Managing payroll efficiently is crucial for any business, and direct deposit offers a convenient solution for both employers and employees. However, choosing the right allocation method for direct deposit can streamline the process further, ensuring accurate and timely payments. This article explores the key allocation methods available—such as percentage-based, fixed-amount, and remainder-based distributions—helping you determine the best approach for your payroll needs. By simplifying fund allocation, businesses can reduce errors, enhance transparency, and improve employee satisfaction. Learn how to optimize your direct deposit system to save time, minimize administrative burdens, and keep your workforce paid effortlessly.

Streamline Your Payroll with an Efficient Allocation Method for Direct Deposit

Detailed Explanation: Implementing an allocation method for direct deposit can significantly reduce payroll complexities, ensuring timely and accurate employee payments. By automating fund distribution, businesses save time, minimize errors, and enhance financial transparency. This approach allows employers to split deposits across multiple accounts (e.g., checking, savings, or retirement) per employee preferences, offering flexibility and convenience.

1. What Is an Allocation Method for Direct Deposit?

The allocation method refers to the system used to distribute employee wages across different bank accounts via direct deposit. Employers can set fixed amounts or percentages for each account, ensuring funds are automatically routed. For example:

| Account Type | Amount ($) | Percentage (%) |

|---|---|---|

| Checking | 1,200 | 60% |

| Savings | 500 | 25% |

| Retirement | 300 | 15% |

—

2. Benefits of Using Allocation in Direct Deposit

The key advantages include: – Time savings: Eliminates manual check processing. – Error reduction: Automated calculations prevent mistakes. – Employee satisfaction: Workers control how their earnings are split. – Cost efficiency: Lowers bank fees and administrative expenses. —

