Understanding the financial implications of short-term disability insurance is crucial for individuals and families to make informed decisions about their budget and financial security. The cost of short-term disability insurance varies widely based on several factors including age, health, occupation, and the level of coverage desired. As unexpected illnesses or injuries can significantly impact one’s income, having the right insurance coverage can provide a vital safety net. This article will explore the factors that influence the cost of short-term disability insurance and help you assess how it fits into your overall budget and financial planning strategy effectively.

Understanding the Costs Associated with Short Term Disability Insurance

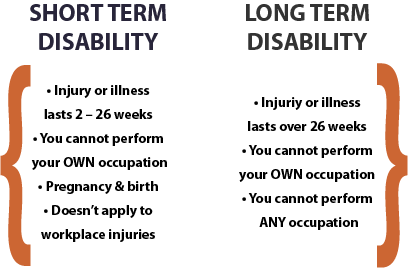

Short term disability insurance is designed to provide financial support to individuals who are unable to work due to illness, injury, or other medical conditions. The cost of this type of insurance can vary significantly depending on several factors, including the individual’s age, health, occupation, and the specific terms of the policy. Understanding these costs is crucial for budgeting and making informed decisions about whether or not to invest in short term disability insurance.

Factors That Influence the Cost of Short Term Disability Insurance

The cost of short term disability insurance is influenced by a variety of factors. Age and health status are significant determinants, as older individuals or those with pre-existing medical conditions are generally considered higher risk and may face higher premiums. The type of occupation is also a critical factor, as certain jobs are considered higher risk than others. For example, individuals working in construction or manufacturing may pay more for short term disability insurance than those working in office settings.

Calculating the Premiums for Short Term Disability Insurance

Premiums for short term disability insurance are typically calculated based on the individual’s income level and the benefit amount they are eligible to receive. The benefit amount is usually a percentage of the individual’s pre-disability income, and the premium is often a percentage of this benefit amount. For instance, if an individual earns $50,000 per year and is eligible for a benefit amount of 60% of their income, their weekly benefit would be $576. The premium for this benefit might be around 1% to 3% of the benefit amount.

Comparing Costs Across Different Insurance Providers

It’s essential to compare the costs of short term disability insurance across different providers to find the most affordable option. Different insurers may offer varying premium rates for similar coverage, so shopping around is crucial. The following table illustrates a comparison of short term disability insurance costs from different providers:

| Insurance Provider | Weekly Benefit Amount | Monthly Premium |

|---|---|---|

| Provider A | $500 | $25 |

| Provider B | $500 | $30 |

| Provider C | $500 | $20 |

Understanding the Benefit Period and Its Impact on Cost

The benefit period, which is the length of time an individual can receive benefits, can significantly impact the cost of short term disability insurance. Policies with longer benefit periods typically come with higher premiums. For example, a policy that provides benefits for up to 90 days may be less expensive than one that provides benefits for up to 180 days.

Tax Implications of Short Term Disability Insurance Premiums and Benefits

The tax implications of short term disability insurance can also affect the overall cost. Premiums paid with after-tax dollars may result in benefits being tax-free, while premiums paid with pre-tax dollars may result in benefits being taxable. Understanding these tax implications is crucial for accurately calculating the true cost of the insurance. In summary, the cost of short term disability insurance is influenced by a complex array of factors, including age, health, occupation, income level, and the specific terms of the policy. Carefully evaluating these factors and comparing costs across different providers can help individuals make informed decisions about their insurance needs.

Does your employer pay you for short-term disability?

Whether an employer pays an employee for short-term disability depends on various factors, including the company’s policies, the nature of the employee’s job, and the applicable laws. In the United States, for instance, the Family and Medical Leave Act (FMLA) allows eligible employees to take up to 12 weeks of unpaid leave for certain family and medical reasons, including a serious health condition that renders them unable to perform their job. However, the FMLA does not require employers to pay employees during this leave. Some employers, though, may offer short-term disability insurance as part of their benefits package, which can provide partial income replacement for a specified period.

Understanding Short-term Disability Benefits

Short-term disability benefits are designed to support employees who are unable to work due to a non-work-related illness or injury. The specifics of these benefits, including the amount of the benefit and the duration for which it is paid, can vary significantly from one employer to another. Typically, short-term disability insurance covers a portion of an employee’s salary for a limited time, such as up to 90 or 180 days. Here are key aspects of short-term disability benefits:

- The benefit amount is usually a percentage of the employee’s pre-disability earnings, often ranging between 50% to 67%.

- The elimination period, which is the time between the onset of disability and when benefits begin, can vary but is commonly between 0 to 14 days.

- The maximum benefit period for short-term disability is generally limited, often to a few months.

Employer Policies and Short-term Disability

Employers have varying policies regarding short-term disability. Some may offer paid sick leave or short-term disability insurance as part of their employee benefits package. Others might not provide any paid time off for disability. The decision to offer short-term disability benefits can be influenced by factors such as the size of the company, the industry, and the competitive landscape for talent. Here are some considerations:

- Larger companies are more likely to offer short-term disability benefits as part of a comprehensive benefits package to attract and retain employees.

