As a shareholder in an S corporation, understanding your tax obligations is crucial for maintaining compliance and avoiding unnecessary financial burdens. One common query among S corp owners revolves around unemployment tax, specifically whether they are required to pay it. Unemployment tax is typically associated with funding state unemployment insurance, but its applicability to S corp owners can be complex. This article delves into the specifics of whether S corp owners need to pay unemployment tax, exploring the relevant regulations and exceptions that apply to different situations, to provide clarity on this often-misunderstood topic.

Understanding Unemployment Tax Obligations for S Corp Owners

S Corp owners often have questions about their tax obligations, including whether they need to pay unemployment tax. Unemployment tax is a federal and state tax that employers pay to fund unemployment benefits for workers who lose their jobs through no fault of their own. To determine if S Corp owners need to pay unemployment tax, it’s essential to understand the tax laws and regulations surrounding S Corporations.

What is Unemployment Tax?

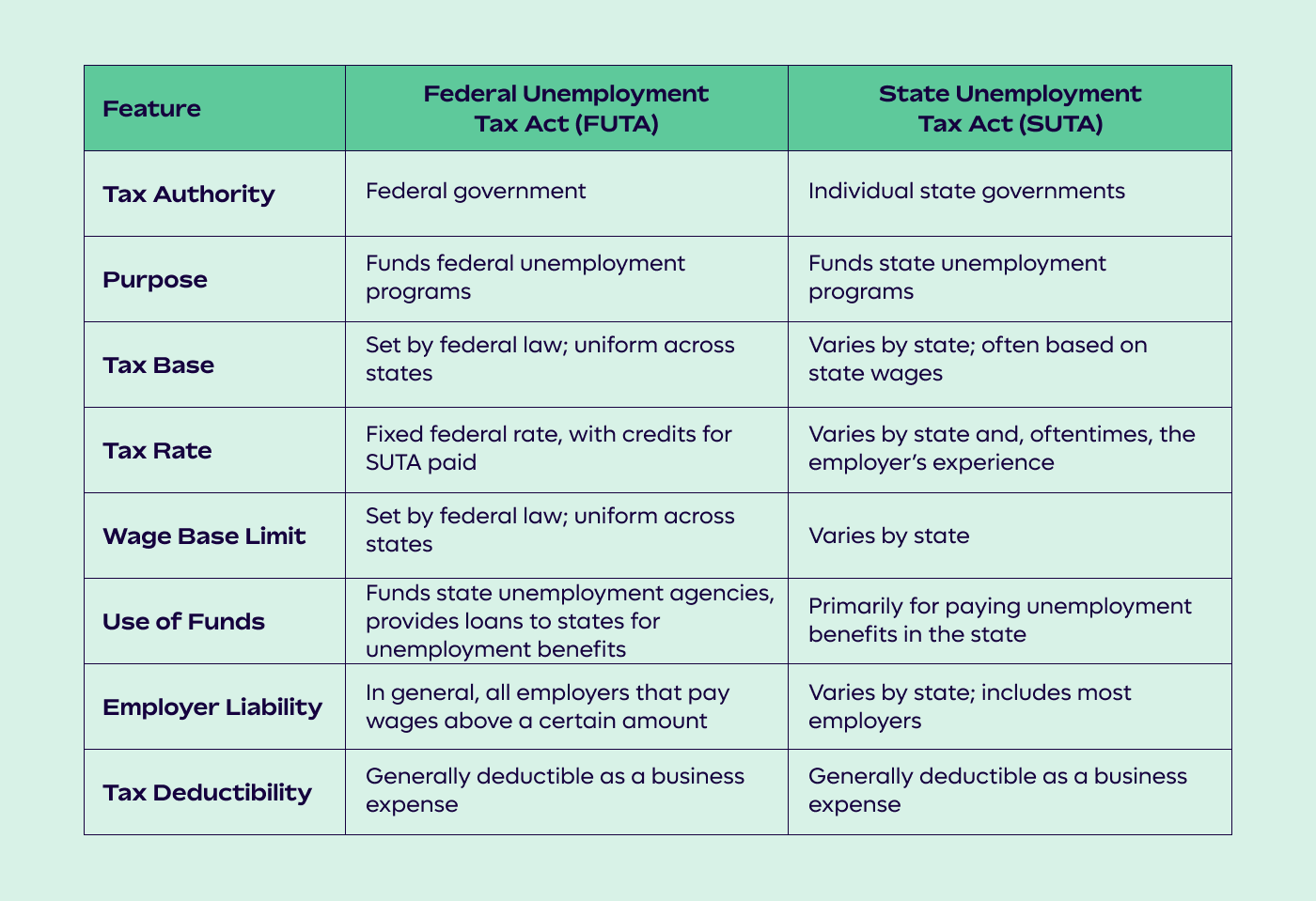

Unemployment tax is a type of payroll tax that employers pay on a portion of their employees’ wages. The tax is used to fund state and federal unemployment insurance programs, which provide financial assistance to workers who become unemployed. The Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA) govern the unemployment tax.

S Corp Ownership and Employment Status

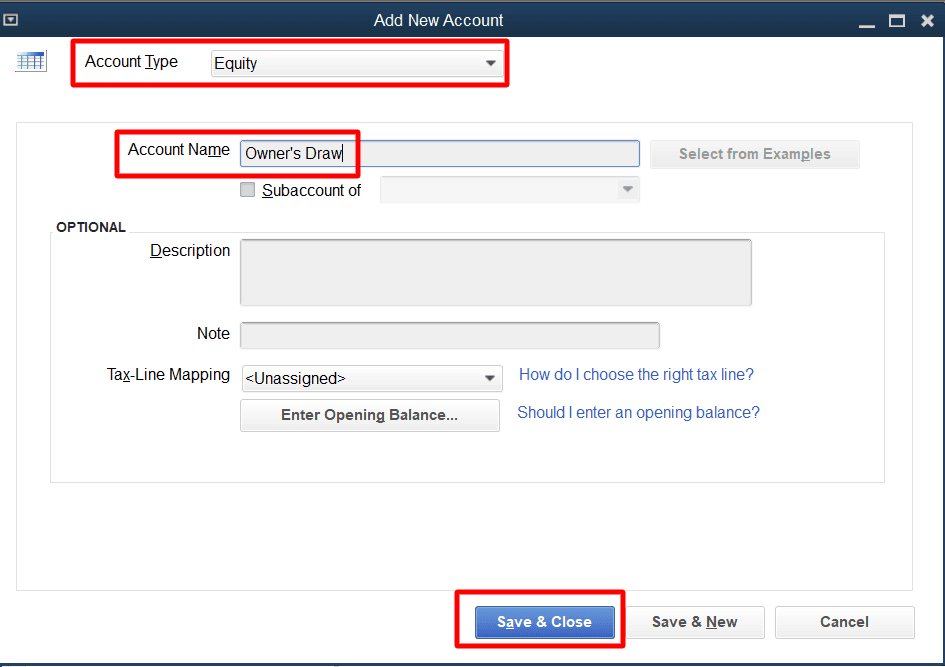

To determine if S Corp owners need to pay unemployment tax, it’s crucial to understand their employment status. S Corp owners who own more than 2% of the corporation’s stock are considered self-employed and are not treated as employees for tax purposes. As a result, they are not subject to unemployment tax on their distributions or salary.

Unemployment Tax Exemptions for S Corp Owners

S Corp owners who are considered self-employed are exempt from unemployment tax. However, S Corp owners who receive a salary as an employee of the corporation may be subject to unemployment tax on their wages. The corporation must pay unemployment tax on the wages paid to its employees, including S Corp owners who are also employees.

