Running a small business requires careful financial management, and tracking expenses is crucial for maximizing profits and minimizing unnecessary costs. A well-organized Small Business Expenses List PDF can simplify this process by helping entrepreneurs monitor spending, prepare for tax season, and identify potential savings. Whether for rent, utilities, payroll, or office supplies, a comprehensive checklist ensures no deductible expense goes unnoticed. This article explores essential business expenses to include in your PDF tracker, along with practical tips to optimize spending. By using a structured expense list, small business owners can streamline bookkeeping, improve budgeting, and ultimately keep more money in their pockets.

Small Business Expenses List PDF: A Practical Guide to Tracking Costs

1. Why a Small Business Expenses List PDF is Essential

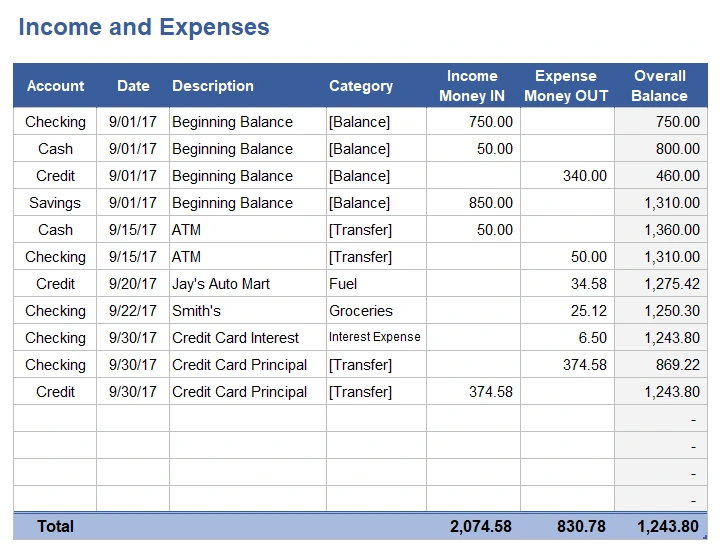

Keeping track of expenses is crucial for financial management and tax compliance. A PDF expense list helps organize receipts, invoices, and transactions in one place, simplifying bookkeeping. It also allows for easy sharing with accountants or business partners. Manual tracking often leads to errors, but a structured PDF ensures accuracy and efficiency.

| Benefit | Description |

|---|---|

| Simplified Record-Keeping | Centralizes all expenses in a single document. |

| Tax Deductions | Identifies eligible write-offs and reduces taxable income. |

| Budget Management | Helps track spending patterns and cut unnecessary costs. |

2. Key Expenses to Include in Your Small Business PDF

A well-structured expense list should categorize essential costs. Common business expenses include office supplies, utilities, marketing, and payroll. Tracking these ensures no deduction is overlooked during tax season.

| Category | Examples |

|---|---|

| Operational Costs | Rent, electricity, internet. |

| Employee Expenses | Salaries, benefits, training. |

| Marketing & Advertising | Social media ads, print materials. |

3. How to Create a Custom Small Business Expense List PDF

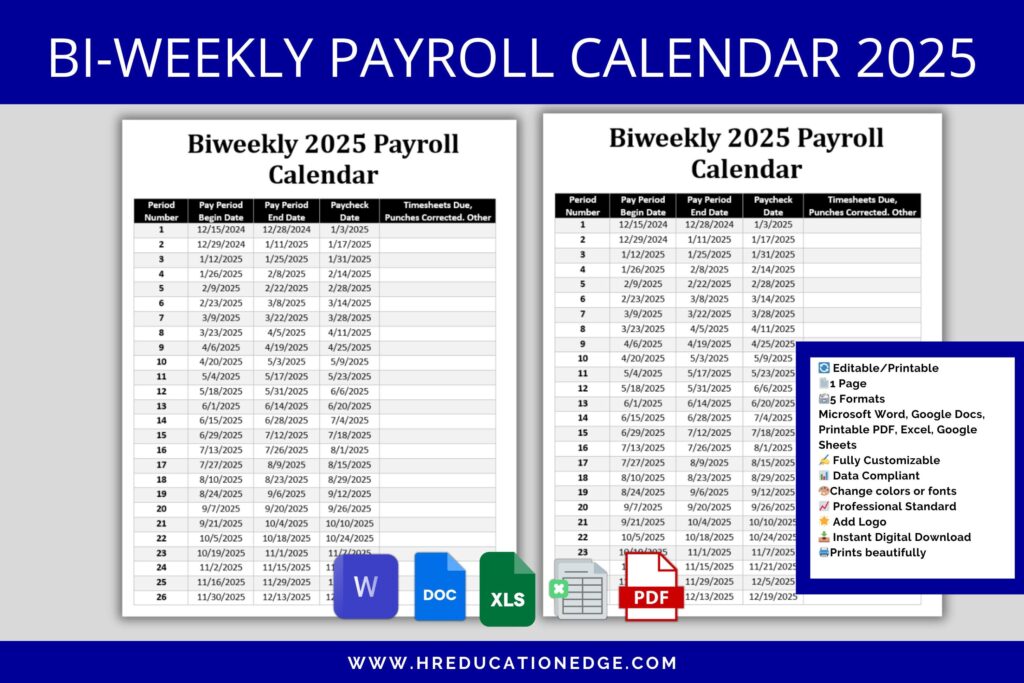

To make a personalized expense tracker, use tools like Excel or specialized accounting software before converting to PDF. Include columns for date, vendor, amount, and category. Regularly update the file to avoid missing transactions.

