Running a pest control business involves managing various risks, from property damage to liability claims. Ensuring your company is adequately protected with the right insurance coverage is essential for long-term success and peace of mind. Without proper policies, unforeseen incidents could result in significant financial losses or legal complications. This article explores the key insurance types every pest control operator should consider, from general liability to workers’ compensation, helping you safeguard your business against potential threats. Whether you’re just starting or looking to reassess your current coverage, understanding these protections will help you operate with confidence in a competitive and high-risk industry.

Must-Have Insurance Policies for Protecting Your Pest Control Business

Operating a pest control business comes with various risks, including property damage, employee injuries, and liability claims. Having the right insurance coverage is crucial for financial protection and legal compliance. Below, we explore the essential policies your business needs.

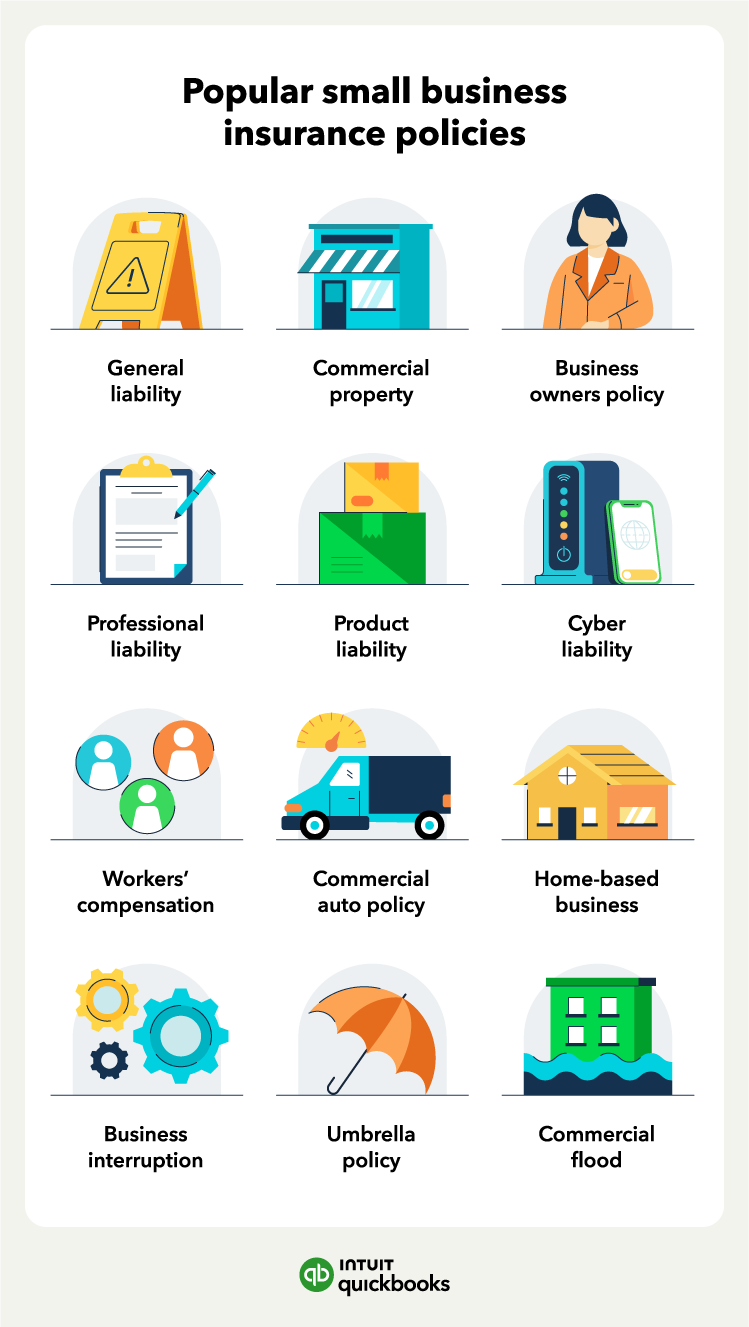

1. General Liability Insurance

General Liability Insurance protects your business from claims related to third-party injuries, property damage, or advertising injuries. For example, if a client slips on spilled chemicals or their property is damaged during treatment, this policy covers legal fees and settlements. Without it, your business could face heavy financial losses.

