Providing health insurance for employees is a critical yet often challenging responsibility for small business owners in Maine. With rising healthcare costs, finding affordable coverage that meets both employer budgets and employee needs can seem daunting. Fortunately, Maine offers a variety of health insurance options tailored for small businesses, including group plans, SHOP Marketplace solutions, and cooperatives designed to lower costs. Understanding these choices can help employers secure quality healthcare without straining finances. This article explores key affordable health insurance options available to small businesses in Maine, highlighting coverage types, eligibility criteria, and cost-saving strategies to make informed decisions for your workforce.

Affordable Small Business Health Insurance Options in Maine

1. Understanding Health Insurance Plans for Small Businesses in Maine

Choosing the right health insurance plan for your small business in Maine can be challenging. Options vary depending on the size of your company, budget, and employee needs. In Maine, small businesses (1-50 employees) can access affordable plans through the Small Business Health Options Program (SHOP) or private insurers. Evaluating factors like premium costs, deductibles, and coverage benefits is essential before making a decision.

| Factor | Description |

|---|---|

| Premium | Monthly cost for insurance coverage |

| Deductible | Amount paid before insurance covers costs |

| Coverage | Medical services included in the plan |

2. Top Affordable Health Insurance Providers in Maine

Several insurers offer competitive health insurance plans tailored to small businesses in Maine. Some top providers include Anthem Blue Cross Blue Shield, Harvard Pilgrim, and Aetna. Comparing their offerings can help employers find the best balance of cost and coverage. Many providers offer telehealth services, wellness programs, and discounts for group policies.

| Provider | Key Features |

|---|---|

| Anthem BCBS | Wide network, flexible plans |

| Harvard Pilgrim | Strong wellness incentives |

| Aetna | Telehealth and cost-saving options |

3. How to Qualify for SHOP Marketplace Insurance

Maine’s SHOP Marketplace helps small businesses provide health insurance at competitive rates. To qualify, a business must have 1-50 full-time employees and meet participation requirements (e.g., 70% employee enrollment). The SHOP platform allows employers to compare and purchase plans while potentially qualifying for the Small Business Health Care Tax Credit.

| Requirement | Details |

|---|---|

| Employee Count | 1-50 full-time employees |

| Enrollment Rate | At least 70% participation |

| Tax Credit | Up to 50% of premium costs |

4. Cost-Saving Strategies for Small Business Health Insurance

Reducing healthcare expenses is crucial for small businesses. Employers can save by opting for high-deductible health plans (HDHPs) paired with HSAs (Health Savings Accounts), encouraging preventive care, and negotiating group rates. Another strategy is to offer wellness incentives, lowering long-term insurance costs by promoting employee health.

| Strategy | Potential Savings |

|---|---|

| HDHP + HSA | Lower premiums, tax benefits |

| Wellness Programs | Reduced claims, healthier workforce |

| Group Rate Negotiation | Discounts for bulk enrollment |

5. Key Deadlines and Enrollment Periods in Maine

Staying informed about open enrollment and special enrollment deadlines ensures businesses don’t miss opportunities to secure coverage. The SHOP Marketplace in Maine allows year-round sign-ups for employers, while private insurers may have specific windows. Changes in workforce size or life events (e.g., marriage, birth) can trigger special enrollment periods.

| Event | Enrollment Window |

|---|---|

| SHOP Marketplace | Year-round for employers |

| Private Insurers | Typically November-December |

| Special Enrollment | 60 days after qualifying life event |

How much is health insurance per month in Maine?

