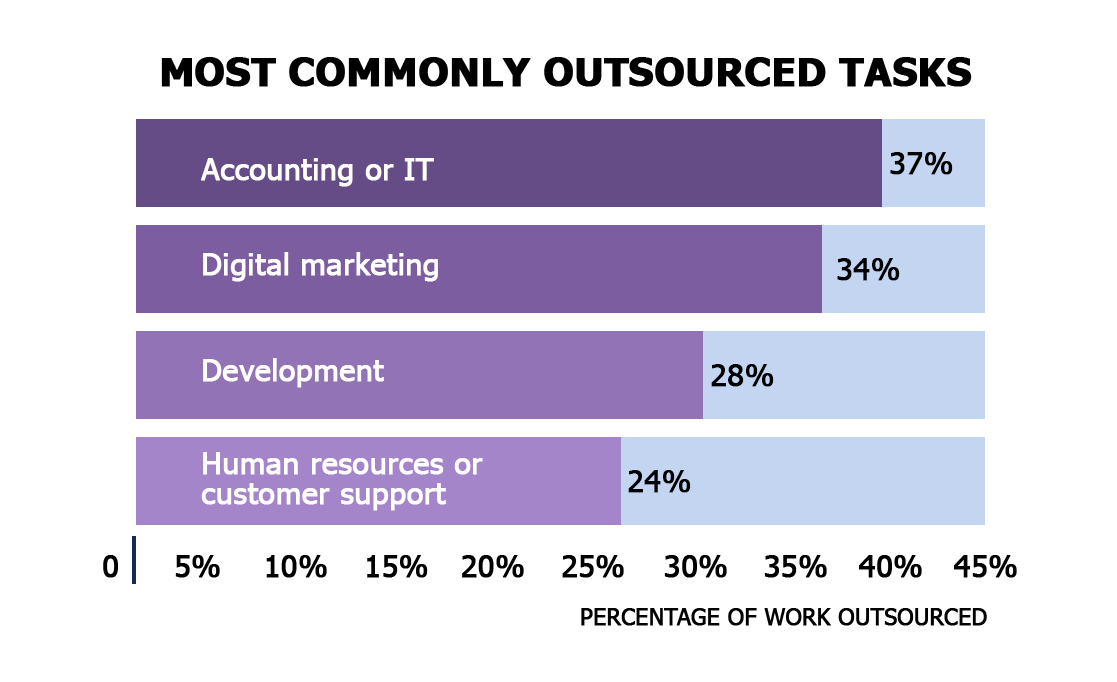

Managing payroll can be a complex and time-consuming task for businesses, taking away from more strategic activities. Outsourcing payroll can help alleviate this burden, but understanding the associated costs is crucial for making an informed decision. The cost of outsourcing payroll varies based on several factors including the size of the business, the complexity of payroll needs, and the services required. This article will explore the different elements that influence the cost of outsourcing payroll, providing business owners with the insights needed to determine if outsourcing payroll is a cost-effective solution for their organization.

Understanding the Costs Associated with Outsourcing Payroll Services

Outsourcing payroll services can be a strategic decision for businesses looking to streamline their operations, reduce costs, and improve compliance with regulatory requirements. The cost of outsourcing payroll can vary significantly depending on several factors, including the size of the business, the complexity of the payroll, and the service provider chosen. To make an informed decision, it’s crucial to understand the various components that contribute to the overall cost.

Factors Influencing the Cost of Outsourcing Payroll

Several factors can influence the cost of outsourcing payroll services. These include the number of employees, the frequency of payroll processing, and the level of service required. Businesses with a larger workforce or more complex payroll needs, such as those with multiple locations or varying pay schedules, may incur higher costs. Additionally, the level of service required, such as basic payroll processing versus comprehensive HR services, can also impact the cost.