- The specifics of the short-term disability plan, such as the benefit amount and duration, can be tailored to the employer’s needs and budget.

- Some employers may require employees to use accrued sick leave or vacation time before becoming eligible for short-term disability benefits.

Legal Requirements and Short-term Disability

The legal requirements surrounding short-term disability vary by jurisdiction. In some states, there are laws that mandate short-term disability insurance or provide state-run disability insurance programs. Employers must comply with these laws if they operate in jurisdictions where such laws are in effect. Here are key legal considerations:

- Employers in certain states, like California, New Jersey, and New York, are required to participate in state disability insurance programs or provide equivalent coverage.

- The Family and Medical Leave Act (FMLA) provides eligible employees with up to 12 weeks of unpaid leave for certain medical reasons, but it does not require pay during this leave.

- Employers must ensure compliance with all applicable laws regarding disability benefits, including the Americans with Disabilities Act (ADA), which requires reasonable accommodations for employees with disabilities.

Can you buy your own short-term disability insurance?

The answer to this question is yes, you can purchase your own short-term disability insurance. This type of insurance is designed to provide financial protection in the event that you become unable to work due to illness or injury. Short-term disability insurance typically provides benefits for a limited period, usually up to 90 or 180 days, and can help replace a portion of your income while you are recovering.

Types of Short-Term Disability Insurance Plans

There are various types of short-term disability insurance plans available, and the specifics can vary depending on the provider and the policy. Some common types include individual plans, which are purchased directly by individuals, and group plans, which are often offered through employers. When considering a plan, it’s essential to review the details, including the benefit amount, the benefit period, and any exclusions or limitations.

- Individual Plans: These plans are tailored to the individual’s needs and can be purchased directly from an insurance provider.

- Group Plans: These plans are often offered through employers as a benefit to employees and may have more favorable rates due to the group discount.

- Association Plans: Some professional associations or organizations offer group short-term disability insurance plans to their members.

Benefits of Purchasing Short-Term Disability Insurance

Purchasing short-term disability insurance can provide several benefits, including financial protection and peace of mind. If you become unable to work due to illness or injury, this insurance can help replace a portion of your income, ensuring that you can continue to meet your financial obligations. The key benefits of short-term disability insurance include:

- Income Replacement: Short-term disability insurance can help replace a portion of your income while you are unable to work.

- Flexibility: Many plans offer flexible benefit periods and amounts, allowing you to choose a plan that fits your needs.

- Financial Security: Having this insurance can provide financial security and reduce stress during a challenging time.

Considerations When Buying Short-Term Disability Insurance

When buying short-term disability insurance, there are several factors to consider to ensure you choose the right plan. It’s crucial to review the policy details carefully and understand the terms and conditions. Key considerations include:

- Benefit Amount: Consider how much income you need to replace if you become unable to work.

- Benefit Period: Think about how long you might need the insurance benefits to last.

- Exclusions and Limitations: Understand what is covered and what is not under the policy.

Frequently Asked Questions

What Factors Influence the Cost of Short-Term Disability Insurance?

The cost of short-term disability insurance is influenced by several key factors, including age, health, occupation, and income level. Generally, the older you are, the more you can expect to pay for short-term disability insurance because age is a significant risk factor for disability. Additionally, individuals with pre-existing medical conditions or those working in high-risk occupations may face higher premiums due to the increased likelihood of filing a claim. Furthermore, the level of income replacement you choose also affects the cost; opting for a higher percentage of income replacement will increase your premiums.

How Does the Cost of Short-Term Disability Insurance Compare to Long-Term Disability Insurance?

The cost of short-term disability insurance is typically lower than that of long-term disability insurance because it provides coverage for a shorter period, usually up to 90 or 180 days. Short-term disability insurance is designed to cover temporary disabilities that prevent you from working for a brief period, whereas long-term disability insurance kicks in after the short-term coverage ends and can last for years or until retirement age. As a result, long-term disability insurance is generally more expensive due to its longer coverage period and the potential for more extensive claims.

Can Employers Influence the Cost of Short-Term Disability Insurance for Employees?

Yes, employers can significantly influence the cost of short-term disability insurance for their employees. Many employers offer group short-term disability insurance as part of their benefits package, which can be more cost-effective than individual policies. The employer may cover the entire premium, or it may be a shared cost between the employer and employee. When employers contribute to the premium, it not only benefits the employees by reducing their out-of-pocket expenses but can also be a tax-deductible expense for the employer.

Are There Ways to Reduce the Cost of Short-Term Disability Insurance?

There are several strategies to reduce the cost of short-term disability insurance. One approach is to opt for a longer elimination period, which is the time you must wait before benefits begin. Choosing a longer elimination period can lower your premiums because it reduces the likelihood of the insurance company having to pay out benefits soon after a claim is filed. Additionally, maintaining a healthy lifestyle and managing chronic health conditions can potentially lower your premiums over time by reducing your risk profile. Comparing quotes from different insurance providers and considering group coverage options through an employer can also help in finding more affordable rates.