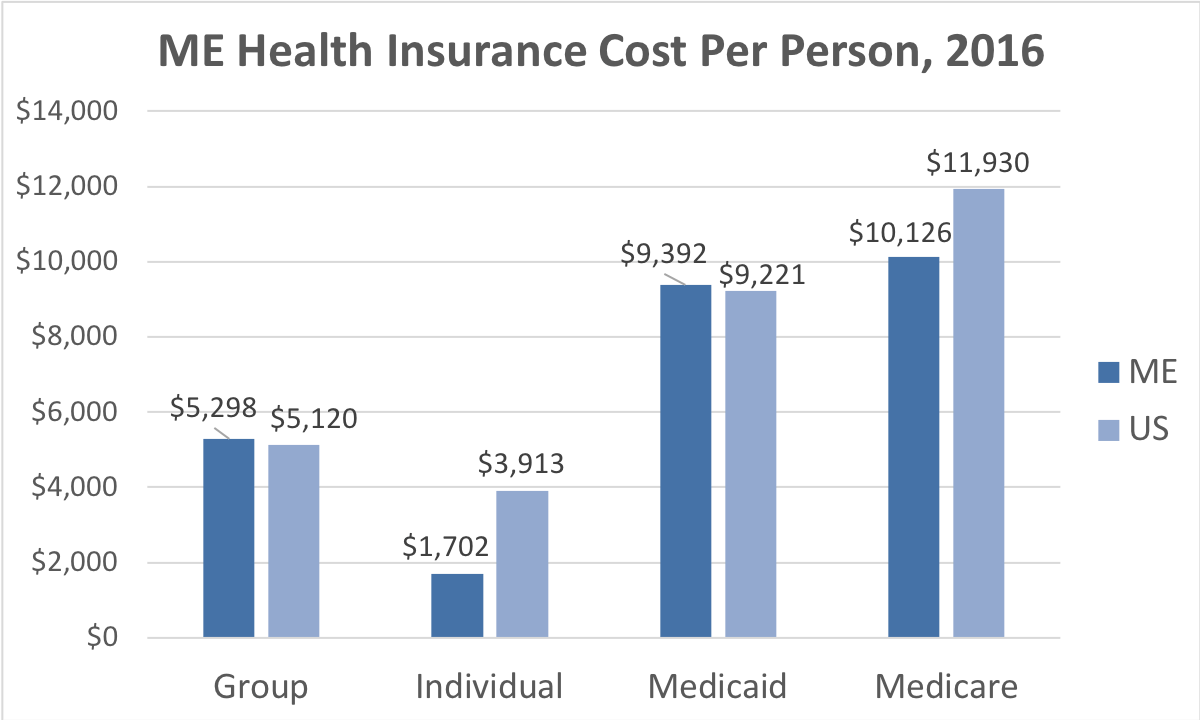

Average Cost of Health Insurance in Maine

The average cost of health insurance in Maine is around $500 to $700 per month for an individual, while a family plan can range from $1,200 to $1,800 monthly. These prices vary based on factors like age, location, and plan type. Maine also offers subsidized plans through the Affordable Care Act (ACA) marketplace, which can lower costs significantly for eligible residents.

- Individual plans typically range from $450 to $900 per month.

- Family plans average between $1,200 and $2,000 monthly.

- ACA subsidies can reduce premiums for qualifying individuals.

—

Factors Affecting Health Insurance Costs in Maine

Several key factors influence how much you pay for health insurance in Maine, including age, tobacco use, and plan tier (Bronze, Silver, Gold, Platinum). Rural areas may have higher premiums due to fewer providers, while urban regions often offer more competitive pricing.

- Age: Older individuals pay higher premiums, sometimes double the rate for younger adults.

- Plan Tier: Bronze plans are cheaper but have higher deductibles, while Platinum plans cost more but offer lower out-of-pocket expenses.

- Location: Counties with fewer insurers may have pricier plans.

—

Low-Cost Health Insurance Options in Maine

Maine residents can access affordable health insurance through Medicaid (MaineCare), the ACA marketplace, or employer-sponsored plans. Some Mainers may qualify for cost-sharing reductions or expanded Medicaid under state programs, reducing monthly expenses.

- MaineCare: Free or low-cost coverage for low-income individuals and families.

- ACA Marketplace: Subsidies based on income can lower premiums.

- Employer Plans: Often cheaper than individual policies if available.

How to reduce small business health insurance costs?

Shop Around and Compare Insurance Plans

One of the most effective ways to reduce small business health insurance costs is to compare multiple providers and plans. Insurance rates and coverage options vary significantly, so researching and negotiating can lead to better deals. Consider the following steps:

- Request quotes from at least three different insurance carriers to evaluate pricing and benefits.

- Use a broker or an online marketplace to simplify the comparison process and find tailored plans.

- Review plan networks to ensure preferred doctors and hospitals are included, avoiding out-of-network costs.

Optimize Plan Design and Employee Contributions

Adjusting your health insurance plan design can significantly lower costs while still providing valuable coverage. A well-structured plan balances affordability for the employer and employee. Key strategies include:

- High-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs) often reduce premiums.

- Implement tiered contributions, where employees pay a higher percentage for dependents or premium plans.

- Offer voluntary benefits as add-ons, allowing employees to customize coverage without raising employer costs.

Leverage Tax Credits and Government Programs

Many small businesses qualify for tax credits or government-sponsored programs that lower insurance expenses. Taking advantage of these incentives can make coverage more affordable. Consider these options:

- Small Business Health Care Tax Credit: Available to businesses with fewer than 25 full-time employees meeting specific criteria.

- Association Health Plans (AHPs): Join a group plan through a trade organization to access better rates.

- State programs: Some states offer subsidies or reinsurance programs to offset premium costs.

Is $200 a month expensive for health insurance?

The cost of health insurance at $200 a month can be considered affordable or expensive depending on several factors, including coverage, location, age, and income level. For a young, healthy individual with minimal medical needs, it may seem high, but for those requiring comprehensive coverage, it could be a reasonable or even low price. Comparing it to national averages (e.g., ~$450 for an individual plan in the U.S.) suggests it may be a budget-friendly option, but affordability ultimately depends on personal circumstances.