| Step | Action |

|---|---|

| 1. List All Expenses | Record every business-related purchase. |

| 2. Categorize | Group similar costs for easier analysis. |

| 3. Review Monthly | Ensure accuracy and adjust budgets if needed. |

4. Best Tools to Generate a Small Business Expenses List PDF

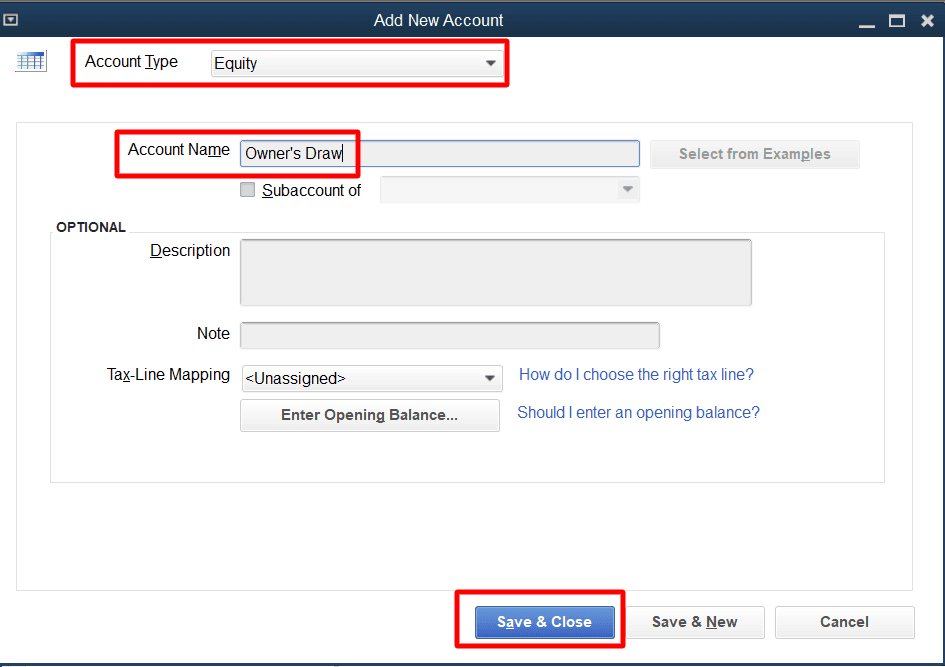

Several software options automate expense tracking and PDF creation. Popular choices include QuickBooks, FreshBooks, and Wave. These tools sync with bank accounts, categorize spending, and export reports as PDFs.

| Tool | Key Feature |

|---|---|

| QuickBooks | Auto-categorizes transactions and generates tax-ready reports. |

| FreshBooks | User-friendly interface with receipt scanning. |

| Wave | Free accounting software ideal for startups. |

5. Tips to Maximize Savings Using an Expense List PDF

A well-maintained expense list reveals opportunities to reduce costs. Negotiate better rates with vendors, eliminate unused subscriptions, and leverage tax deductions. Regularly reviewing the PDF prevents overspending.

| Strategy | Impact |

|---|---|

| Bulk Purchases | Lowers per-unit costs for supplies. |

| Remote Work Savings | Reduces office space and utility expenses. |

| Tax Planning | Identifies deductible expenses early. |

What is the $75 receipt rule?

Understanding the $75 Receipt Rule

The $75 receipt rule refers to an IRS regulation that requires businesses to provide a receipt or similar documentation for any expense of $75 or more if they plan to deduct it as a business expense. This rule helps ensure proper record-keeping for tax purposes.

- The rule applies to travel, entertainment, gifts, and other deductible business expenses.

- Receipts must include the amount, date, place, and business purpose of the expense.

- Failure to comply may result in the disallowance of deductions during an IRS audit.

When Does the $75 Receipt Rule Apply?

The $75 threshold triggers the requirement for detailed documentation. Below this amount, a written record (like a log) may suffice, but exceeding $75 mandates a formal receipt.

- Applies to single transactions of $75 or more, not cumulative expenses.

- Includes meals, lodging, transportation, and client-related costs.

- Digital receipts (e.g., emailed confirmations) are acceptable if they contain required details.

How to Comply with the $75 Receipt Rule

To avoid issues with the IRS, businesses and self-employed individuals should follow these best practices for compliance.

- Save all receipts exceeding $75 and organize them by date or category.

- Ensure receipts include vendor name, payment method, and a description of the expense.

- Use expense-tracking software or apps to automate record-keeping and reduce errors.

What is the best way to track small business expenses?

