Attracting top talent is a significant challenge for small business owners, who often find themselves competing against larger corporations with deeper pockets. One effective way to level the playing field is by offering competitive benefits packages that cater to the diverse needs of potential employees. By doing so, small businesses can not only attract but also retain skilled professionals. Here are some of the best benefits packages that small business owners can consider to draw in the best talent and foster a loyal and productive workforce.

Attracting Top Talent with Competitive Benefits Packages

To attract the best talent, small business owners must offer more than just a competitive salary. A comprehensive benefits package is essential in today’s job market, as it not only helps to attract top performers but also retains existing employees and promotes overall job satisfaction. By understanding the importance of benefits packages and tailoring them to meet the needs of their workforce, small business owners can gain a competitive edge in the market.

Understanding the Importance of Benefits Packages

Benefits packages are a crucial component of an employee’s overall compensation. They can include a range of perks, from health insurance and retirement plans to paid time off and flexible work arrangements. By offering a well-structured benefits package, small business owners can demonstrate their commitment to their employees’ well-being and job satisfaction.

| Benefits Type | Description |

|---|---|

| Health Insurance | Medical, dental, and vision coverage for employees and their families |

| Retirement Plans | 401(k), IRA, or other plans to help employees save for the future |

| Paid Time Off | Vacation days, sick leave, and holidays to promote work-life balance |

Key Components of a Competitive Benefits Package

A competitive benefits package typically includes a combination of core benefits, such as health insurance and retirement plans, as well as additional perks that enhance job satisfaction. By understanding the needs and preferences of their workforce, small business owners can tailor their benefits package to meet the unique needs of their employees.

| Core Benefits | Additional Perks |

|---|---|

| Health Insurance | Flexible Work Arrangements |

| Retirement Plans | Professional Development Opportunities |

| Paid Time Off | Employee Recognition Programs |

Tailoring Benefits Packages to Meet Employee Needs

To maximize the effectiveness of their benefits package, small business owners must understand the unique needs and preferences of their workforce. This can involve conducting employee surveys, gathering feedback, and analyzing industry trends to identify the most valued benefits.

| Employee Needs | Benefits Solutions |

|---|---|

| Work-Life Balance | Flexible Work Arrangements, Paid Time Off |

| Financial Security | Retirement Plans, Life Insurance |

| Health and Wellness | Health Insurance, Wellness Programs |

Communicating Benefits Packages Effectively

Effective communication is critical to ensuring that employees understand and appreciate the value of their benefits package. Small business owners should clearly communicate the details of their benefits package, provide regular updates, and offer support to help employees make informed decisions.

| Communication Channels | Benefits Information |

|---|---|

| Email Notifications | Benefits Package Details |

| Company Intranet | Benefits Enrollment Information |

| HR Support | Benefits-Related Questions and Concerns |

Reviewing and Updating Benefits Packages

To remain competitive, small business owners must regularly review and update their benefits package to ensure it remains relevant and effective. This involves monitoring industry trends, gathering employee feedback, and making adjustments as needed to stay ahead of the curve.

| Review Frequency | Update Triggers |

|---|---|

| Annual Review | Changes in Industry Trends |

| Bi-Annual Review | Employee Feedback and Surveys |

| As Needed | Changes in Business Operations or Workforce Demographics |

What are the benefit packages for small businesses?

The benefit packages for small businesses are designed to attract and retain top talent, improve employee satisfaction, and increase productivity. Competitive benefits are essential for small businesses to stay competitive in the job market. These packages typically include a combination of health insurance, retirement plans, paid time off, and other benefits that cater to the diverse needs of employees.