What Factors Determine If $200 a Month Is Expensive for Health Insurance?

Several variables influence whether $200/month is costly for health insurance:

- Coverage level: High-deductible plans are cheaper but offer less upfront coverage, while low-deductible plans may justify the $200 price.

- Geographical area: Premiums vary by state; $200 might be below average in high-cost regions but expensive in others.

- Subsidies: Low-income individuals may qualify for government assistance, making $200/month seem expensive in comparison.

How Does $200 a Month Compare to Average Health Insurance Costs?

To assess whether $200/month is expensive, consider national benchmarks:

- Individual plans: The U.S. average is around $450/month, making $200 relatively affordable.

- Employer-sponsored plans: Employees typically pay $100–$200/month, so this aligns with common contributions.

- Marketplace plans: Subsidized options may drop premiums below $200, but unsubsidized plans often exceed it.

Who Might Find $200 a Month Affordable or Expensive?

Affordability varies by individual circumstances:

- Young adults: May find $200 expensive if they rarely use medical services.

- Families: Paying $200 per person could quickly become costly for household budgets.

- Chronic conditions: Those with frequent medical needs may see $200 as a bargain for robust coverage.

Can you write off health insurance for a small business?

Yes, small businesses can typically write off health insurance premiums as a tax-deductible expense, provided certain conditions are met. The IRS allows deductions for health insurance costs paid on behalf of employees, owners, or their families, depending on the business structure (e.g., sole proprietorship, partnership, S-corporation, or C-corporation). However, eligibility rules vary, such as the requirement that the business must be profitable or that the owner must not be eligible for employer-sponsored coverage elsewhere.

Who Qualifies for Health Insurance Deductions?

To qualify for health insurance deductions, the business structure and ownership status play key roles.

- Sole proprietors, partners, and LLC members may deduct premiums for themselves and their families if the business reports a net profit.

- S-corporation shareholders must own more than 2% of the company and report premiums as taxable income to qualify for the deduction.

- C-corporations can fully deduct premiums paid for employees, including owners, without the same restrictions as pass-through entities.

What Types of Health Insurance Are Deductible?

The IRS allows deductions for qualified health plans that meet specific criteria.

- Group health insurance purchased for employees is generally 100% deductible if the plan meets ACA requirements.

- Individual policies may be deductible for self-employed individuals if no other employer-sponsored coverage is available.

- Dental and long-term care insurance may also qualify, but rules differ—consult a tax professional for specifics.

How to Claim Health Insurance Deductions?

Proper documentation and filing methods are essential for claiming deductions.

- Sole proprietors report deductions on Schedule 1 (Form 1040) under the Self-Employed Health Insurance Deduction.

- Partnerships and S-corporations include premiums on Form 1065 or 1120-S, with owners claiming deductions on personal returns.

- C-corporations deduct premiums as a business expense on Form 1120.

Frequently Asked Questions

What are the most affordable small business health insurance options in Maine?

Affordable small business health insurance options in Maine include plans through the Health Insurance Marketplace (Healthcare.gov), which may qualify for tax credits. Additionally, Maine’s Bureau of Insurance collaborates with private insurers like Anthem, Harvard Pilgrim, and Aetna to offer competitive group plans. Small businesses with fewer than 50 employees can explore Association Health Plans (AHPs) or join a Maine Chamber of Commerce health co-op for reduced premiums. Comparing quotes from multiple providers ensures the best cost-effective coverage.

How can small businesses in Maine qualify for health insurance tax credits?

To qualify for small business health care tax credits in Maine, employers must have fewer than 25 full-time employees with average annual wages below $58,000 (2023 guidelines). The business must pay at least 50% of employees’ premium costs and purchase coverage through SHOP (Small Business Health Options Program). The tax credit can cover up to 50% of employer contributions (35% for nonprofits). Filing Form 8941 with the IRS is required to claim this credit.

Are there state-specific programs for small business health insurance in Maine?

Yes, Maine offers state-specific programs, such as DirigoChoice, a subsidized health plan for small businesses and self-employed individuals. Some employers may also access Maine’s Medicaid Buy-In program for employees with disabilities. The Maine Association of Health Plans provides resources for comparing local policies. Additionally, Farmers and fishing businesses may qualify for specialized group plans under Maine’s agricultural health initiatives.

What factors affect the cost of small business health insurance in Maine?

The cost of small business health insurance in Maine depends on factors like group size, employee age distribution, and chosen plan type (HMO, PPO, or EPO). Coverage levels (bronze, silver, gold, or platinum) also influence premiums, along with geographic location due to varying healthcare costs across regions. Employers can lower expenses by opting for higher deductibles, implementing wellness programs, or exploring self-funded insurance models for larger groups.