Payroll Processing Fees

Payroll processing fees are a primary component of the cost associated with outsourcing payroll. These fees can be structured in various ways, including per-employee-per-month (PEPM) or as a flat monthly fee. The cost per employee can range from $5 to $20 PEPM, depending on the provider and the services included. Some providers may also charge additional fees for services such as tax filing or benefits administration.

| Provider | PEPM Fee | Services Included |

|---|---|---|

| Provider A | $8 | Payroll processing, tax filing |

| Provider B | $12 | Payroll processing, tax filing, benefits administration |

| Provider C | $6 | Payroll processing only |

Additional Services and Fees

In addition to payroll processing fees, businesses may incur costs for additional services such as HR consulting, benefits administration, or time and attendance tracking. These services can be provided à la carte or as part of a comprehensive package. The cost of these services can vary widely depending on the provider and the level of support required.

Implementation and Setup Costs

When outsourcing payroll, businesses may also need to consider implementation and setup costs. These costs can include data migration, system integration, and employee training. The complexity of the implementation process can impact the overall cost, with more complex integrations requiring more time and resources.

Comparing Payroll Outsourcing Providers

To find the best value for their business, companies should compare the services and pricing of different payroll outsourcing providers. This involves evaluating the level of service required, the costs associated with different providers, and the potential for cost savings through streamlined operations or reduced compliance risks.

| Provider | Setup Fee | Monthly Fee | PEPM Fee |

|---|---|---|---|

| Provider X | $500 | $100 | $10 |

| Provider Y | $0 | $200 | $8 |

| Provider Z | $1000 | $0 | $12 |

How much does it cost to set up payroll services?

The cost to set up payroll services can vary depending on several factors, including the size of the organization, the complexity of the payroll requirements, and the type of payroll service provider chosen.

Factors Affecting Payroll Setup Costs

The cost of setting up payroll services is influenced by various factors. The size of the organization is a significant factor, as larger organizations with more employees require more complex payroll processing. The complexity of payroll requirements is another factor, as organizations with multiple pay rates, benefits, and deductions require more sophisticated payroll processing.

- The number of employees to be processed

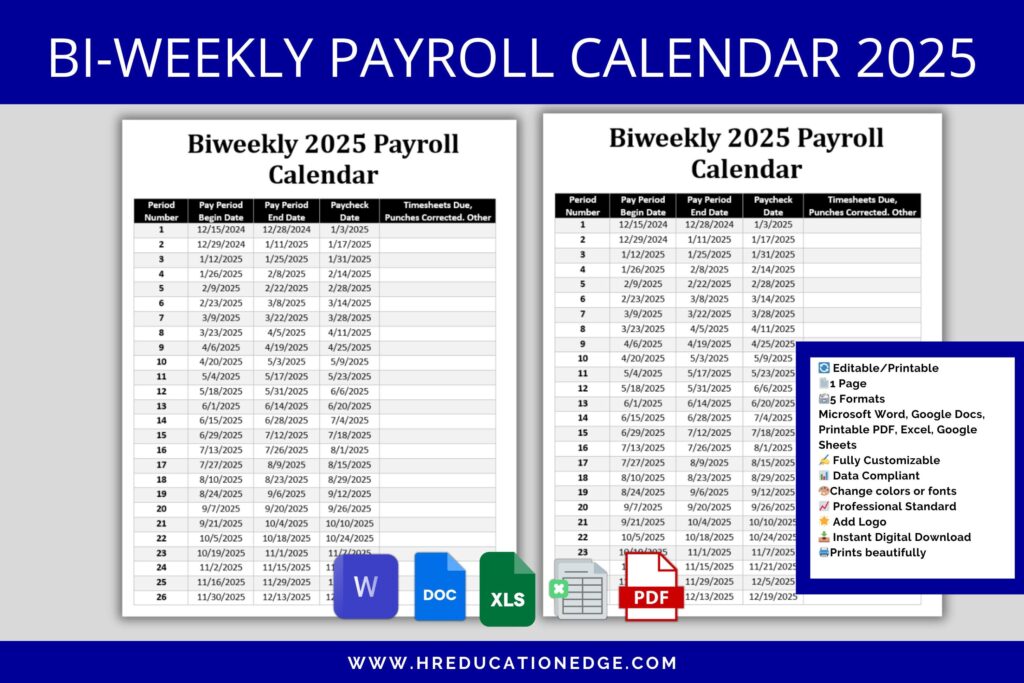

- The frequency of payroll processing, such as weekly or bi-weekly

- The need for additional services, such as tax compliance and benefits administration

