In today’s fast-paced business environment, payroll delays can disrupt operations and frustrate employees. Enter same-day payroll processing—a game-changing solution that delivers speed, accuracy, and efficiency. Whether you’re a small business or a large enterprise, modern payroll systems now offer lightning-fast processing, allowing you to complete payroll runs in hours, not days. With advanced automation and real-time integrations, these solutions reduce errors, save time, and enhance compliance. Discover how same-day payroll can streamline your workflow, boost employee satisfaction, and keep your business agile. Explore the cutting-edge tools and technologies that make instant payments possible, transforming the way you manage payroll forever.

Streamline Your Business with Same Day Payroll Processing

Why Choose Lightning-Fast Payroll Processing?

In today’s fast-paced business environment, efficiency and accuracy in payroll processing are critical. Same-day payroll solutions help companies manage employee payments swiftly, reducing administrative burdens and improving employee satisfaction. With automated systems, errors are minimized, and compliance with tax regulations is ensured.

| Benefit | Description |

|---|---|

| Time-Saving | Eliminates delays in payroll cycles |

| Accuracy | Reduces manual errors in calculations |

| Compliance | Ensures adherence to tax laws |

| Employee Satisfaction | Timely payments boost morale |

How Same Day Payroll Enhances Operational Efficiency

Implementing same-day payroll processing optimizes business operations by automating repetitive tasks. This allows HR teams to focus on strategic initiatives rather than manual data entry. Cloud-based platforms enable real-time updates and seamless integration with accounting software.

| Feature | Impact |

|---|---|

| Automation | Reduces manual workload |

| Real-Time Processing | Speeds up payroll execution |

| Integration Capabilities | Connects with HR and accounting systems |

Key Features of a Reliable Same Day Payroll System

A dependable payroll solution includes features like direct deposit, tax filing assistance, and custom reporting. These tools ensure seamless payroll management while reducing compliance risks. Look for systems with user-friendly interfaces and robust security protocols.

| Feature | Benefit |

|---|---|

| Direct Deposit | Ensures instant payments |

| Tax Compliance | Simplifies regulatory adherence |

| Custom Reports | Provides detailed insights |

| Data Security | Protects sensitive information |

Industries That Benefit Most from Same Day Payroll

Industries with fluctuating workforces, such as retail, hospitality, and healthcare, gain significantly from same-day payroll solutions. Businesses with gig workers or contract employees also benefit from instant payment processing to maintain workforce flexibility.

| Industry | Benefits |

|---|---|

| Retail | Manages seasonal hires efficiently |

| Hospitality | Supports high turnover rates |

| Healthcare | Ensures timely payments for temporary staff |

| Gig Economy | Facilitates instant contractor payouts |

Steps to Implement a Same Day Payroll System

Transitioning to same-day payroll requires careful planning. Begin by assessing your current payroll structure, then select a software provider that fits your needs. Train your HR team, conduct a test run, and finalize the integration with existing financial systems.

| Step | Action |

|---|---|

| Evaluate Needs | Identify payroll pain points |

| Choose Software | Select a scalable payroll solution |

| Training | Educate staff on system usage |

| Testing | Ensure smooth payroll execution |

| Integration | Link with accounting and HR tools |

Can payroll be processed the same day?

Can Payroll Be Processed the Same Day?

Yes, payroll can be processed the same day, but it depends on several factors, including the payroll system used, the timeliness of data submission, and whether same-day funding is available. Manual payroll methods may struggle with tight deadlines, while automated payroll systems can expedite the process. Additionally, same-day direct deposit services from some banks or payroll providers enable employees to receive their wages immediately.

What Factors Determine Same-Day Payroll Processing?

Several key factors influence whether payroll can be processed on the same day:

- Payroll software or provider: Automated systems like ADP, Gusto, or QuickBooks can process payroll faster than manual methods.

- Banking cut-off times: Many banks have deadlines for same-day direct deposits, so submissions must meet these timelines.

- Employee data accuracy: Errors in timesheets, tax forms, or bank details can delay same-day processing.

What Are the Benefits of Same-Day Payroll Processing?

Same-day payroll offers advantages for both employers and employees:

- Improved employee satisfaction: Employees appreciate immediate access to earned wages, boosting morale.

- Emergency flexibility: Workers facing urgent financial needs benefit from quick payments.

- Operational efficiency: Automated payroll reduces administrative delays and human errors.

What Are the Limitations of Same-Day Payroll?

Despite its benefits, same-day payroll has challenges:

- Higher costs: Some payroll providers charge extra for expedited processing and same-day funding.

- Time-sensitive requirements: Late submissions of timesheets or approvals can prevent same-day execution.

- Bank processing delays: Even if payroll is processed, some banks may take 1-2 days to credit accounts.

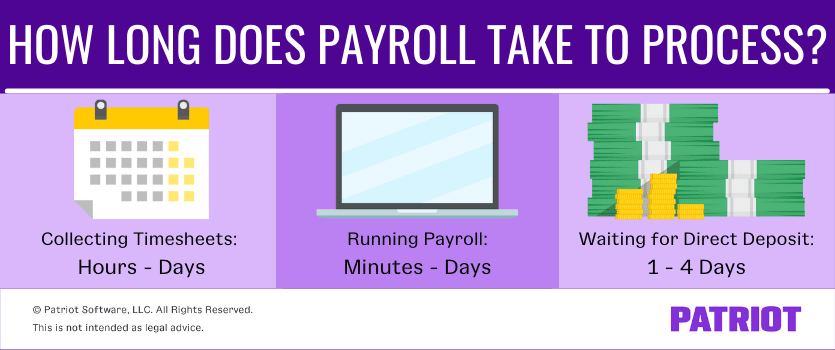

How fast can payroll be processed?