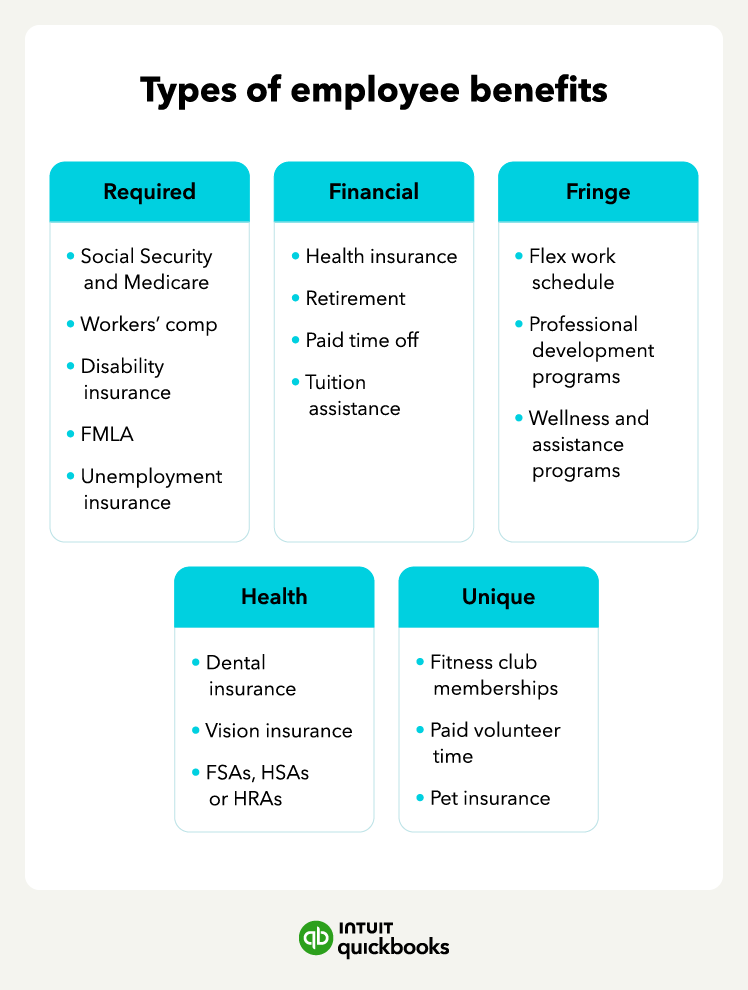

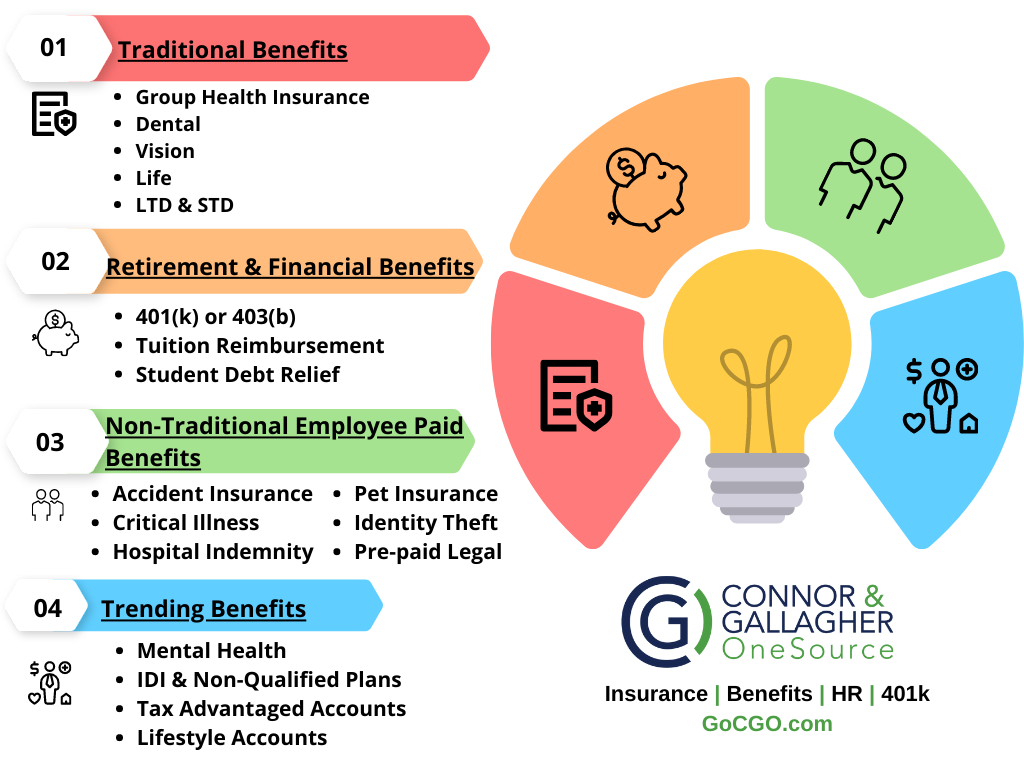

Types of Benefit Packages

Small businesses can choose from a variety of benefit packages to suit their needs and budget. Some popular options include:

- Health and wellness benefits, such as medical, dental, and vision insurance, which help employees maintain their physical and mental health.

- Retirement plans, like 401(k) or SEP-IRA, which enable employees to save for their future and plan for retirement.

- Flexible benefits, including flexible spending accounts (FSAs) or commuter benefits, which allow employees to manage their expenses and improve their work-life balance.

Benefits for Employee Retention

Benefit packages play a crucial role in employee retention, as they demonstrate an employer’s commitment to their employees’ well-being. Some key benefits that contribute to employee retention include:

- Paid time off, which allows employees to recharge and spend time with their loved ones.

- Professional development opportunities, such as training and education assistance, which help employees grow in their careers.

- Employee assistance programs (EAPs), which provide employees with access to counseling, mental health resources, and other support services.

Customizing Benefit Packages

Small businesses can tailor their benefit packages to meet the unique needs of their employees. This can involve:

- Conducting employee surveys to understand their needs and preferences.

- Offering flexible benefit options, such as cafeteria plans or flexible spending accounts, which allow employees to choose the benefits that matter most to them.

- Partnering with benefits providers to offer a range of benefits and services that cater to diverse employee needs.

What is considered a good benefits package?

A good benefits package is considered to be a comprehensive and competitive offering that includes a range of benefits that cater to the diverse needs of employees. Comprehensive health insurance, retirement plans, and paid time off are some of the key components of a good benefits package. Employers who offer a robust benefits package are more likely to attract and retain top talent, as it demonstrates their commitment to supporting the well-being and financial security of their employees.