Payroll Service Provider Costs

Different payroll service providers charge varying fees for their services. Some providers charge a flat monthly fee, while others charge a per-employee fee. The cost of payroll services can also depend on the level of service required, such as basic payroll processing or full-service payroll management.

- Basic payroll processing services, which include calculating pay and generating paychecks

- Full-service payroll management, which includes additional services such as tax compliance and benefits administration

- Customized payroll solutions, which are tailored to meet the specific needs of the organization

Additional Costs to Consider

In addition to the initial setup costs, there may be other costs associated with payroll services, such as ongoing maintenance fees and support costs. It’s essential to consider these costs when evaluating payroll service providers to ensure that the total cost of ownership is understood.

- Ongoing maintenance fees, which may be charged monthly or annually

- Support costs, such as customer support and training

- Implementation costs, which may be charged for setting up the payroll system

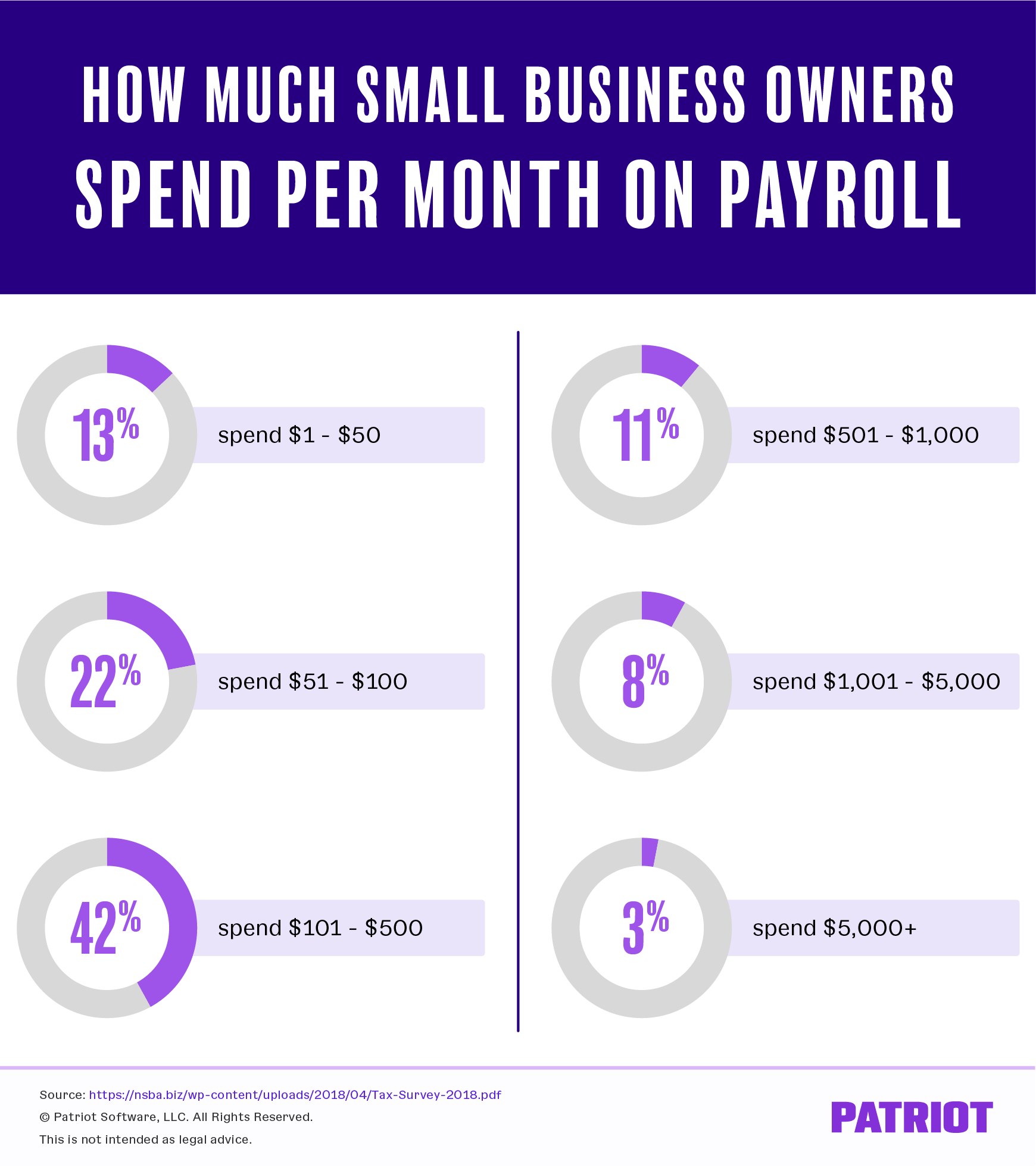

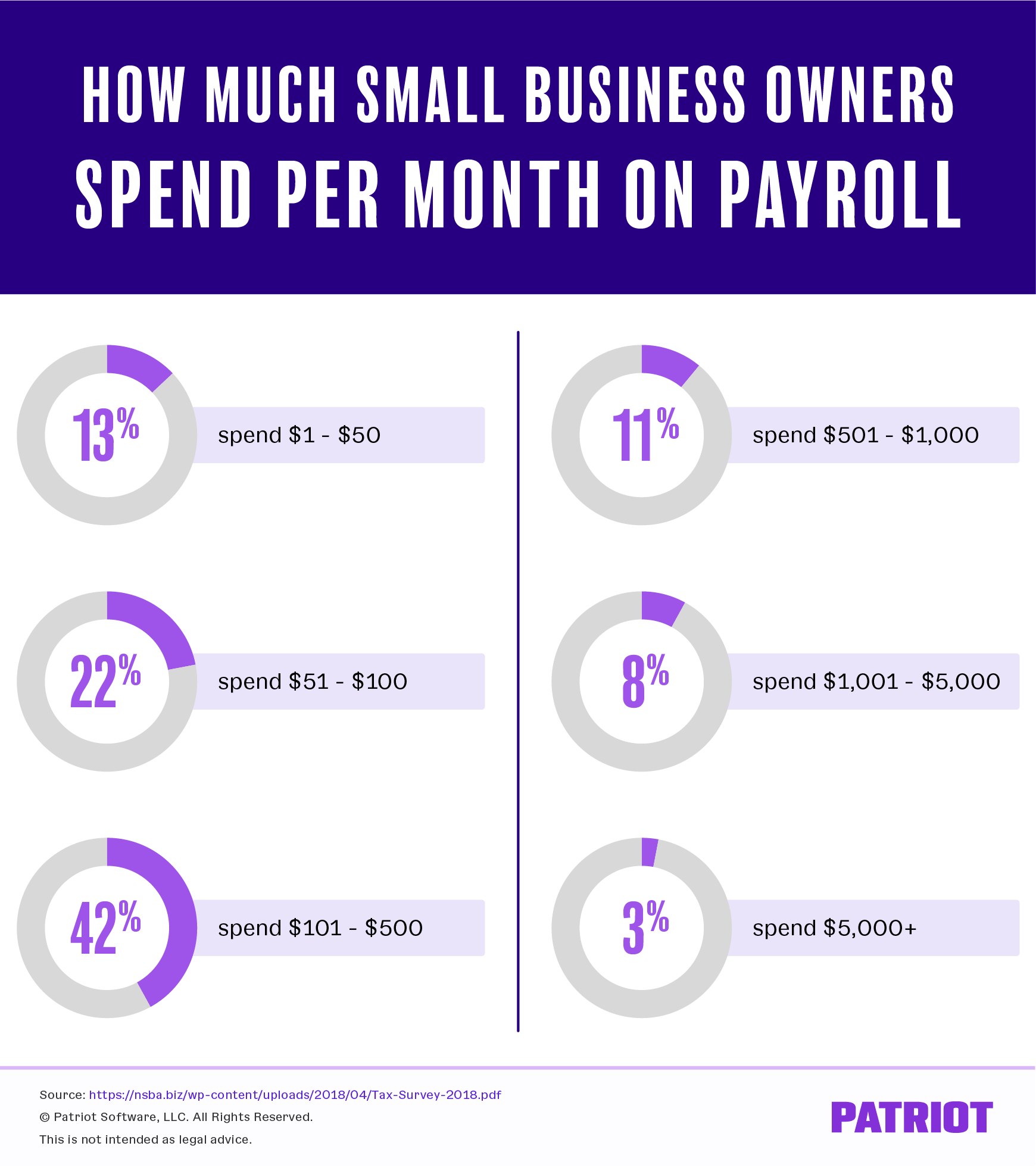

How much should payroll be for a small business?

