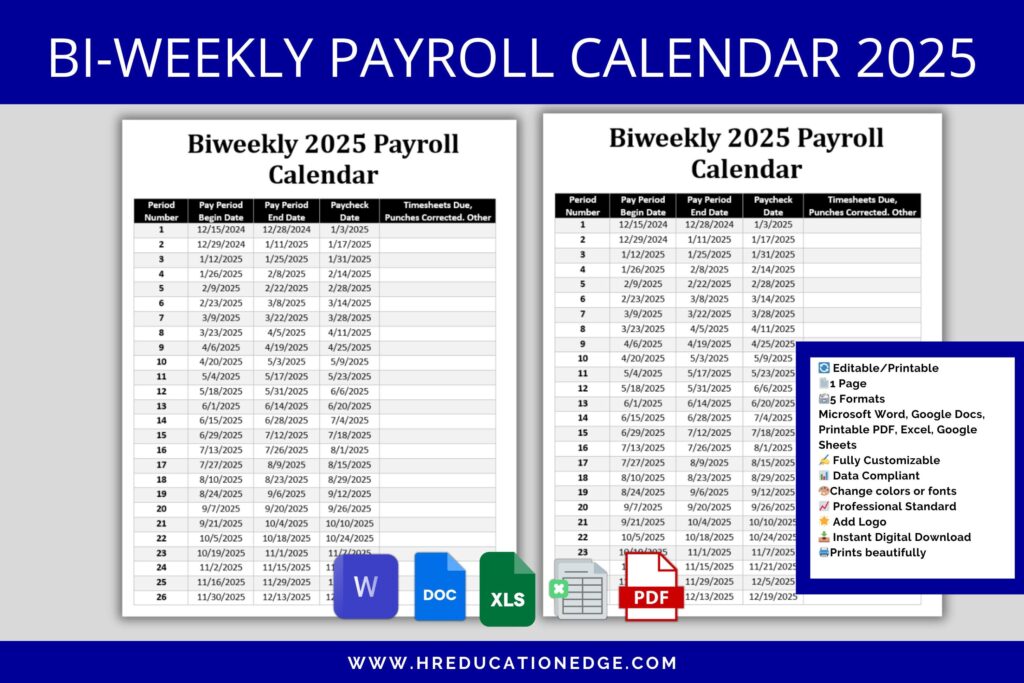

Managing payroll efficiently is critical for any business, and a well-structured biweekly payroll calendar simplifies the process. The Biweekly Payroll Calendar Generator 2025 provides a seamless way to plan pay periods, holidays, and tax deadlines in advance. By customizing your payroll schedule, you can ensure accurate, timely payments while reducing administrative stress. This tool helps businesses of all sizes stay compliant and organized throughout the year. Whether you handle payroll manually or use automated systems, having a clear calendar ensures smoother operations. Create your personalized 2025 Biweekly Payroll Calendar today and streamline your payroll process for the coming year.

How to Use the Biweekly Payroll Calendar Generator for 2025

1. Why Choose a Biweekly Payroll Calendar for 2025?

A biweekly payroll calendar ensures that employees are paid every two weeks, simplifying budgeting and financial planning. In 2025, this system helps businesses maintain consistency, reduce errors, and comply with labor laws. Using a generator automates date calculations, making it easier to schedule payments accurately.

| Advantage | Description |

|---|---|

| Consistency | Paydays occur on the same day every two weeks. |

| Efficiency | Reduces manual calculation errors in payroll processing. |

| Compliance | Helps businesses adhere to labor regulations. |

2. How to Generate Your 2025 Biweekly Payroll Calendar

Creating a biweekly payroll calendar for 2025 is simple with an online generator. Input the first pay period date, and the tool will automatically calculate all subsequent paydays. This ensures accuracy and saves time for HR teams.

| Step | Action |

|---|---|

| 1 | Enter the start date of your first pay period. |

| 2 | Select biweekly as your pay frequency. |

| 3 | Generate and download your customized calendar. |

3. Key Dates in the 2025 Biweekly Payroll Calendar

The 2025 biweekly payroll calendar includes important paydays, tax filing deadlines, and holidays that may affect payroll. Businesses should mark these dates early to avoid delays or penalties.

| Date Type | Example (2025) |

|---|---|

| Paydays | January 10, January 24, etc. |

| Tax Deadlines | April 15 (Q1), June 16 (Q2), etc. |

| Holidays | July 4 (Independence Day), December 25 (Christmas). |

4. Benefits of Automating Your Payroll Calendar

An automated biweekly payroll calendar generator minimizes human error, ensures compliance, and streamlines payroll operations. This is especially useful for businesses managing multiple pay schedules.

