Wage garnishment is a legal process where a portion of an employee’s earnings is withheld to pay a debt. Employers are typically required to notify employees before initiating garnishment, but if this doesn’t happen, employees may feel blindsided and unsure of their rights. Unexpected wage deductions can create financial strain and raise concerns about employer compliance with federal and state laws. Understanding your rights is crucial—both in verifying the legitimacy of the garnishment and addressing any procedural violations. This article explores the steps to take if your employer failed to notify you of wage garnishment, including legal protections and potential recourse to resolve the issue effectively.

Employer Did Not Notify Me of Wage Garnishment: Your Rights

If your employer failed to notify you about a wage garnishment, you may have legal rights to address the situation. This could involve improper procedures, lack of due process, or violations under the Consumer Credit Protection Act (CCPA). Below, we explain your potential recourse and steps to take if you were not informed of wage withholding.

Understanding Wage Garnishment Notification Laws

Federal law requires creditors and courts to follow strict notification procedures before garnishing wages. Your employer must also provide a notice before withholding pay. If you were not informed, the garnishment may be disputed under protections like the Fair Labor Standards Act (FLSA).

| Legal Requirement | Your Right |

|---|---|

| Creditor must obtain court order | Challenge if no proper notice was served |

| Employer must inform you | Request proof of notification |

| Maximum garnishment limits apply | Report excessive withholdings |

Steps to Take If Your Employer Didn’t Notify You

First, request written confirmation from your employer about the garnishment details. If they failed to notify you, consult an employment lawyer or file a complaint with the Department of Labor (DOL) for potential violations.

How to Verify the Validity of the Wage Garnishment

Check court records to confirm if the garnishment order is legitimate. Contact the issuing court or agency listed on the order to ensure proper documentation exists before withholding occurred.

Legal Protections Against Improper Wage Garnishments

The CCPA limits garnishments to 25% of disposable income and prohibits termination for a single debt withholding. If your employer violates these rules, legal action may be possible.

What to Do If You Can’t Afford the Garnishment

Request a hearing to modify the withholding amount based on financial hardship. Some states allow exemptions for low-income earners under specific circumstances.

| Action | Authority to Contact |

|---|---|

| Dispute invalid garnishment | Court or state labor board |

| Report employer violations | U.S. Department of Labor |

| Seek a reduction in withholding | Issuing creditor/court |

What if my employer did not notify me of wage garnishment?

What Are My Rights If My Employer Did Not Notify Me of Wage Garnishment?

If your employer did not inform you about a wage garnishment, you still have legal rights. The law typically requires creditors or courts to notify you directly before garnishment begins. However, employers also have a duty to inform you once they receive the garnishment order. Here’s what you should know:

- Notification requirement: Federal and state laws usually mandate that both the creditor and your employer provide notice.

- Legal recourse: If your employer failed to notify you, you may file a complaint with your state’s labor department or seek legal advice.

- Dispute options: You might challenge the garnishment if proper notice wasn’t given, especially if it affects your exempt earnings.

Can I Recover Garnished Wages If I Was Not Notified?

Recovering garnished wages depends on whether the garnishment was lawful and if proper procedures were followed. If your employer didn’t notify you, you may have grounds to recover some or all of the withheld wages. Follow these steps:

- Verify the garnishment’s validity: Check if the creditor obtained a court order and if you received legal notice.

- Consult an attorney: A lawyer can help determine if the garnishment violated federal or state laws.

- File a claim: If the garnishment was improper, you may request a refund through the court or your employer.

How Can I Prevent Future Unnotified Wage Garnishments?

To avoid unnoticed wage garnishments, take proactive steps to stay informed about potential legal actions against you. Ignorance of a debt doesn’t stop garnishment, but these actions can help:

- Monitor your mail: Ensure you receive legal notices by keeping your address updated with creditors and courts.

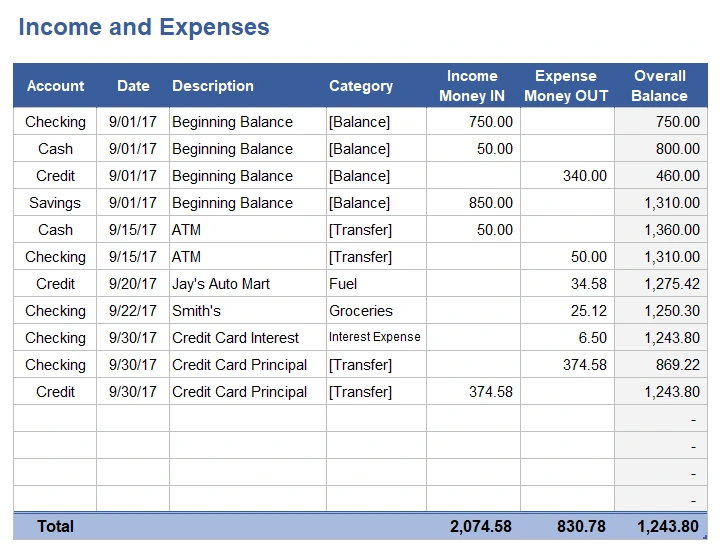

- Check wage statements: Review your pay stubs regularly for unexplained deductions.

