Hours Worked | 40 |

| Federal Income Tax | $120 |

| State Tax | $45 |

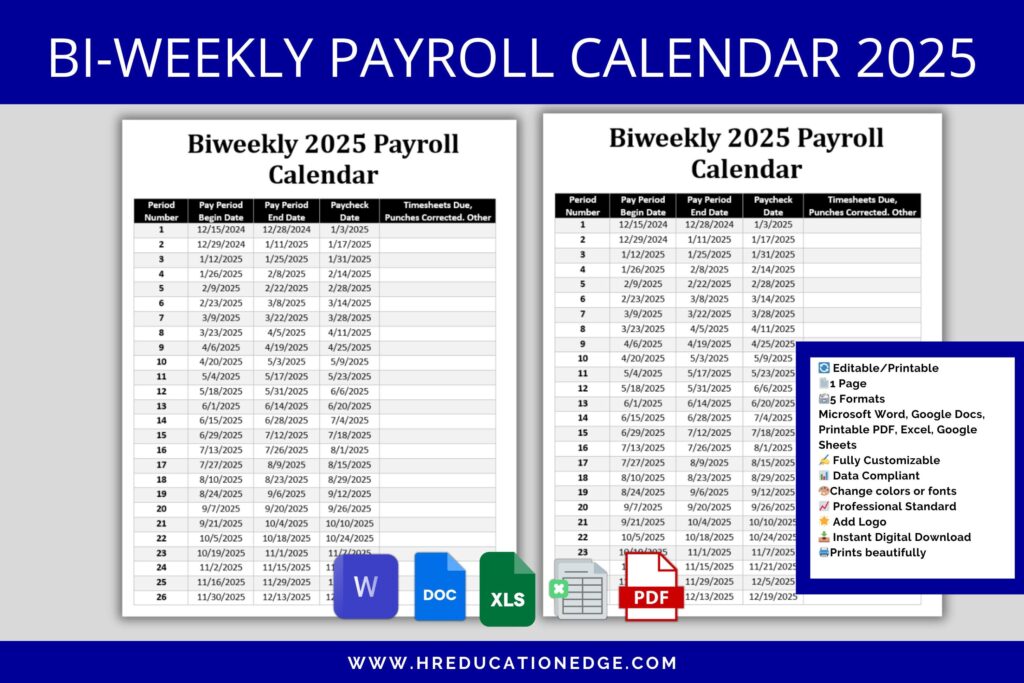

2. Choose a Check Stub Creation Method

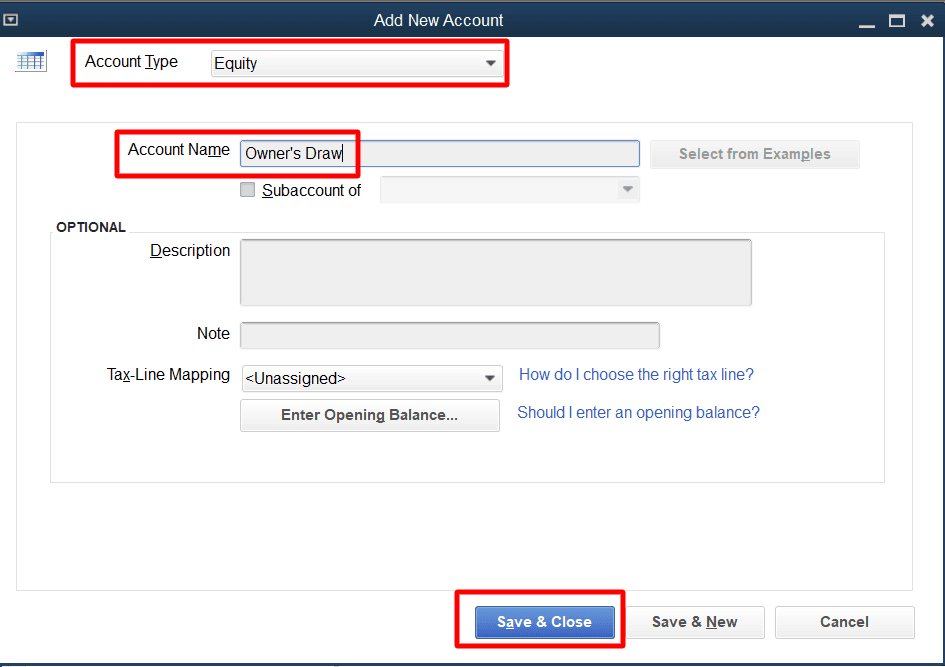

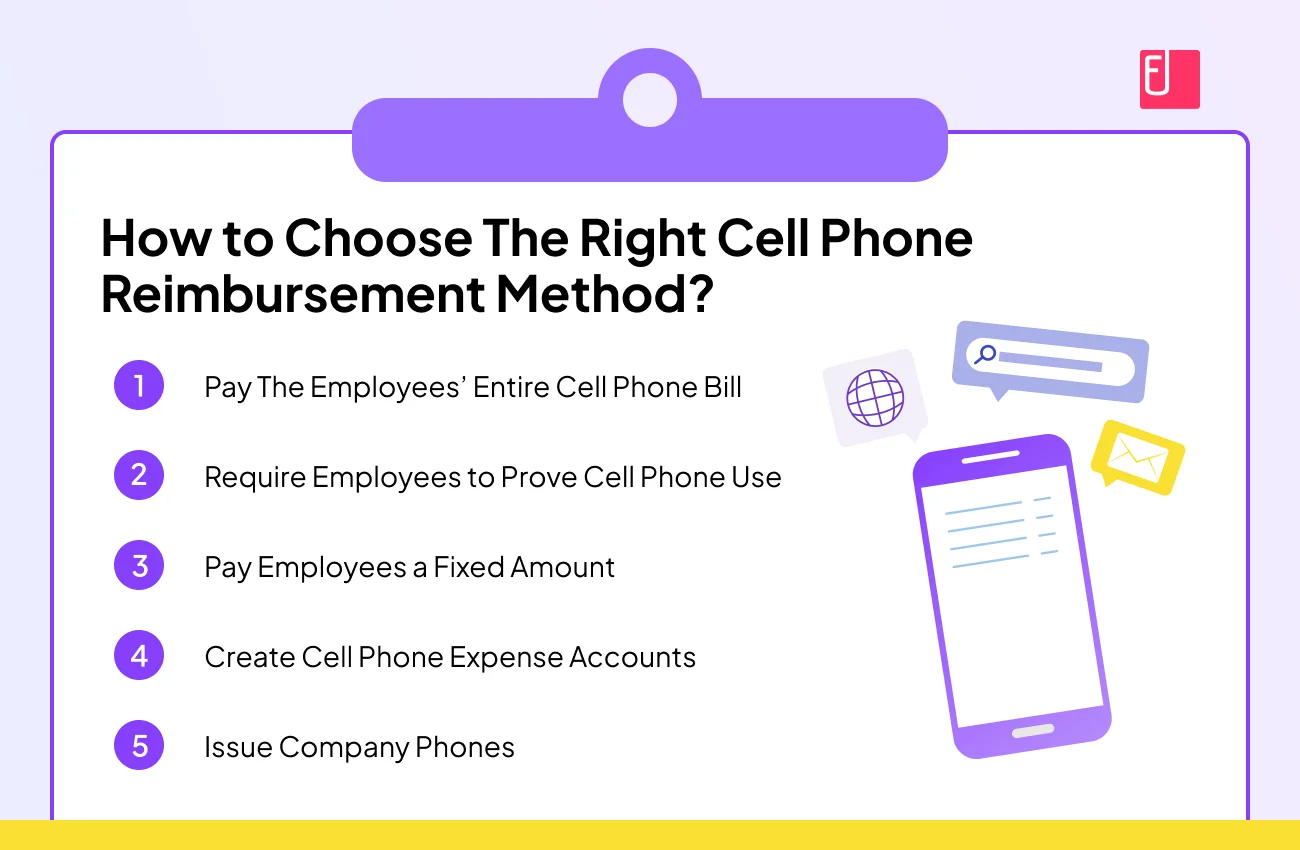

You can create check stubs manually, using payroll software, or with online check stub generators. – Manual Method: Requires Excel or Word templates but is time-consuming. – Payroll Software: Automates calculations (e.g., QuickBooks, ADP). – Online Generators: Fast but may charge a fee.