1. Use Accounting Software for Accurate Tracking

One of the most efficient ways to track small business expenses is by using dedicated accounting software. These tools automate expense recording, categorize transactions, and generate reports, reducing human error. Popular options like QuickBooks, FreshBooks, or Xero sync with bank accounts and credit cards, making real-time tracking effortless.

- Automate data entry by linking banking and payment platforms.

- Categorize expenses (e.g., payroll, supplies, utilities) for tax deductions.

- Generate financial reports to monitor cash flow and profitability.

2. Separate Personal and Business Finances

Avoid confusion by maintaining separate bank accounts and credit cards for your business. This simplifies tracking, ensures accurate bookkeeping, and helps during tax season.

- Open a dedicated business bank account to isolate transactions.

- Use a business credit card for all company-related purchases.

- Reconcile accounts monthly to spot discrepancies early.

3. Implement a Receipt Management System

Keeping organized records of receipts is critical for expense validation and tax compliance. Digital tools like Expensify or Shoeboxed scan, store, and categorize receipts automatically.

- Digitize paper receipts using mobile apps to prevent loss.

- Store receipts chronologically for easy retrieval during audits.

- Back up records securely in cloud storage or accounting software.

What expenses are 100% tax deductible?

Business-Related Expenses

Certain business-related expenses can be fully deducted from your taxable income. These costs must be deemed both ordinary and necessary for running your business. Examples include:

- Office supplies: Pens, paper, printer ink, and other consumables used for business purposes.

- Advertising and marketing: Costs related to promoting your business, such as social media ads or print campaigns.

- Employee salaries and benefits: Wages, bonuses, and health insurance contributions for employees.

Charitable Contributions

Donations made to qualified charitable organizations are often 100% tax deductible. You must ensure the recipient is registered as a 501(c)(3) nonprofit to claim the deduction. Common deductible contributions include:

- Cash donations: Monetary gifts made via check, credit card, or online payments.

- Property donations: Items like clothing, furniture, or vehicles donated to charities.

- Out-of-pocket volunteer expenses: Mileage or supplies purchased while volunteering for a qualified organization.

Medical and Dental Expenses

While most medical expenses are only deductible if they exceed a certain percentage of your income, some can be fully written off. These typically include:

- Preventive care: Costs for vaccinations, screenings, and annual check-ups covered under specific plans.

- Long-term care insurance premiums: Payments for policies that meet IRS criteria.

- Medical travel: Mileage or transportation costs for essential medical treatments.

How much can an LLC write off?

What Business Expenses Can an LLC Write Off?

An LLC (Limited Liability Company) can write off a wide range of business expenses to reduce taxable income. The IRS allows deductions for ordinary and necessary costs incurred while operating the business. These expenses must be directly related to the company’s activities and documented properly.

- Office expenses: Rent, utilities, and office supplies.

- Employee costs: Salaries, benefits, and payroll taxes.

- Marketing: Advertising, website maintenance, and promotional materials.

Are There Limits to LLC Tax Deductions?

While many expenses are deductible, some have limits or restrictions imposed by the IRS. Certain deductions may require specific documentation or may only be partially claimed, depending on the nature of the expense.

- Meals and entertainment: Only 50% of meal costs for business purposes are deductible.

- Home office deduction: Must meet strict criteria, such as exclusive and regular use for business.

- Vehicle expenses: Deductions vary based on actual costs or the standard mileage rate.

How Does an LLC Claim These Deductions?

To properly claim deductions, an LLC must maintain accurate records and file the appropriate tax forms. The process differs depending on whether the LLC is taxed as a sole proprietorship, partnership, or corporation.

- Track expenses: Use accounting software or receipts to document all business costs.

- File the correct forms: Schedule C (sole proprietorship), Form 1065 (partnership), or Form 1120 (corporation).

- Consult a tax professional: Ensure compliance with IRS rules and maximize deductible expenses.

Frequently Asked Questions

What is included in the Small Business Expenses List PDF?

Tracking and organizing business expenditures is essential for financial management. The Small Business Expenses List PDF provides a comprehensive categorized list of common business expenses, such as office supplies, travel costs, utilities, payroll, and marketing expenses. It is designed to help small business owners monitor spending efficiently, ensuring no deductible expense is overlooked when filing taxes or budgeting.

How can the Small Business Expenses List PDF help me save money?

By using the Small Business Expenses List PDF, you can identify unnecessary costs and optimize your spending. The structured format allows you to track recurring expenses, compare them over time, and make informed financial decisions. Additionally, it ensures you claim all eligible tax deductions, potentially reducing your taxable income and maximizing savings.

Is the Small Business Expenses List PDF customizable for different industries?

Yes, the Small Business Expenses List PDF is designed to be adaptable for various industries. While it includes standard business expenses, you can easily add or remove categories to align with your specific sector, such as retail, consulting, or hospitality. This flexibility ensures that the document remains relevant and useful regardless of your business type.

Can I use the Small Business Expenses List PDF for tax purposes?

Absolutely. The Small Business Expenses List PDF serves as a detailed record of deductible expenses, making it invaluable during tax season. By maintaining an accurate log of expenditures, you can provide documentation to support your claims, ensuring compliance with tax regulations. This also minimizes errors and simplifies the filing process for you or your accountant.