As a business owner, managing finances effectively is crucial to maximizing profits and minimizing tax liabilities. For Limited Liability Companies (LLCs), understanding deductible expenses is key to reducing taxable income. A comprehensive LLC expenses cheat sheet can be a valuable resource in this regard. This article discusses the importance of tracking LLC expenses and how a downloadable PDF cheat sheet can help LLC owners identify potential tax deductions, ensuring they save big on taxes and maintain compliance with tax regulations. Proper expense tracking is vital for financial health.

Maximizing Your LLC’s Tax Savings with the Right Expense Tracking

To save big on taxes, it’s crucial for Limited Liability Company (LLC) owners to understand and accurately track their business expenses. An LLC Expenses Cheat Sheet PDF can be a valuable tool in this endeavor, providing a comprehensive guide to deductible expenses and helping owners navigate the complexities of tax law.

Understanding Deductible Expenses

Deductible expenses are costs incurred by the LLC in the course of its business operations that can be subtracted from its taxable income, thereby reducing its tax liability. To qualify as deductible, expenses must be ordinary (common and accepted in the industry) and necessary (helpful and appropriate for the business).

| Expense Category | Examples |

|---|---|

| Operational Expenses | Rent, Utilities, Office Supplies |

| Travel Expenses | Transportation, Lodging, Meals |

| Professional Fees | Legal Fees, Accounting Fees, Consulting Fees |

Utilizing an LLC Expenses Cheat Sheet PDF

An LLC Expenses Cheat Sheet PDF is designed to simplify the process of identifying and recording deductible expenses. By having a comprehensive list of potential deductions, LLC owners can ensure they’re not missing out on valuable tax savings opportunities.

| Deductible Expense | Description |

|---|---|

| Home Office Deduction | A portion of rent or mortgage interest and utilities attributable to a home office |

| Business Use of Your Car | Expenses related to the business use of a personal vehicle, including gas, maintenance, and insurance |

| Meals and Entertainment | Costs associated with entertaining clients or customers, subject to certain limitations |

Common Mistakes to Avoid

When tracking and deducting expenses, LLC owners must be mindful of common pitfalls that can lead to audit issues or lost deductions. This includes failing to maintain accurate records and misclassifying personal expenses as business expenses.

| Mistake | Consequence |

|---|---|

| Insufficient Record Keeping | Loss of deductions due to lack of supporting documentation |

| Misclassifying Expenses | Audit issues and potential penalties for incorrect tax reporting |

| Overlooking Deductions | Missed opportunities for tax savings due to unclaimed deductions |

Best Practices for Expense Tracking

To maximize tax savings and minimize audit risk, LLC owners should implement effective expense tracking practices. This includes using accounting software to streamline expense recording and maintaining detailed, organized records of all business expenses.

| Best Practice | Benefit |

|---|---|

| Implementing Accounting Software | Streamlined expense tracking and reduced administrative burden |

| Maintaining Organized Records | Ease of access to expense information for tax preparation and audit purposes |

| Regularly Reviewing Expenses | Identification of areas for cost reduction and optimization of tax deductions |

Consulting a Tax Professional

Given the complexities of tax law and the potential for changes in legislation, it’s advisable for LLC owners to consult with a tax professional to ensure they’re taking full advantage of available deductions and complying with all tax regulations.

| Benefit of Consulting a Tax Professional | Description |

|---|---|

| Expert Knowledge | Stay up-to-date with the latest tax laws and regulations |

| Personalized Guidance | Tailored advice based on the LLC’s specific financial situation and goals |

| Audit Support | Assistance in the event of an audit, including representation and resolution |

How to maximize tax deductions for LLC?

To maximize tax deductions for an LLC, it’s crucial to understand the various expenses that can be deducted and how to properly document them. The IRS allows LLCs to deduct business expenses that are ordinary and necessary for the operation of the business. This can include a wide range of expenses such as rent, utilities, equipment, supplies, travel expenses, and professional fees. To maximize deductions, it’s essential to maintain accurate and detailed records of all business expenses throughout the year.