| S Corp Owner Status | Unemployment Tax Liability |

|---|---|

| More than 2% owner | Exempt from unemployment tax |

| Employee of the S Corp | Subject to unemployment tax on wages |

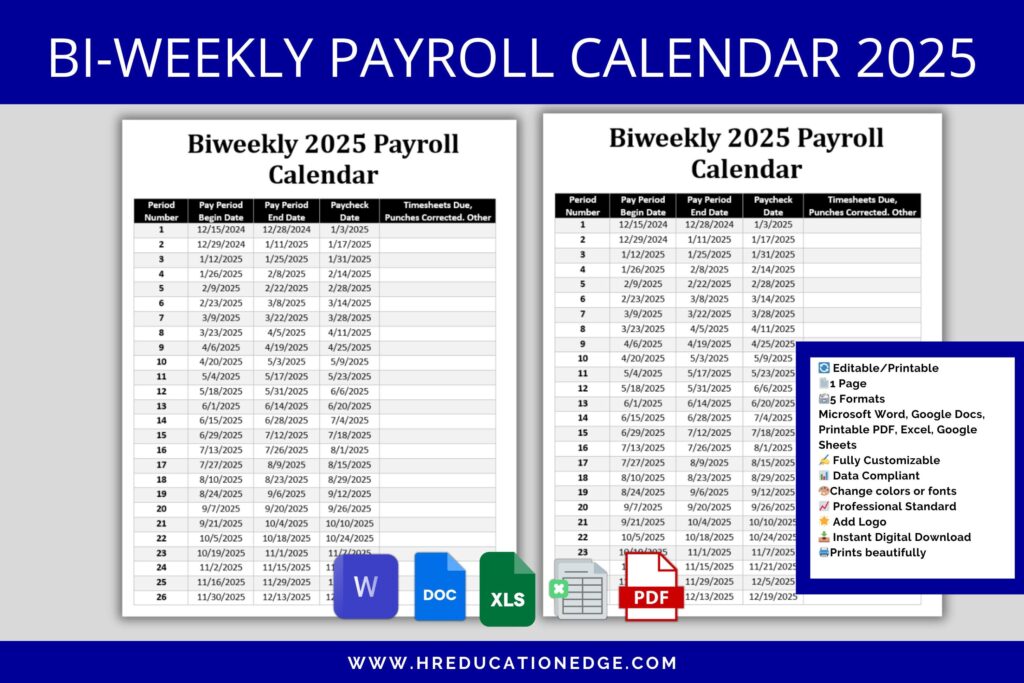

Reporting Unemployment Tax for S Corps

S Corps must report unemployment tax on their employees’ wages using Form 940, the Employer’s Annual Federal Unemployment (FUTA) Tax Return. The corporation must also file state unemployment tax returns and pay any required state unemployment tax.

Implications for S Corp Owners

S Corp owners who are considered self-employed should understand that they are not eligible for unemployment benefits if they lose their income from the S Corp. However, they may be able to claim other tax benefits, such as deductions for business expenses, to reduce their tax liability.

Do S Corp owners have to pay federal unemployment tax?

In general, S Corporation owners, also known as shareholders, are not considered employees of the corporation for tax purposes, unless they are also employees of the corporation. As a result, they are not subject to federal unemployment tax, also known as FUTA (Federal Unemployment Tax Act) tax, on their share of the corporation’s income. However, if an S Corp owner is also an employee of the corporation, their wages are subject to FUTA tax.

FUTA Tax Exemption for S Corp Owners

S Corp owners who are not employees of the corporation are exempt from FUTA tax. This is because FUTA tax is typically paid by employers on the wages of their employees. Since S Corp owners are not considered employees, they are not subject to FUTA tax on their share of the corporation’s income. The following are some key points to consider:

- S Corp owners are not considered employees for tax purposes, unless they are also employees of the corporation.

- FUTA tax is paid by employers on the wages of their employees.

- S Corp owners who are not employees are exempt from FUTA tax on their share of the corporation’s income.

Exceptions to FUTA Tax Exemption

While S Corp owners who are not employees are generally exempt from FUTA tax, there are some exceptions to consider. For example, if an S Corp owner is also an employee of the corporation, their wages are subject to FUTA tax. Additionally, if an S Corp owner is considered a statutory employee, they may also be subject to FUTA tax. The following are some key points to consider:

- If an S Corp owner is also an employee of the corporation, their wages are subject to FUTA tax.

- Statutory employees may be subject to FUTA tax, even if they are S Corp owners.

- S Corp owners who are not employees or statutory employees are generally exempt from FUTA tax.

Implications for S Corp Owners

The exemption from FUTA tax can have significant implications for S Corp owners. For example, S Corp owners who are not employees may not be eligible for unemployment benefits if they lose their income. Additionally, S Corp owners may need to consider other tax planning strategies to minimize their tax liability. The following are some key points to consider:

- S Corp owners who are not employees may not be eligible for unemployment benefits.

- S Corp owners may need to consider other tax planning strategies to minimize their tax liability.

- S Corp owners should consult with a tax professional to understand their specific tax obligations and opportunities.

Do business owners have to pay unemployment on themselves?

Business owners, particularly those who are self-employed or own pass-through entities, have varying obligations regarding unemployment insurance. The requirement to pay unemployment insurance on themselves depends on the business structure and the state’s regulations.

