Navigating short-term disability benefits for pre-existing conditions can be challenging, but understanding eligibility criteria is key to securing the support you need. Insurance providers often impose restrictions on pre-existing conditions, requiring careful documentation and timely applications. Whether you’re dealing with a chronic illness or a recurring medical issue, knowing the rules—such as look-back periods, waiting periods, and required medical evidence—can improve your chances of approval. This article explores practical tips to strengthen your claim, from gathering thorough medical records to meeting deadlines. By staying informed and proactive, you can maximize your eligibility and access the financial protection you deserve during temporary disability.

Understanding Short-Term Disability for Pre-Existing Conditions

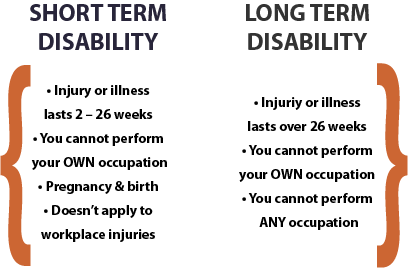

Short-term disability (STD) insurance provides financial support if you’re temporarily unable to work due to an illness or injury. However, securing coverage for pre-existing conditions can be challenging. Insurance providers often impose specific rules and waiting periods before approving claims related to prior medical issues. This guide outlines key eligibility tips to help you navigate the process.

1. What Qualifies as a Pre-Existing Condition?

A pre-existing condition is any illness, injury, or medical issue diagnosed or treated before applying for STD insurance. Common examples include diabetes, heart disease, or chronic back pain. Insurers typically review medical records from a look-back period (e.g., 3–12 months before enrollment) to determine eligibility.

| Term | Definition |

|---|---|

| Pre-Existing Condition | A medical issue diagnosed or treated before STD coverage begins. |

| Look-Back Period | The timeframe insurers review medical history to identify pre-existing conditions. |

2. How Insurers Evaluate Pre-Existing Conditions

Insurance companies assess pre-existing conditions based on medical records, prescriptions, and prior treatments. Some policies require a waiting period (e.g., 6–12 months) before covering these conditions. If symptoms flare up during this time, your claim may be denied.

| Factor | Impact on Eligibility |

|---|---|

| Medical History | Previous diagnoses/treatments may trigger exclusions. |

| Waiting Period | Must pass before pre-existing conditions are covered. |

3. Tips to Improve Approval Chances

To boost your odds of approval, enroll during an open enrollment period, disclose all medical history honestly, and choose a plan with shorter waiting periods. If you switch jobs, check if your new employer’s STD policy has a creditable coverage clause to waive exclusions.

| Strategy | Benefit |

|---|---|

| Full Disclosure | Reduces risk of claim denial due to undisclosed conditions. |

| Creditable Coverage | May eliminate waiting periods if switching policies. |

4. Common Exclusions and Limitations

Many STD policies exclude coverage for pre-existing conditions within the first 6–12 months. Some plans impose benefit caps (e.g., 50% salary) or shorter payment durations for such claims. Always review the policy’s fine print before signing.