| Feature | Impact |

|---|---|

| Automatic Updates | Adjusts for leap years and holidays. |

| Customization | Allows integration with payroll software. |

| Time-Saving | Eliminates manual date entry. |

5. Common Mistakes to Avoid with a Biweekly Payroll Calendar

Errors in payroll scheduling can lead to delayed payments or legal issues. Avoid these mistakes when using a 2025 biweekly payroll calendar generator.

| Mistake | Solution |

|---|---|

| Incorrect Start Date | Double-check the first pay period. |

| Ignoring Holidays | Factor in bank closures for timely payments. |

| Manual Calculations | Rely on a generator tool for accuracy. |

How do I create a payroll calendar?

Step-by-Step Guide to Creating a Payroll Calendar

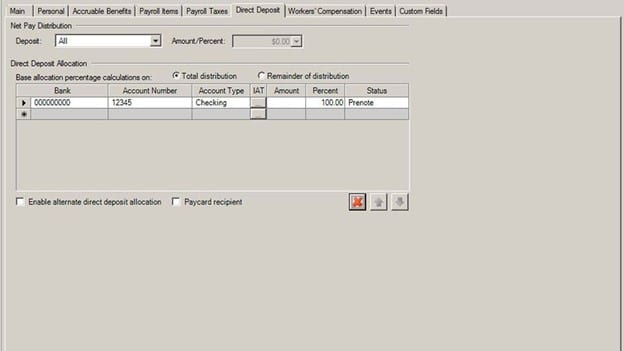

To create a payroll calendar, follow these steps to ensure accuracy and compliance with labor laws. First, determine your pay frequency, whether weekly, biweekly, semi-monthly, or monthly. Next, identify key dates like pay periods, paydays, and tax deadlines. Use a spreadsheet or payroll software to organize these dates. Finally, communicate the calendar to employees and update it annually.

- Choose a pay frequency that complies with state and federal regulations.

- Mark pay periods and paydays, accounting for holidays and weekends.

- Review and distribute the calendar to employees and stakeholders.

Key Components of an Effective Payroll Calendar

An effective payroll calendar includes critical components to avoid errors and delays. It must clearly outline start and end dates for each pay period, along with corresponding paycheck issuance dates. Include deadlines for timesheet submissions and payroll processing. Additionally, note any holidays or company closures that may affect payroll timelines.

- Define pay periods with start and end dates for accurate tracking.

- Highlight payday deadlines to ensure timely payments.

- Include tax and reporting due dates to avoid penalties.