- Communicate with HR: Ask your employer’s payroll department to alert you if they receive a garnishment order.

Can the government garnish your wages without notice?

When Can the Government Garnish Your Wages?

The government can garnish your wages under specific circumstances, typically when you owe certain types of debt. However, advance notice is usually required unless exceptional conditions apply. Common scenarios include:

- Unpaid taxes: The IRS can garnish wages without court approval but must first notify you.

- Defaulted student loans: Federal agencies may garnish up to 15% of disposable earnings after sending a notice.

- Child support or alimony: Courts can order immediate garnishment, but you’ll still receive a formal notice.

What Are the Legal Protections Against Wage Garnishment?

Federal and state laws provide safeguards to limit how much can be garnished and ensure due process:

- Consumer Credit Protection Act (CCPA): Caps garnishments at 25% of disposable income or 30 times the federal minimum wage per week, whichever is lower.

- Right to challenge: You can request a hearing to dispute the garnishment if the notice was incorrect or unfair.

- Exemptions: Certain incomes, like Social Security or veterans’ benefits, are protected from most garnishments.

How to Respond to a Wage Garnishment Notice?

If you receive a garnishment notice, take these steps to address the situation:

- Verify the debt: Confirm the legitimacy of the claim by reviewing the notice details and contacting the issuing agency.

- Negotiate alternatives: Propose a payment plan or settlement to avoid garnishment.

- Seek legal help: Consult an attorney to explore defenses, such as incorrect amounts or protected income status.

Will I be notified if my check is garnished?

Will I Receive a Notice Before My Check Is Garnished?

Yes, you will typically receive a notice before your check is garnished. The process involves several steps, and notification is usually required by law. Here’s what you can expect:

- Court Order or Legal Demand: Creditors must first obtain a judgment against you, which is then sent to your employer.

- Employer Notification: Your employer is legally required to notify you of the garnishment before deducting funds from your paycheck.

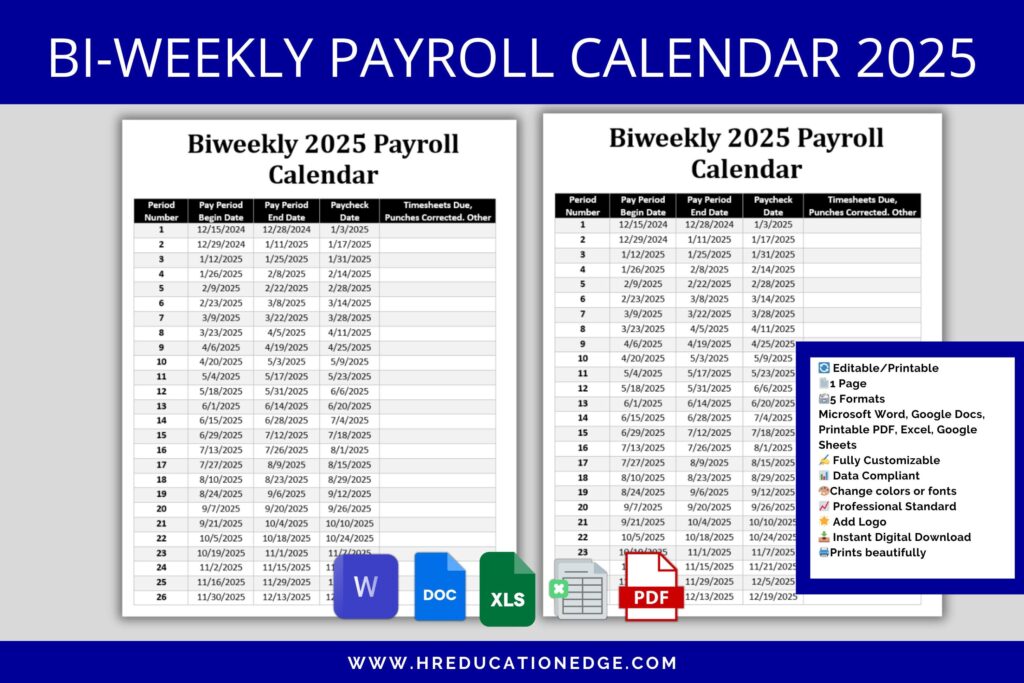

- Time Frame: Notices are usually sent within a few days of the court order or garnishment request.

What Information Is Included in a Garnishment Notice?

A garnishment notice contains key details about the process. Below are the most important elements you’ll find:

- Creditor’s Name: Identifies who is initiating the garnishment.

- Amount Being Garnished: Specifies the percentage or fixed amount being withheld from your paycheck.

- Duration: States how long the garnishment will continue unless you take action.

Can I Contest a Garnishment After Being Notified?

Yes, you have the right to challenge a garnishment if you believe it’s unjust or incorrect. Here’s what you can do:

- File an Exemption Claim: Some wages, like Social Security or disability payments, may be protected.

