When an employee’s time with a company comes to an end in California, understanding the intricacies of vacation payout upon termination is crucial. California law provides specific protections and entitlements to employees regarding accrued but unused vacation time. Employers must navigate these regulations carefully to ensure compliance. This article aims to clarify the rights of employees and the obligations of employers in California concerning vacation payout at termination, providing insight into the legal framework that governs this aspect of employment law in the state. Accurate knowledge is essential.

Understanding Vacation Payout Laws in California

When an employee’s tenure with a company comes to an end, either by termination or resignation, one of the critical aspects to consider is the payout of accrued but unused vacation time. In California, specific laws govern how vacation payouts are handled upon termination, ensuring that employees receive fair compensation for their earned vacation time.

California Law Requires Vacation Payout Upon Termination

California law is clear: employers must pay employees for all accrued, unused vacation time when they are terminated or leave the company. This is based on the principle that vacation pay is considered a form of earned wages. The law views vacation time as part of an employee’s compensation package, which they earn as they work. Employers are required to pay out accrued vacation time in the same manner as they would pay final wages. This means that if an employer has a policy of paying final wages immediately upon termination, they must also pay accrued vacation pay at the same time. Failure to comply can result in penalties and potential lawsuits.

Calculating Vacation Payout

The calculation of vacation payout involves determining how much vacation time an employee has accrued but not used. Employers must have a clear policy on how vacation time accrues, and this policy must be communicated to employees. The accrual rate is typically based on the employee’s length of service and can vary between companies. For example, an employee might accrue 10 days of vacation per year, accrued monthly at a rate of 0.833 days per month. If an employee has worked for 6 months without taking any vacation, they would have accrued 5 days of vacation. Upon termination, they would be entitled to be paid for these 5 days.

| Accrual Period | Accrual Rate (Days/Month) | Total Accrued Days |

|---|---|---|

| 1-6 months | 0.833 | 5 |

| 7-12 months | 0.833 | 10 |

Impact of Company Policies on Vacation Payout

While California law mandates the payout of accrued vacation time, company policies can affect how vacation time accrues and is paid out. Employers can set a cap on accrued vacation time or have a use it or lose it policy, but these policies must be clearly communicated and consistently applied. If an employer has a policy that limits the amount of vacation time that can be accrued, this can impact the amount of vacation payout upon termination. For instance, if a company has a policy that caps accrued vacation at 20 days and an employee has accrued 25 days, the employer is only required to pay out up to the cap of 20 days.

Legal Consequences for Non-Compliance

Employers who fail to comply with California’s vacation payout laws can face significant legal consequences. Employees can file a wage claim with the California Division of Labor Standards Enforcement (DLSE) or pursue a lawsuit against their former employer. The consequences can include paying the employee the accrued vacation time plus penalties and attorney’s fees. In some cases, employers may also be subject to waiting time penalties for failing to pay final wages, including accrued vacation, in a timely manner.

| Non-Compliance Issue | Potential Penalty |

|---|---|

| Failure to Pay Accrued Vacation | Wage claim, lawsuit, penalties |

| Untimely Payment of Final Wages | Waiting time penalties |

Best Practices for Employers

To avoid legal issues, employers should establish clear policies regarding vacation accrual and payout. This includes having a well-defined vacation accrual policy, communicating it clearly to employees, and ensuring that all accrued vacation is paid out upon termination. Employers should also ensure that their payroll practices comply with California law, including timely payment of final wages and accrued vacation. Regular audits of payroll practices can help identify and correct any compliance issues before they become major problems.

| Best Practice | Benefit |

|---|---|

| Clear Vacation Accrual Policy | Reduces disputes over accrued vacation |

| Timely Payment of Final Wages | Avoids waiting time penalties |

By understanding and complying with California’s laws regarding vacation payout at termination, employers can maintain positive employee relations and avoid costly legal disputes.

Does California require vacation payout upon termination?

In California, employers are required to pay out accrued but unused vacation time to employees upon termination. This is because California considers vacation time as earned wages, and therefore, it is subject to the same rules as other forms of compensation. The California Labor Code requires employers to pay employees for all earned wages, including accrued vacation time, upon termination.