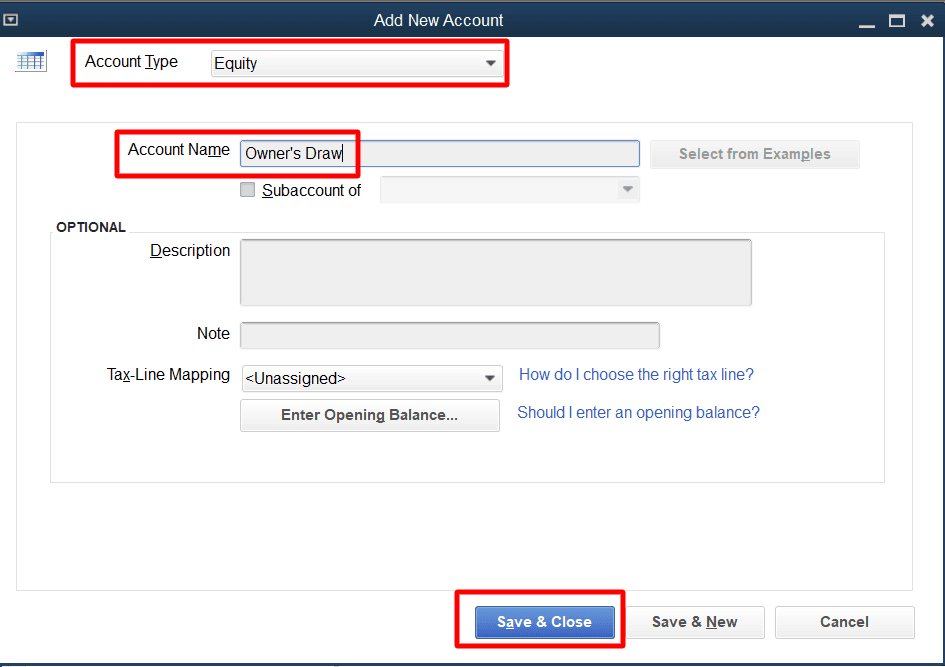

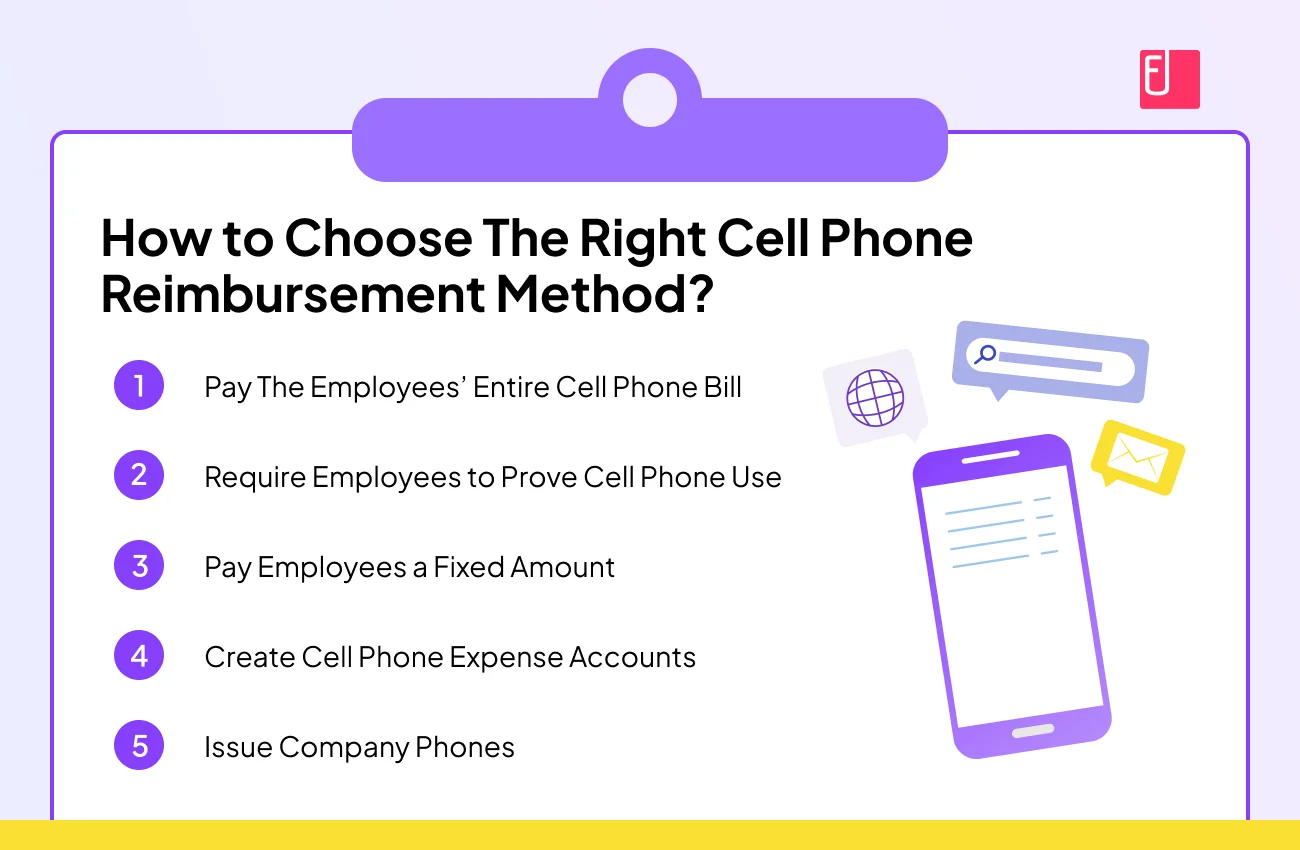

Tools and Software for Managing Payroll Calendars

Using specialized tools and software simplifies payroll calendar management. Popular options include QuickBooks, Gusto, and ADP, which automate date tracking and send reminders. Spreadsheets like Excel or Google Sheets are also useful for manual tracking. Ensure the tool you choose integrates with your accounting system and supports compliance updates.

- Invest in payroll software for automation and accuracy.

- Use templates if managing payroll manually in spreadsheets.

- Sync with accounting systems to streamline data flow.

Why are there 27 pay periods in 2025?

How Does the Calendar Year Affect Pay Periods?

The number of pay periods in a year depends on the frequency of payments and how the days align with the calendar. In 2025, there are 27 pay periods for those paid biweekly (every two weeks) because the year contains 365 days, which is 1 day more than the 52 weeks typically used to calculate 26 pay periods. Since 2025 starts on a Wednesday, the extra day causes an additional pay period for some pay schedules.