| Exclusion | Details |

|---|---|

| Benefit Caps | May limit payouts for pre-existing conditions. |

| Time Limits | Coverage could end sooner than standard claims. |

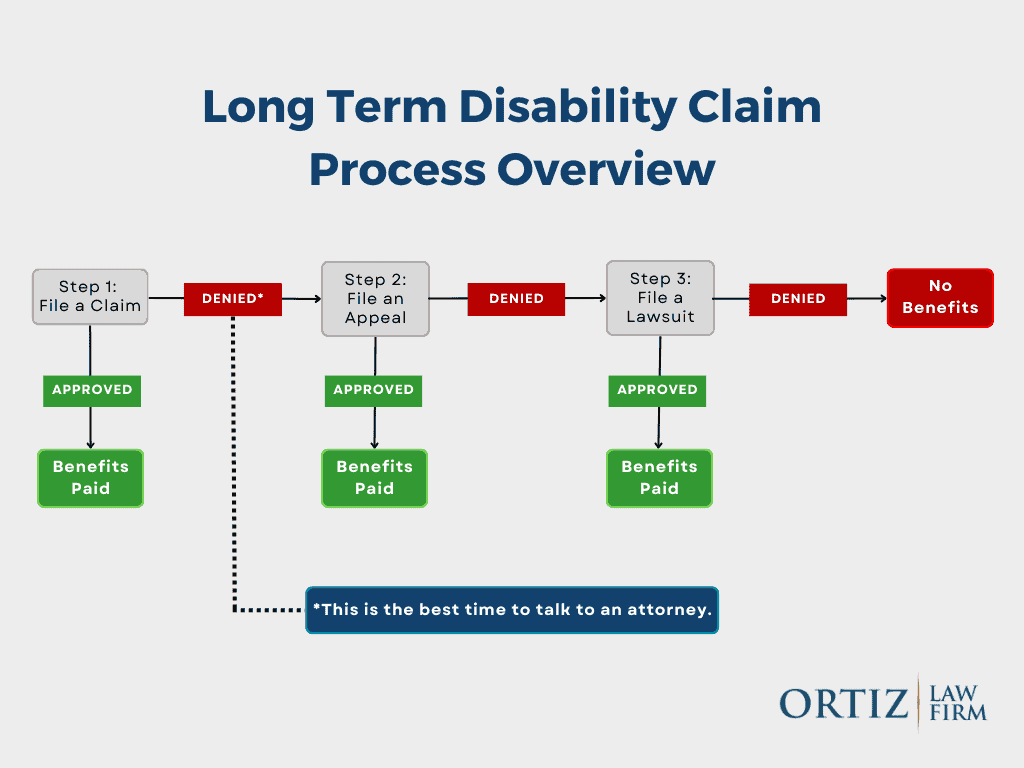

5. The Appeal Process for Denied Claims

If your claim is denied due to a pre-existing condition, request a written explanation and gather supporting documents (e.g., doctor’s notes, test results). File an appeal within the insurer’s deadline, and consider legal help if the denial seems unjust.

| Step | Action |

|---|---|

| Request Denial Details | Insurer must provide a reason in writing. |

| Submit Evidence | Medical records proving condition worsened post-coverage. |

Can short-term disability deny you for pre-existing conditions?

Yes, short-term disability (STD) insurance can deny your claim if you have a pre-existing condition. Many STD policies include clauses that exclude coverage for medical conditions you had before obtaining the policy. These exclusions typically apply if you received treatment, diagnosis, or medical advice for the condition within a specified look-back period (often 3 to 12 months before the policy’s effective date). However, eligibility rules vary by insurer, plan, and state regulations.

What Is a Pre-Existing Condition Under Short-Term Disability?

A pre-existing condition is any medical issue for which you received diagnosis, treatment, or consultation before your STD policy’s effective date. Insurance providers assess these conditions to determine coverage eligibility.

- Common examples include chronic illnesses like diabetes, heart disease, or prior injuries.

- Insurers review medical records to identify pre-existing conditions.

- Some policies may impose exclusion periods (e.g., 6-12 months) before covering such conditions.

How Do Insurers Determine Denial Based on Pre-Existing Conditions?

Insurance companies evaluate pre-existing conditions by reviewing your medical history and policy terms. Denials often hinge on timing, treatment records, and policy exclusions.

- The look-back period defines how far insurers check for prior treatments.

- If symptoms or treatments occurred during this window, coverage may be denied.

- Some states limit how insurers apply these rules under consumer protection laws.

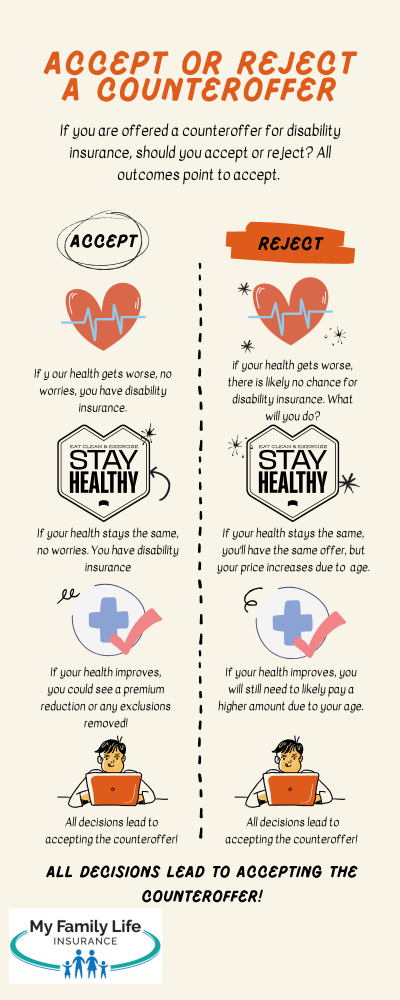

Can You Appeal a Denial for a Pre-Existing Condition?