California Law on Vacation Payout

California law is clear on the requirement to pay out accrued vacation time upon termination. The state’s labor code mandates that employers pay employees for all accrued and unused vacation time. This means that employers cannot have a use it or lose it policy that forfeits accrued vacation time if it is not used by a certain date. The law requires employers to pay out accrued vacation time, regardless of whether the employee has taken time off.

- The law applies to all employers in California, regardless of size.

- Employers must pay out accrued vacation time at the employee’s final rate of pay.

- Failure to pay out accrued vacation time can result in penalties and fines for employers.

Calculating Vacation Payout

Calculating vacation payout upon termination can be complex, as it depends on various factors, including the employer’s vacation policy and the employee’s accrual rate. Employers must calculate the amount of accrued but unused vacation time and pay it out to the employee upon termination. The calculation should be based on the employee’s final rate of pay.

- Employers must review their vacation policies to determine the accrual rate and any applicable caps.

- The calculation should include all accrued but unused vacation time.

- Employers must pay out the accrued vacation time at the employee’s final rate of pay, including any applicable overtime or other compensation.

Consequences of Non-Compliance

Employers who fail to pay out accrued vacation time upon termination may face penalties and fines. The California Labor Commissioner may impose penalties on employers who fail to comply with the state’s labor laws, including the requirement to pay out accrued vacation time. Employers may also face lawsuits from employees who are not paid their accrued vacation time.

- Employers may be liable for waiting time penalties if they fail to pay out accrued vacation time in a timely manner.

- The California Labor Commissioner may impose fines and penalties on employers who fail to comply with the law.

- Employers may also face reputation damage and potential lawsuits from employees who are not paid their accrued vacation time.

Can you cash out vacation time if you get fired?