| Method | Pros | Cons |

|---|---|---|

| Manual | Free, customizable | Prone to errors |

| Payroll Software | Accurate, automated | Costly |

| Online Generator | Quick, easy | Limited features |

3. Calculate Gross Pay and Deductions

Gross pay is the total earnings before deductions. For hourly employees, multiply hours worked by pay rate. For salaried employees, divide the annual salary by pay periods. Example Calculation:

| Category | Calculation | Amount |

|---|---|---|

| Gross Pay | 40 hours × $20/hour | $800 |

| Federal Tax | 15% of gross pay | $120 |

| Net Pay | Gross pay – deductions | $635 |

4. Enter Details into a Check Stub Template

Use a check stub template to input all calculated data. Ensure it includes: – Employer & employee details – Pay period dates – Earnings & deductions – Year-to-date totals Example Template Structure:

| Section | Details Included |

|---|---|

| Header | Company name, employee name |

| Earnings | Hours, rate, gross pay |

| Deductions | Taxes, benefits |

| Net Pay | Final amount received |

5. Verify and Distribute Check Stubs

Before finalizing, double-check all numbers for accuracy. Errors can lead to tax discrepancies or employee disputes. Distribute stubs digitally (PDF) or physically with paychecks. Verification Checklist:

| Item | Action |

|---|---|

| Gross Pay | Match hours × rate |

| Tax Withholdings | Confirm percentage |

| Net Pay | Ensure deductions subtract correctly |

How do I make pay stubs step by step?

Gather Necessary Information

To create accurate pay stubs, you must first collect all essential details. This includes employee and employer information, pay period, earnings, deductions, and taxes. Ensure you have:

- Employee details: Full name, address, and Social Security Number (if applicable).

- Employer details: Business name, address, and Employer Identification Number (EIN).

- Pay period: Start and end dates of the payment cycle.

Calculate Earnings and Deductions

Next, determine the gross pay and subtract all required deductions to arrive at the net pay. Follow these steps:

- Calculate gross pay: Multiply hours worked by the hourly rate or use the fixed salary amount.

- Subtract pre-tax deductions: Include contributions to retirement plans or health insurance.

- Deduct taxes: Federal, state, and local income taxes, as well as Social Security and Medicare.

Use a Template or Software

To streamline the process, use a pay stub template or dedicated payroll software for accuracy and professionalism. Here’s how:

- Download a template: Find free or paid templates online that match your needs.

- Input employee and payment data: Fill in the gathered information and calculated amounts.

- Verify and print: Double-check for errors before generating or printing the pay stubs.

Can I make my own check stubs?

Yes, you can create your own check stubs if you have the correct information and tools. Many individuals, such as freelancers or small business owners, generate their own pay stubs for personal use or employee records. However, it’s important to ensure the details are accurate and comply with legal requirements to avoid issues.

What Information is Needed to Create a Check Stub?

To make a check stub, you must gather essential payroll details. Ensure your stub includes all legally required information to remain compliant and avoid potential disputes or legal problems.

- Employee and Employer Details: Names, addresses, and tax identification numbers.

- Payment Breakdown: Gross pay, deductions (taxes, benefits), and net pay.

- Tax Information: Federal, state, and local tax withholdings.

What Tools Can Help You Generate Check Stubs?

Several online platforms and software can assist in creating professional check stubs quickly and accurately. These tools often automate calculations, reducing errors and saving time.

- Online Generators: Websites like Check Stub Maker or PayStubCreator provide templates.

- Payroll Software: Tools such as QuickBooks or Gusto include check stub features.

- Spreadsheet Templates: Excel or Google Sheets can be customized for manual entry.

Are Homemade Check Stubs Legally Valid?

While you can create your own check stubs, they must meet legal standards to be recognized by financial institutions or government agencies. Accuracy and compliance are critical for legitimacy.

- Accuracy: Ensure all numbers match payroll records and tax filings.

- Professional Format: Use clear, standardized layouts to appear official.

- Record Keeping: Maintain backup documentation in case of audits.

What three items must appear on your pay stub?