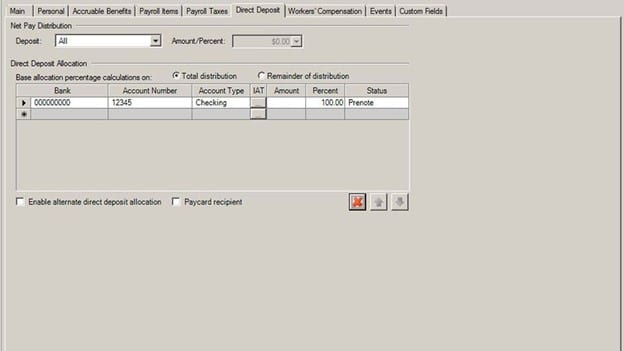

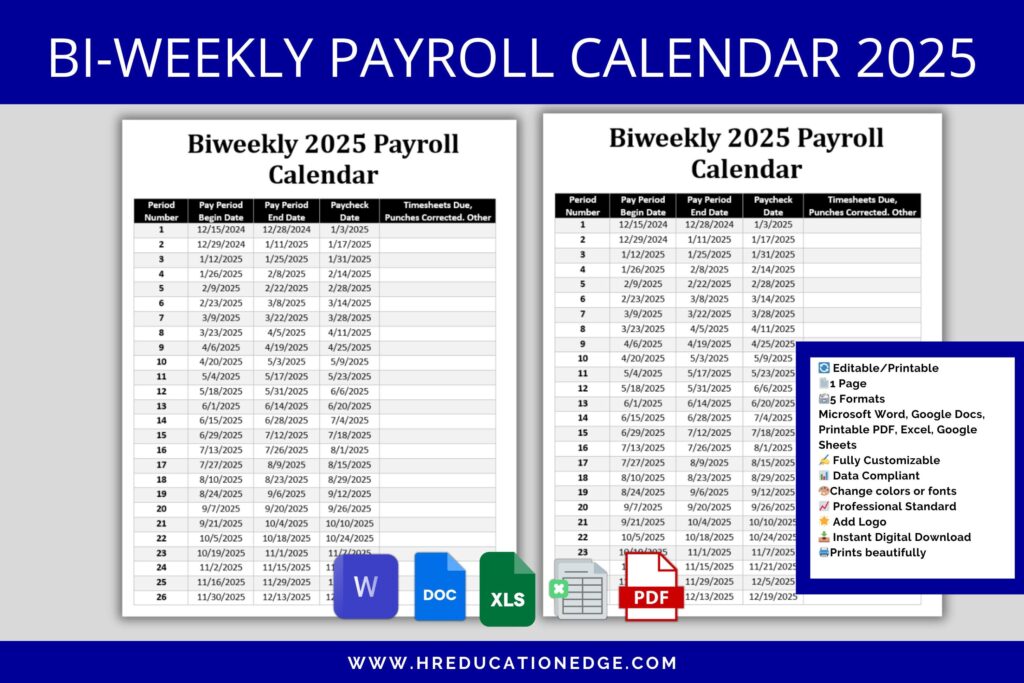

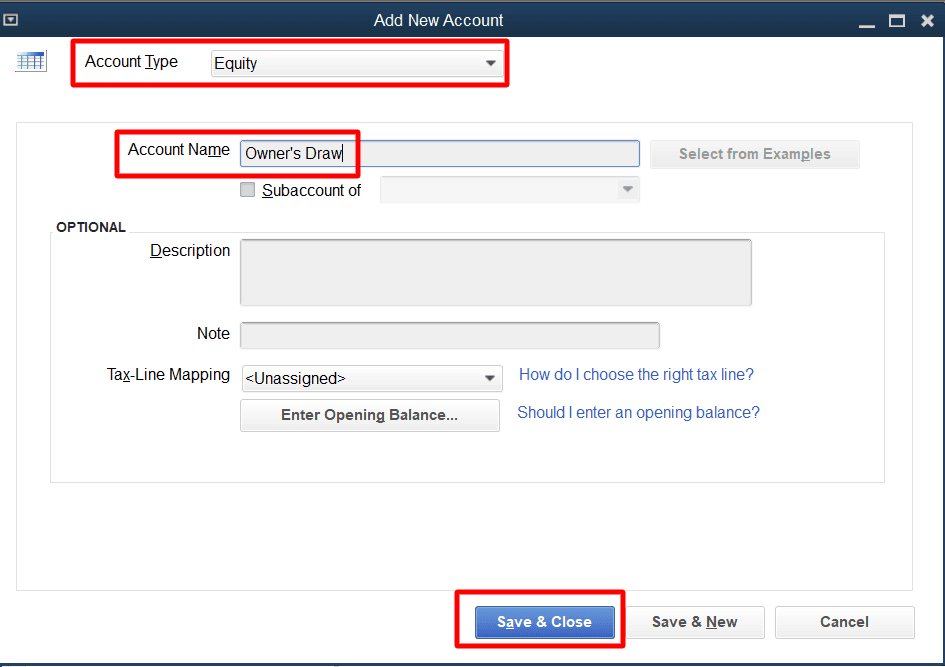

3. How to Set Up Allocation Rules for Payroll

Follow these steps to implement allocation: 1. Collect employee banking details (account numbers, routing info). 2. Define allocation preferences (fixed amounts or percentages). 3. Input rules into payroll software (e.g., QuickBooks, ADP). 4. Run a test batch to verify accuracy before full rollout. —

4. Common Challenges and Solutions

Challenge 1: Employees frequently update account details. – Solution: Use a self-service portal for real-time updates. Challenge 2: Compliance with banking regulations. – Solution: Partner with a payroll provider that ensures legal adherence. —

5. Best Practices for Managing Direct Deposit Allocations

– Audit allocations quarterly to reflect employee changes. – Train HR staff on software usage to avoid misallocations. – Communicate clearly with employees about enrollment deadlines.

Frequently Asked Questions

What is the Allocation Method for Direct Deposit?

The Allocation Method for Direct Deposit is a streamlined approach to managing payroll by distributing an employee’s earnings across multiple bank accounts. Instead of depositing the entire paycheck into a single account, this method allows for automated splits based on predetermined percentages or fixed amounts. It simplifies financial planning for employees and reduces administrative burdens for employers, ensuring efficient fund distribution while maintaining accuracy and compliance with payroll regulations.

How does the Allocation Method improve payroll efficiency?

By using the Allocation Method, employers can automate the direct deposit process, eliminating manual intervention and reducing errors. Employees benefit from seamless fund allocation to savings, checking, or investment accounts without additional paperwork. This method also minimizes processing time and enhances transparency, as payroll teams can quickly verify allocations while employees receive clear breakdowns of their deposits. Overall, it transforms payroll into a faster, error-free system.

Can employees customize their allocation settings?

Yes, most payroll systems supporting the Allocation Method allow employees to personalize their deposit preferences. Through a secure self-service portal, they can specify how their paycheck is split—whether by percentage-based distributions or fixed amounts to different accounts. Employers typically approve these requests to ensure compliance, but the flexibility empowers employees to manage personal finances effortlessly while maintaining direct control over their earnings.

What are the security benefits of the Allocation Method for Direct Deposit?

The Allocation Method enhances security by reducing the need for physical checks or manual bank transfers, which are susceptible to loss or fraud. Since funds are electronically deposited into verified accounts, the risk of interception or unauthorized access is minimized. Additionally, payroll systems often include encryption and multi-factor authentication, ensuring that sensitive banking details remain protected. This method not only safeguards employee earnings but also helps employers maintain compliance with financial security standards.