Understanding Unemployment Insurance for Business Owners

Unemployment insurance is a program designed to provide financial assistance to workers who lose their jobs through no fault of their own. For business owners, the rules surrounding unemployment insurance can be complex. In general, self-employment income is not subject to unemployment insurance taxes. However, business owners who have employees may be required to pay unemployment insurance taxes on those employees’ wages. The specifics can vary significantly by state, with some states offering voluntary coverage for certain types of business owners.

- The type of business entity (sole proprietorship, partnership, S corporation, etc.) can affect whether the owner is considered an employee for unemployment insurance purposes.

- State regulations play a significant role in determining the requirements for unemployment insurance coverage for business owners and their employees.

- Business owners who are considering their obligations under unemployment insurance laws should review their state’s specific regulations and possibly consult with a tax professional or accountant.

Business Structures and Unemployment Insurance

The structure of the business can significantly impact whether a business owner must pay unemployment insurance on themselves. For example, S corporation shareholders who receive a salary may be subject to unemployment insurance taxes on their wages, but not on their distributions. In contrast, sole proprietors typically do not pay themselves a salary in the traditional sense and thus are not subject to unemployment insurance taxes on their business income.

- S corporations and C corporations may be required to pay unemployment insurance taxes on the wages of their employees, including owner-employees who receive a salary.

- Partnerships and limited liability companies (LLCs) that are treated as pass-through entities for tax purposes generally do not pay unemployment insurance taxes on the income distributed to their owners.

- The classification of workers as employees versus independent contractors can also impact a business’s unemployment insurance obligations.

Implications for Business Owners

Business owners must understand their obligations regarding unemployment insurance to ensure compliance with state regulations and to manage their business expenses effectively. Non-compliance can result in penalties and fines, making it essential for business owners to be informed.

- Business owners should be aware of the reporting requirements for unemployment insurance taxes and ensure they are meeting these obligations.

- Record keeping is crucial for business owners to demonstrate compliance with unemployment insurance regulations and to facilitate audits or inquiries.

- Consulting with a professional can help business owners navigate the complexities of unemployment insurance and ensure they are taking advantage of available options or exemptions.

Can I collect unemployment if I own an S Corp?

The answer to this question depends on several factors, including the level of involvement you have with the S Corp, your role within the company, and the specific laws governing unemployment benefits in your state. Generally, if you are actively working for your S Corp and receiving a salary, you are considered employed and not eligible for unemployment benefits. However, if you are not actively working for the S Corp and are not receiving a salary, you may be eligible for unemployment benefits.

Understanding S Corp Ownership and Unemployment Benefits

To determine eligibility for unemployment benefits as an S Corp owner, it’s essential to understand how your state’s unemployment agency views S Corp ownership. In many states, S Corp owners are considered self-employed and are not eligible for unemployment benefits unless they have taken specific steps to opt into the state’s unemployment insurance program.

- The level of control you have over the S Corp can impact your eligibility for unemployment benefits, as those with significant control may be viewed as self-employed.

- The specific laws and regulations governing S Corps and unemployment benefits vary by state, so it’s crucial to consult with your state’s unemployment agency.

- Some S Corp owners may be required to make elective coverage choices to be eligible for unemployment benefits.

Factors Affecting Eligibility for Unemployment Benefits

Several factors can affect your eligibility for unemployment benefits as an S Corp owner, including your level of involvement with the company, your income from the S Corp, and whether you have made any elections under the state’s unemployment insurance laws.

- If you are receiving a salary from the S Corp, you are likely considered employed and may not be eligible for unemployment benefits unless you are laid off or your hours are significantly reduced.

- Your level of control and involvement in the day-to-day operations of the S Corp can impact your eligibility, as significant control may classify you as self-employed.

- State laws regarding unemployment insurance for S Corp owners can vary, making it essential to review your state’s specific regulations.

Navigating the Application Process for Unemployment Benefits

If you are an S Corp owner considering applying for unemployment benefits, it’s crucial to understand the application process and what to expect.

- Be prepared to provide detailed information about your S Corp, including your role and level of involvement, as well as your income from the company.

- Consult with your state’s unemployment agency to determine the specific documentation required for your application.

- Understand that the decision to grant unemployment benefits is typically made on a case-by-case basis, taking into account your specific circumstances and the laws of your state.