1. Gross Earnings

A pay stub must include gross earnings, which represent the total amount of money earned before any deductions are taken out. This figure is crucial for understanding your total compensation for the pay period. Key details often listed under gross earnings include:

- Regular wages: The base pay for hours worked during the pay period.

- Overtime pay: Additional compensation for hours worked beyond the standard schedule.

- Bonuses or commissions: Extra earnings tied to performance or company incentives.

2. Tax Deductions

Your pay stub must show all tax deductions, which are amounts withheld from your paycheck for federal, state, and local taxes. These deductions ensure compliance with legal requirements and vary based on your income and location. Common tax deductions listed are:

- Federal income tax: Withheld based on your W-4 form and IRS tax brackets.

- State income tax: Applicable in most states, except those with no income tax.

- FICA taxes: Includes Social Security and Medicare contributions.

3. Net Pay

The net pay is the final amount you receive after all deductions and taxes have been subtracted from your gross earnings. It is the most important figure for employees, as it reflects the actual take-home pay. The net pay section often breaks down:

- Total deductions: Sum of taxes, benefits, and other withholdings.

- Year-to-date totals: Cumulative earnings and deductions for the current year.

- Payment method: Whether the amount was deposited or issued as a physical check.

Is it legal to make your own pay stubs self-employed?

Creating your own pay stubs as a self-employed individual is legal, provided they accurately reflect your income and other financial details. However, falsifying or misrepresenting information on pay stubs can lead to serious legal consequences, including tax fraud charges. Here are some key considerations:

– Accuracy: The pay stubs must match your actual earnings and tax withholdings.

– Purpose: They are often used for loan applications, rental agreements, or proof of income.

– Tools: Many self-employed professionals use accounting software or templates to generate legitimate pay stubs.

Legal Requirements for Self-Employed Pay Stubs

When creating your own pay stubs as a self-employed professional, certain legal requirements must be met to ensure compliance:

- Accurate income reporting: The pay stub must match your reported earnings to the IRS or other tax authorities.

- Proper deductions: Clearly list any business expenses, taxes, or withholdings if applicable.

- Transparency: Avoid any false claims, as this could result in penalties or audits.

Common Uses of Self-Employed Pay Stubs

Self-employed individuals often need pay stubs for various official purposes, including:

- Loan applications: Banks may require proof of consistent income.

- Rental agreements: Landlords often request pay stubs to verify income stability.

- Tax documentation: Helps in tracking earnings and deductions for annual filings.

Risks of Falsifying Pay Stubs

Creating fake or misleading pay stubs can have serious consequences:

- Legal penalties: Falsifying financial documents may lead to fraud charges or fines.

- Credit issues: Inaccurate pay stubs can harm your credibility with lenders.

- Tax problems: Misreporting income may trigger IRS audits or back taxes.

Frequently Asked Questions

What is a check stub and why is it important?

A check stub, also known as a pay stub, is a document that accompanies a paycheck, detailing an employee’s earnings and deductions for a specific pay period. Check stubs are crucial because they provide transparency, helping employees understand their gross pay, taxes withheld, and other deductions like insurance or retirement contributions. Additionally, they serve as proof of income, which may be required for loans, rentals, or other financial transactions.

What information should be included in a check stub?

A properly formatted check stub must contain several key details: the employee’s name and address, employer details, pay period dates, gross wages, itemized deductions (taxes, Social Security, Medicare, etc.), and net pay. Optional inclusions may cover bonuses, overtime, or reimbursements. Ensuring accuracy in these elements is vital for compliance and employee satisfaction.

How can I create check stubs manually?

To create check stubs manually, start by using a spreadsheet or word processor to outline the necessary sections mentioned earlier. Calculate gross pay by multiplying hours worked by the hourly rate (including overtime if applicable). Subtract deductions like federal and state taxes, Social Security, and benefits to determine net pay. Though time-consuming, this method offers full customization for small businesses or self-employed individuals.

Are there online tools or software to generate check stubs?

Yes, numerous online tools and software solutions simplify check stub creation by automating calculations and formatting. Platforms like PayStub Creator, QuickBooks, or ADP allow users to input employee and payment details, generating professional-grade stubs instantly. These tools often include templates, tax calculators, and compliance checks, saving time and reducing errors compared to manual methods.