The ideal payroll percentage for a small business can vary greatly depending on several factors such as industry, location, and business model. Generally, payroll costs, which include salaries, wages, benefits, and payroll taxes, should be around 20-30% of the gross revenue for most businesses. However, this can fluctuate based on the type of business. For instance, labor-intensive businesses like restaurants or retail stores may have higher payroll costs, sometimes exceeding 40% of their gross revenue, while businesses that are more product-based or service-oriented with fewer employees might have lower payroll costs.

Factors Influencing Payroll Costs

Payroll costs are influenced by a multitude of factors including the size of the workforce, the industry standards for salaries and wages, the benefits provided to employees, and the location of the business due to varying minimum wage laws and costs of living. To manage payroll effectively, businesses must consider these factors carefully.

- The size and structure of the workforce directly impact payroll costs, with larger workforces or those with more senior staff members typically costing more.

- Industry standards for compensation can dictate the level of salaries and wages, with certain industries paying more due to the specialized skills required.

- Benefits and perks, such as health insurance, retirement plans, and paid time off, add to the overall cost of employing staff.

Calculating Optimal Payroll Percentage

To determine the optimal payroll percentage for a specific small business, owners must analyze their financials and industry benchmarks. This involves looking at the gross revenue and the total payroll costs to find a ratio that is sustainable and profitable.

- Gross Revenue is the total income from sales before any expenses are deducted, serving as the base for calculating the payroll percentage.

- Total Payroll Costs include not just salaries and wages but also benefits, payroll taxes, and any other compensation-related expenses.

- Industry Benchmarks provide a reference point, helping businesses understand what is considered a normal or acceptable payroll percentage within their specific industry.

Managing and Reducing Payroll Costs</h

For small businesses looking to manage or reduce their payroll costs, there are several strategies that can be employed. This includes optimizing staffing levels, adjusting compensation packages, and leveraging technology to streamline payroll processes.

- Optimizing Staffing Levels involves ensuring that the workforce is appropriately sized for the business needs, potentially reducing the need for overtime or temporary staff.

- Adjusting Compensation Packages can involve offering benefits or perks that are cost-effective for the business but still attractive to employees.