Are business owners exempt from federal unemployment taxes?

Business owners are generally not exempt from federal unemployment taxes, but there are certain conditions and exceptions that apply. The Federal Unemployment Tax Act (FUTA) requires most employers to pay a tax to fund state unemployment insurance programs. The tax is typically a percentage of the wages paid to employees, and it is used to fund unemployment benefits for workers who lose their jobs through no fault of their own.

FUTA Tax Exemptions for Business Owners

Business owners may be exempt from FUTA taxes if they meet certain conditions. For example, small business owners who pay wages below a certain threshold may be exempt from FUTA taxes. Additionally, certain types of businesses, such as non-profit organizations, may be exempt from FUTA taxes if they meet specific requirements. The following are some key factors that determine FUTA tax exemptions:

- Type of business entity: Certain business entities, such as S corporations and partnerships, may be exempt from FUTA taxes if they meet specific requirements.

- Wage threshold: Businesses that pay wages below a certain threshold, typically $1,500 in a calendar quarter, may be exempt from FUTA taxes.

- Non-profit status: Non-profit organizations that are exempt from income tax under Section 501(c)(3) of the Internal Revenue Code may be exempt from FUTA taxes.

FUTA Tax Implications for Business Owners

Business owners who are not exempt from FUTA taxes must pay the tax on the wages they pay to their employees. The FUTA tax rate is typically 6% of the first $7,000 of wages paid to each employee. However, businesses that pay state unemployment taxes on time can receive a credit of up to 5.4%, reducing the effective FUTA tax rate to 0.6%. The following are some key FUTA tax implications for business owners:

- Tax rate: The FUTA tax rate is typically 6% of the first $7,000 of wages paid to each employee.

- State unemployment taxes: Businesses that pay state unemployment taxes on time can receive a credit of up to 5.4% against their FUTA tax liability.

- Wage base: The FUTA tax is only applied to the first $7,000 of wages paid to each employee.

FUTA Tax Compliance for Business Owners

Business owners who are required to pay FUTA taxes must comply with certain reporting and payment requirements. They must file Form 940 with the IRS to report their FUTA tax liability, and they must make timely payments to avoid penalties and interest. The following are some key FUTA tax compliance requirements for business owners:

- Form 940: Businesses must file Form 940 with the IRS to report their FUTA tax liability.

- Timely payments: Businesses must make timely payments to avoid penalties and interest.

- Record-keeping: Businesses must maintain accurate records of their wages and FUTA tax payments.

Frequently Asked Questions

What is Unemployment Tax and Who Pays It?

The unemployment tax is a type of tax that is used to fund state workforce agencies that provide unemployment benefits to eligible workers who have lost their jobs through no fault of their own. Typically, employers are required to pay this tax, but the specifics can vary depending on the type of business entity and its classification for tax purposes. For S Corp owners, understanding their obligations regarding this tax is crucial for compliance and financial planning.

Are S Corp Owners Considered Employees for Unemployment Tax Purposes?

For S Corporation owners, determining whether they are considered employees for the purpose of unemployment tax is key. If an S Corp owner is also an employee of the corporation, they are subject to the same rules as other employees regarding unemployment insurance. However, the IRS looks closely at the ownership percentage and the level of control the owner has over the business to determine if they are considered an employee or not. Owners with a significant ownership stake, typically 2% or more, may be treated differently.

Do S Corp Owners Need to Pay Unemployment Tax?

The requirement for S Corp owners to pay unemployment tax depends on several factors, including their role within the company and their ownership percentage. Generally, if an S Corp owner is considered an employee and receives a W-2 wage, they are subject to unemployment tax on their wages, just like other employees. However, the corporation must also pay unemployment tax on the wages it pays to its employees, including owner-employees, unless it is exempt or has a zero tax rate due to a good claims history.

How Can S Corp Owners Minimize Their Unemployment Tax Liability?

To minimize their unemployment tax liability, S Corp owners should first ensure they are in compliance with all relevant laws and regulations. Understanding the state unemployment tax laws is crucial since rates and rules vary significantly. Maintaining a good claims history by contesting unjust claims and keeping a stable workforce can also help in reducing unemployment tax rates over time. Additionally, consulting with a tax professional to optimize the corporation’s tax strategy and ensure accurate classification of employees and owners can be beneficial.