Understanding Business Expenses

Understanding what constitutes a business expense is key to maximizing tax deductions. Business expenses are costs incurred to operate the business, and they can be deducted from the business’s taxable income. To qualify as a deductible business expense, the cost must be both ordinary and necessary for the business.

- Identify ordinary expenses that are common in your industry.

- Ensure expenses are necessary and directly related to the business operation.

- Keep receipts and records to substantiate the expenses.

Maximizing Home Office Deductions

For LLCs that operate from a home office, maximizing the home office deduction can significantly reduce taxable income. The home office deduction allows businesses to deduct a portion of rent or mortgage interest and utilities as business expenses. To qualify, the home office must be used regularly and exclusively for business.

- Calculate the square footage of the home office space.

- Use the simplified option for calculating the deduction, which is $5 per square foot, up to a maximum of $1,500.

- Alternatively, calculate the actual expenses related to the home office, including mortgage interest, utilities, and insurance.

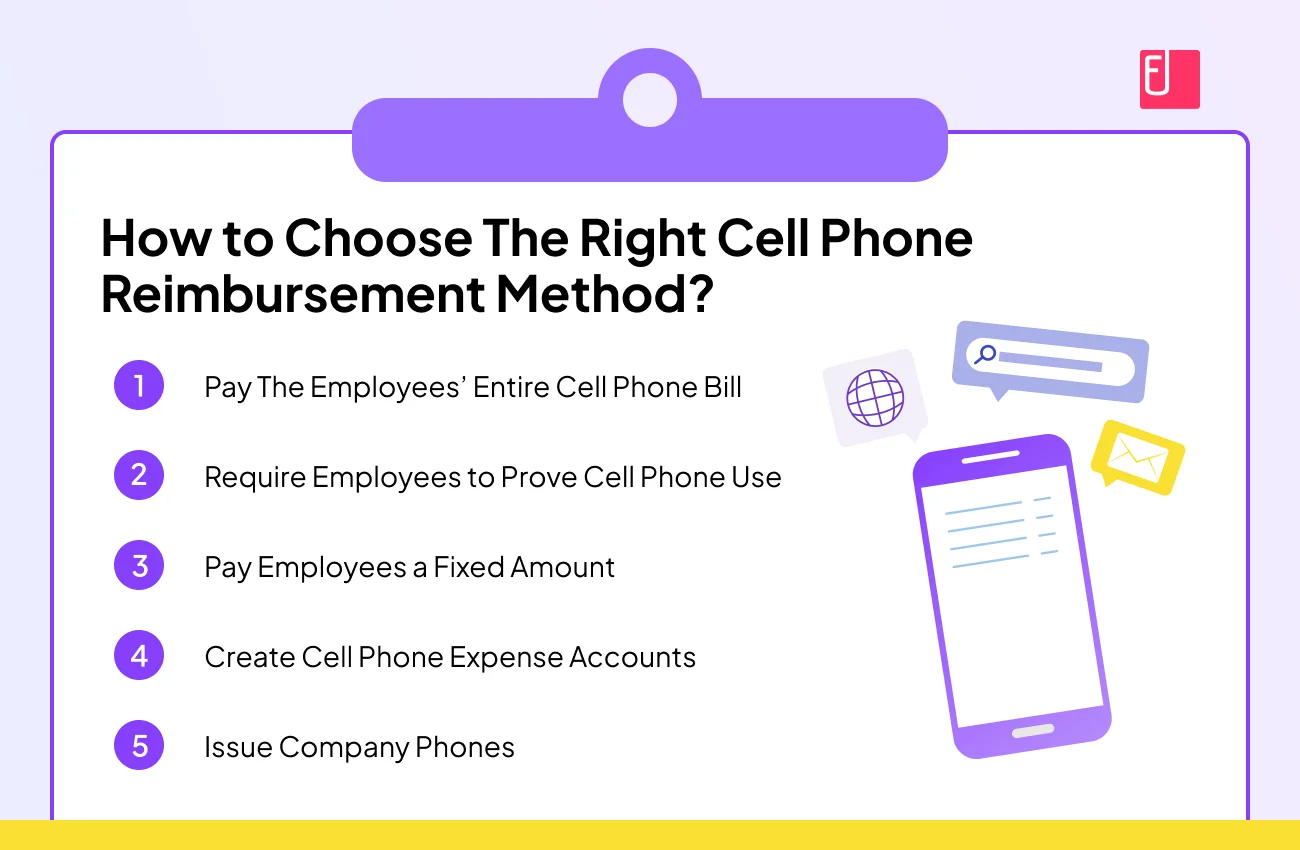

Tracking Travel and Meal Expenses

Travel and meal expenses can be significant deductions for LLCs, especially those that require frequent travel for business. To deduct these expenses, they must be directly related to the business and properly documented.

- Keep a log or diary to track travel and meal expenses, including the date, location, and business purpose.

- Save receipts for all expenses, as they are required to substantiate the deductions.

- Understand the 50% limit on meal expenses; only 50% of meal expenses can be deducted, and they must be not lavish or extravagant.

How much can an LLC write off on taxes?

The amount an LLC can write off on taxes depends on various factors, including the type of business, its income, and the specific expenses incurred. The Internal Revenue Code allows businesses to deduct ordinary and necessary expenses related to their operations. This can include a wide range of expenses such as rent, utilities, equipment, supplies, travel expenses, and salaries.

Business Expenses Eligible for Deduction

Business expenses that are eligible for deduction include those that are directly related to the operation of the business. For an LLC, this can include expenses such as rent or mortgage payments for the business location, equipment purchases or leases, and salaries and benefits for employees. To qualify as a deductible expense, the expenditure must be both ordinary (common in the industry) and necessary (required for the business to operate).

- Operating Expenses: day-to-day expenses such as utilities, supplies, and maintenance.