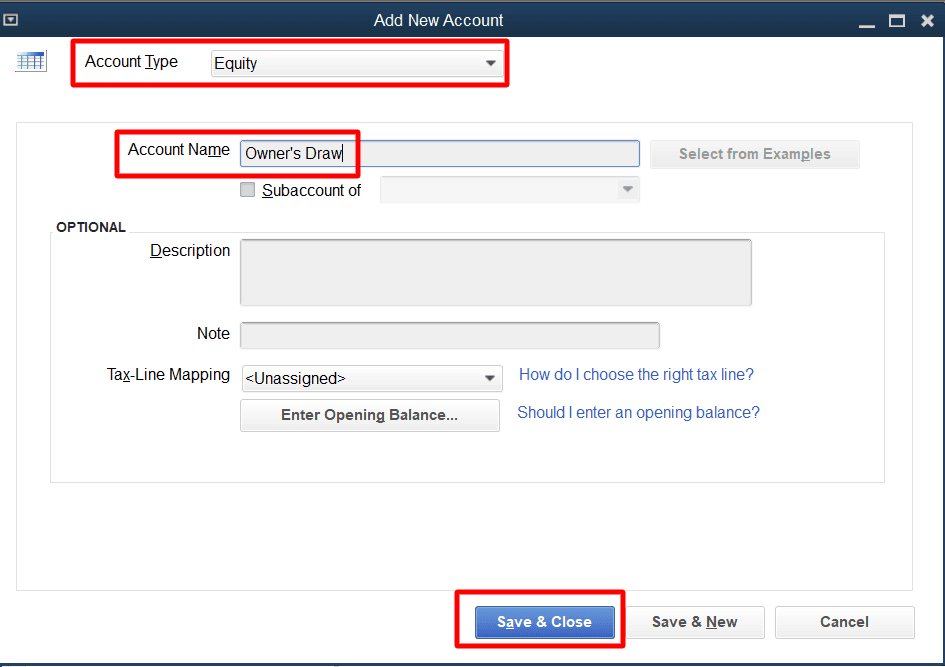

- Leveraging Technology, such as using payroll software, can help reduce the administrative burden and costs associated with managing payroll.

What is the best payroll service for small businesses?

The best payroll service for small businesses is a crucial aspect to consider, as it can help streamline financial operations, reduce errors, and ensure compliance with tax regulations. When evaluating payroll services, small businesses should look for providers that offer a comprehensive range of features, including automated payroll processing, tax compliance, and employee data management.

Key Features to Consider

When selecting a payroll service, small businesses should consider the following key features to ensure they find a provider that meets their needs. A good payroll service should offer:

- Automated Payroll Processing: This feature can help reduce errors and save time by automating tasks such as calculating employee salaries, deductions, and taxes.