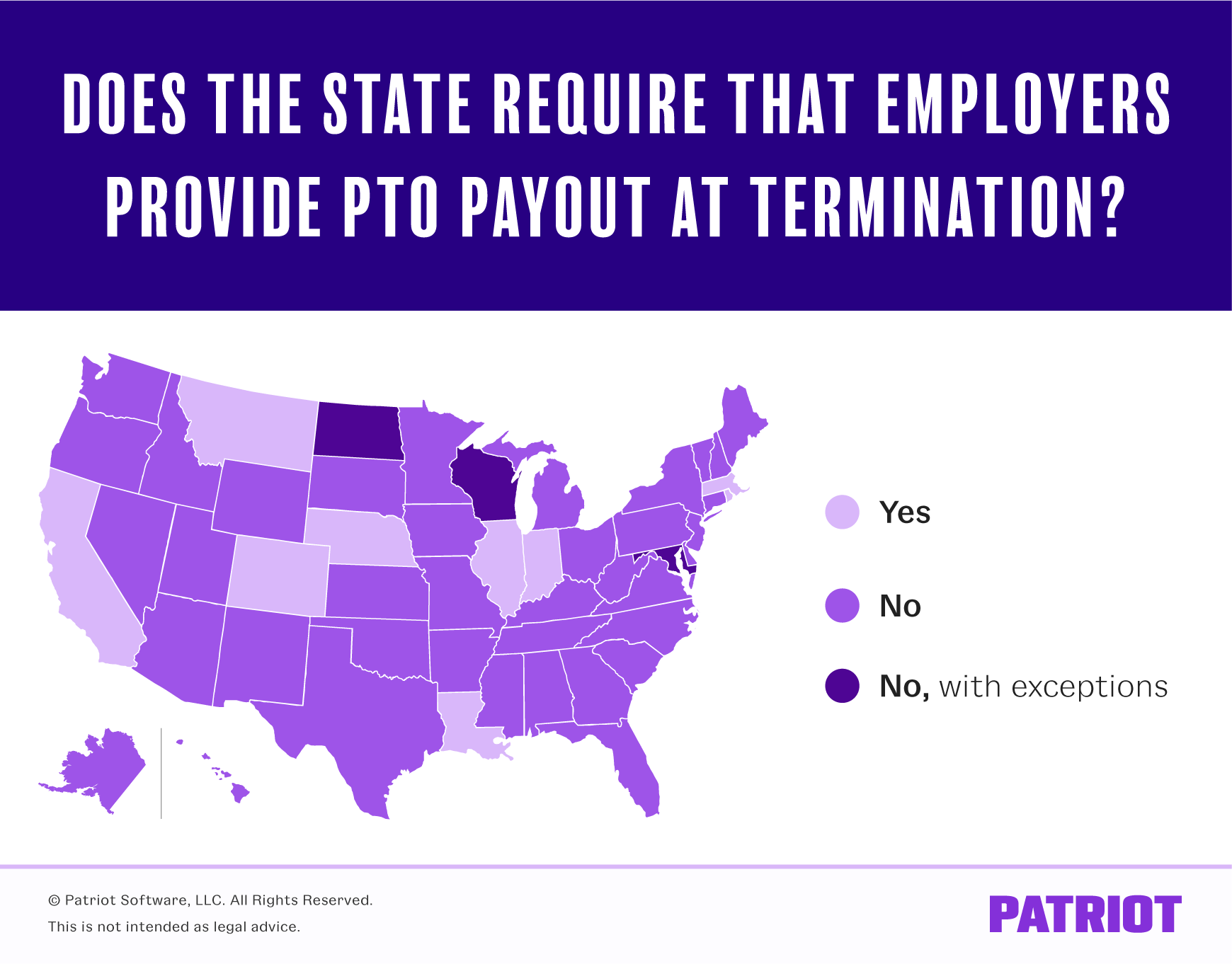

In the United States, the laws regarding vacation time and payout upon termination vary from state to state. Generally, earned vacation time is considered a form of wage or compensation that employees have accrued over time. When an employee is terminated, they may be entitled to receive payment for their accrued but unused vacation time.

State Laws and Company Policies

The laws governing vacation payout upon termination differ significantly across states. Some states, like California, Colorado, and Illinois, have laws that require employers to pay out accrued but unused vacation time upon termination. In contrast, other states leave it to the employer’s discretion or company policy. It’s essential to review the specific laws in your state and your company’s policies to understand your entitlements.

- Check your state’s laws: Research your state’s laws regarding vacation payout upon termination to understand your rights.

- Review company policies: Familiarize yourself with your company’s policies on vacation time and payout upon termination.

- Understand your employment contract: If you have an employment contract, review it to see if it addresses vacation payout upon termination.

Factors Affecting Vacation Payout

Several factors can influence whether you can cash out your vacation time if you get fired. These include the laws in your state, your company’s policies, and the terms of your employment contract. Accrued vacation time is a critical factor, as it represents the amount of vacation time you’ve earned but not used.

- Accrued vs. earned: Understand the difference between accrued and earned vacation time, as this can impact your eligibility for payout.

- Company policies on payout: Check if your company has a policy of paying out accrued vacation time upon termination.

- State laws on accrued benefits: Familiarize yourself with your state’s laws regarding accrued benefits, including vacation time.

Payout Options and Tax Implications

If you’re entitled to receive payment for your accrued but unused vacation time, you should understand the payout options and tax implications. Lump-sum payments are common, but tax implications can vary depending on your location and the amount received.

- Lump-sum payments: Understand the tax implications of receiving a lump-sum payment for your accrued vacation time.

- Tax withholding: Be aware that taxes may be withheld from your payout, affecting the amount you receive.

- Consult a tax professional: If you’re unsure about the tax implications, consider consulting a tax professional for guidance.