Key Components of a Good Benefits Package

A good benefits package typically includes a combination of benefits that address the physical, emotional, and financial well-being of employees. Some of the key components include:

- Health Insurance: Comprehensive health insurance that covers medical, dental, and vision expenses is a crucial component of a good benefits package.

- Retirement Plans: Employers who offer retirement plans, such as 401(k) or pension plans, demonstrate their commitment to supporting employees’ long-term financial security.

- Paid Time Off: Paid vacation days, sick leave, and holidays are essential for employees to recharge and maintain a healthy work-life balance.

Additional Benefits that Enhance a Good Benefits Package

In addition to the key components, employers can enhance their benefits package by offering additional benefits that cater to the diverse needs of employees. Some examples include:

- Life Insurance: Offering life insurance can provide employees with peace of mind and financial security for their loved ones.

- Disability Insurance: Disability insurance can help employees who become injured or ill and are unable to work.

- Wellness Programs: Wellness programs, such as gym memberships or mental health resources, can support employees’ overall well-being and productivity.

Best Practices for Implementing a Good Benefits Package

To get the most out of a benefits package, employers should consider best practices for implementation. Some examples include:

- Communicate Benefits Clearly: Employers should clearly communicate the benefits available to employees and provide resources to help them understand their options.

- Regularly Review and Update Benefits: Employers should regularly review and update their benefits package to ensure it remains competitive and relevant to employees’ needs.