- Request a Hearing: You can dispute the garnishment in court if proper notice wasn’t given or if errors exist.

- Negotiate with Creditor: In some cases, you may arrange a repayment plan to stop the garnishment.

Will my boss know if my wages are garnished?

Does the Employer Get Notified When Wages Are Garnished?

Yes, your employer will be notified if your wages are garnished. The court or agency ordering the garnishment sends a legal notice to your employer, requiring them to withhold a portion of your paycheck to satisfy the debt. Here’s how the process typically works:

- Court order or administrative notice is sent directly to your employer.

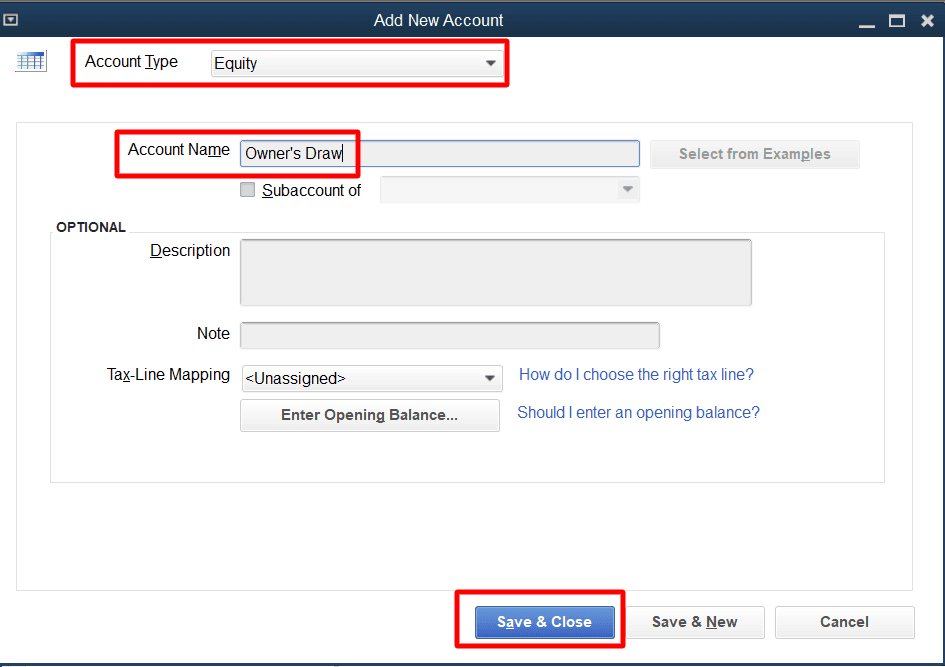

- Your employer’s payroll department processes the garnishment and deducts the required amount.

- The employer must comply with the garnishment by law and cannot ignore it.

What Information Does the Boss Receive About the Garnishment?

While your boss or supervisor may not always be directly informed, the payroll or HR department will handle the garnishment. Here’s what they might see:

- The reason for garnishment (e.g., child support, taxes, or creditor debt).

- The amount or percentage to be withheld from your paycheck.

- The duration of the garnishment unless the debt is paid earlier.

Can You Prevent Your Boss from Finding Out About Wage Garnishment?

It is unlikely you can completely prevent your employer from knowing, but here are some steps to minimize exposure:

- Communicate privately with HR to ensure confidentiality.

- Address the debt directly to stop the garnishment early.

- Review state laws, as some protect employee privacy more than others.

Frequently Asked Questions

1. What should I do if my employer didn’t notify me about a wage garnishmen t?

If your employer failed to inform you about a wage garnishment, the first step is to request documentation from your payroll or HR department. Federal law generally requires creditors or courts to notify you before garnishment begins, but your employer may not be legally obligated to provide a separate notice. However, they must comply with the garnishment order once received. You should also contact the issuing agency or creditor to verify the legitimacy of the garnishment and understand your rights.

2. Is my employer legally required to notify me about wage garnishment?

In most cases, employers are not legally required to notify employees about wage garnishment, as the initial notice typically comes from the court or creditor. However, employers must follow the garnishment order and deduct wages accordingly. If you suspect improper handling, review the Consumer Credit Protection Act (CCPA) or consult an employment attorney to ensure your rights are protected.

3. Can I dispute a wage garnishment if I wasn’t properly notified?

Yes, you can dispute the garnishment if you did not receive proper notice from the creditor or court. File a claim or motion in the court that issued the order, stating your case for insufficient notification. Depending on the circumstances, the court may pause or cancel the garnishment. Act quickly, as there are often strict deadlines for disputing such orders.

4. What protections do I have if my employer incorrectly processes my wage garnishment?

The CCPA limits garnishment amounts to a percentage of your disposable earnings, and your employer must comply with these rules. If they deduct more than legally allowed or garnish wages without a valid order, you may have grounds for legal action. Document all discrepancies and seek assistance from the Department of Labor or a legal professional to recover improperly withheld wages.