Yes, appealing a denial is possible by submitting additional evidence or disputing the insurer’s assessment. Success depends on policy details and legal rights.

- Gather medical records proving your condition worsened after policy activation.

- Consult an attorney or advocate to challenge unfair denials.

- Check if your state mandates mandatory coverage for certain conditions.

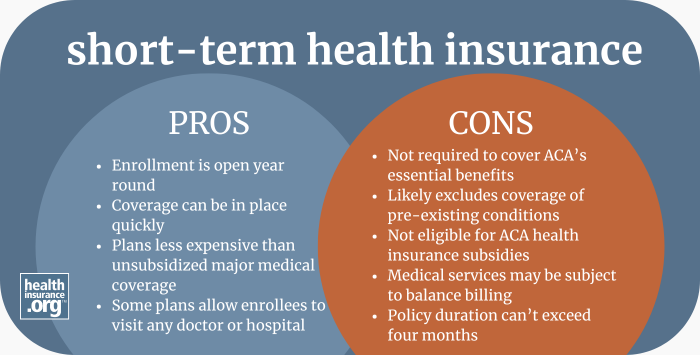

Can short-term health insurance deny pre-existing conditions?

Yes, short-term health insurance plans can deny coverage for pre-existing conditions. These plans are not regulated under the Affordable Care Act (ACA) and do not provide the same protections as ACA-compliant plans. Insurers offering short-term policies often exclude pre-existing conditions, meaning they may refuse to pay for treatment related to any illness or injury you had before enrolling.

How Do Short-Term Health Insurance Plans Define Pre-Existing Conditions?

Short-term health insurers generally define a pre-existing condition as any illness, injury, or medical issue for which you received:

- Diagnosis or treatment in the past 5 years.

- Medical advice or consultation before the policy’s start date.

- Prescription medications related to the condition prior to enrollment.

Some insurers may also consider chronic conditions like diabetes or heart disease as disqualifying factors.

What Happens If You Have a Pre-Existing Condition on a Short-Term Plan?

If you have a pre-existing condition while enrolled in a short-term plan:

- Claims may be denied if the insurer links your treatment to a prior condition.

- Coverage gaps may leave you responsible for full medical costs.

- Policy renewal could be denied if the condition is discovered later.

This makes short-term plans risky for individuals with ongoing health issues.

Are There Alternatives for People with Pre-Existing Conditions?

If you have pre-existing conditions, consider these alternatives instead of short-term plans:

- ACA-compliant plans, which cannot deny coverage based on health history.

- Medicaid or state-based programs for low-income individuals.

- COBRA if transitioning from an employer-sponsored plan.

These options offer more comprehensive coverage and better protections for pre-existing conditions.

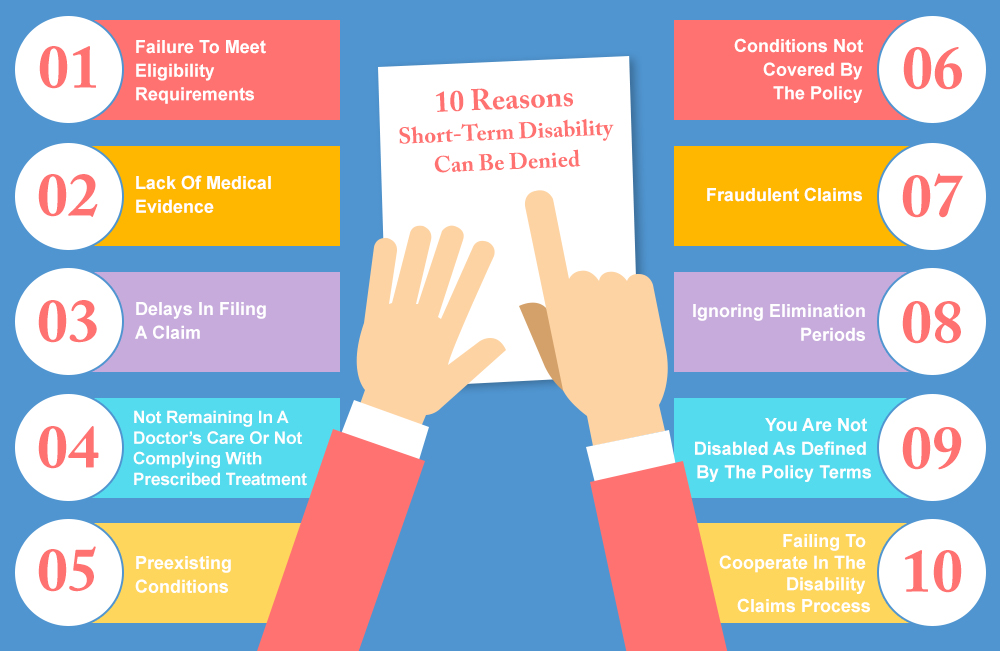

Why do people get denied for short-term disability?