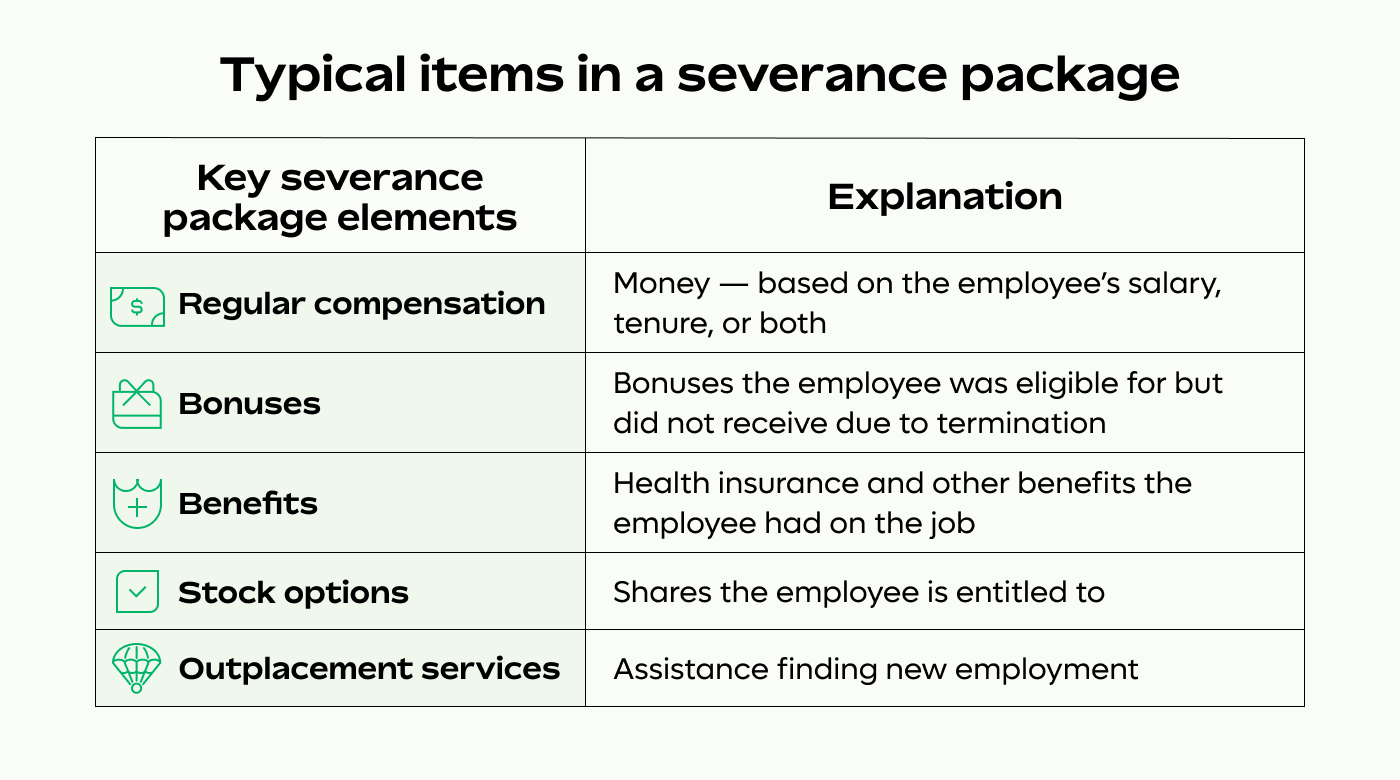

Is vacation payout considered severance pay?

The answer to this question is not straightforward and depends on various factors, including the jurisdiction, the company’s policies, and the employment contract. In general, severance pay is a payment made by an employer to an employee who is leaving their job due to circumstances such as layoffs, downsizing, or termination. On the other hand, vacation payout refers to the payment made to an employee for their accrued but unused vacation time when they leave their job.

Understanding Severance Pay

Severance pay is typically provided to employees who are involuntarily separated from their employment, and its purpose is to provide financial support during the transition period. The amount of severance pay varies widely depending on the company, industry, and location. Some key aspects of severance pay include:

- Eligibility criteria: Not all employees are eligible for severance pay; it usually depends on the length of service, job type, and circumstances of separation.

- Calculation methods: Severance pay can be calculated based on factors such as length of service, salary, and position.

- Tax implications: Severance pay is generally considered taxable income, but the tax treatment may vary depending on the jurisdiction.

Vacation Payout and Severance Pay: Similarities and Differences

While both vacation payout and severance pay are payments made to employees when they leave their job, there are significant differences between the two. Vacation payout is a payment for accrued but unused vacation time, whereas severance pay is a payment made due to job loss or separation. Some key similarities and differences include:

- Accrual and entitlement: Vacation payout is based on accrued vacation time, whereas severance pay is based on the circumstances of separation.

- Payment structure: Vacation payout is usually a lump sum payment, whereas severance pay can be paid in a lump sum or installments.

- Tax treatment: Both vacation payout and severance pay are generally considered taxable income.

Legal Considerations and Jurisdictional Variations

The treatment of vacation payout and severance pay varies across jurisdictions, and employers must comply with relevant laws and regulations. Some key legal considerations include:

- Statutory requirements: Some jurisdictions require employers to provide severance pay or vacation payout under certain circumstances.