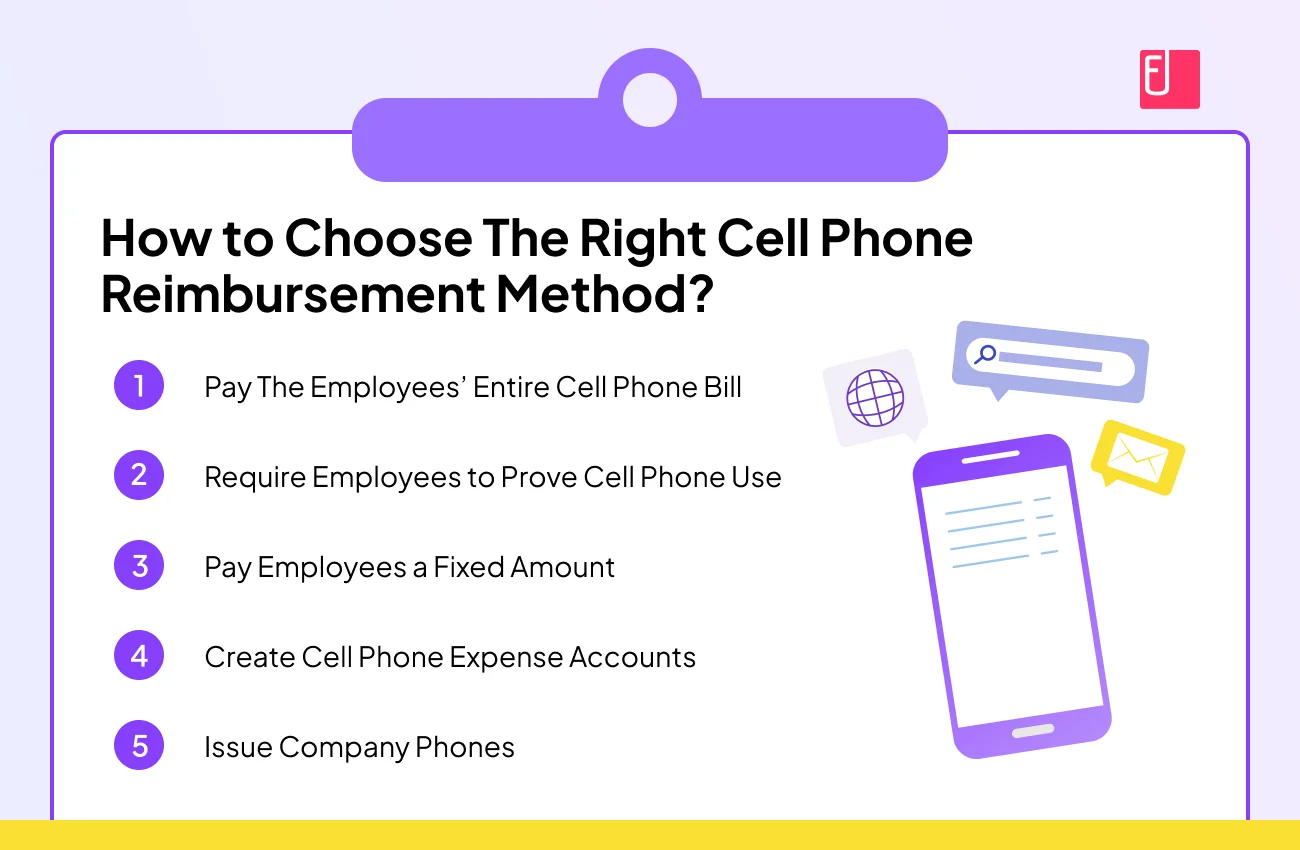

- Tax Compliance: A reliable payroll service should be able to handle tax filings, including payroll tax returns and W-2 forms, to ensure compliance with tax regulations.

- Employee Data Management: A good payroll service should provide a secure and user-friendly platform for managing employee data, including time-off tracking and benefits administration.

Benefits of Outsourcing Payroll

Outsourcing payroll to a third-party provider can offer several benefits to small businesses, including cost savings, increased efficiency, and reduced administrative burdens. By outsourcing payroll, small businesses can:

- Reduce Labor Costs: Outsourcing payroll can help small businesses reduce the time and resources required to manage payroll in-house.

- Improve Accuracy: A reliable payroll service can help reduce errors and ensure accurate payroll processing.

- Enhance Compliance: A payroll service can help small businesses stay compliant with tax regulations and avoid costly penalties.

Popular Payroll Service Options

There are several popular payroll service options available to small businesses, each offering a range of features and benefits. Some of the most popular options include:

- Gusto: A comprehensive payroll service that offers automated payroll processing, tax compliance, and employee data management.

- Paychex: A well-established payroll service that offers a range of features, including payroll processing, tax compliance, and HR support.

- QuickBooks Payroll: A popular payroll service that integrates with QuickBooks accounting software, offering automated payroll processing and tax compliance.

Is it better to outsource payroll?

Outsourcing payroll can be a strategic decision for businesses, allowing them to streamline operations and reduce administrative burdens. By outsourcing payroll, companies can tap into the expertise of specialized providers who are well-versed in payroll regulations and compliance requirements. This can help minimize the risk of errors and ensure that employees are paid accurately and on time. Moreover, outsourcing payroll can also provide access to advanced technology and scalable solutions, enabling businesses to adapt to changing workforce needs.