- Provide Flexible Benefits Options: Offering flexible benefits options, such as flexible spending accounts or cafeteria plans, can help employees tailor their benefits to their individual needs.

How much do employee benefits cost for a small business?

The cost of employee benefits for a small business can vary widely depending on several factors, including the type and level of benefits offered, the number of employees, and the industry in which the business operates. Generally, employee benefits can range from 10% to 30% of an employee’s salary, with some benefits, such as health insurance, being more costly than others.

Factors Affecting Employee Benefits Costs

The cost of employee benefits is influenced by several factors. The type of benefits offered is a significant factor, with some benefits being more expensive than others. For example, health insurance and retirement plans tend to be more costly than other benefits, such as paid time off or life insurance. Other factors that can affect the cost of employee benefits include the number of employees, the age and health of employees, and the industry in which the business operates.

- The type and level of benefits offered can significantly impact costs.

- The number of employees can also affect the overall cost of benefits.

- The industry in which the business operates can influence the cost of certain benefits, such as workers’ compensation insurance.

Common Employee Benefits and Their Costs

Some common employee benefits and their associated costs include health insurance, retirement plans, and paid time off. The cost of these benefits can vary depending on the specifics of the benefit and the number of employees participating. For example, the cost of health insurance can range from $5,000 to $15,000 per employee per year, depending on the level of coverage and the number of employees covered.

- Health insurance can be one of the most costly benefits, with premiums ranging from $5,000 to $15,000 per employee per year.

- Retirement plans, such as 401(k) plans, can also be costly, with employer matching contributions adding to the expense.

- Paid time off, including vacation days and sick leave, can also impact labor costs.

Strategies for Managing Employee Benefits Costs

To manage employee benefits costs, small businesses can consider several strategies. One approach is to shop around for benefits providers to compare prices and services. Another strategy is to offer flexible benefits, allowing employees to choose the benefits that are most valuable to them. Additionally, small businesses can consider self-funding certain benefits, such as health insurance, to reduce costs.

- Shopping around for benefits providers can help small businesses find the best prices and services.

- Offering flexible benefits can help reduce costs by allowing employees to choose the benefits they need.

- Self-funding certain benefits can also help reduce costs, but may require careful planning and management.

Frequently Asked Questions

What are the most attractive benefits packages for top talent in small businesses?

The most attractive benefits packages for top talent in small businesses typically include a combination of health insurance, retirement plans, and flexible work arrangements. Comprehensive health insurance is a highly valued benefit, as it provides employees with financial protection against medical expenses. Additionally, retirement plans such as 401(k) or SEP-IRAs can help employees save for their future, and flexible work arrangements such as telecommuting or flexible hours can improve work-life balance. Other benefits like paid time off, professional development opportunities, and employee wellness programs can also be attractive to top talent.

How can small business owners afford to offer competitive benefits packages?

Small business owners can afford to offer competitive benefits packages by leveraging group rates for insurance and other benefits, streamlining benefits administration, and negotiating with providers. By pooling their employees together, small businesses can qualify for group rates that are lower than individual rates. Additionally, using benefits administration software can simplify the process of managing benefits and reduce costs. Small business owners can also negotiate with providers to get the best rates and terms for their benefits packages.

What are the tax implications of offering benefits packages to employees?

The tax implications of offering benefits packages to employees vary depending on the type of benefit. Tax-deductible benefits such as health insurance and retirement plans can reduce a small business’s taxable income. However, some benefits like life insurance or disability insurance may have different tax implications. It’s essential for small business owners to consult with a tax professional to understand the tax implications of their benefits packages and ensure compliance with tax laws.

How can small business owners communicate the value of their benefits packages to employees?

Small business owners can communicate the value of their benefits packages to employees by clearly explaining the benefits, providing regular updates, and offering education and support. By providing clear and concise information about their benefits packages, small business owners can help employees understand the value of their benefits. Additionally, regular updates on benefits changes or new offerings can keep employees informed and engaged. Offering education and support can also help employees make the most of their benefits.