Insufficient Medical Evidence

One of the most common reasons for short-term disability denial is the lack of sufficient or credible medical evidence to support the claim. Insurance providers require detailed documentation to verify the severity and validity of the condition. If the evidence is unclear or incomplete, the claim may be denied.

- Missing test results or incomplete medical records can lead to rejection.

- Vague physician notes that don’t clearly outline the disability’s impact on work ability.

- Delayed submissions of required documents past the deadline set by the insurer.

Pre-Existing Condition Exclusions

Many short-term disability policies exclude coverage for pre-existing conditions, especially if symptoms or treatments existed before the policy’s effective date. Insurers may investigate medical history to determine if the disability qualifies.

- Diagnosis or treatment within a specified look-back period (e.g., 3–12 months before coverage).

- Lack of a waiting period—some policies require a set time before covering pre-existing conditions.

- Inconsistent disclosures about prior health issues when applying for the policy.

Non-Qualifying Conditions or Job Duties

Certain medical conditions or job responsibilities may not meet the insurer’s definition of a disabling condition, resulting in claim denial. Policies often define disability as the inability to perform essential job functions.

- Partial disabilities or conditions allowing modified work may not qualify.

- Self-reported symptoms (e.g., chronic pain without objective medical proof).

- Job requirements that don’t align with the disability’s restrictions (e.g., sedentary work vs. physical labor).

What are three examples of pre-existing conditions that may be written into a disability contract as exclusions?

Chronic Back Conditions

Disability contracts often exclude chronic back conditions due to their prevalence and potential for long-term claims. These conditions may be considered pre-existing if diagnosed or treated before the policy’s effective date. Common exclusions include:

- Herniated discs – A pre-existing spinal issue that may lead to ongoing mobility limitations.

- Degenerative disc disease – A progressive condition often excluded due to its inevitability of worsening over time.

- Spinal stenosis – Narrowing of the spinal canal, which may have been documented prior to coverage.

Mental Health Disorders

Many disability policies limit or exclude coverage for pre-existing mental health disorders, as they can require extended treatment periods. Examples of excluded conditions may include:

- Clinical depression – A pre-diagnosed condition that could affect work capacity.

- Bipolar disorder – Often excluded due to its episodic nature and ongoing management needs.

- Anxiety disorders – Pre-existing cases may be excluded if previously documented in medical records.

Cardiovascular Diseases

Pre-existing cardiovascular diseases are frequently excluded from disability contracts due to their high-risk nature. These conditions may include:

- Coronary artery disease – A known condition that may lead to future disability claims.

- Congestive heart failure – Often excluded if diagnosed prior to policy issuance.

- Prior heart attacks – A history of myocardial infarction may disqualify coverage for related disabilities.

Frequently Asked Questions

Can I Qualify for Short-Term Disability with a Pre-Existing Condition?

Qualifying for short-term disability with a pre-existing condition depends on the insurance policy’s specific terms. Many plans enforce a look-back period, which examines medical history before coverage begins. If your condition was treated or diagnosed during this period, benefits may be denied. However, some policies allow coverage if the condition was stable before the disability claim.

What Is the Typical Look-Back Period for Pre-Existing Conditions?

Most short-term disability policies have a look-back period ranging from 3 to 12 months. During this time, insurers review whether you received medical treatment for your condition before enrollment. If diagnosed or treated within this window, your claim could be denied as a pre-existing exclusion. Always check your policy’s exact terms to understand the applicable timeframe.

How Can I Strengthen My Claim for Short-Term Disability with a Pre-Existing Condition?

To strengthen your claim, provide detailed medical records proving your condition was stable before coverage or worsened due to a new incident. A doctor’s statement linking the disability to a separate, non-related cause can also help. Additionally, submit proof of continuous treatment history and follow all insurer requirements promptly.

Are There Workarounds If My Pre-Existing Condition Disqualifies Me from Short-Term Disability?

If denied, explore alternative options like employer-paid leave (e.g., FMLA) or state disability programs. Some insurers offer conditional approvals if new medical evidence emerges. You may also appeal the decision with additional documentation or seek legal advice to challenge the denial based on policy ambiguities.