Benefits of Outsourcing Payroll

Outsourcing payroll can bring numerous benefits to businesses, including cost savings, increased efficiency, and improved accuracy. By outsourcing payroll, companies can reduce labor costs associated with maintaining an in-house payroll team and minimize the risk of non-compliance. Some key benefits of outsourcing payroll include:

- Expertise and knowledge: Payroll providers have extensive experience and knowledge of payroll regulations and compliance requirements.

- Cost savings: Outsourcing payroll can help reduce labor costs and minimize the need for investments in payroll technology and training.

- Increased efficiency: Payroll providers can process payroll quickly and accurately, freeing up internal resources for more strategic activities.

Key Considerations for Outsourcing Payroll

When considering outsourcing payroll, businesses should carefully evaluate potential providers and assess their reputation, experience, and service offerings. It’s essential to choose a provider that can meet the company’s specific payroll needs and provide reliable support. Some key considerations when outsourcing payroll include:

- Security and data protection: Ensure that the provider has robust security measures in place to protect sensitive employee data.

- Compliance and regulatory expertise: Verify that the provider has a strong understanding of relevant payroll regulations and compliance requirements.

- Scalability and flexibility: Choose a provider that can adapt to changing business needs and provide scalable solutions.

Potential Drawbacks of Outsourcing Payroll

While outsourcing payroll can bring many benefits, there are also potential drawbacks to consider. Businesses should be aware of the potential risks and challenges associated with outsourcing payroll, including loss of control and dependence on the provider. Some potential drawbacks include:

- Limited control: By outsourcing payroll, businesses may have limited control over the payroll process and may need to rely on the provider for certain tasks.

- Vendor lock-in: Companies may become dependent on the provider and face challenges when switching to a new provider.

- Communication challenges: Businesses may need to invest time and effort in communicating effectively with the provider and ensuring that their needs are met.

Frequently Asked Questions

What are the average costs associated with outsourcing payroll services for small businesses?

The average cost of outsourcing payroll services for small businesses can vary greatly depending on the payroll processing company, the number of employees, and the services required. Generally, small businesses can expect to pay anywhere from $25 to $150 per month for basic payroll services, which typically include payroll processing, tax compliance, and employee data management. Some payroll processing companies may also charge a per-employee fee, which can range from $2 to $10 per employee per month. It’s essential to research and compare different payroll processing companies to find the best fit for your business needs and budget.

How do payroll processing companies charge for their services, and what factors affect the cost?

Payroll processing companies typically charge for their services based on a flat monthly fee, a per-employee fee, or a combination of both. The cost can be affected by several factors, including the number of employees, pay frequency, and complexity of payroll. For example, businesses with multiple locations or those that require customized payroll solutions may be charged more. Additionally, companies that offer additional services, such as HR support, time-tracking, and benefits administration, may charge extra for these services. It’s crucial to understand the pricing model and what’s included in the cost to avoid any unexpected fees.

Are there any additional costs or fees associated with outsourcing payroll services?

Yes, there may be additional costs or fees associated with outsourcing payroll services. Some payroll processing companies may charge setup fees, implementation fees, or cancellation fees. Others may charge extra for services like tax filing, workers’ compensation, or benefits administration. It’s also possible that some companies may charge overtime or holiday pay processing fees. To avoid any surprises, it’s essential to carefully review the contract and ask about any potential additional fees before signing up with a payroll processing company.

Can outsourcing payroll services help reduce costs in the long run, and how?

Outsourcing payroll services can help reduce costs in the long run by minimizing the risk of payroll errors, reducing the need for in-house payroll staff, and lowering compliance costs. By outsourcing payroll, businesses can avoid the costs associated with maintaining payroll software, training payroll staff, and staying up-to-date with changing regulations. Additionally, payroll processing companies often have economies of scale that allow them to provide services at a lower cost than what it would take for a business to do it in-house. By outsourcing payroll, businesses can focus on core operations and improve overall efficiency.