Factors Affecting Payroll Processing Speed

The speed at which payroll can be processed depends on several key factors. Automation, workforce size, and compliance requirements play a significant role in determining how quickly payroll can be completed. Here are the most influential factors:

- Payroll Software: Automated systems drastically reduce time by handling calculations, tax filings, and direct deposits instantly.

- Employee Count: Larger workforces require more time for verification and data entry, while smaller teams allow faster processing.

- Compliance Checks: Ensuring adherence to labor laws and tax regulations may delay processing if manual reviews are needed.

Standard Payroll Processing Timelines

Different businesses follow varying timelines for payroll processing, depending on their operational needs. Here’s a breakdown of common processing speeds:

- Same-Day Payroll: Some advanced systems can process payments within hours, ideal for gig workers or freelancers.

- 2–3 Business Days: Most mid-sized companies using semi-automated tools fall within this range.

- Weekly/Biweekly Cycles: Traditional payroll schedules often take 3–5 days due to manual verification steps.

Ways to Accelerate Payroll Processing

Businesses can adopt strategies to speed up payroll and minimize delays. Implementing efficiency-driven practices ensures timely payments. Consider these approaches:

- Cloud-Based Solutions: Real-time data access and integration with HR systems streamline the process.

- Employee Self-Service Portals: Reduce administrative tasks by letting staff update their own details.

- Outsourcing Payroll: Third-party providers specialize in fast, error-free processing, freeing up internal resources.

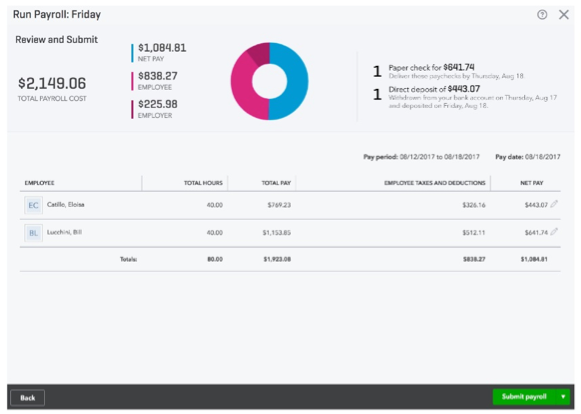

Can QuickBooks do same day payroll?

Does QuickBooks Offer Same-Day Payroll?

Yes, QuickBooks Payroll offers a same-day payroll feature, but it depends on the specific plan and timing. The Intuit QuickBooks Payroll Premium and Elite plans support same-day direct deposit, allowing employees to receive their pay on the same day if the payroll is submitted by the cutoff time. Key conditions include:

- Cutoff times: Payroll must be submitted by 10:30 AM PT (Monday–Friday) for same-day deposit.

- Plan requirements: Only available for Premium and Elite subscriptions.

- Bank eligibility: Requires employee banks to support Rapid Deposit.

What Are the Requirements for QuickBooks Same-Day Payroll?

To use same-day payroll in QuickBooks, certain criteria must be met to ensure timely processing. Here are the essential requirements:

- Subscription tier: You must have either QuickBooks Payroll Premium or Elite.

- Employee setup: Employees must be enrolled in direct deposit with verified banking details.

- Processing deadlines: Payroll submissions must be completed before 10:30 AM PT on a business day.

How Does QuickBooks Same-Day Payroll Compare to Other Options?

QuickBooks same-day payroll is competitive but differs from other payroll providers in speed and flexibility. Consider these comparisons:

- Competitors: Providers like ADP or Gusto may offer next-day payroll but not always same-day.

- Fees: QuickBooks may charge extra fees for expedited processing in lower-tier plans.

- Limitations: Not all banks support Rapid Deposit, delaying funds for some employees.

Frequently Asked Questions

What is same-day payroll processing and how does it work?

Same-day payroll processing refers to the ability to calculate, approve, and distribute employee wages within a single business day. Unlike traditional payroll systems that may take several days, this lightning-fast solution leverages advanced automation software and integrates seamlessly with time-tracking tools and banking systems. Once hours are logged and verified, the system processes deductions, taxes, and net pay instantly, enabling direct deposits or printed checks to be issued on the same day.

Why should businesses consider switching to same-day payroll?

Adopting same-day payroll processing enhances employee satisfaction by providing faster access to earned wages, which can boost morale and productivity. For employers, it minimizes administrative delays, reduces errors through automation, and ensures compliance with real-time tax updates. Small businesses and startups, in particular, benefit from streamlined cash flow management, while larger enterprises can optimize their payroll operations for scalability and efficiency.

Are there any challenges or limitations with same-day payroll solutions?

While same-day payroll offers significant advantages, some challenges include bank processing cutoffs, which may delay payments if submissions are made after deadlines. Additionally, businesses with complex pay structures (e.g., multistate taxes or union rules) may require tailored software configurations. Ensuring data accuracy is critical, as errors must be identified and corrected swiftly to meet tight deadlines. Partnering with a reliable payroll provider can mitigate these hurdles.

How can companies implement same-day payroll processing effectively?

To implement same-day payroll, businesses should first evaluate cloud-based payroll software with robust automation and real-time reporting capabilities. Next, integrate existing HR and accounting systems to eliminate manual data entry. Training staff on timely timekeeping and setting clear payroll submission deadlines are essential steps. Finally, collaborate with banks that support fast ACH transfers to guarantee funds reach employees without delays. Regular audits ensure ongoing efficiency and compliance.