- Biweekly pay results in 26 payments in most years, but an extra one occurs when the year starts mid-week.

- 365-day years don’t divide evenly into 14-day pay cycles, creating an occasional 27th pay period.

- Payroll adjustments may be needed for salaried employees to account for the extra period without overpayment.

How Does a Biweekly Pay Schedule Work?

A biweekly pay schedule means employees are paid every 14 days, totaling 26 pay periods in most years. However, when the first pay date of the year falls early in the week (like Wednesday in 2025), the accumulated days push the total to 27 pay periods. Employers must adjust budgets and salary calculations to accommodate this shift.

- 26 pay periods are standard for biweekly pay, but a 27th occurs roughly every 11 years.

- Weekly alignment determines whether the extra pay period happens, based on the year’s start date.

- Payroll systems must be programmed to handle the irregularity to prevent financial discrepancies.

What Are the Financial Implications of 27 Pay Periods?

For salaried employees, an extra pay period can complicate annual salary distributions. Employers might divide the yearly salary by 27 instead of 26, reducing each paycheck slightly. Alternatively, some may treat it as a bonus period, requiring careful financial planning.

- Salary proration ensures employees aren’t overpaid by adjusting per-check amounts.

- Budget reviews are necessary for companies to manage the extra payroll expense.

- Tax withholding may differ slightly due to the additional paycheck, affecting annual tax filings.

What is an example of a biweekly payroll schedule?

Understanding a Biweekly Payroll Schedule

A biweekly payroll schedule means employees are paid every two weeks, typically resulting in 26 pay periods per year. For example, if a company’s payday is every other Friday, employees receive their wages on those designated Fridays. This structure is popular because it balances consistency for employees and administrative efficiency for employers.

- Frequency: Payments occur every 14 days, aligning with a two-week cycle.

- Pay periods: Each pay period covers exactly two weeks of work, simplifying hour calculations.

- Overtime: For nonexempt employees, overtime is easier to track over a fixed two-week span.

Example of a Biweekly Pay Period

An example of a biweekly payroll could involve paydays on alternating Fridays, such as January 5th and January 19th. Employers process payroll a few days before the payday to account for holidays or banking delays. This ensures employees receive their wages on time.

- Set dates: Paydays fall on the same weekday every two weeks (e.g., every other Friday).

- Consistency: Employees can anticipate paychecks on a predictable schedule.

- Budgeting: Both employers and employees benefit from regular, evenly spaced pay periods.

Advantages of a Biweekly Pay Schedule

A biweekly pay schedule offers several benefits, including simplified payroll processing and better financial planning for employees. Employers often prefer it because it reduces the frequency of payroll runs compared to weekly pay.

- Reduced paperwork: Processing payroll 26 times a year instead of 52 (weekly) lowers administrative costs.

- Overtime compliance: Simplified tracking of overtime for hourly workers within defined two-week periods.

- Employee satisfaction: Regular paydays help employees manage their finances more effectively.

Frequently Asked Questions

What is a Biweekly Payroll Calendar Generator?

A Biweekly Payroll Calendar Generator is a tool designed to help businesses and employers create a customized pay schedule for the year 2025. This tool ensures that employees receive their wages every two weeks, typically resulting in 26 pay periods annually. By using this generator, you can automate the process of determining exact pay dates, holidays, and weekends, streamlining payroll management and reducing manual errors.

Why should I use a Biweekly Payroll Calendar for 2025?

Using a Biweekly Payroll Calendar for 2025 provides consistency and clarity for both employers and employees. It simplifies budgeting by ensuring payroll is processed on fixed dates, avoids confusion around holidays, and helps with compliance by keeping track of deadlines. Additionally, a biweekly schedule often aligns better with employee expectations, as many workers prefer the predictability of receiving their paychecks every two weeks.

How do I create a Biweekly Payroll Calendar for 2025?

Creating a Biweekly Payroll Calendar for 2025 is straightforward with a generator tool. First, select your preferred start date for the payroll cycle. Then, the tool will automatically calculate all subsequent pay periods, accounting for weekends and holidays. You can then download or print the calendar for easy reference. Some tools even allow customization to include company-specific details, such as payday approval deadlines or direct deposit processing times.

Can I customize the Biweekly Payroll Calendar to fit my company’s needs?

Yes, a Biweekly Payroll Calendar Generator typically offers customization options to accommodate your business’s unique requirements. You can adjust for different pay periods, incorporate company holidays, or set specific cutoff dates for timesheet submissions. Some tools also let you add notes or reminders for payroll administrators, ensuring smooth operations. This flexibility makes it an essential resource for businesses of all sizes.