| Coverage | Protection Offered |

|---|---|

| Bodily Injury | Covers medical expenses if a third party is injured. |

| Property Damage | Pays for repairs if your services damage client property. |

| Personal & Advertising Injury | Protects against slander or copyright infringement claims. |

2. Commercial Auto Insurance

Since pest control businesses rely on vehicles for transport, Commercial Auto Insurance covers accidents involving company-owned vehicles. Whether it’s a collision or theft, this policy ensures repair costs, medical bills, and legal claims are covered. Personal auto insurance may not provide sufficient protection for business use.

| Coverage | Protection Offered |

|---|---|

| Collision | Pays for vehicle repairs after an accident. |

| Liability | Covers injury or property damage caused to others. |

| Comprehensive | Protects against non-collision events (e.g., theft, vandalism). |

3. Workers’ Compensation Insurance

If employees are injured on the job, Workers’ Compensation Insurance covers medical expenses, lost wages, and rehabilitation. Pest control technicians face chemical exposure risks, bites, and physical strain, making this policy mandatory in most states.

| Coverage | Protection Offered |

|---|---|

| Medical Expenses | Covers hospital bills and treatment costs. |

| Disability Benefits | Provides income replacement for injured employees. |

| Legal Protection | Shields against employee lawsuits related to injuries. |

4. Professional Liability Insurance

Professional Liability Insurance (Errors & Omissions) covers claims arising from mistakes in your services, such as failing to eliminate pests or using incorrect treatments. Even if unintentional, these errors can lead to lawsuits, and this policy covers legal defense and settlements.

| Coverage | Protection Offered |

|---|---|

| Negligence Claims | Protects against allegations of inadequate service. |

| Legal Defense Costs | Covers attorney fees and court expenses. |

| Customer Reimbursement | Pays for refunds or re-treatment costs. |

5. Property Insurance

Your pest control business may have valuable equipment, inventory, and office space. Property Insurance covers losses from fire, theft, or natural disasters. Without it, replacing expensive tools and chemicals could severely impact your operations.

| Coverage | Protection Offered |

|---|---|

| Building Coverage | Repairs or rebuilds damaged business premises. |

| Equipment Protection | Replaces stolen or destroyed pest control tools. |

| Business Interruption | Compensates for lost income during recovery. |

How much is liability insurance for pest control business?

Average Cost of Liability Insurance for Pest Control Businesses

The average cost of liability insurance for a pest control business typically ranges between $400 and $1,500 annually. However, premiums vary based on factors like business size, location, and coverage limits. Here are key considerations:

- General Liability Insurance: Usually costs between $400 and $1,200 per year, covering third-party injuries or property damage.

- Professional Liability Insurance: Priced around $500 to $1,500 annually, it protects against claims of negligence or errors in services.

- Workers’ Compensation Insurance: Required if you have employees, costing approximately $1,000 to $3,000 per year.

Factors Affecting Liability Insurance Costs

Several variables influence the price of liability insurance for pest control businesses. Understanding these can help you budget effectively:

- Business Size: Larger businesses with more employees or higher revenue pay higher premiums.

- Location: States with stricter regulations or higher claim rates may have increased costs.

- Coverage Limits:

Higher coverage limits or additional endorsements (e.g., pollution liability) raise premiums.

Ways to Reduce Liability Insurance Costs

Pest control businesses can take steps to lower insurance expenses without sacrificing coverage:

- Bundle Policies: Purchasing a Business Owner’s Policy (BOP) combining general liability and property insurance often saves money.

- Implement Safety Training: Reducing workplace accidents or claims can qualify you for discounts.

- Compare Quotes: Shopping from multiple insurers ensures you get the best rate for your specific needs.

What insurance do I need to run my own business?

General Liability Insurance

General Liability Insurance protects your business from common risks, such as property damage, bodily injury, and personal injury claims. It covers legal fees, medical expenses, and settlements, ensuring your business operates smoothly. Key aspects include:

- Property Damage: Covers costs if your business damages someone else’s property.