- Capital Expenditures: significant purchases such as equipment or property that may be depreciated over time.

- Travel Expenses: costs associated with business travel, including transportation, lodging, and meals.

Deductions Specific to LLC Structure

The tax deductions available to an LLC can also depend on its tax classification. An LLC can elect to be taxed as a sole proprietorship, partnership, S corporation, or C corporation. Each of these classifications has different rules regarding what expenses can be deducted and how they are reported. For example, an LLC taxed as a pass-through entity (such as a partnership or S corporation) will pass business income and expenses through to the owners’ personal tax returns.

- Pass-Through Deductions: deductions that flow through to the owners’ personal tax returns.

- Self-Employment Tax Deductions: deductions related to self-employment taxes for LLC members who are actively involved in the business.

- Business Use of Home Deductions: deductions for a home office or other business use of a personal residence.

Record Keeping and Compliance

To take advantage of tax deductions, an LLC must maintain accurate and detailed records of its expenses. This includes receipts, invoices, bank statements, and any other documentation that supports the expense. The IRS requires businesses to keep these records for at least three years in case of an audit. Proper record keeping and compliance with tax laws and regulations are crucial for ensuring that an LLC can claim all the deductions it is eligible for.

- Expense Tracking: using accounting software or other methods to track and categorize expenses.

- Receipt and Invoice Retention: keeping detailed records of all business expenses.

- Audit Preparedness: being prepared in case of an IRS audit by having thorough documentation.

How to use LLC to save on taxes?

To use an LLC to save on taxes, it’s essential to understand the tax implications and benefits associated with this business structure. An LLC, or Limited Liability Company, offers flexibility in taxation as it can be treated as a pass-through entity, avoiding double taxation that corporations often face. The tax savings come from the ability to pass business income directly to the owners’ personal tax returns, thus potentially lowering the overall tax rate and reducing the complexity of tax filings.

Choosing the Right Tax Classification

One of the key steps in using an LLC to save on taxes is choosing the right tax classification. The IRS allows LLCs to be taxed as sole proprietorships, partnerships, S corporations, or C corporations, depending on the number of owners and the tax elections made. Pass-through taxation is often beneficial as it avoids double taxation. For instance, an LLC can elect to be taxed as an S corporation, which can reduce self-employment taxes on the owners’ personal tax returns.