- Employment contracts: Employment contracts or collective bargaining agreements may specify the terms and conditions of severance pay and vacation payout.

- Case law and precedents: Court decisions and precedents can influence the interpretation of severance pay and vacation payout in specific jurisdictions.

Can I get my PTO paid out if I quit?

The answer to this question largely depends on the company’s policies and the laws of the state you’re in. In general, Paid Time Off (PTO) is a benefit that many employers offer to their employees, allowing them to take time off for vacation, sick leave, or personal days while still receiving pay. When an employee quits their job, the question arises as to whether they will be paid out for any accrued but unused PTO.

Company Policies on PTO Payout

Company policies play a significant role in determining whether an employee can get their PTO paid out upon quitting. Some companies have a use it or lose it policy, where accrued PTO is forfeited if not used within a certain timeframe. Other companies may allow employees to cash out their accrued PTO when they leave the company. It’s essential to review the company’s policies or consult with HR to understand their stance on PTO payout.

- Check the employee handbook or company policies to see if it addresses PTO payout upon termination.

- Understand the state laws regarding PTO payout, as some states require employers to pay out accrued PTO.

- Review any employment contracts or agreements to see if they specify PTO payout terms.

State Laws Governing PTO Payout

State laws can significantly impact whether an employer is required to pay out accrued PTO when an employee quits. Some states, such as California, Colorado, and Illinois, have laws that require employers to pay out accrued PTO upon termination. Other states may not have such laws, leaving it up to the employer’s discretion. It’s crucial to understand the specific laws in your state to determine your entitlement to PTO payout.

- Research the labor laws in your state to see if they require PTO payout upon termination.

- Understand the definition of termination under state law, as it may impact PTO payout.

- Consult with the state’s labor department or an attorney if you’re unsure about your state’s laws.

Negotiating PTO Payout

In some cases, employees may be able to negotiate a PTO payout when they quit their job. This can be particularly relevant for employees who have accrued a significant amount of PTO or are leaving on good terms. It’s essential to approach the negotiation in a professional manner and be prepared to make a strong case for why you deserve a PTO payout.

- Review your employment contract or company policies to understand your accrued PTO balance.

- Prepare a solid case for why you deserve a PTO payout, highlighting your contributions to the company.

- Be prepared to negotiate the terms of your PTO payout, and be flexible regarding the outcome.

Frequently Asked Questions

What is vacation payout at termination in California?

In California, when an employee is terminated, they are entitled to receive payment for their accrued and unused vacation time. This is because California law considers vacation time as a form of earned wages. According to the California Labor Code, employers are required to pay employees for their accrued vacation time upon separation from employment. This means that if an employee has not used all of their accrued vacation time, they should be paid for it when they leave their job, whether they are fired, laid off, or quit.

How is vacation payout calculated at termination in California?

The calculation of vacation payout at termination in California is based on the employee’s accrued and unused vacation time. Employers must determine the amount of vacation time the employee has accrued but not used, and then pay them for that time at their final rate of pay. The final rate of pay is typically the employee’s hourly or salary rate at the time of termination. Employers should also consider any vacation accrual policies they have in place, as well as any applicable collective bargaining agreements.

Are there any exceptions to vacation payout at termination in California?

While California law generally requires employers to pay employees for their accrued and unused vacation time upon termination, there are some exceptions. For example, if an employer has a written policy that states that employees will not be paid for accrued vacation time upon termination, this policy may be enforceable. However, such a policy must be clear and conspicuous, and employees must have agreed to it as a condition of their employment. Additionally, certain executive, administrative, and professional employees who are exempt from overtime pay may be subject to different rules regarding vacation payout.

What can I do if my employer refuses to pay me for my accrued vacation time upon termination in California?

If your employer refuses to pay you for your accrued and unused vacation time upon termination, you may be able to file a wage claim with the California Division of Labor Standards Enforcement (DLSE). The DLSE is responsible for enforcing California’s labor laws, including those related to vacation payout. You may also be able to pursue a lawsuit against your employer to recover your unpaid vacation wages, as well as other damages and penalties. It is recommended that you consult with an attorney who specializes in employment law to discuss your options and determine the best course of action.