- Bodily Injury: Pays for medical expenses if a customer is injured on your premises.

- Advertising Injury: Protects against claims of slander or copyright infringement in ads.

Professional Liability Insurance

Also known as Errors and Omissions (E&O) Insurance, this policy covers claims of negligence, mistakes, or failure to deliver services as promised. It’s essential for service-based businesses. Key features include:

- Legal Defense Costs: Covers attorney fees if sued for professional errors.

- Negligence Claims: Protects against client lawsuits for subpar work.

- Contractual Disputes: Addresses breaches of contract or missed deadlines.

Workers’ Compensation Insurance

If you have employees, Workers’ Compensation Insurance is typically mandatory. It covers medical bills and lost wages for work-related injuries or illnesses. Important elements include:

- Medical Expenses: Pays for treatment if an employee gets hurt on the job.

- Disability Benefits: Provides income replacement for temporary/permanent disabilities.

- Legal Protection: Shields your business from employee lawsuits over workplace injuries.

How much is a $5 million dollar insurance policy for a business?

What Factors Influence the Cost of a $5 Million Business Insurance Policy?

The cost of a $5 million business insurance policy depends on multiple variables. These include the industry type, business size, location, claims history, and coverage specifics. High-risk industries like construction or healthcare typically pay more due to increased liability. Underwriters also assess the business’s financial stability and operational risks before determining premiums.

- Industry Risk Level: Higher-risk sectors face steeper premiums.

- Coverage Type: General liability, professional liability, or umbrella policies differ in pricing.

- Deductibles: Choosing a higher deductible can reduce premium costs.

Average Premium Range for a $5 Million Business Insurance Policy

Premiums for a $5 million policy vary widely, but businesses can expect to pay between $5,000 and $50,000 annually. Small businesses in low-risk industries may pay at the lower end, while large corporations in high-risk fields could incur significantly higher costs. Insurers may also offer payment plans or discounts for bundling policies.

- Small Businesses: Typically pay $5,000–$15,000 annually.

- Mid-Sized Companies: Often range $15,000–$30,000 per year.

- High-Risk Enterprises: Can exceed $30,000 annually.

How to Reduce the Cost of a $5 Million Business Insurance Policy

Lowering premiums for a $5 million policy involves proactive risk management and strategic planning. Businesses can negotiate better rates by demonstrating strong safety protocols, maintaining a clean claims history, and comparing quotes from multiple insurers. Bundling policies or adjusting coverage limits can also lead to savings.

- Risk Mitigation: Implement safety training and compliance programs.

- Shop Around: Compare quotes from different providers.

- Adjust Coverage: Modify deductibles or exclusions to fit budget needs.

Frequently Asked Questions

What types of insurance are essential for a pest control business?

General liability insurance is critical for pest control businesses as it covers third-party bodily injuries, property damage, and advertising injuries. Professional liability insurance (errors and omissions) protects against claims of negligence or inadequate service. Additionally, commercial auto insurance is essential if your company uses vehicles, while workers’ compensation insurance is legally required in most states to cover employee injuries. These policies form the foundation of a robust protection plan.

Why is general liability insurance important for pest control companies?

General liability insurance safeguards pest control businesses from financial losses due to accidents, such as accidental chemical spills or property damage during service. For instance, if a technician inadvertently damages a client’s flooring, this policy covers repair costs. Moreover, it includes legal defense fees for covered claims, offering peace of mind and protecting your business’s reputation.

How does workers’ compensation insurance benefit pest control businesses?

Workers’ compensation insurance is vital for pest control companies, as technicians often handle hazardous chemicals and tools. If an employee sustains an injury or illness on the job, this policy covers medical expenses, lost wages, and rehabilitation costs. It also shields your business from lawsuits related to workplace injuries, ensuring compliance with state laws and fostering a safer work environment.

Should pest control businesses consider professional liability insurance?

Yes, professional liability insurance (or E&O insurance) is highly recommended for pest control operators. This coverage addresses claims arising from mistakes, such as failing to eliminate an infestation or using incorrect treatment methods. Without it, your business could face costly legal disputes and settlements. It’s particularly valuable for maintaining client trust and financial stability in case of professional errors.