- File Form 2553 to elect S corporation status, ensuring eligibility criteria are met.

- Understand that S corporation status can reduce self-employment taxes on distributions.

- Consult with a tax professional to determine the most beneficial tax status for your LLC.

Deducting Business Expenses

Another way to save on taxes with an LLC is by deducting legitimate business expenses. The IRS allows businesses to deduct expenses that are ordinary and necessary for the operation of the business. This can significantly reduce the taxable income of the LLC, thereby reducing the tax liability. It’s crucial to maintain accurate records of all business expenses to take full advantage of these deductions.

- Keep detailed records of all business-related expenses, including receipts and invoices.

- Understand what expenses are considered ordinary and necessary for your business type.

- Consult with a tax professional to ensure you’re taking advantage of all eligible deductions.

Utilizing Tax Credits and Other Incentives

LLCs can also save on taxes by utilizing tax credits and other incentives. Tax credits directly reduce the amount of tax owed, dollar for dollar, and can be more beneficial than deductions. There are various tax credits available for different business activities, such as research and development, hiring certain employees, or investing in renewable energy.

- Research available tax credits that your LLC may be eligible for, such as the Research and Development Tax Credit.

- Understand the requirements and documentation needed to claim tax credits.

- Consult with a tax professional to identify and claim all eligible tax credits and incentives.

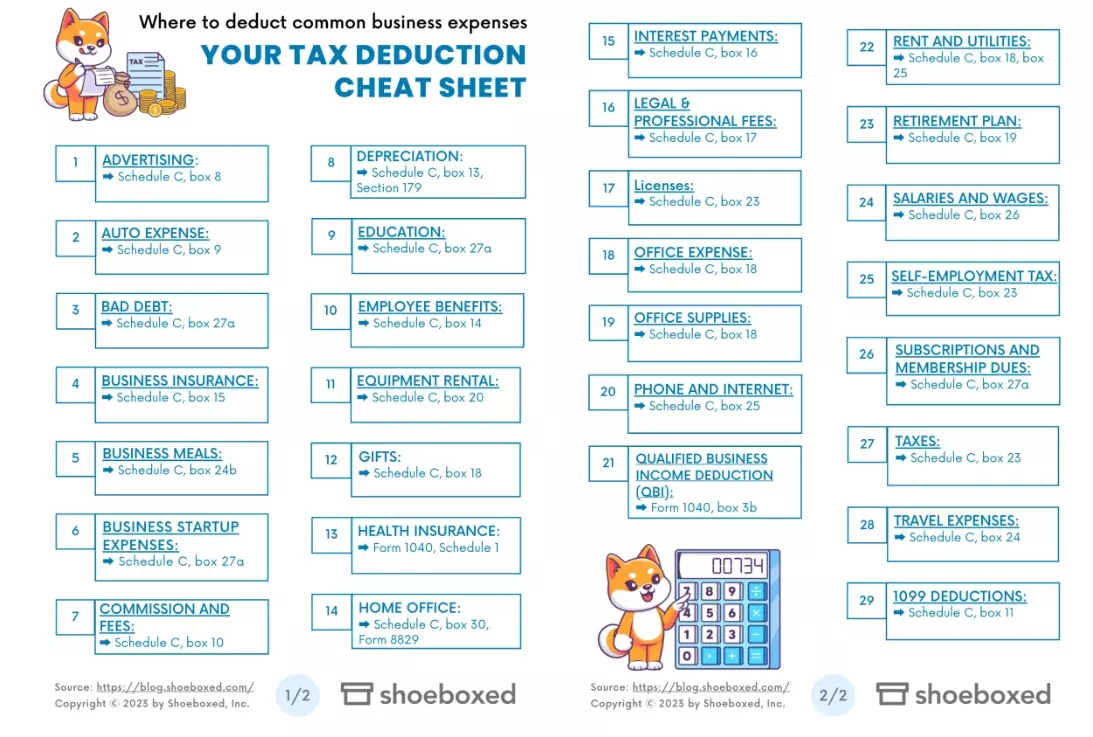

What expenses are 100% tax-deductible?

Expenses that are 100% tax-deductible typically include costs directly related to the operation of a business or investment activities. The tax deductibility of expenses is governed by tax laws and regulations, which can vary significantly by jurisdiction. Generally, to be considered 100% tax-deductible, an expense must be ordinary and necessary for the business or investment activity.

Business Operating Expenses

Business operating expenses that are directly related to the operation of a business can be 100% tax-deductible. These expenses are crucial for the day-to-day functioning of the business. Examples include:

- Rent and Utilities for business premises, which are essential for the operation of the business.

- Salaries and Wages paid to employees, which are a necessary expense for businesses that have staff.

- Business Travel Expenses that are directly related to business activities, such as transportation, accommodation, and meals.

Investment Expenses

Certain expenses related to investment activities can also be 100% tax-deductible. These expenses are typically associated with the management and maintenance of investments. Examples include:

- Investment Advisory Fees paid to professionals for managing investments.

- Safe Deposit Box Fees for storing investment documents or assets.

- Travel Expenses related to Investment Activities, such as visiting investment properties.

Specific Tax-Deductible Expenses for Self-Employed Individuals

Self-employed individuals can deduct business expenses on their tax returns, which can include a variety of expenses directly related to their business activities. Examples include:

- Home Office Deduction, which allows self-employed individuals to deduct a portion of their rent or mortgage interest and utilities as business expenses.

- Business Use of Their Car, where they can deduct the business use percentage of their car expenses, including fuel, maintenance, and insurance.

- Professional Fees, such as legal and accounting fees related to their business.

Frequently Asked Questions

What is an LLC Expenses Cheat Sheet PDF and how can it help with tax savings?

An LLC Expenses Cheat Sheet PDF is a comprehensive guide that outlines the various expenses that can be deducted by Limited Liability Companies (LLCs) to minimize their tax liability. This document serves as a valuable resource for LLC owners and accountants, providing a detailed list of deductible expenses, including operational costs, business travel expenses, and equipment purchases. By utilizing an LLC Expenses Cheat Sheet PDF, businesses can ensure they are taking advantage of all eligible deductions, thereby reducing their taxable income and ultimately saving big on taxes.

What types of expenses are typically included in an LLC Expenses Cheat Sheet PDF?

A typical LLC Expenses Cheat Sheet PDF covers a wide range of expenses that are commonly incurred by LLCs. These may include rent and utility payments for business premises, salaries and wages paid to employees, marketing and advertising expenses, and insurance premiums. Additionally, the cheat sheet may also cover travel expenses, professional fees, and depreciation on business assets. By categorizing and documenting these expenses, LLCs can accurately claim deductions and minimize their tax liability.

How can I use an LLC Expenses Cheat Sheet PDF to maximize my tax deductions?

To maximize tax deductions using an LLC Expenses Cheat Sheet PDF, it is essential to thoroughly review the document and ensure that all eligible expenses are being claimed. Accurate record-keeping is crucial, as LLCs must be able to substantiate their deductions in the event of an audit. By regularly consulting the cheat sheet and maintaining detailed records of business expenses, LLC owners can identify areas where they may be able to claim additional deductions, such as home office expenses or business use of their vehicle.

Can I customize an LLC Expenses Cheat Sheet PDF to suit my business needs?

While a standard LLC Expenses Cheat Sheet PDF can provide a solid foundation for understanding deductible expenses, it is often beneficial to tailor the document to the specific needs of your business. This may involve adding or removing categories of expenses, or providing additional information relevant to your industry or business operations. By customizing the cheat sheet, you can ensure that it remains a relevant and effective tool for minimizing your tax liability and maximizing your savings.

![How to Streamline Year-End HR Processes [+ Checklist] | GoCo.io](https://hrforsmb.com/wp-content/uploads/2025/05/end-of-year-hr-checklist-streamline-your-year-end-process.webp)